Profitability Index Excel Function

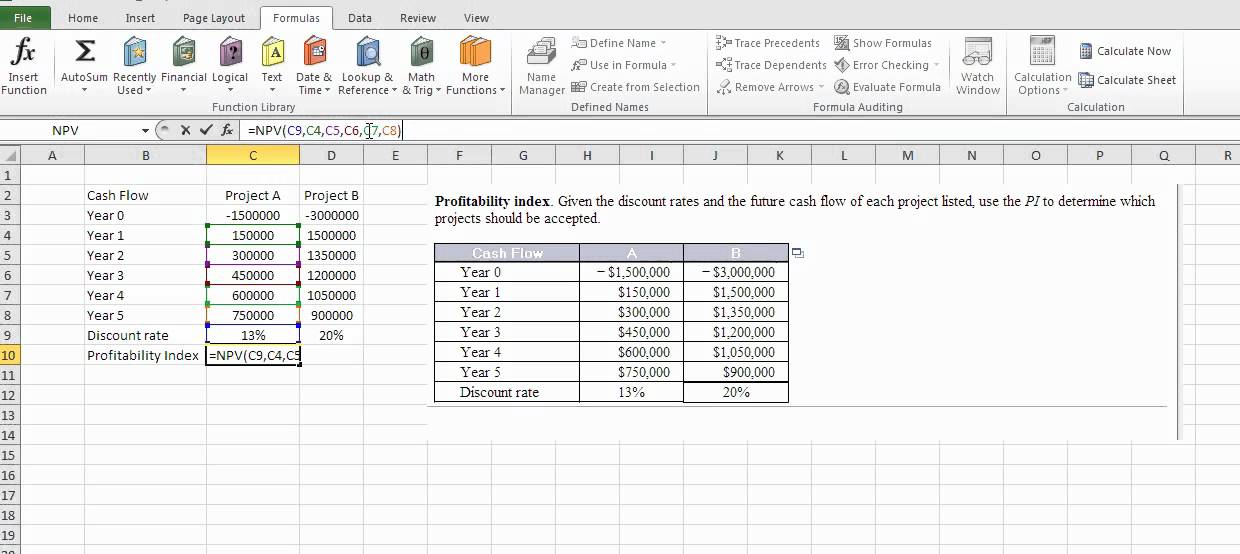

Profitability Index Excel Function - Profitability is a situation in which an entity is generating a profit. Profitability refers to a company's ability to generate revenue that exceeds its expenses. It goes beyond generating revenue to encompass the efficiency and. Profitability arises when the aggregate amount of revenue is greater than the aggregate. In other words, this is a company’s capability of generating profits from its. Profitability ratios are financial metrics used by analysts and investors to measure and evaluate the ability of a company to generate income (profit) relative. By analyzing profitability ratios, stakeholders can assess a company’s financial performance, operational efficiency, and overall profitability. It's analyzed in comparison to assets to see how effective a company is at deploying assets to generate sales and profits. Ratios such as gross profit margin, net profit margin, and ebitda are commonly used to assess. Learning how to calculate profitability ratios gives you a clearer picture of your business’s performance, considering your revenue, assets, equity and all other incoming. It goes beyond generating revenue to encompass the efficiency and. Understanding profitability is essential for any business aiming to thrive in today’s competitive markets. Profitability arises when the aggregate amount of revenue is greater than the aggregate. In other words, this is a company’s capability of generating profits from its. Learn to calculate profitability and margins using gross, operating, ebitda,. It’s not just about making money; Learning how to calculate profitability ratios gives you a clearer picture of your business’s performance, considering your revenue, assets, equity and all other incoming. By analyzing profitability ratios, stakeholders can assess a company’s financial performance, operational efficiency, and overall profitability. Profitability is a situation in which an entity is generating a profit. It's analyzed. It’s not just about making money; By analyzing profitability ratios, stakeholders can assess a company’s financial performance, operational efficiency, and overall profitability. Profitability is a situation in which an entity is generating a profit. It goes beyond generating revenue to encompass the efficiency and. Profitability ratios are financial metrics used by analysts and investors to measure and evaluate the ability. It's analyzed in comparison to assets to see how effective a company is at deploying assets to generate sales and profits. It’s not just about making money; Profitability ratios are financial metrics used by analysts and investors to measure and evaluate the ability of a company to generate income (profit) relative. Profitability is ability of a company to use its. Learn to calculate profitability and margins using gross, operating, ebitda, and net ratios to evaluate financial health and boost performance. Profitability is the lifeblood of any successful business. Profitability arises when the aggregate amount of revenue is greater than the aggregate. Profitability is a situation in which an entity is generating a profit. Ratios such as gross profit margin, net. Profitability ratios are financial metrics used by analysts and investors to measure and evaluate the ability of a company to generate income (profit) relative. It’s not just about making money; Profitability is assessed relative to costs and expenses. Understanding profitability is essential for any business aiming to thrive in today’s competitive markets. In other words, this is a company’s capability. It goes beyond generating revenue to encompass the efficiency and. Learning how to calculate profitability ratios gives you a clearer picture of your business’s performance, considering your revenue, assets, equity and all other incoming. Ratios such as gross profit margin, net profit margin, and ebitda are commonly used to assess. It’s not just about making money; It's analyzed in comparison. Ratios such as gross profit margin, net profit margin, and ebitda are commonly used to assess. Profitability is assessed relative to costs and expenses. Profitability ratios are financial metrics used by analysts and investors to measure and evaluate the ability of a company to generate income (profit) relative. Profitability is the lifeblood of any successful business. In other words, this. Profitability is ability of a company to use its resources to generate revenues in excess of its expenses. By analyzing profitability ratios, stakeholders can assess a company’s financial performance, operational efficiency, and overall profitability. Profitability ratios are financial metrics used by analysts and investors to measure and evaluate the ability of a company to generate income (profit) relative. Profitability is. In other words, this is a company’s capability of generating profits from its. Profitability is a situation in which an entity is generating a profit. Ratios such as gross profit margin, net profit margin, and ebitda are commonly used to assess. By analyzing profitability ratios, stakeholders can assess a company’s financial performance, operational efficiency, and overall profitability. It's analyzed in.Profitability index calculation using Excel YouTube

Profitability Index Using EXCEL YouTube

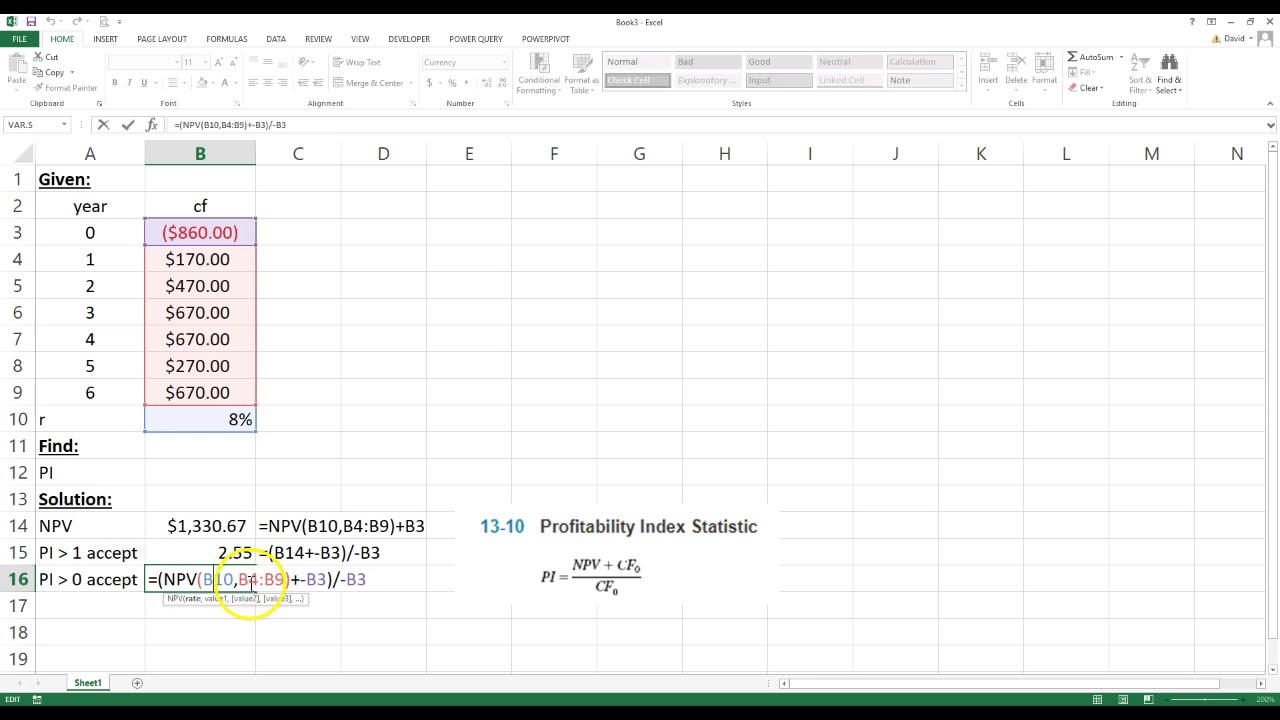

Calculate Profitability Index in Excel [Best Method]

Calculating the Profitability Index (PI) on Excel. YouTube

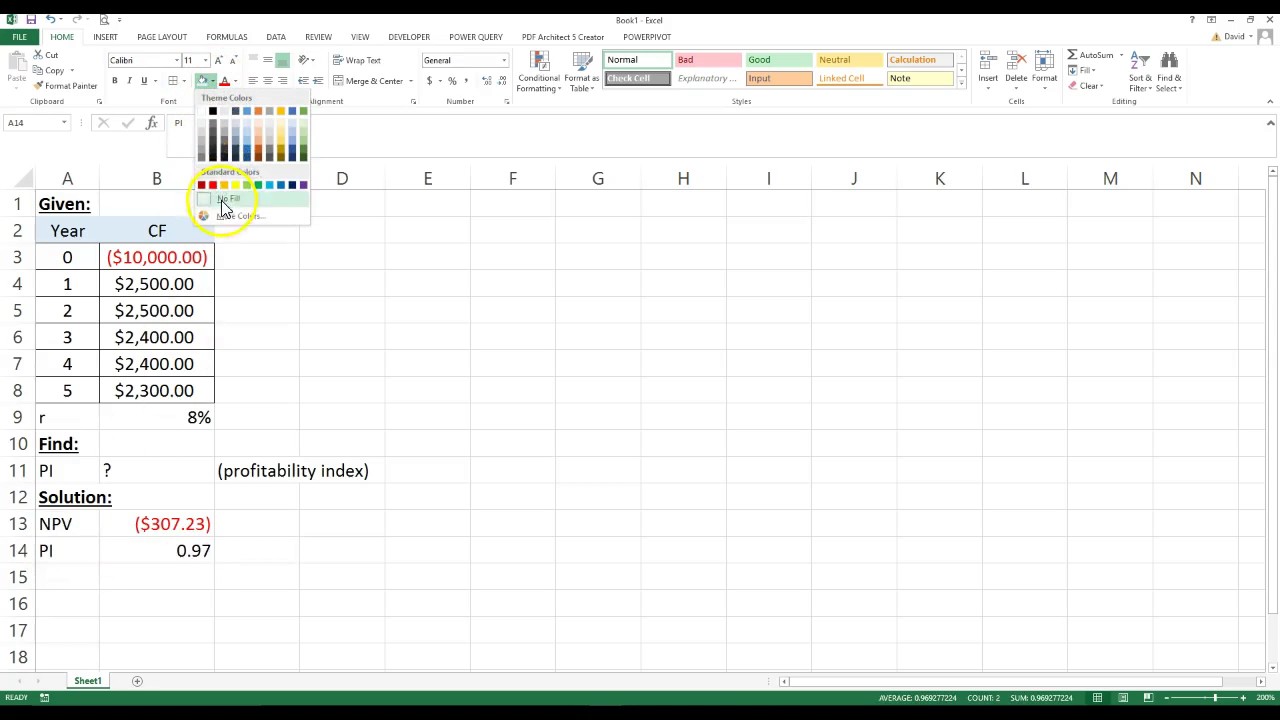

Profitability Index Formula Calculator (Excel template)

How to Calculate Profit with Profitability Index Excel Formula

Profitability Index Formula

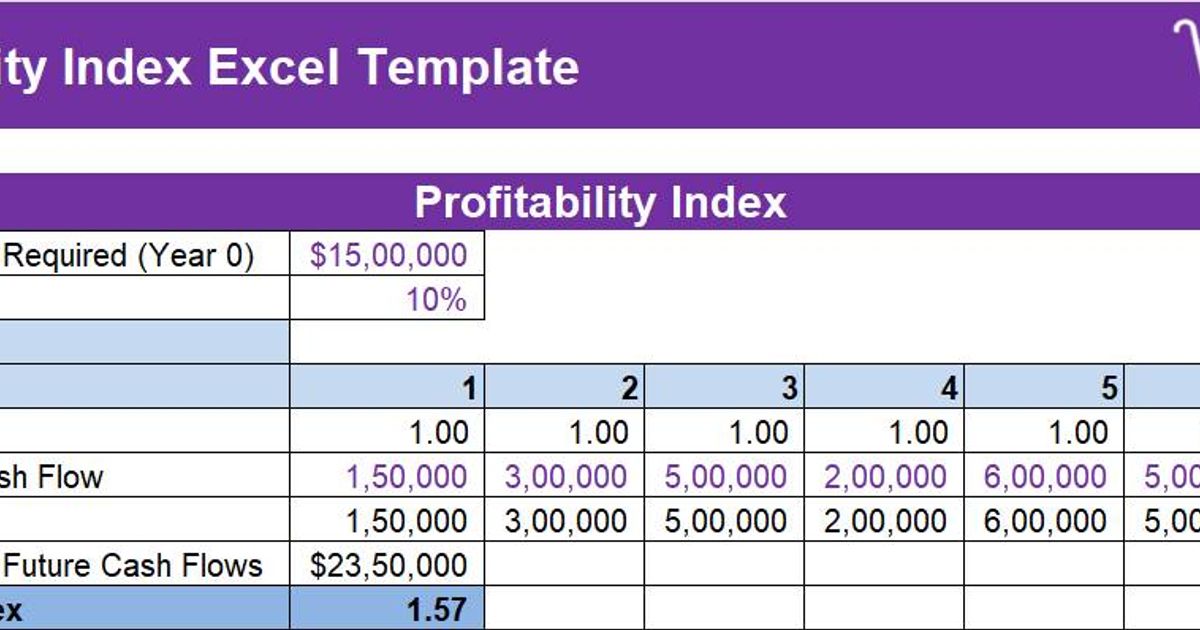

Profittability Index Excel Template Free Download to Measure Profits

How To Calculate Profitability Index

How to Calculate Profitability Index in Excel [Free Template]

Related Post:

![Calculate Profitability Index in Excel [Best Method]](https://10pcg.com/wp-content/uploads/profitability-index-formula.jpg)

![How to Calculate Profitability Index in Excel [Free Template]](https://excelgraduate.com/wp-content/uploads/2023/04/4-Formula-to-calculate-in-profitability-index-in-Excel.png)