Volatility Formula In Excel

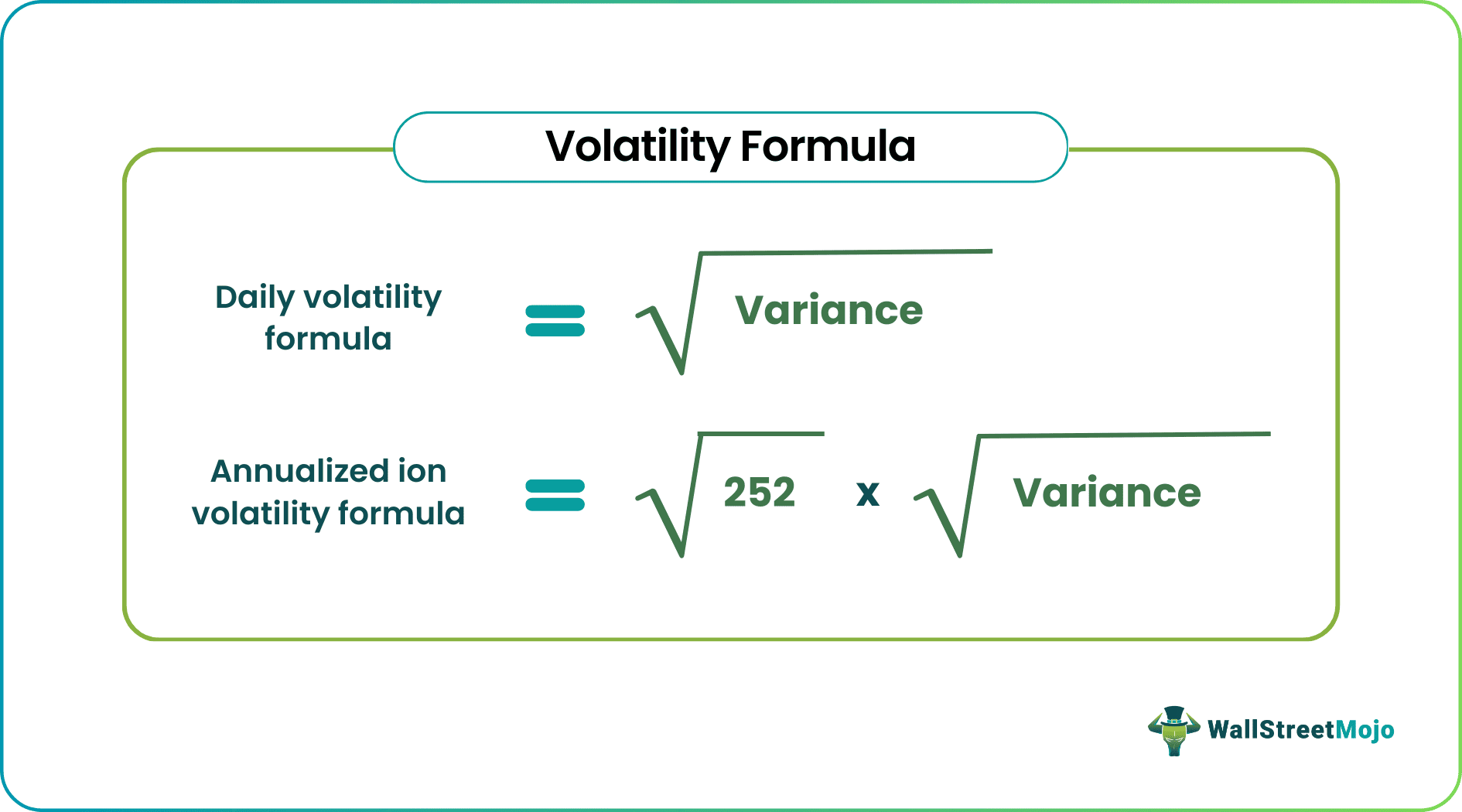

Volatility Formula In Excel - You can think of volatility in investing just as you would in other areas of. In finance, volatility (usually denoted by σ) is the degree of variation of a trading price series over time, usually measured by the standard deviation of logarithmic returns. Volatility is the frequent price fluctuations experienced by underlying security in a financial market. How to use volatility in a sentence. Access futures, options, etps, and trading tools to manage market volatility risk and enhance portfolio strategies. Discover effective strategies that can be used. Find out what it is, the factors that influence it, how to calculate it and manage it. Volatility is how much an investment or the stock market's value fluctuates over time. Volatility measures how much the price of a stock, derivative, or index fluctuates. The quality or state of being likely to change suddenly, especially by becoming worse: With investments, volatility refers to changes in an asset's or market's price — especially as measured against its usual behavior or a benchmark. Volatility is the frequent price fluctuations experienced by underlying security in a financial market. Discover effective strategies that can be used. The higher the volatility, the greater the potential risk of loss for investors. Volatility is a. Volatility is a significant, unexpected, rapid fluctuation in trading prices due to a large swath of people buying or selling investments around the same time. You can think of volatility in investing just as you would in other areas of. How to use volatility in a sentence. With investments, volatility refers to changes in an asset's or market's price —. Find out what it is, the factors that influence it, how to calculate it and manage it. It is otherwise the rate at which the price rapidly increases or decreases. The higher the volatility, the greater the potential risk of loss for investors. Volatility is how much an investment or the stock market's value fluctuates over time. In finance, volatility. How to use volatility in a sentence. Explore cboe's vix index and volatility products suite. Volatility is the frequent price fluctuations experienced by underlying security in a financial market. With investments, volatility refers to changes in an asset's or market's price — especially as measured against its usual behavior or a benchmark. It is otherwise the rate at which the. You can think of volatility in investing just as you would in other areas of. Find out what it is, the factors that influence it, how to calculate it and manage it. With investments, volatility refers to changes in an asset's or market's price — especially as measured against its usual behavior or a benchmark. Volatility measures how much the. Volatility measures how much the price of a stock, derivative, or index fluctuates. Explore cboe's vix index and volatility products suite. You can think of volatility in investing just as you would in other areas of. Discover effective strategies that can be used. Find out what it is, the factors that influence it, how to calculate it and manage it. You can think of volatility in investing just as you would in other areas of. The higher the volatility, the greater the potential risk of loss for investors. Volatility is how much an investment or the stock market's value fluctuates over time. Volatility measures how much the price of a stock, derivative, or index fluctuates. It is otherwise the rate. Explore cboe's vix index and volatility products suite. Volatility is how much an investment or the stock market's value fluctuates over time. It is otherwise the rate at which the price rapidly increases or decreases. Volatility is a significant, unexpected, rapid fluctuation in trading prices due to a large swath of people buying or selling investments around the same time.. The meaning of volatility is the quality or state of being volatile. How to use volatility in a sentence. Volatility measures how much the price of a stock, derivative, or index fluctuates. Volatility is a significant, unexpected, rapid fluctuation in trading prices due to a large swath of people buying or selling investments around the same time. Find out what. The quality or state of being likely to change suddenly, especially by becoming worse: Explore cboe's vix index and volatility products suite. The meaning of volatility is the quality or state of being volatile. With investments, volatility refers to changes in an asset's or market's price — especially as measured against its usual behavior or a benchmark. The higher the.Volatility Formula How to Calculate Daily & Annualized Volatility in

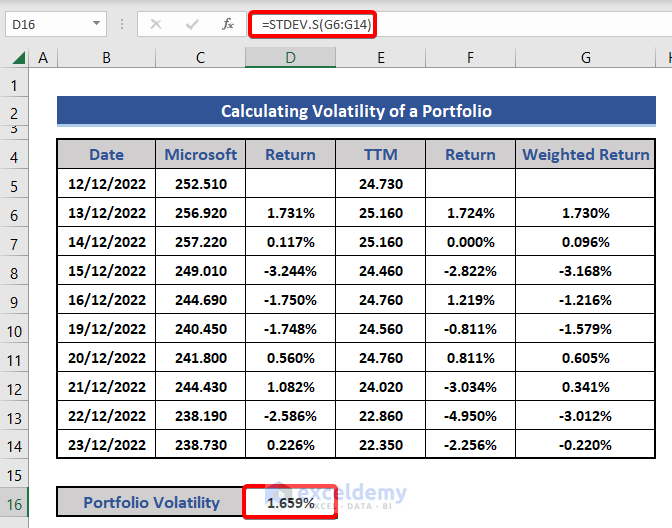

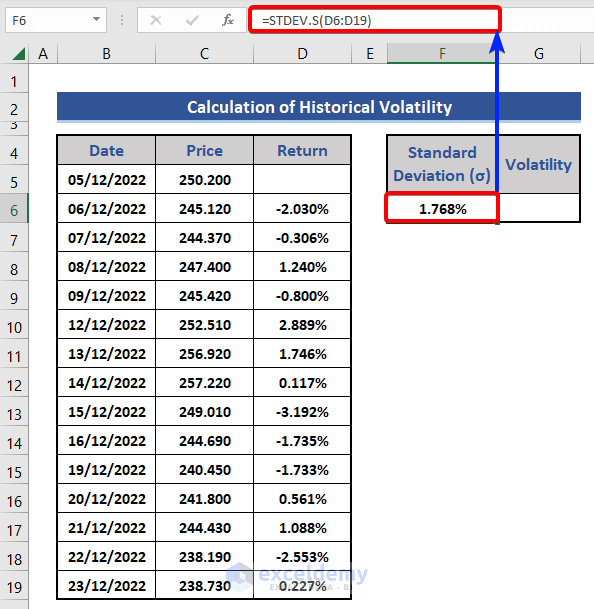

How to Calculate Volatility in Excel (2 Suitable Ways) ExcelDemy

How to Calculate Volatility in Excel (2 Suitable Ways) ExcelDemy

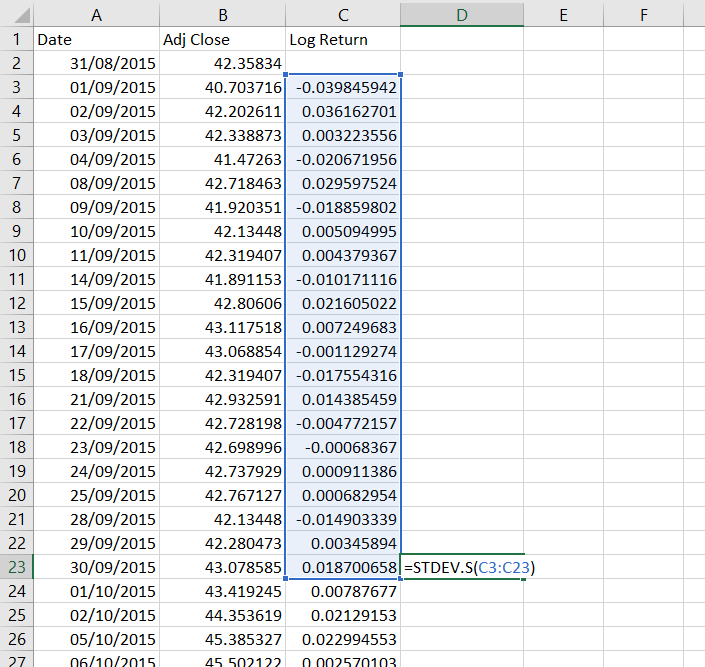

How to Calculate Historical Volatility in Excel Macroption

Computing Historical Volatility in Excel

Excel tutorial how to calculate annualized volatility in excel

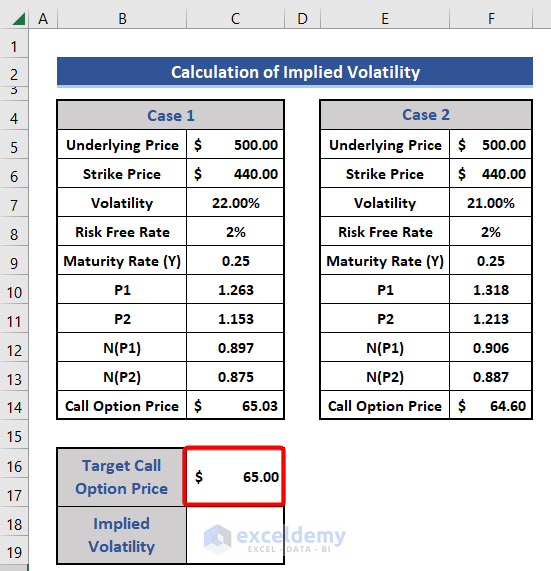

How to Calculate Volatility in Excel (2 Suitable Ways) ExcelDemy

Volatility Formula Calculator (Examples With Excel Template)

How to Calculate Volatility in Excel (2 Suitable Ways) ExcelDemy

How to Calculate Historical Volatility in Excel (with Easy Steps)

Related Post: