Npv Calculations In Excel

Npv Calculations In Excel - Companies must weigh the benefits of adding projects. The net present value rule is the idea that investors and managers should only engage in deals, projects or transactions that have. It is used to calculate the intrinsic value of a stock. Npv also factors in the time value of money by discounting all cash flows to their present value. What is the gordon growth model? Net present value (npv) reflects a company’s estimate of the possible profit (or loss) from an investment in a project. Equivalent annual cost (or eac) is the cost per year of owning, operating, and maintaining an asset over its lifetime. By contrast, irr projects the rate of. The gordon growth model (ggm) is a version of the dividend discount model (ddm). The difference between npv and irr net present value (npv) measures how much value (in dollars) a project or investment could add. The net present value rule is the idea that investors and managers should only engage in deals, projects or transactions that have. By contrast, irr projects the rate of. The gordon growth model (ggm) is a version of the dividend discount model (ddm). What is net present value rule? It is used to calculate the intrinsic value of a stock. What is net present value rule? The gordon growth model (ggm) is a version of the dividend discount model (ddm). Npv also factors in the time value of money by discounting all cash flows to their present value. Our easy guide shows you how to find irr on a financial calculator or in excel. The net present value rule is. Equivalent annual cost (or eac) is the cost per year of owning, operating, and maintaining an asset over its lifetime. Calculating irr might seem tricky for multiple cash flow periods. Net present value (npv) reflects a company’s estimate of the possible profit (or loss) from an investment in a project. What is the gordon growth model? Npv also factors in. Our easy guide shows you how to find irr on a financial calculator or in excel. What is net present value rule? Net present value (npv) reflects a company’s estimate of the possible profit (or loss) from an investment in a project. The gordon growth model (ggm) is a version of the dividend discount model (ddm). By contrast, irr projects. By contrast, irr projects the rate of. The net present value rule is the idea that investors and managers should only engage in deals, projects or transactions that have. Companies must weigh the benefits of adding projects. It is used to calculate the intrinsic value of a stock. Net present value (npv) reflects a company’s estimate of the possible profit. The difference between npv and irr net present value (npv) measures how much value (in dollars) a project or investment could add. Companies must weigh the benefits of adding projects. Calculating irr might seem tricky for multiple cash flow periods. The gordon growth model (ggm) is a version of the dividend discount model (ddm). By contrast, irr projects the rate. It is used to calculate the intrinsic value of a stock. Our easy guide shows you how to find irr on a financial calculator or in excel. Companies must weigh the benefits of adding projects. Calculating irr might seem tricky for multiple cash flow periods. The difference between npv and irr net present value (npv) measures how much value (in. Net present value (npv) reflects a company’s estimate of the possible profit (or loss) from an investment in a project. The difference between npv and irr net present value (npv) measures how much value (in dollars) a project or investment could add. What is net present value rule? The net present value rule is the idea that investors and managers. Calculating irr might seem tricky for multiple cash flow periods. Our easy guide shows you how to find irr on a financial calculator or in excel. Net present value (npv) reflects a company’s estimate of the possible profit (or loss) from an investment in a project. The difference between npv and irr net present value (npv) measures how much value. The difference between npv and irr net present value (npv) measures how much value (in dollars) a project or investment could add. What is net present value rule? What is the gordon growth model? Our easy guide shows you how to find irr on a financial calculator or in excel. Net present value (npv) reflects a company’s estimate of the.Npv Calculator Excel Template

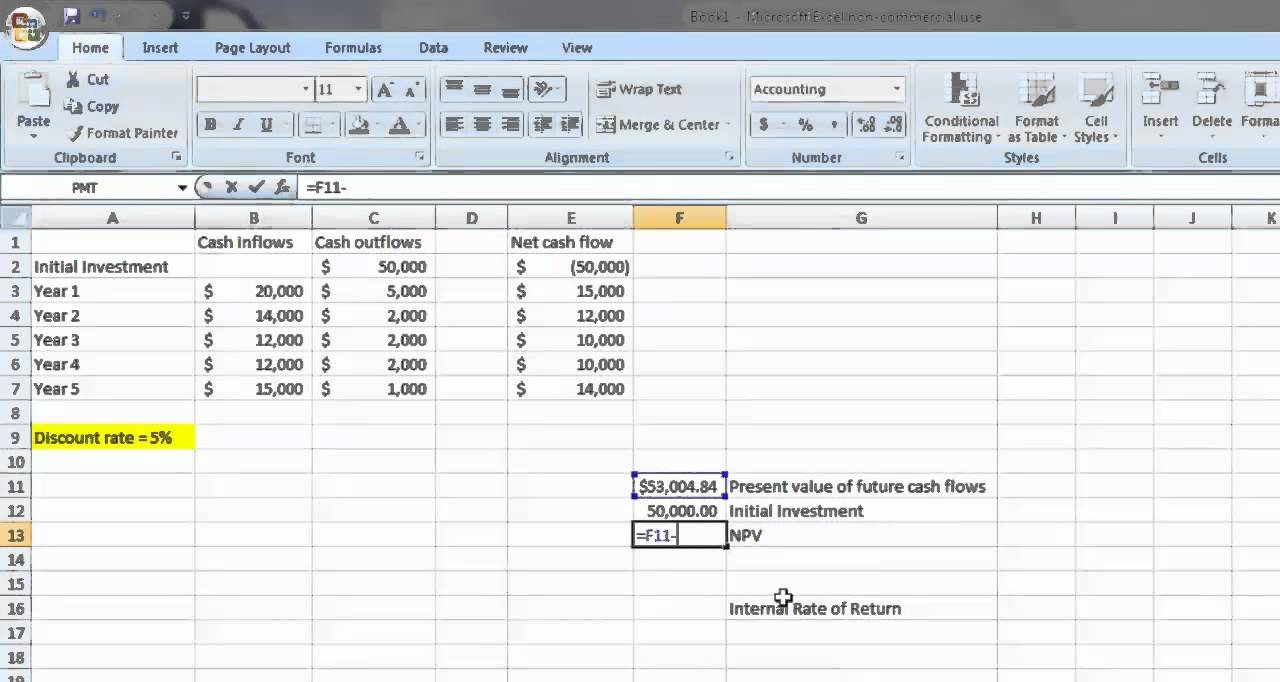

How to Use NPV Function in Excel (3 Easy Examples) ExcelDemy

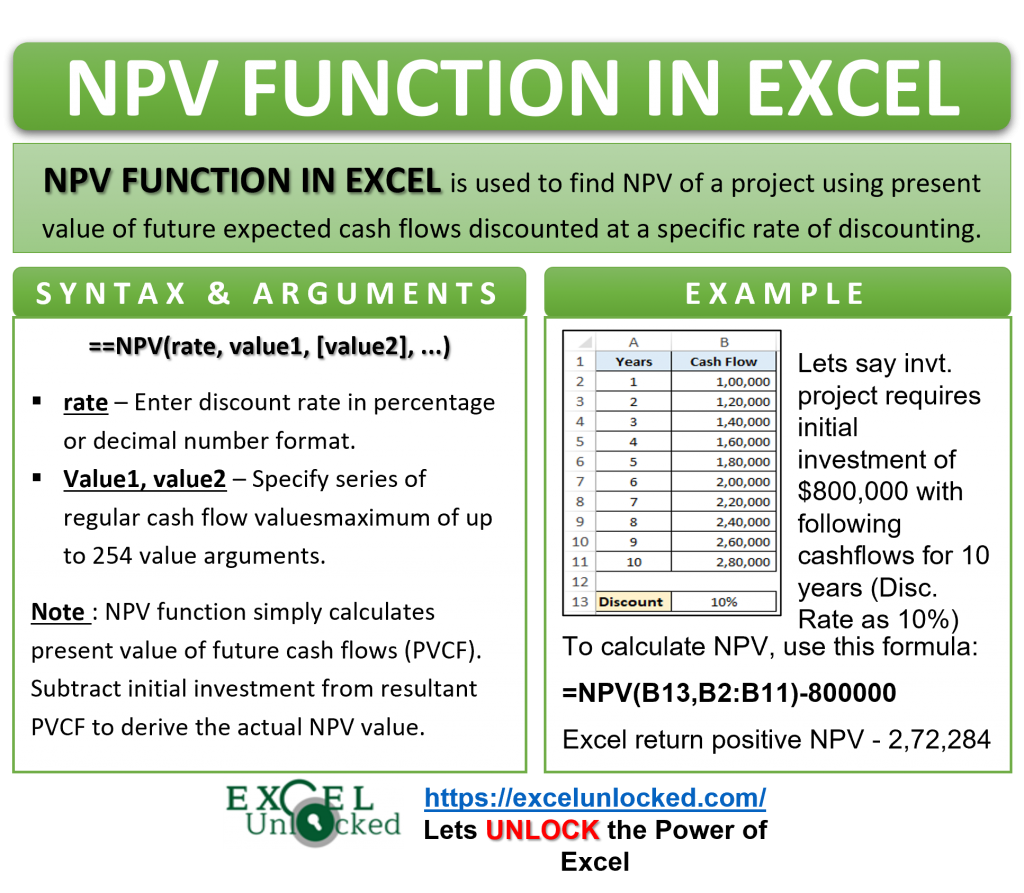

NPV Function How to Calculate NPV in Excel Excel Unlocked

NPV formula for net present value Excel formula Exceljet

How to Calculate NPV in Excel 9 Steps (with Pictures) wikiHow

How to Calculate NPV in Excel 9 Steps (with Pictures) wikiHow

Calculate Net Present Value To Decide Between Two Projects In Excel

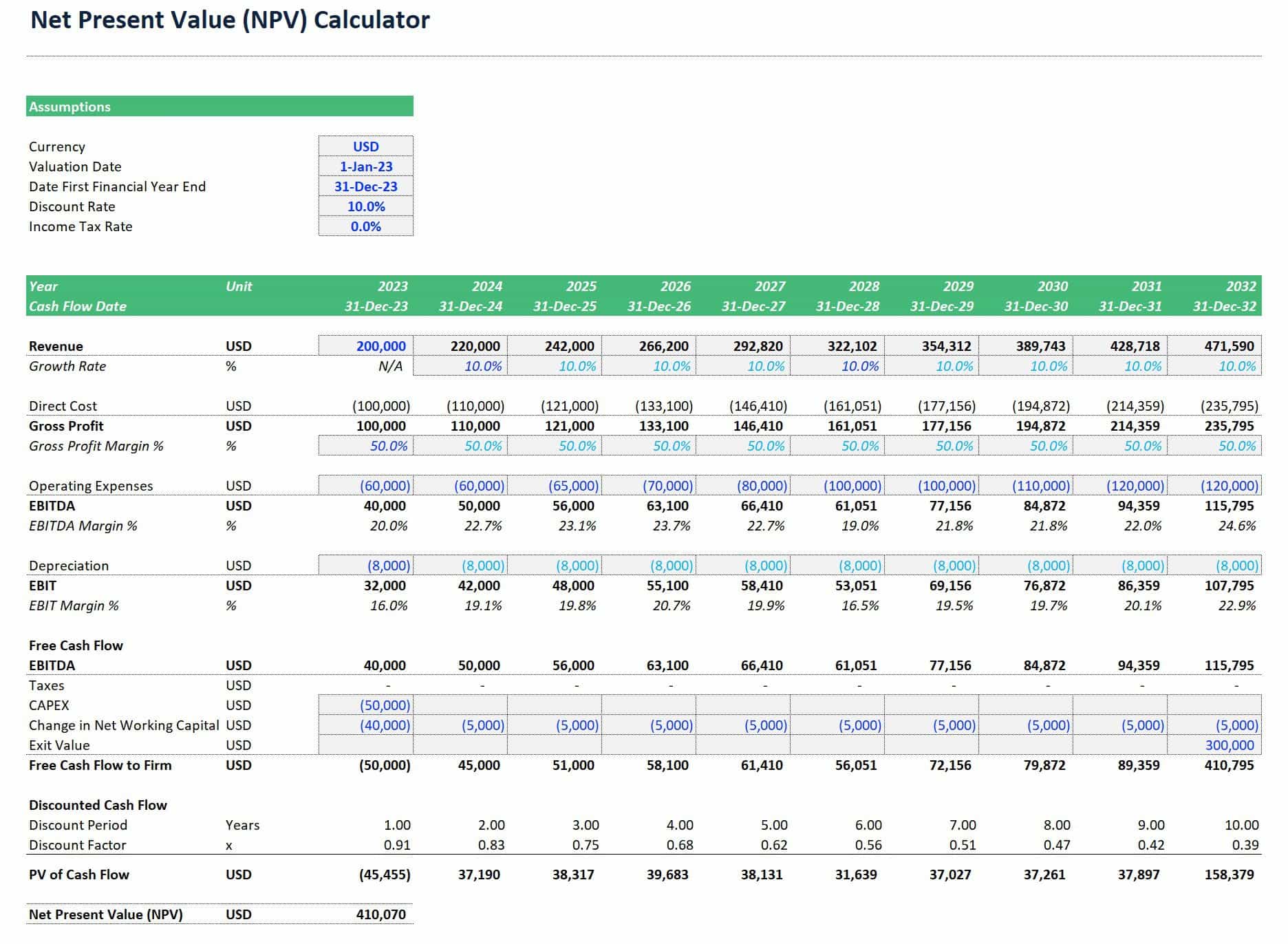

Net Present Value Calculator in Excel eFinancialModels

Npv Calculator Excel Template

Npv Calculator Excel Template

Related Post: