Straight Line Depreciation Excel

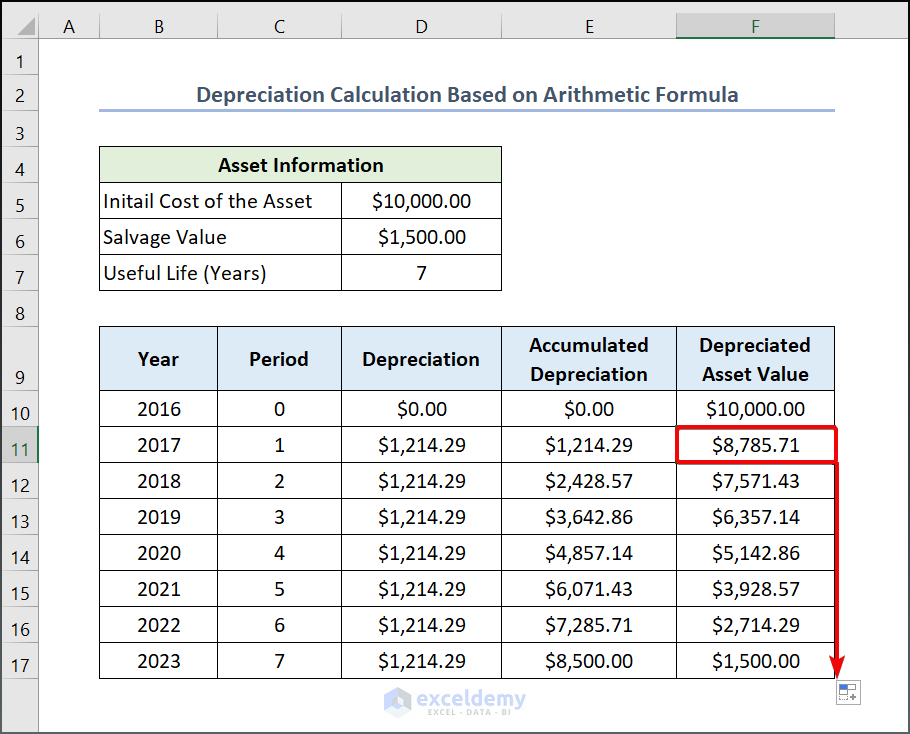

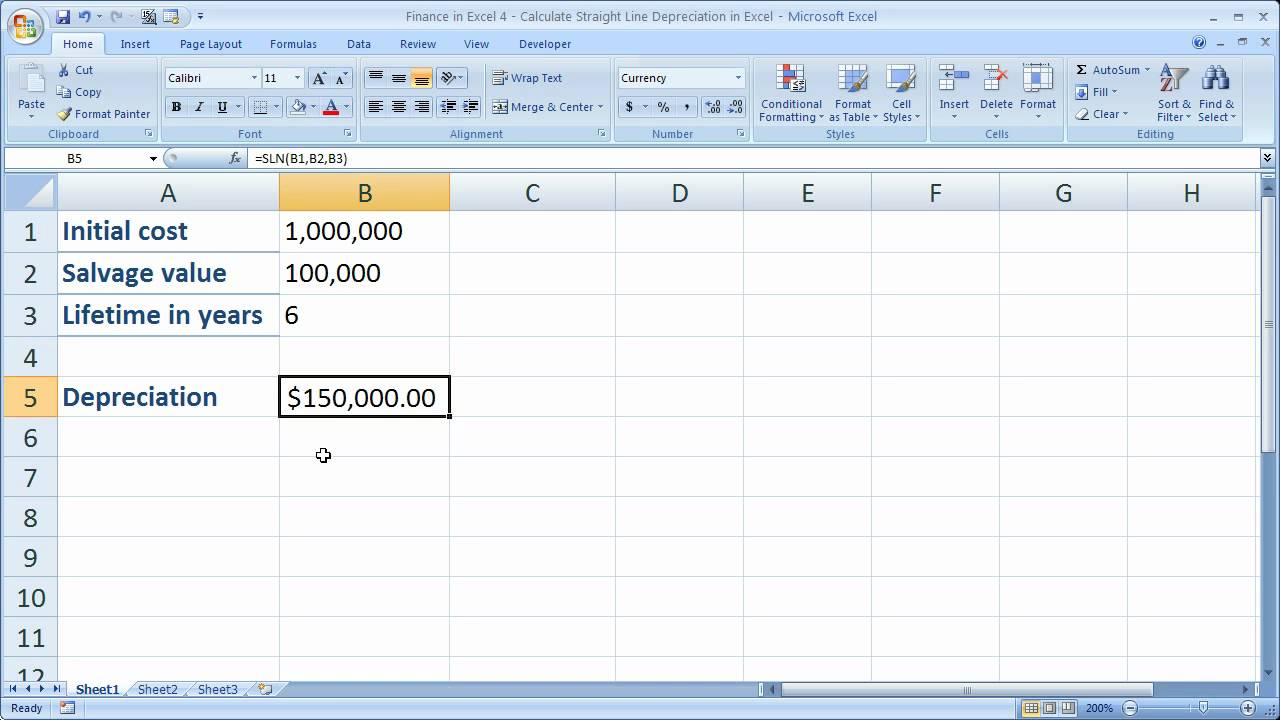

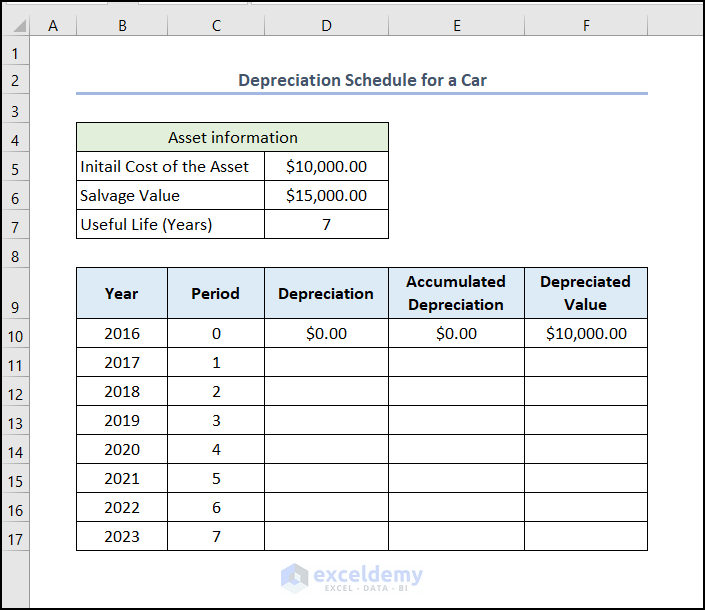

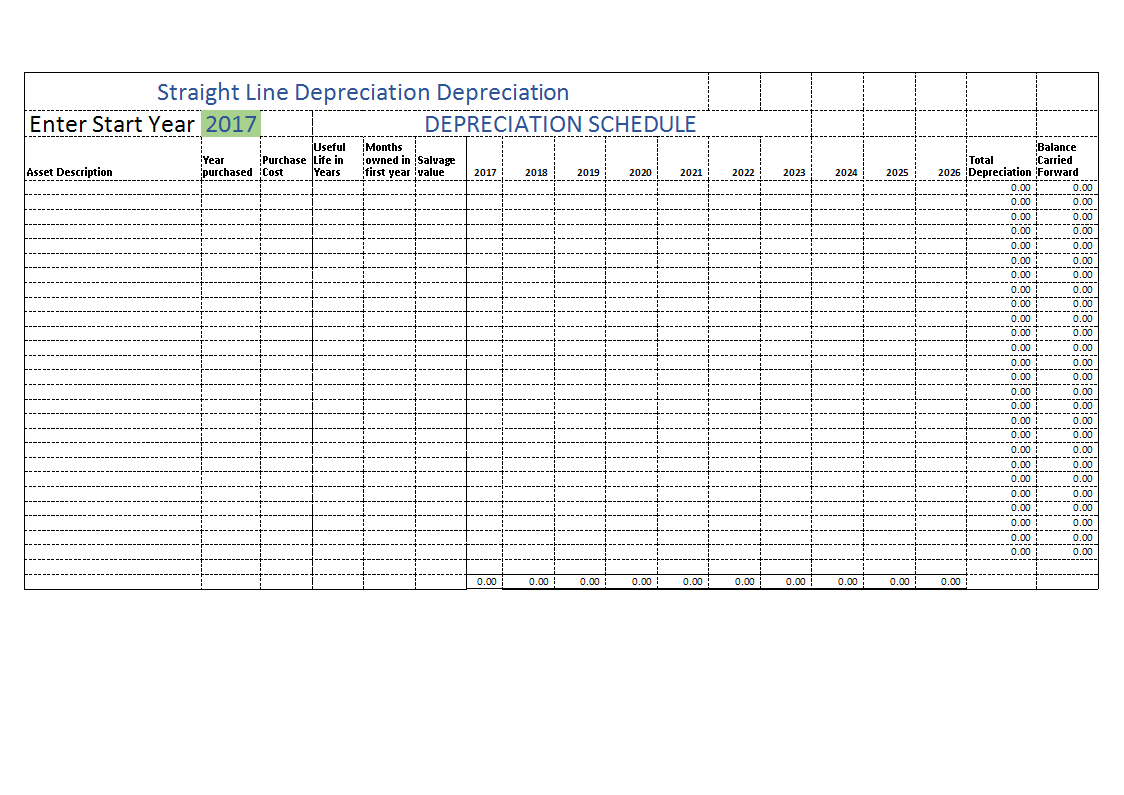

Straight Line Depreciation Excel - In financial modeling, the sln function helps calculate the straight line depreciation of a fixed asset when building a budget. Learn more about various types of depreciation methods. Excel offers five different depreciation functions. This article describes the formula syntax and usage of the sln function in microsoft excel. Sln, ddb, syd, vdb, and db. In this article, we will learn how to calculate straight line depreciation using formula in excel. We consider an asset with an initial cost of $10,000, a salvage value (residual value) of $1000 and a useful life of 10 periods (years). Learn how to calculate straight line depreciation using the sln function. Learn how to efficiently manage and automate straight line depreciation in excel, customize schedules, and analyze financial impacts. Straight line depreciation means uniformly depreciating an asset over its life. Excel offers several functions to calculate depreciation: Sln (cost, salvage, life) the. In this article, we will learn how to calculate straight line depreciation using formula in excel. This article describes the formula syntax and usage of the sln function in microsoft excel. In financial modeling, the sln function helps calculate the straight line depreciation of a fixed asset when. We consider an asset with an initial cost of $10,000, a salvage value (residual value) of $1000 and a useful life of 10 periods (years). Straight line depreciation means uniformly depreciating an asset over its life. Learn how to calculate straight line depreciation using the sln function. Sln, ddb, syd, vdb, and db. In this article, we will learn how. We consider an asset with an initial cost of $10,000, a salvage value (residual value) of $1000 and a useful life of 10 periods (years). Learn how to calculate straight line depreciation using the sln function. Learn how to efficiently manage and automate straight line depreciation in excel, customize schedules, and analyze financial impacts. Learn more about various types of. Excel offers five different depreciation functions. Sln, ddb, syd, vdb, and db. Excel is a useful tool in our daily lives. This article describes the formula syntax and usage of the sln function in microsoft excel. Excel offers several functions to calculate depreciation: Learn how to efficiently manage and automate straight line depreciation in excel, customize schedules, and analyze financial impacts. This article describes the formula syntax and usage of the sln function in microsoft excel. Learn how to calculate straight line depreciation using the sln function. Learn more about various types of depreciation methods. Excel offers five different depreciation functions. Sln, ddb, syd, vdb, and db. Straight line depreciation means uniformly depreciating an asset over its life. This article describes the formula syntax and usage of the sln function in microsoft excel. We consider an asset with an initial cost of $10,000, a salvage value (residual value) of $1000 and a useful life of 10 periods (years). In this article,. We consider an asset with an initial cost of $10,000, a salvage value (residual value) of $1000 and a useful life of 10 periods (years). Sln (cost, salvage, life) the. Straight line depreciation means uniformly depreciating an asset over its life. Learn how to calculate straight line depreciation using the sln function. Learn more about various types of depreciation methods. In this article, we will learn how to calculate straight line depreciation using formula in excel. Excel offers several functions to calculate depreciation: This article describes the formula syntax and usage of the sln function in microsoft excel. Excel offers five different depreciation functions. Sln (cost, salvage, life) the. Learn how to calculate straight line depreciation using the sln function. Straight line depreciation means uniformly depreciating an asset over its life. Learn how to efficiently manage and automate straight line depreciation in excel, customize schedules, and analyze financial impacts. Learn more about various types of depreciation methods. Excel is a useful tool in our daily lives. Excel offers several functions to calculate depreciation: In this article, we will learn how to calculate straight line depreciation using formula in excel. Excel offers five different depreciation functions. Learn more about various types of depreciation methods. In financial modeling, the sln function helps calculate the straight line depreciation of a fixed asset when building a budget.How to Calculate Straight Line Depreciation Using Formula in Excel

Practical of straight line depreciation in excel 2020 YouTube

How to Calculate the Straight Line Depreciation Using a Formula in

Finance in Excel 4 Calculate Straight Line Depreciation in Excel

Calculate Depreciation in Excel with SLN Straight line Method by

How to Calculate the Straight Line Depreciation Using a Formula in

免费 Straight line depreciation Excel 样本文件在

How to Calculate the Straight Line Depreciation Using a Formula in

Straight Line Depreciation Excel Template Calculate Asset Value Over Time

How to Calculate the Straight Line Depreciation Using a Formula in

Related Post: