Taxable Income Formula Excel

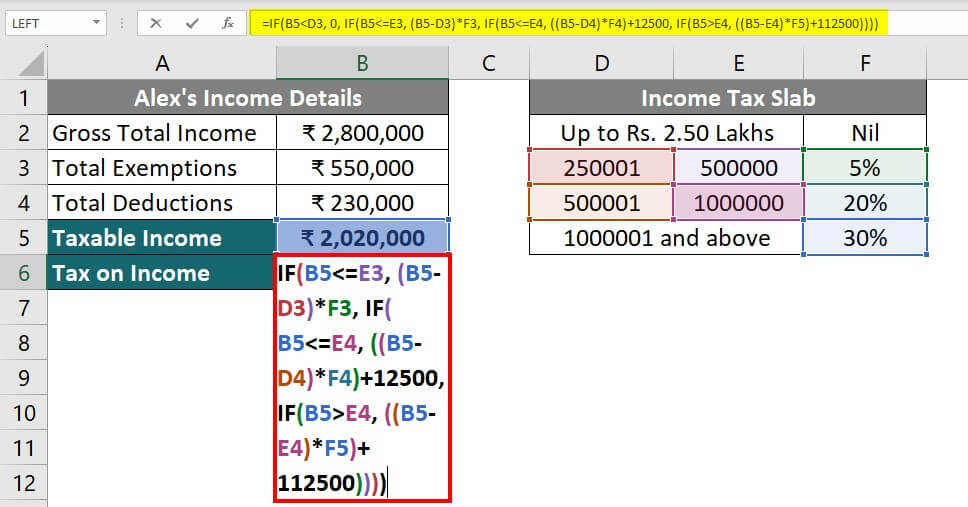

Taxable Income Formula Excel - Individuals begin with gross income, the. Another way of calling it is adjusted gross. Taxable income differs from—and is less than—gross income. Taxable income is the portion of your gross income that's subject to federal tax. Even if you don’t receive a form reporting income, you should report it on. Most forms of income count as taxable — but not all. It can be described broadly as adjusted gross income. Here’s how to calculate your taxable income, and some ways to reduce your liability. Find out what and when income is taxable and nontaxable, including employee wages, fringe benefits, barter income and royalties. Taxable income and gross income differ for several reasons. Taxable income differs from—and is less than—gross income. Understanding taxable income is a crucial step in this journey. Taxable income is the amount of income subject to tax, after deductions and exemptions. Most income is taxable unless it’s specifically exempted by law. Your taxable income is simply the portion of your total income that the irs considers subject to taxes. Even if you don’t receive a form reporting income, you should report it on. Your taxable income is simply the portion of your total income that the irs considers subject to taxes during a given year; Most income is taxable unless it’s specifically exempted by law. Taxable income then takes your agi and reduces it further through deductions, ultimately determining. Not all income is taxable. Taxable income is the portion of your gross income that's subject to federal tax. Most income is taxable unless it’s specifically exempted by law. Another way of calling it is adjusted gross. Most forms of income count as taxable — but not all. Understanding taxable income is a crucial step in this journey. Taxable income is the portion of your gross income that's subject to federal tax. Even if you don’t receive a form reporting income, you should report it on. A financial advisor or tax. Income can be money, property, goods or services. Taxable income then takes your agi and reduces it further through deductions, ultimately determining how much of your income is subject to tax. Taxable income is the portion of your gross income that's subject to federal tax. All income you receive during the year is considered taxable income unless it's specifically exempt by law. Navigating the world of taxes can. Another way of calling it is adjusted gross. Taxable income is the portion of your gross income that's used to calculate how much tax you owe in a given tax year. Navigating the world of taxes can be daunting. Taxable income is the portion of your gross income that's subject to federal tax. Most forms of income count as taxable. Taxable income differs from—and is less than—gross income. Taxable income then takes your agi and reduces it further through deductions, ultimately determining how much of your income is subject to tax. Even if you don’t receive a form reporting income, you should report it on. Your taxable income is simply the portion of your total income that the irs considers. Your taxable income is simply the portion of your total income that the irs considers subject to taxes during a given year; Taxable income and gross income differ for several reasons. Here’s how to calculate your taxable income, and some ways to reduce your liability. Taxable income is the portion of your gross income that's subject to federal tax. Find. Not all income is taxable. Navigating the world of taxes can be daunting. Most forms of income count as taxable — but not all. Income can be money, property, goods or services. Find out what and when income is taxable and nontaxable, including employee wages, fringe benefits, barter income and royalties. It can be described broadly as adjusted gross income. Taxable income and gross income differ for several reasons. Understanding taxable income is a crucial step in this journey. Income can be money, property, goods or services. Here’s how to calculate your taxable income, and some ways to reduce your liability.how to calculate taxable in excel tax calculation in

Mastering Formulas In Excel How To Find Taxable Formula

Tax Formula In Excel For Fy 202424 Kally Marinna

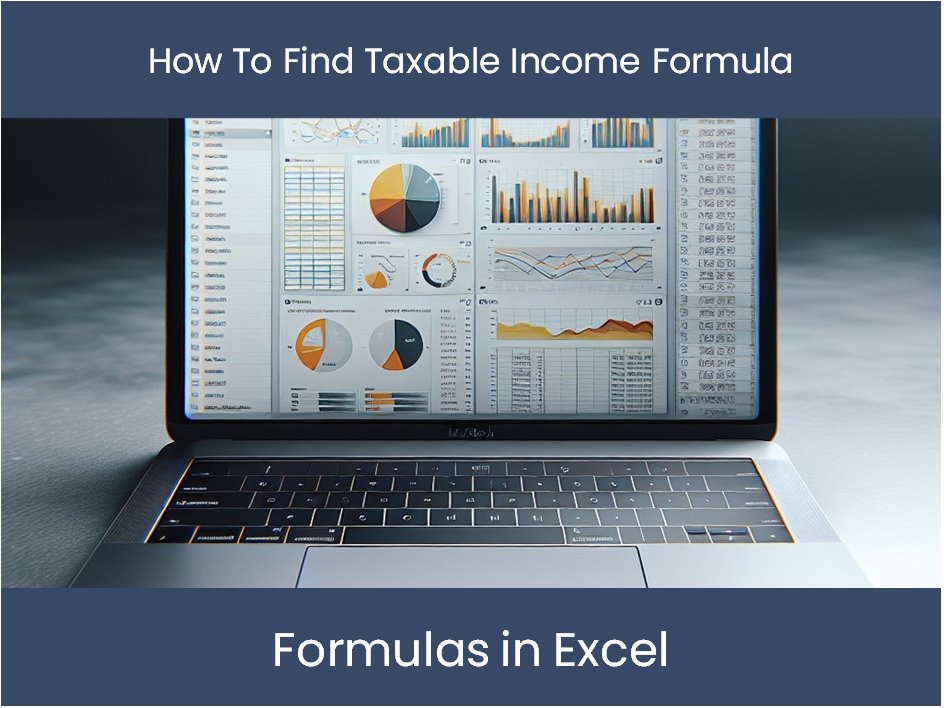

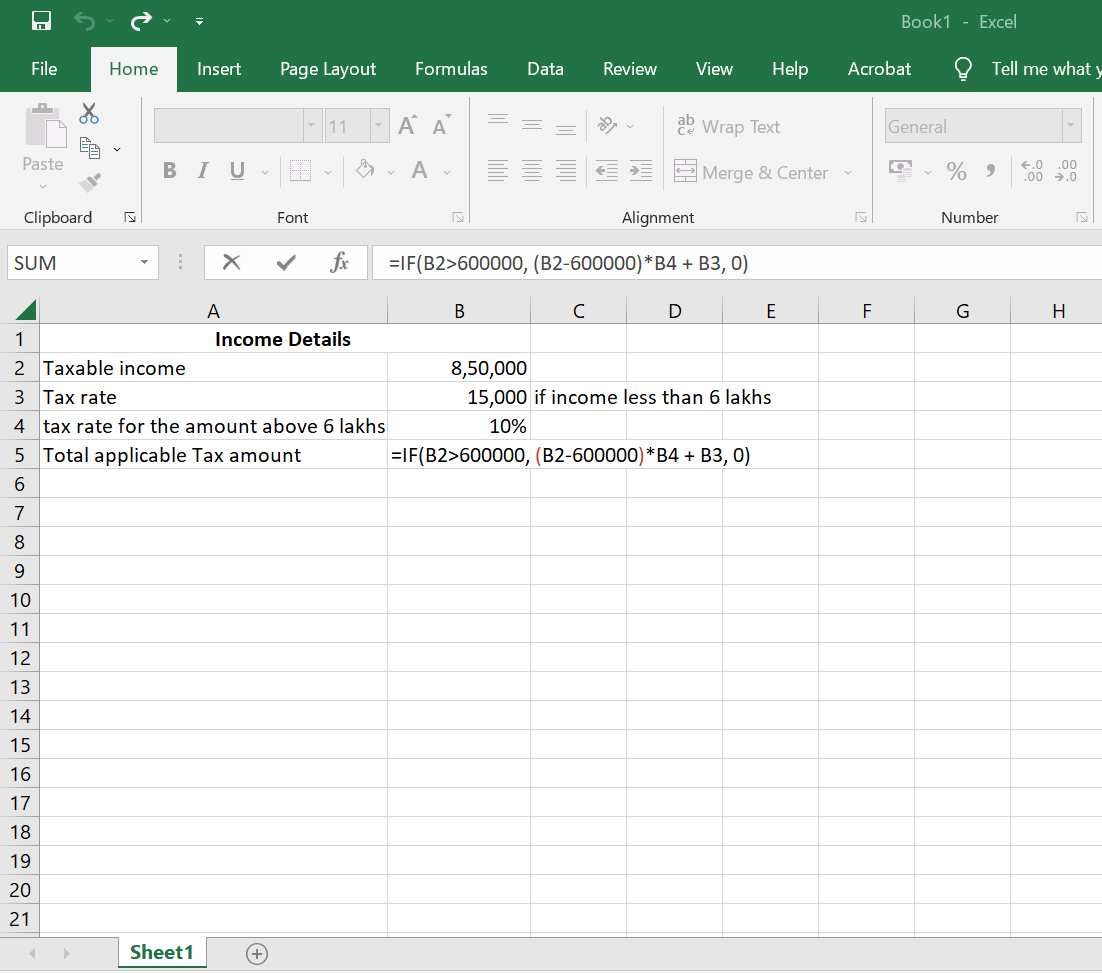

tax calculation formula in excel

Tax Calculator FY 202526 Excel [DOWNLOAD] FinCalC Blog

Tax Calculator 202526 Excel Archives FinCalC Blog

Calculating Tax Using Excel Easy Method YouTube

Calculate Tax in Excel AY 202425 Template & Examples

tax calculation formula in excel

tax calculation formula in excel

Related Post:

![Tax Calculator FY 202526 Excel [DOWNLOAD] FinCalC Blog](https://fincalc-blog.in/wp-content/uploads/2025/02/image-1.png)