Valuation Formula Excel

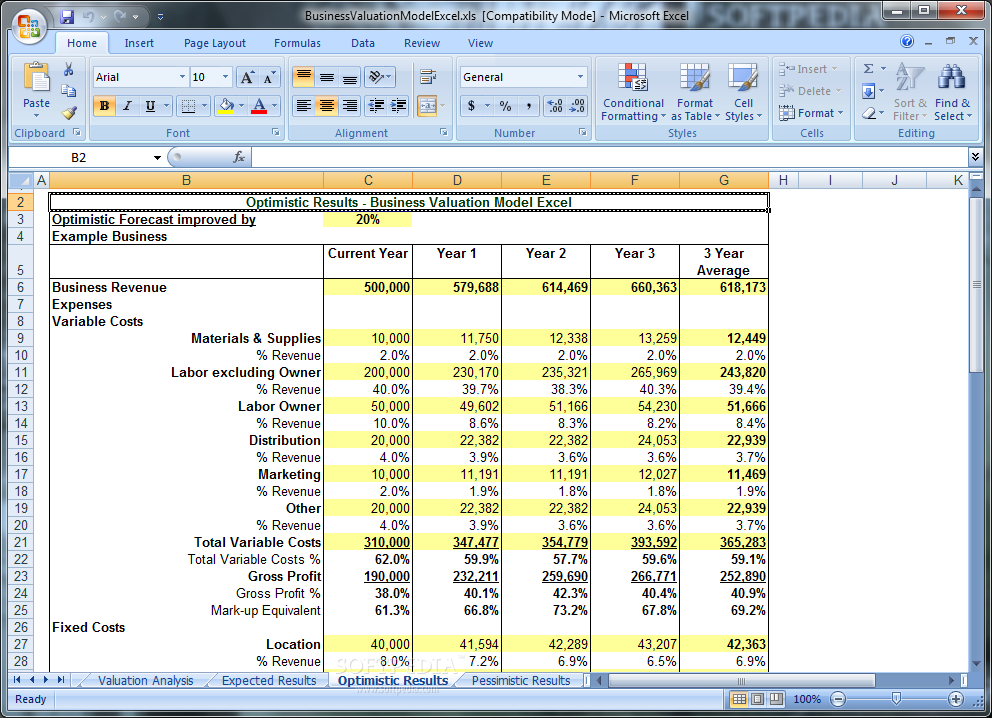

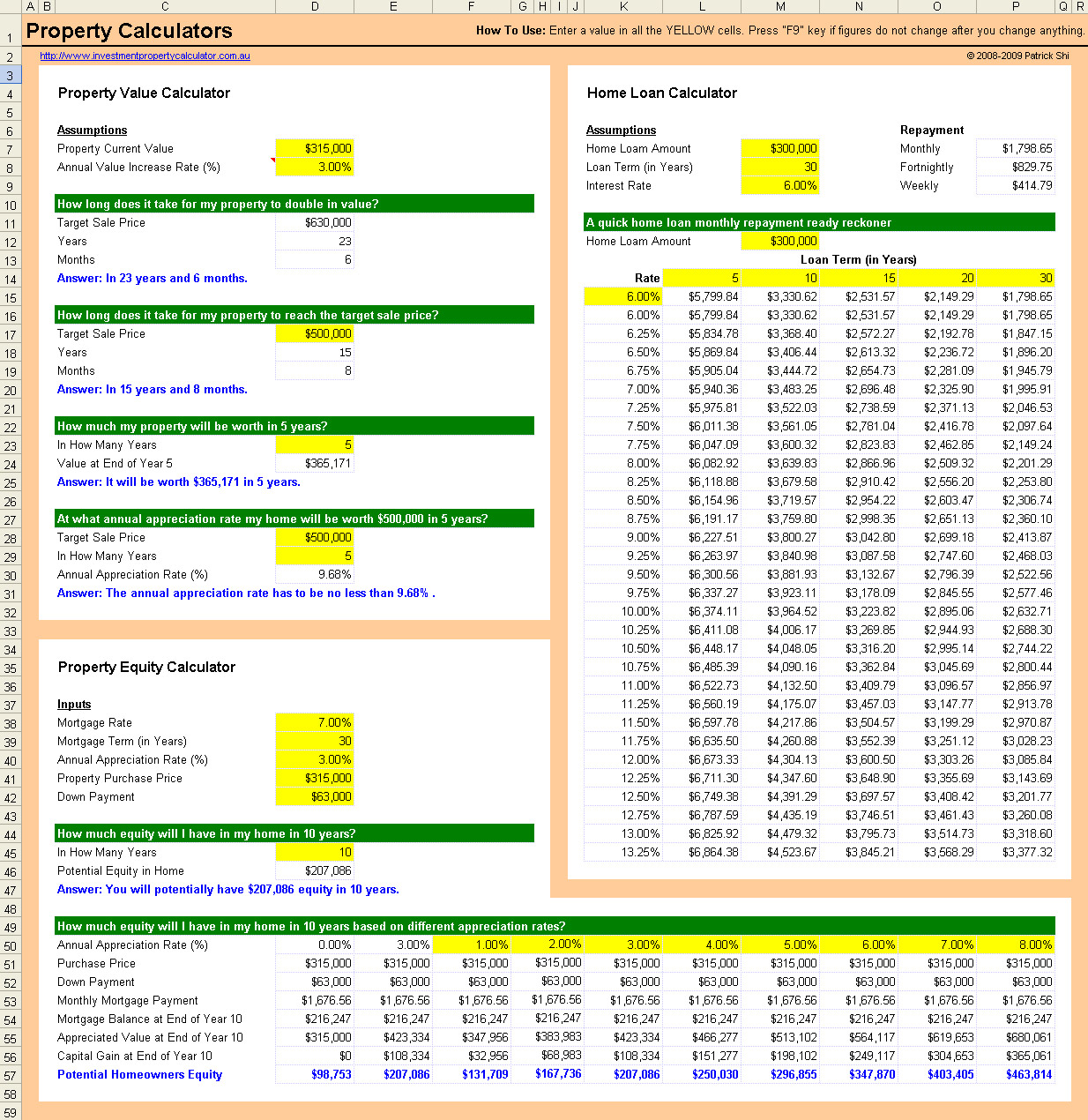

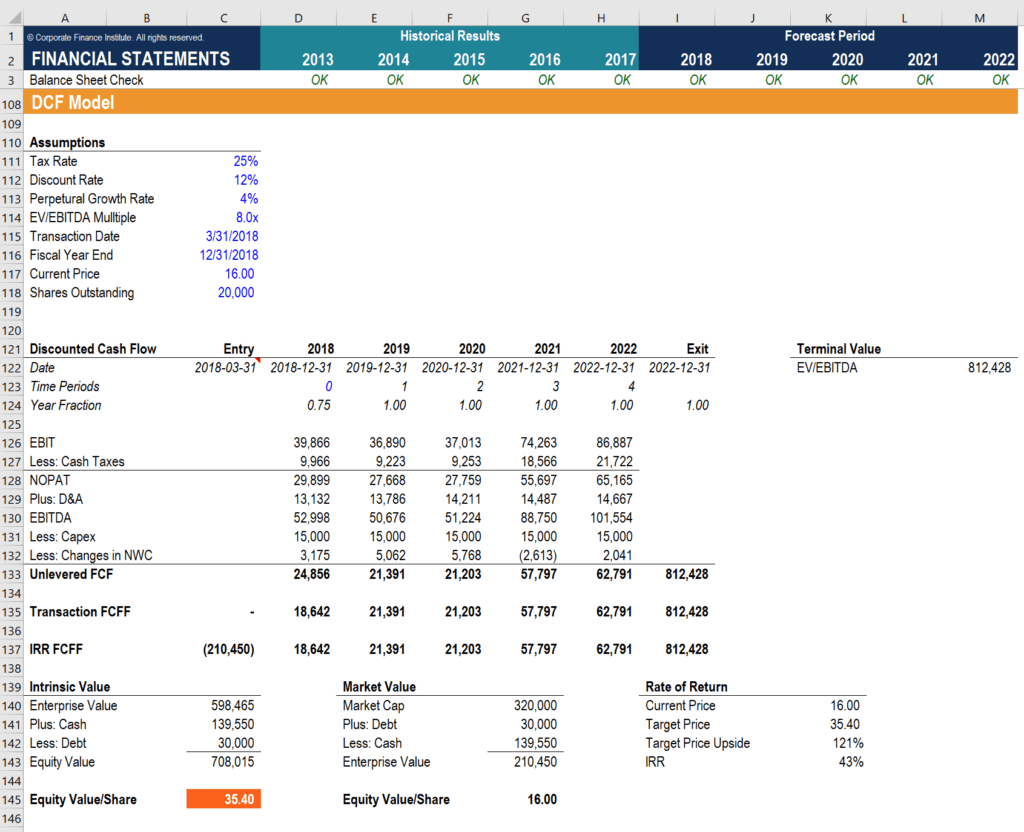

Valuation Formula Excel - In this course, we will cover. The market approach is a valuation method used to determine the appraisal value of a business, intangible asset, business ownership interest, or security by The ebitda multiple is a financial ratio that compares a company's enterprise value to its annual ebitda. Valuing a startup can be quite challenging, but there are several startup valuation methods available for use by financial analysts. Business valuation involves the determination of the fair economic value of a company or business for various reasons such as sale value, divorce litigation, and. Cfi's financial modeling & valuation analyst (fmva®) certification imparts vital financial analysis skills, emphasizing constructing effective financial models for confident business decisions. Explore cfi's valuation courses to find expert insights and learn about different methods and tools to make informed financial decisions and drive growth. Valuing a startup can be quite challenging, but there are several startup valuation methods available for use by financial analysts. In this course, we will cover. Explore cfi's valuation courses to find expert insights and learn about different methods and tools to make informed financial decisions and drive growth. The ebitda multiple is a financial ratio that compares a company's. The market approach is a valuation method used to determine the appraisal value of a business, intangible asset, business ownership interest, or security by Valuing a startup can be quite challenging, but there are several startup valuation methods available for use by financial analysts. Business valuation involves the determination of the fair economic value of a company or business for. Explore cfi's valuation courses to find expert insights and learn about different methods and tools to make informed financial decisions and drive growth. The ebitda multiple is a financial ratio that compares a company's enterprise value to its annual ebitda. Business valuation involves the determination of the fair economic value of a company or business for various reasons such as. Valuing a startup can be quite challenging, but there are several startup valuation methods available for use by financial analysts. Cfi's financial modeling & valuation analyst (fmva®) certification imparts vital financial analysis skills, emphasizing constructing effective financial models for confident business decisions. Business valuation involves the determination of the fair economic value of a company or business for various reasons. Business valuation involves the determination of the fair economic value of a company or business for various reasons such as sale value, divorce litigation, and. In this course, we will cover. The ebitda multiple is a financial ratio that compares a company's enterprise value to its annual ebitda. The market approach is a valuation method used to determine the appraisal. The ebitda multiple is a financial ratio that compares a company's enterprise value to its annual ebitda. Business valuation involves the determination of the fair economic value of a company or business for various reasons such as sale value, divorce litigation, and. The market approach is a valuation method used to determine the appraisal value of a business, intangible asset,. Cfi's financial modeling & valuation analyst (fmva®) certification imparts vital financial analysis skills, emphasizing constructing effective financial models for confident business decisions. In this course, we will cover. Explore cfi's valuation courses to find expert insights and learn about different methods and tools to make informed financial decisions and drive growth. Valuing a startup can be quite challenging, but there. Business valuation involves the determination of the fair economic value of a company or business for various reasons such as sale value, divorce litigation, and. In this course, we will cover. Explore cfi's valuation courses to find expert insights and learn about different methods and tools to make informed financial decisions and drive growth. The ebitda multiple is a financial. The ebitda multiple is a financial ratio that compares a company's enterprise value to its annual ebitda. In this course, we will cover. The market approach is a valuation method used to determine the appraisal value of a business, intangible asset, business ownership interest, or security by Valuing a startup can be quite challenging, but there are several startup valuation. Cfi's financial modeling & valuation analyst (fmva®) certification imparts vital financial analysis skills, emphasizing constructing effective financial models for confident business decisions. The ebitda multiple is a financial ratio that compares a company's enterprise value to its annual ebitda. The market approach is a valuation method used to determine the appraisal value of a business, intangible asset, business ownership interest,.Business Valuation Excel Template

Valuation Excel Template

Planilha de Valuation em Excel Smart Planilhas

Company Valuation Template

Net Present Value Excel Template

Professional Net Present Value Calculator Excel Template Excel TMP

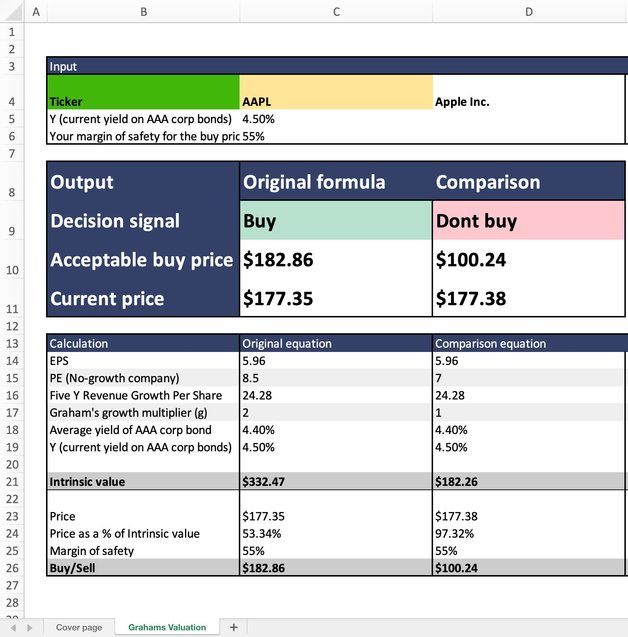

Grahams Valuation Formula Google Sheets and Excel Template

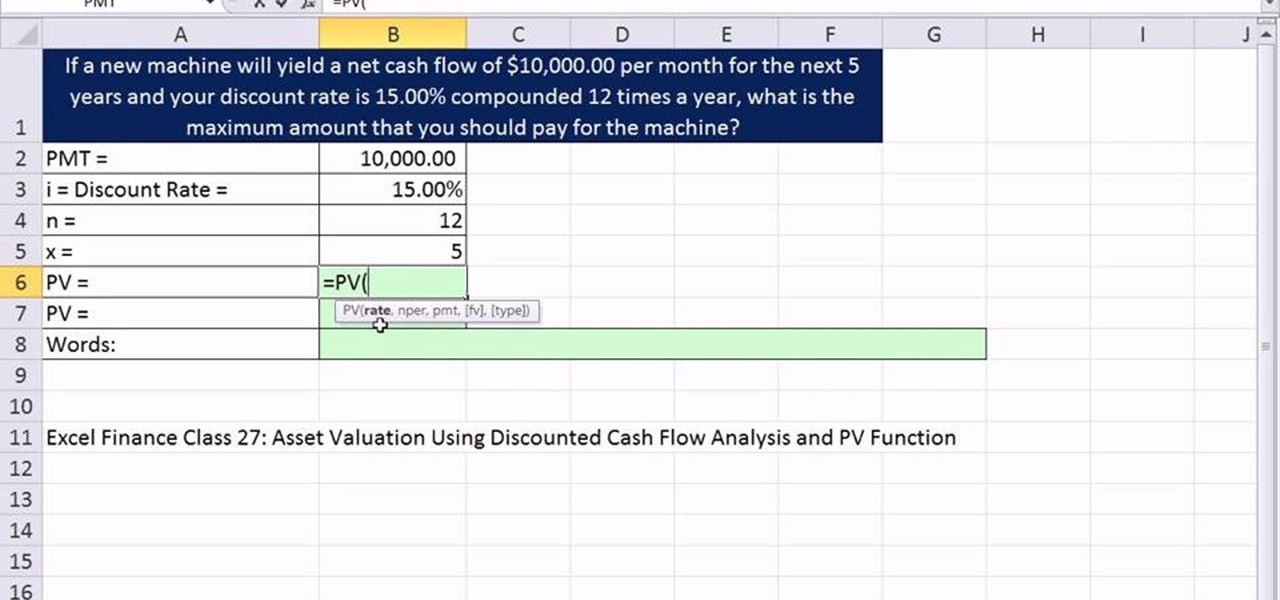

How to Calculate the present value of an annuity for asset valuation in

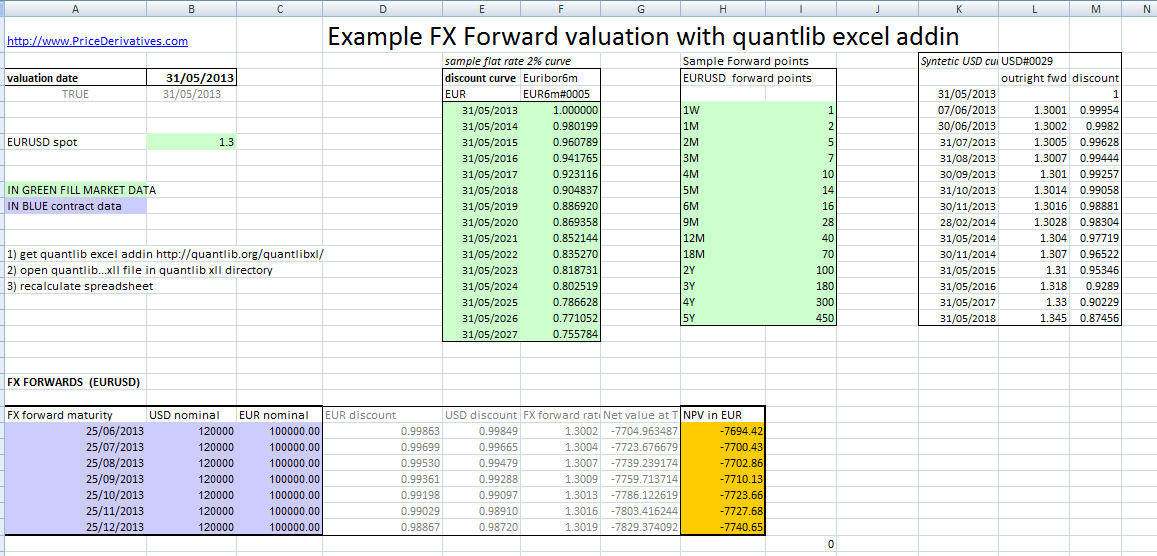

FX forward valuation excel

Valuation Modeling in Excel Example, How to Use, Why

Related Post: