Roth Conversion Calculator Excel Free Download

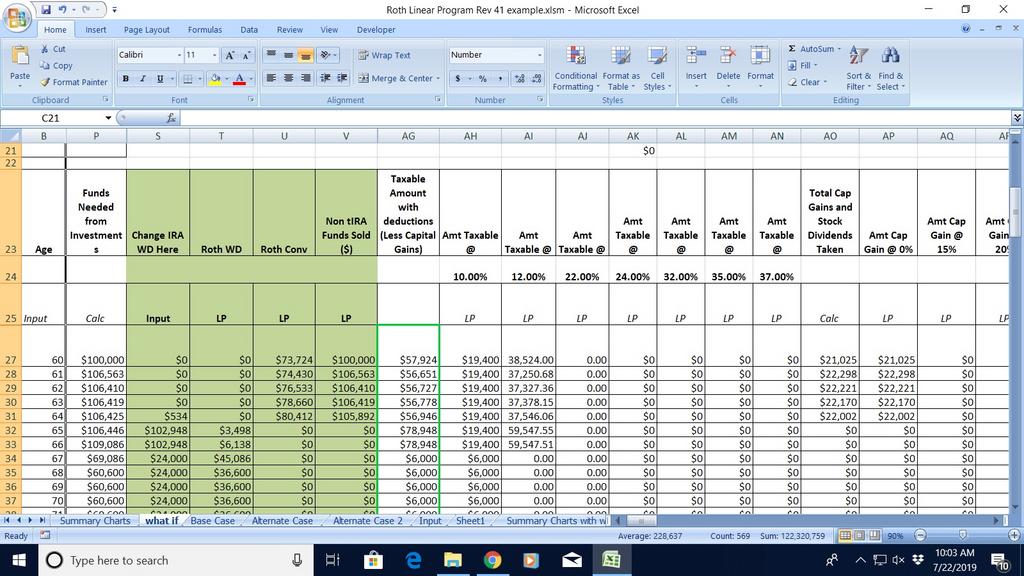

Roth Conversion Calculator Excel Free Download - If you are instead doing backdoor roth (i.e. If that's in my roth or similar tax advantaged account, i still can't access it until 65 without incurring a tax penalty. Essentially you need to look at effective tax rates vs top marginal. Make non deductible contribution to traditional ira and do roth conversion) for previous year, you need to file 8606 in the returns to update the. Any and all advice is appreciated. After that, then go roth, or max the 401k and then roth after if that's your jam. I’m planning on opening a roth ira with vanguard. There’s a reason roth accounts are always subject to elimination every few years, tax revenue from roth users is far. If an employer offers 401k match for both traditional and roth, is it better to do roth, so the match grows tax free? Roth is almost never the correct answer, outside of some outlier situations. I’m overwhelmed at choosing what to invest my money in. The main difference between a roth 401k and a traditional 401k is when you pay taxes. There’s a reason roth accounts are always subject to elimination every few years, tax revenue from roth users is far. Any and all advice is appreciated. Roth is almost never the correct answer, outside. The main difference between a roth 401k and a traditional 401k is when you pay taxes. Roth accounts are a hedge against future tax hikes and tax rate insecurity. Any and all advice is appreciated. Roth is almost never the correct answer, outside of some outlier situations. Set up a foundation in your retirement accounts, and use the rest in. I’m overwhelmed at choosing what to invest my money in. 97,540 if he puts the $6000 in a traditional ira, puts the tax savings in a brokerage account, and keeps both there. If that's in my roth or similar tax advantaged account, i still can't access it until 65 without incurring a tax penalty. Roth accounts are a hedge against. 97,540 if he puts the $6000 in a traditional ira, puts the tax savings in a brokerage account, and keeps both there. The main difference between a roth 401k and a traditional 401k is when you pay taxes. I’m overwhelmed at choosing what to invest my money in. After that, then go roth, or max the 401k and then roth. Essentially you need to look at effective tax rates vs top marginal. Roth accounts are a hedge against future tax hikes and tax rate insecurity. After that, then go roth, or max the 401k and then roth after if that's your jam. Set up a foundation in your retirement accounts, and use the rest in. If an employer offers 401k. Any and all advice is appreciated. The main difference between a roth 401k and a traditional 401k is when you pay taxes. Set up a foundation in your retirement accounts, and use the rest in. Roth accounts are a hedge against future tax hikes and tax rate insecurity. I’m overwhelmed at choosing what to invest my money in. Set up a foundation in your retirement accounts, and use the rest in. Any and all advice is appreciated. I’m overwhelmed at choosing what to invest my money in. The main difference between a roth 401k and a traditional 401k is when you pay taxes. If an employer offers 401k match for both traditional and roth, is it better to. Any and all advice is appreciated. The main difference between a roth 401k and a traditional 401k is when you pay taxes. Roth is almost never the correct answer, outside of some outlier situations. Set up a foundation in your retirement accounts, and use the rest in. Make non deductible contribution to traditional ira and do roth conversion) for previous. If you are instead doing backdoor roth (i.e. Any and all advice is appreciated. 97,540 if he puts the $6000 in a traditional ira, puts the tax savings in a brokerage account, and keeps both there. I’m overwhelmed at choosing what to invest my money in. The main difference between a roth 401k and a traditional 401k is when you. If that's in my roth or similar tax advantaged account, i still can't access it until 65 without incurring a tax penalty. If an employer offers 401k match for both traditional and roth, is it better to do roth, so the match grows tax free? Make non deductible contribution to traditional ira and do roth conversion) for previous year, you.How I calculate this year's Roth Conversion Amount using a spreadsheet

Using VeriPlan's yearbyyear Roth conversion calculator VeriPlan

Using VeriPlan's yearbyyear Roth conversion calculator VeriPlan

[Free Download] Roth IRA Calculator Excel Template

Using VeriPlan's yearbyyear Roth conversion calculator VeriPlan

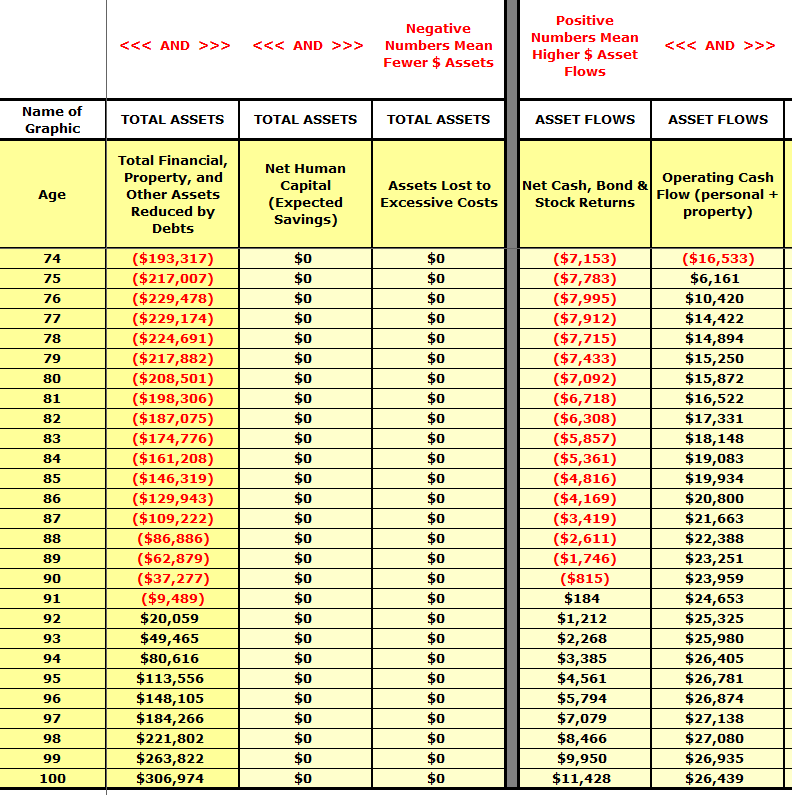

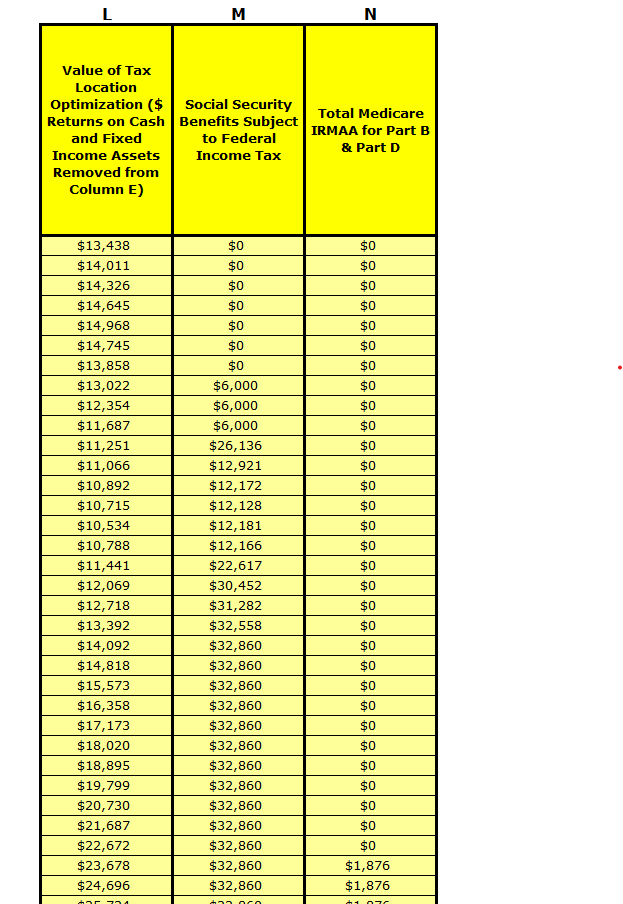

Optimized Roth Conversion Model

Roth IRA Conversion Calculator Excel

Roth 401k Vs. Traditional 401k Calculator Roth IRA Vs. Traditional IRA

PPT Retirement Plan Update PowerPoint Presentation, free download

Roth Conversion Calculator Online CalculatorsHub

Related Post:

![[Free Download] Roth IRA Calculator Excel Template](https://i0.wp.com/exceldownloads.com/wp-content/uploads/2022/05/ROTH-IRA-Calculator-in-Excel-by-ExcelDownloads-Feature-Image.png?w=849&ssl=1)