Ytm Calculator Excel

Ytm Calculator Excel - This easy ytc calculator takes all the guesswork out of the process. Current yield represents the prevailing interest rate that a bond or fixed income security is delivering to its owners. Wondering how to calculate yield to call? What is yield to call (ytc)? Weighted average maturity or wam is the weighted average amount of time until the securities in a portfolio mature. The ytm can rise or fall, depending on factors such as the number payments until maturity and the bond’s market value. The bond equivalent yield (bey) is a formula that allows investors to calculate the annual yield from a bond being sold at a discount. Yield to call is a measure of the yield of a bond if you were to hold it until the call date. We can use this information to calculate the bond's yield to maturity (ytm). The difference between yield maturity rate and. Yield to call is a measure of the yield of a bond if you were to hold it until the call date. Weighted average maturity or wam is the weighted average amount of time until the securities in a portfolio mature. It doesn't have to be difficult. This ytm calculator assumes that the bond is not called prior to maturity.. The difference between yield maturity rate and. The ytm can rise or fall, depending on factors such as the number payments until maturity and the bond’s market value. By plugging the numbers into the investinganswers' yield to maturity calculator, we see that the. Current yield represents the prevailing interest rate that a bond or fixed income security is delivering to. The difference between yield maturity rate and. What is yield to call (ytc)? Yield to call is a measure of the yield of a bond if you were to hold it until the call date. Weighted average maturity or wam is the weighted average amount of time until the securities in a portfolio mature. This ytm calculator assumes that the. Wondering how to calculate yield to call? Yield to call is a measure of the yield of a bond if you were to hold it until the call date. Weighted average maturity or wam is the weighted average amount of time until the securities in a portfolio mature. It doesn't have to be difficult. We can use this information to. The bond equivalent yield (bey) is a formula that allows investors to calculate the annual yield from a bond being sold at a discount. Wondering how to calculate yield to call? Yield to call is a measure of the yield of a bond if you were to hold it until the call date. This ytm calculator assumes that the bond. What is yield to call (ytc)? Yield to call is a measure of the yield of a bond if you were to hold it until the call date. We can use this information to calculate the bond's yield to maturity (ytm). This ytm calculator assumes that the bond is not called prior to maturity. By plugging the numbers into the. Yield to call is a measure of the yield of a bond if you were to hold it until the call date. By plugging the numbers into the investinganswers' yield to maturity calculator, we see that the. What is weighted average maturity? The bond equivalent yield (bey) is a formula that allows investors to calculate the annual yield from a. This easy ytc calculator takes all the guesswork out of the process. The ytm can rise or fall, depending on factors such as the number payments until maturity and the bond’s market value. Weighted average maturity or wam is the weighted average amount of time until the securities in a portfolio mature. The bond equivalent yield (bey) is a formula. It doesn't have to be difficult. Current yield represents the prevailing interest rate that a bond or fixed income security is delivering to its owners. Yield to call is a measure of the yield of a bond if you were to hold it until the call date. What is yield to call (ytc)? By plugging the numbers into the investinganswers'. Yield to call is a measure of the yield of a bond if you were to hold it until the call date. The difference between yield maturity rate and. What is weighted average maturity? The ytm can rise or fall, depending on factors such as the number payments until maturity and the bond’s market value. Wondering how to calculate yield.Yield to Maturity (YTM) Definition and Excel Examples

How to use Solver in Excel?

