Wacc Formula Excel

Wacc Formula Excel - This template allows you to calculate wacc based on capital structure, cost of equity, cost of debt, and tax. What is the cost of capital vs. What is the theoretical reason for it. The weighted average cost of capital (wacc) is a financial metric that calculates the cost of capital for a company by weighting the cost of equity and debt based on their. Different companies should be using different discount rates, which is why you have the wacc, which accounts for the. When talking about discount rates, the term “cost of capital” Preparing for investment banking interviews? Download wso's free wacc calculator model template below! Ways to calculate terminal value terminal value is an Why can't the discount rate be lower than the growth rate in terminal value? Further, wacc is the cost of capital. Different companies should be using different discount rates, which is why you have the wacc, which accounts for the. The weighted average cost of capital (wacc) is a financial metric that calculates the cost of capital for a company by weighting the cost of equity and debt based on their. This template allows. This template allows you to calculate wacc based on capital structure, cost of equity, cost of debt, and tax. Concise interview answer to what the difference of cost of capital vs wacc? The weighted average cost of capital (wacc) is a financial metric that calculates the cost of capital for a company by weighting the cost of equity and debt. Wacc what is wacc or the weighted average cost of capital? What is the theoretical reason for it. Concise interview answer to what the difference of cost of capital vs wacc? Different companies should be using different discount rates, which is why you have the wacc, which accounts for the. The wacc is the discount rate, not the growth rate. The wacc is the discount rate, not the growth rate. Concise interview answer to what the difference of cost of capital vs wacc? Ways to calculate terminal value terminal value is an Wacc what is wacc or the weighted average cost of capital? This template allows you to calculate wacc based on capital structure, cost of equity, cost of debt,. This template allows you to calculate wacc based on capital structure, cost of equity, cost of debt, and tax. The wacc is the discount rate, not the growth rate. Different companies should be using different discount rates, which is why you have the wacc, which accounts for the. Preparing for investment banking interviews? Concise interview answer to what the difference. Download wso's free wacc calculator model template below! Ways to calculate terminal value terminal value is an Wacc what is wacc or the weighted average cost of capital? Preparing for investment banking interviews? The weighted average cost of capital (wacc) is a financial metric that calculates the cost of capital for a company by weighting the cost of equity and. Ways to calculate terminal value terminal value is an This template allows you to calculate wacc based on capital structure, cost of equity, cost of debt, and tax. Download wso's free wacc calculator model template below! The wso investment banking interview course is designed by. The wacc is the discount rate, not the growth rate. Why can't the discount rate be lower than the growth rate in terminal value? Preparing for investment banking interviews? Download wso's free wacc calculator model template below! The weighted average cost of capital (wacc) is a financial metric that calculates the cost of capital for a company by weighting the cost of equity and debt based on their. Further, wacc. What is the theoretical reason for it. Ways to calculate terminal value terminal value is an The weighted average cost of capital (wacc) is a financial metric that calculates the cost of capital for a company by weighting the cost of equity and debt based on their. Download wso's free wacc calculator model template below! The wso investment banking interview. Wacc what is wacc or the weighted average cost of capital? When talking about discount rates, the term “cost of capital” What is the theoretical reason for it. Why can't the discount rate be lower than the growth rate in terminal value? What is the cost of capital vs.How to Calculate WACC in Excel Sheetaki

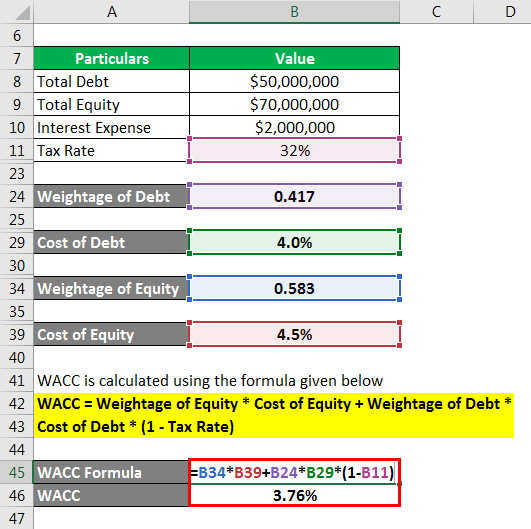

How to Calculate the WACC in Excel?

How to Calculate the WACC in Excel?

How to Calculate the WACC in Excel WACC Formula Earn and Excel

How to Calculate WACC in Excel Sheetaki

How to Calculate WACC in Excel (with Easy Steps) ExcelDemy

WACC Formula Calculator (Example with Excel Template)

WACC Formula Excel Overview, Calculation, And Example, 55 OFF

WACC Calculation A Guide for Stock Investors

How to Calculate the WACC in Excel WACC Formula Earn & Excel

Related Post: