Payment Formula Excel

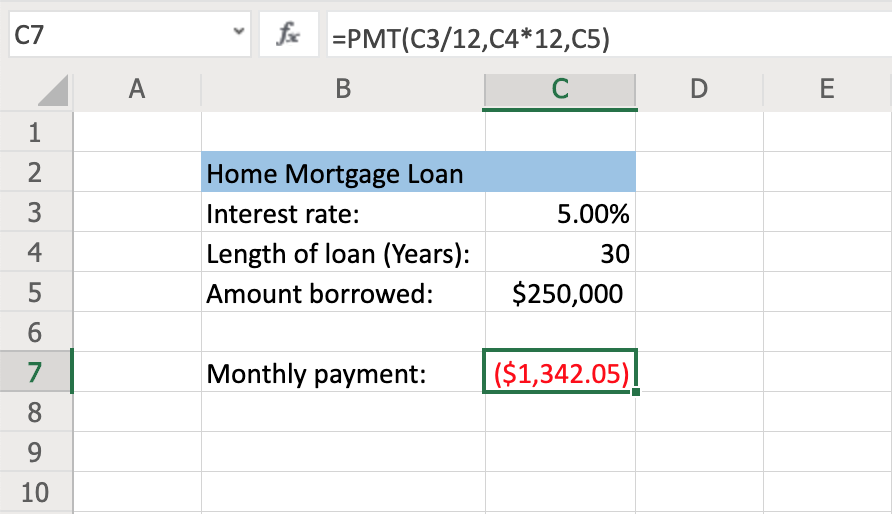

Payment Formula Excel - You can also opt to get a confirmation email in direct pay. Your information is used solely to process your payment. Sign in or create an online account. If you have made a payment through direct pay you can use this feature to view your payment details and status. You get a confirmation number for each payment you make. Note that your tax payment is due although. You can view details of your current payment plan (type of agreement, due dates, and amount you need to pay) by logging into the online payment agreement tool using the. You’ll need it to look up, change or cancel your payment. Learn how to make a tax payment and the details of several options you may qualify for if you can't pay in full right now. The irs uses third party payment processors for payments by debit and credit card. Sign in or create an online account. If you have made a payment through direct pay you can use this feature to view your payment details and status. Learn how to make a tax payment and the details of several options you may qualify for if you can't pay in full right now. You can also opt to get a. Note that your tax payment is due although. Your information is used solely to process your payment. We apologize for any inconvenience. You get a confirmation number for each payment you make. Please come back after that time, or you can visit make a payment for alternative payment methods. You can modify or cancel your payment until 11:45 p.m. Review the amount you owe, balance for each tax year, payment history, tax records and more. Please come back after that time, or you can visit make a payment for alternative payment methods. Sign in or create an online account. Your information is used solely to process your payment. You get a confirmation number for each payment you make. The irs uses third party payment processors for payments by debit and credit card. Please come back after that time, or you can visit make a payment for alternative payment methods. Review the amount you owe, balance for each tax year, payment history, tax records and more. You can modify. You can also opt to get a confirmation email in direct pay. Learn how to make a tax payment and the details of several options you may qualify for if you can't pay in full right now. You’ll need it to look up, change or cancel your payment. The irs uses third party payment processors for payments by debit and. You get a confirmation number for each payment you make. Learn how to make a tax payment and the details of several options you may qualify for if you can't pay in full right now. You can also opt to get a confirmation email in direct pay. If you have made a payment through direct pay you can use this. Apply for a payment plan find details on payment plan types: Sign in or create an online account. Please come back after that time, or you can visit make a payment for alternative payment methods. You’ll need it to look up, change or cancel your payment. Your information is used solely to process your payment. Apply for a payment plan find details on payment plan types: The irs uses third party payment processors for payments by debit and credit card. You’ll need it to look up, change or cancel your payment. Note that your tax payment is due although. You get a confirmation number for each payment you make. We apologize for any inconvenience. You’ll need it to look up, change or cancel your payment. Sign in or create an online account. The irs uses third party payment processors for payments by debit and credit card. Please come back after that time, or you can visit make a payment for alternative payment methods. Please come back after that time, or you can visit make a payment for alternative payment methods. If you have made a payment through direct pay you can use this feature to view your payment details and status. Learn how to make a tax payment and the details of several options you may qualify for if you can't pay in.How to Calculate a Monthly Payment in Excel PMT Function

The Ultimate Guide to Monthly Payment Formula in Excel

How to Calculate Monthly Payments in Excel Using Formulas WPS Office

How to Calculate Monthly Loan Payments in Excel InvestingAnswers

How To Calculate Loan Payments Using The PMT Function In Excel YouTube

Finding the Payment of an Ordinary Annuity in Excel YouTube

How to Calculate Loan Payment in Excel (4 Suitable Examples)

How to Calculate Monthly Payments in Excel Using Formulas WPS Office

Excel PMT Function Calculate Loans or Saving Plans

How to Calculate Monthly Payments in Excel Using Formulas WPS Office

Related Post:

:max_bytes(150000):strip_icc()/Syntax-5bf5c47746e0fb0051768699.jpg)