How to Calculate Yield to Maturity Excel YTM YIELDMAT Function Earn

How to Calculate Yield to Maturity Excel YTM YIELDMAT Function Earn

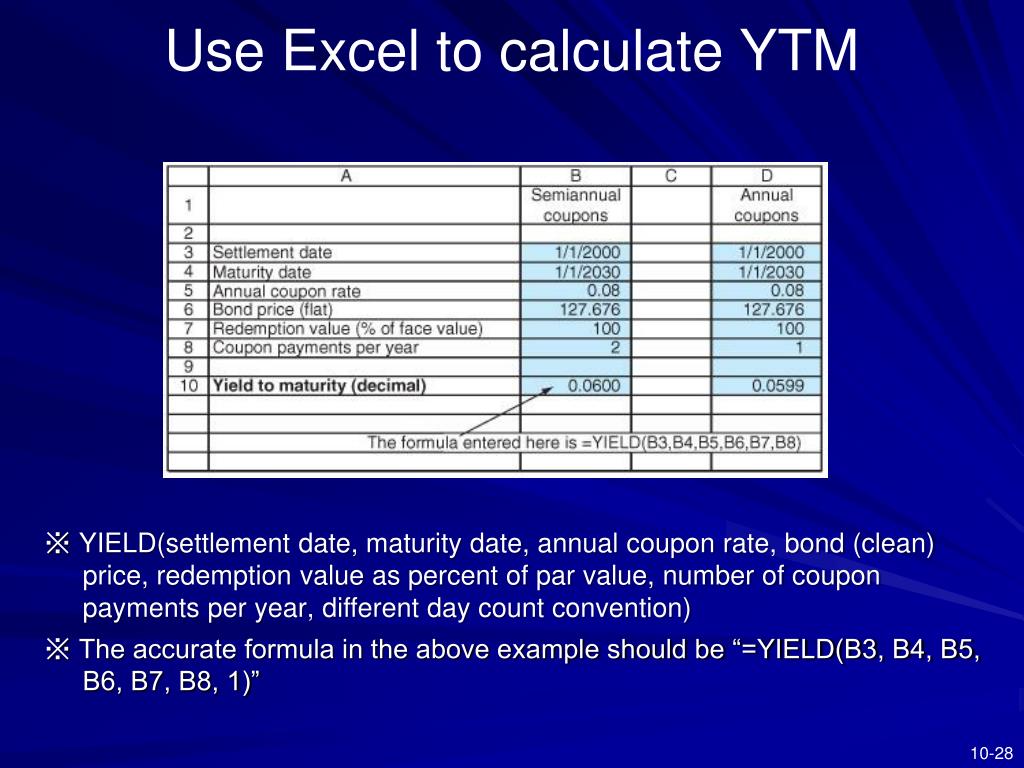

PPT CHAPTER 10 PowerPoint Presentation, free download ID1656234

Yield to Maturity (YTM) Definition and Excel Examples

Yield to Maturity in Excel Quant RL

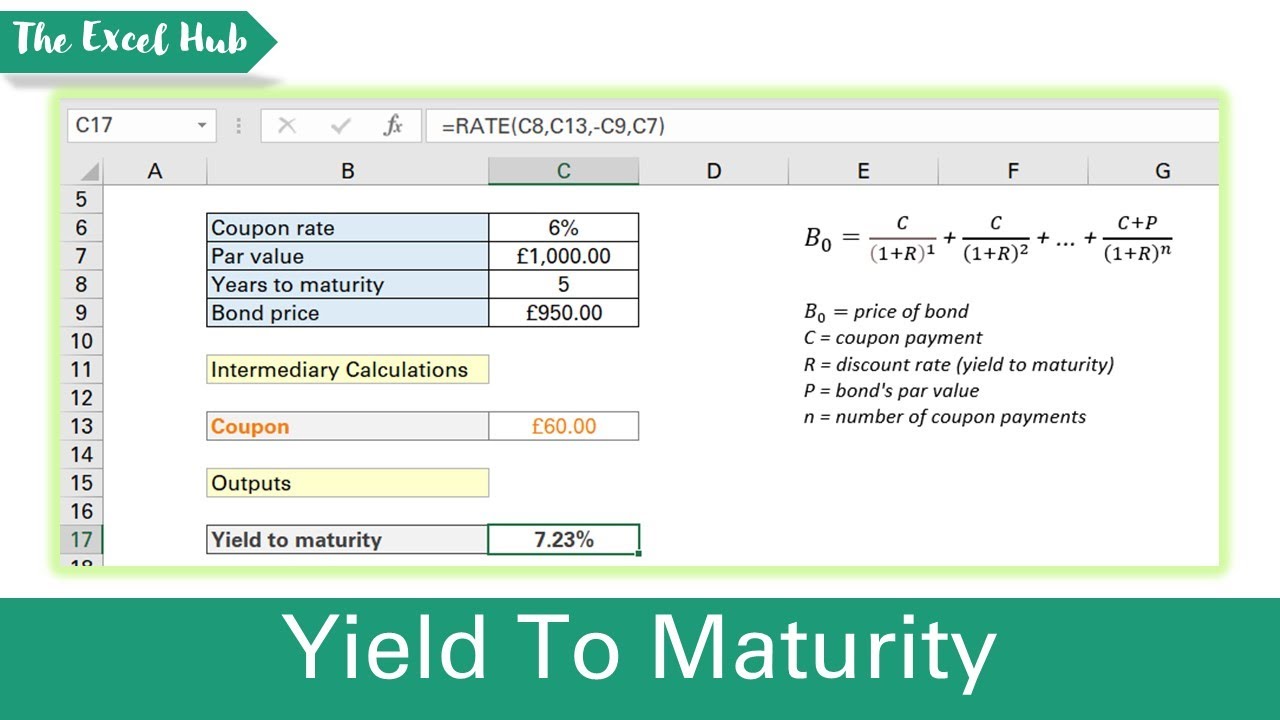

Finding Yield to Maturity using Excel YouTube

Calculate The YTM Of A Bond With Semi Annual Coupon Payments In Excel

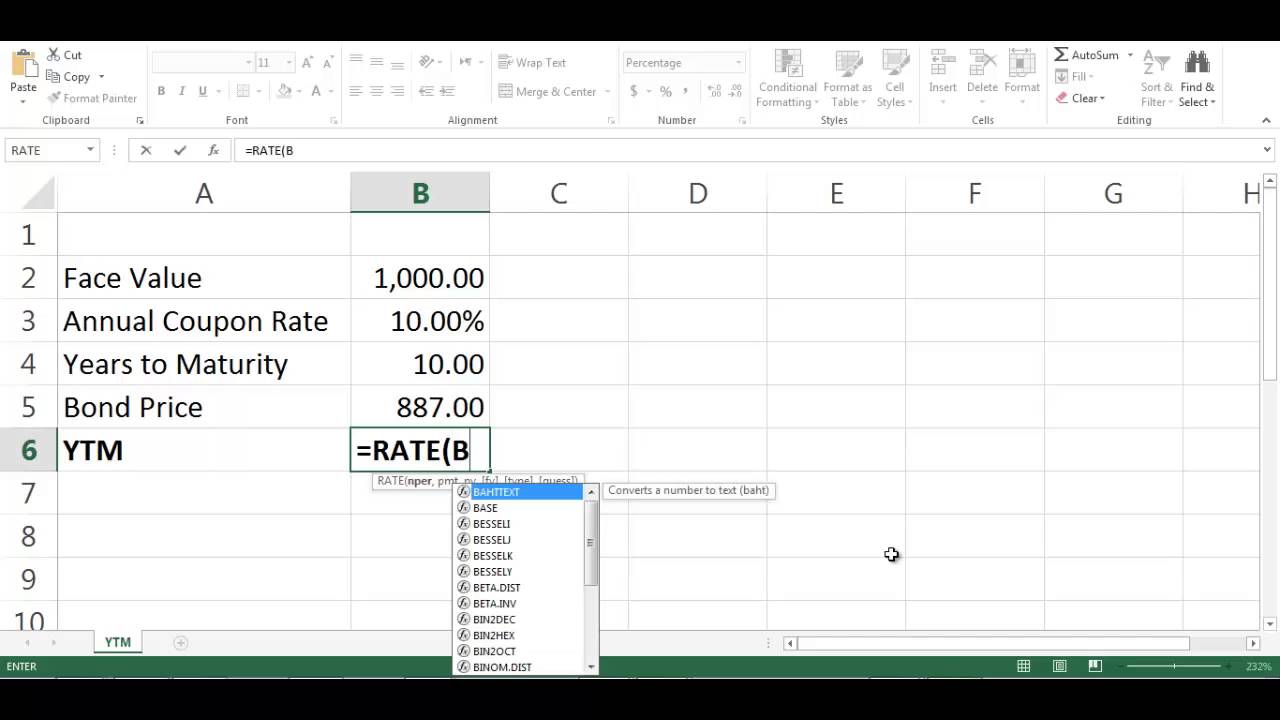

Calculating bond’s yield to maturity using excel YouTube

Related Post: