Section 301 Tariffs List Excel

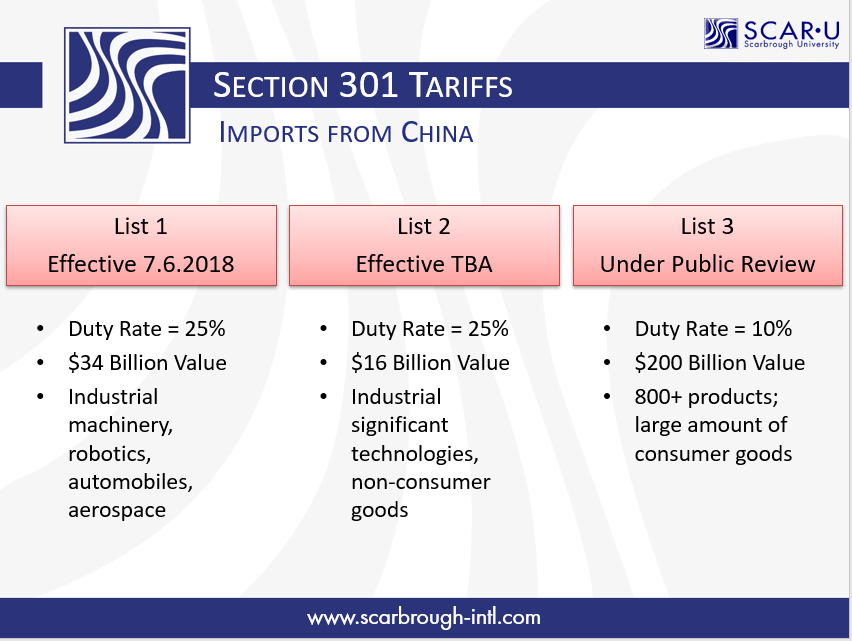

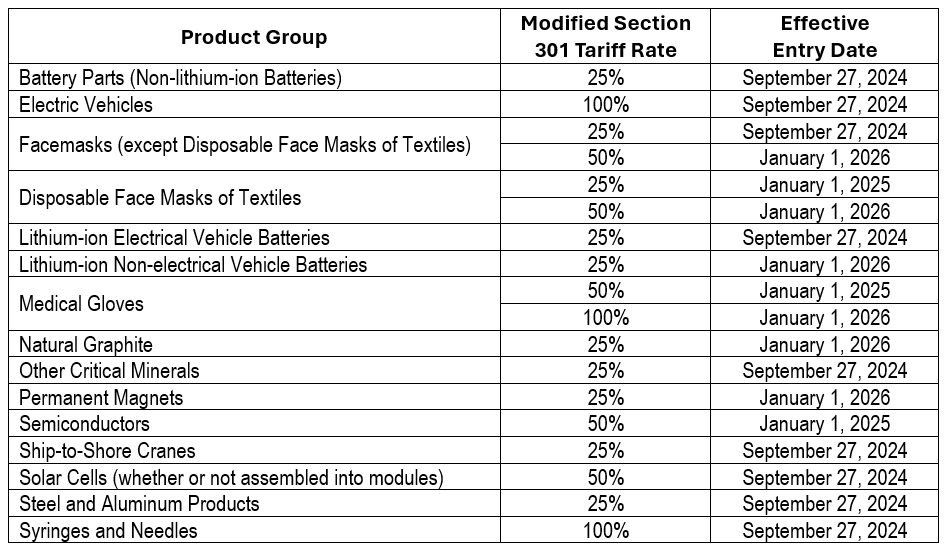

Section 301 Tariffs List Excel - These duties were originally implemented in july of 2018 against a list of hts codes representing. Using the datasets for both section 301. Additional duty rates & effective dates for lists 1, 2, 3 & 4 additional duty rates & effective dates for lists 1, 2, 3 & 4. A collection of helpful resources regarding trade laws. The table below lists the hts subheadings in chapters 01 through 97 that are covered by the additional tariffs on products of china under section 301 and the applicable hts heading in. As with all digital products, this may contain errors or omissions and should not be used solely as the basis for business decisions or in place of legal advice. The current administration imposed tariffs under both section 301 (b) of the trade act of 1974 and section 232 of the trade expansion act of 1962. Parts for articles of 8535.90.40, 8536.30.40 or 8536.50.40, of ceramic or metallic materials, mech. Lists 3 and 4, covering $200 billion and $300 billion respectively, cast a wider net over consumer goods, electronics, and everyday products, with tariff rates ranging from 7.5%. The “section 301” tariffs are additional duties against products from china. These duties were originally implemented in july of 2018 against a list of hts codes representing. Reactive to changes in temp. Parts for articles of 8535.90.40, 8536.30.40 or 8536.50.40, of ceramic or metallic materials, mech. Additional duty rates & effective dates for lists 1, 2, 3 & 4 additional duty rates & effective dates for lists 1, 2, 3 &. Lists 3 and 4, covering $200 billion and $300 billion respectively, cast a wider net over consumer goods, electronics, and everyday products, with tariff rates ranging from 7.5%. The table below lists the hts subheadings in chapters 01 through 97 that are covered by the additional tariffs on products of china under section 301 and the applicable hts heading in.. As with all digital products, this may contain errors or omissions and should not be used solely as the basis for business decisions or in place of legal advice. These duties were originally implemented in july of 2018 against a list of hts codes representing. Additional duty rates & effective dates for lists 1, 2, 3 & 4 additional duty. The current administration imposed tariffs under both section 301 (b) of the trade act of 1974 and section 232 of the trade expansion act of 1962. It provides the applicable tariff rates and statistical categories for all. See full exclusions list for. Parts for articles of 8535.90.40, 8536.30.40 or 8536.50.40, of ceramic or metallic materials, mech. Reactive to changes in. The current administration imposed tariffs under both section 301 (b) of the trade act of 1974 and section 232 of the trade expansion act of 1962. Parts for articles of 8535.90.40, 8536.30.40 or 8536.50.40, of ceramic or metallic materials, mech. See full exclusions list for. A collection of helpful resources regarding trade laws. Lists 3 and 4, covering $200 billion. These duties were originally implemented in july of 2018 against a list of hts codes representing. The table below lists the hts subheadings in chapters 01 through 97 that are covered by the additional tariffs on products of china under section 301 and the applicable hts heading in. The current administration imposed tariffs under both section 301 (b) of the. These duties were originally implemented in july of 2018 against a list of hts codes representing. See full exclusions list for. Reactive to changes in temp. The table below lists the hts subheadings in chapters 01 through 97 that are covered by the additional tariffs on products of china under section 301 and the applicable hts heading in. As with. This dataset is the current 2025 harmonized tariff schedule plus all revisions for the current year. It provides the applicable tariff rates and statistical categories for all. Reactive to changes in temp. The table below lists the hts subheadings in chapters 01 through 97 that are covered by the additional tariffs on products of china under section 301 and the. Parts for articles of 8535.90.40, 8536.30.40 or 8536.50.40, of ceramic or metallic materials, mech. Additional duty rates & effective dates for lists 1, 2, 3 & 4 additional duty rates & effective dates for lists 1, 2, 3 & 4. The current administration imposed tariffs under both section 301 (b) of the trade act of 1974 and section 232 of. The current administration imposed tariffs under both section 301 (b) of the trade act of 1974 and section 232 of the trade expansion act of 1962. The table below lists the hts subheadings in chapters 01 through 97 that are covered by the additional tariffs on products of china under section 301 and the applicable hts heading in. Additional duty.Playing the Numbers Game Sections 232 and ppt download

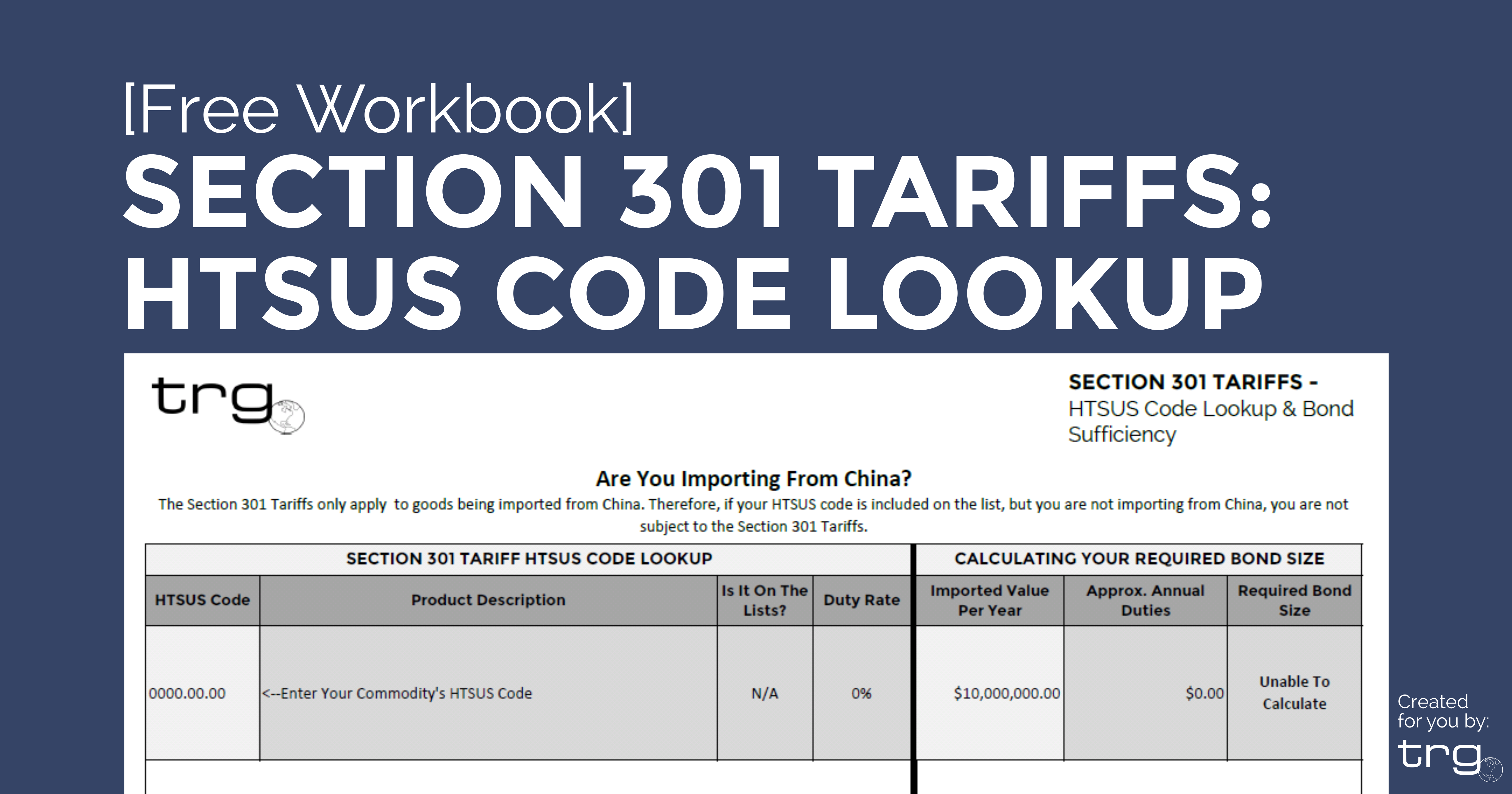

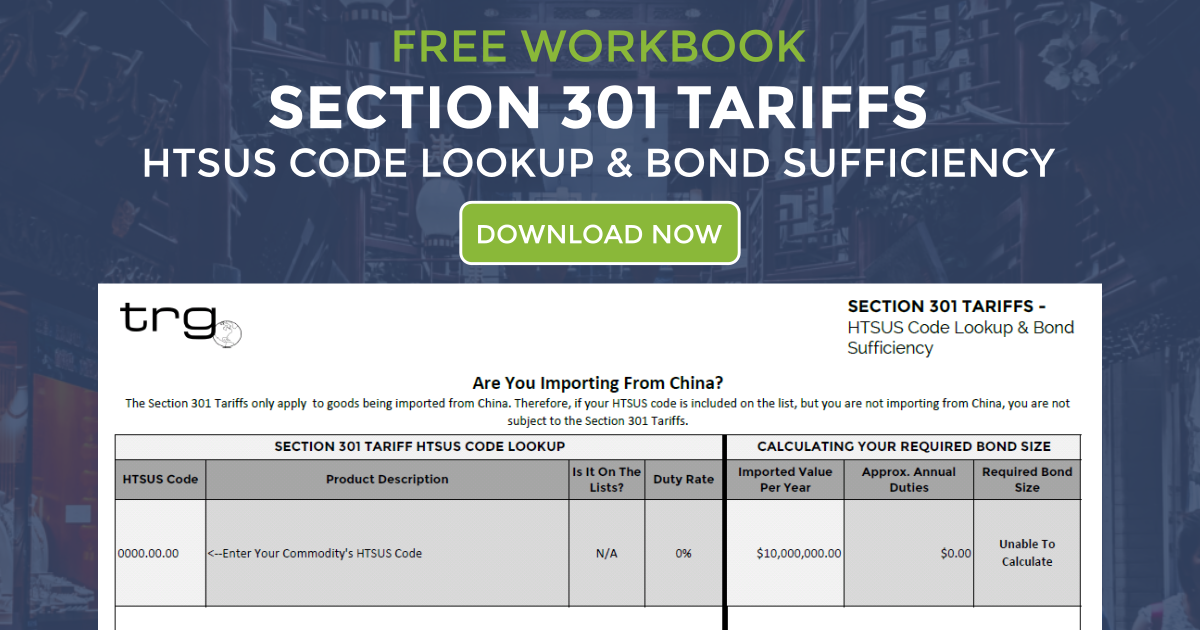

Section 301 Tariff HTSUS Lookup EBook Download Trade Risk Guaranty

Section 301 Tariffs Products from China

Section 301 Tariff Updates USTR Grants Exclusions & Seeks Comments on

Section 301 List 4 Tariffs in Effect Starting September 1 Customs

Section 301 Tariff HTSUS Lookup EBook Download Trade Risk Guaranty

6th Round of Section 301 Tariff (List 1) Exclusions Extended Customs

Trade War Tariff Timeline • Duty Rates, Effective Dates

USTR Finalizes List of Products Subject to Section 301 Tariff Increases

USTR Finalizes List 2 of Section 301 Tariffs on Chinese Products

Related Post: