Mirr Excel

Mirr Excel - As the name suggests, the mirr is modified, and the modified internal rate of return seeks to address several issues with the irr. What is modified internal rate of return (mirr)? In this article, we will cover how to calculate modified internal rate of return (mirr). Mirr or modified internal rate of return refers to the financial metric used to assess precisely the value and profitability of a potential investment or project. [1][2] it is used in capital budgeting to rank alternative investments of unequal. The modified internal rate of return, or mirr, is a financial formula used to measure the return of a project and compare it with other potential projects. This includes the overview, key definition, formula, example calculation as well as advantages and. The modified internal rate of return (mirr) is a measure of the profitability of a project or other investment. Read on to learn how to calculate the mirr and discover a handy mirr formula. What is the modified internal rate of return (mirr)? Similarly, it shows you what. What is the modified internal rate of return (mirr)? The modified internal rate of return (commonly denoted as mirr) is a financial measure that helps to determine the attractiveness. [1][2] it is used in capital budgeting to rank alternative investments of unequal. Read on to learn how to calculate the mirr and discover a handy. The modified internal rate of return ( m irr) is the discount rate at which the present value of a project’s cost is equal to the present value of its terminal value, where the terminal value is. The modified internal rate of return (commonly denoted as mirr) is a financial measure that helps to determine the attractiveness. Mirr or modified. Mirr or modified internal rate of return refers to the financial metric used to assess precisely the value and profitability of a potential investment or project. The modified internal rate of return (commonly denoted as mirr) is a financial measure that helps to determine the attractiveness. [1][2] it is used in capital budgeting to rank alternative investments of unequal. In. The mirr, therefore, more accurately reflects the cost. What is the modified internal rate of return (mirr)? In this article, i will walk you through the details of the mirr theory, explaining its core concepts, mathematical foundations, advantages, disadvantages, and how to calculate it. The modified internal rate of return (mirr) is a measure of the profitability of a project. As the name suggests, the mirr is modified, and the modified internal rate of return seeks to address several issues with the irr. Mirr or modified internal rate of return refers to the financial metric used to assess precisely the value and profitability of a potential investment or project. The modified internal rate of return (mirr) is a financial measure. What is the modified internal rate of return (mirr)? In this article, i will walk you through the details of the mirr theory, explaining its core concepts, mathematical foundations, advantages, disadvantages, and how to calculate it. The modified internal rate of return (commonly denoted as mirr) is a financial measure that helps to determine the attractiveness. Similarly, it shows you. In this article, i will walk you through the details of the mirr theory, explaining its core concepts, mathematical foundations, advantages, disadvantages, and how to calculate it. The modified internal rate of return ( m irr) is the discount rate at which the present value of a project’s cost is equal to the present value of its terminal value, where. What is the modified internal rate of return (mirr)? Read on to learn how to calculate the mirr and discover a handy mirr formula. The modified internal rate of return, or mirr, is a financial formula used to measure the return of a project and compare it with other potential projects. This includes the overview, key definition, formula, example calculation. In this article, i will walk you through the details of the mirr theory, explaining its core concepts, mathematical foundations, advantages, disadvantages, and how to calculate it. The modified internal rate of return ( m irr) is the discount rate at which the present value of a project’s cost is equal to the present value of its terminal value, where. The mirr, therefore, more accurately reflects the cost. Read on to learn how to calculate the mirr and discover a handy mirr formula. The modified internal rate of return ( m irr) is the discount rate at which the present value of a project’s cost is equal to the present value of its terminal value, where the terminal value is..How to Calculate Returns with Excel MIRR Function

How to Use the Excel MIRR Function ExcelDemy

How to Calculate IRR in Excel 4 Best Methods Technipages

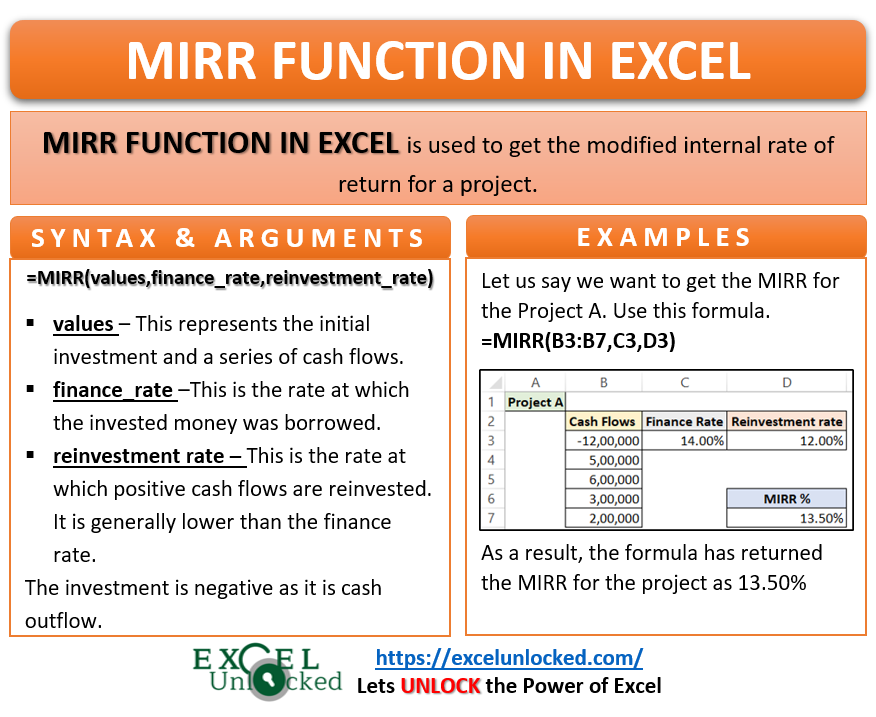

MIRR Function in Excel Modified Internal Rate of Return Excel Unlocked

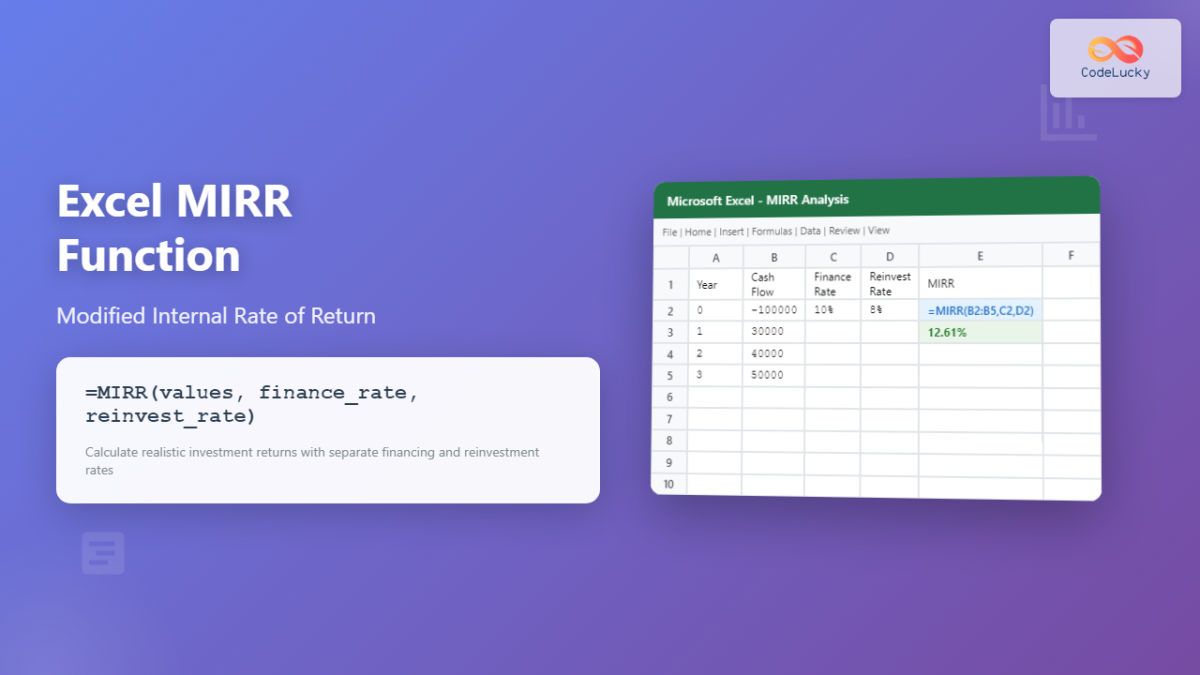

How to Calculate Returns with Excel MIRR Function

How to Calculate Returns with Excel MIRR Function

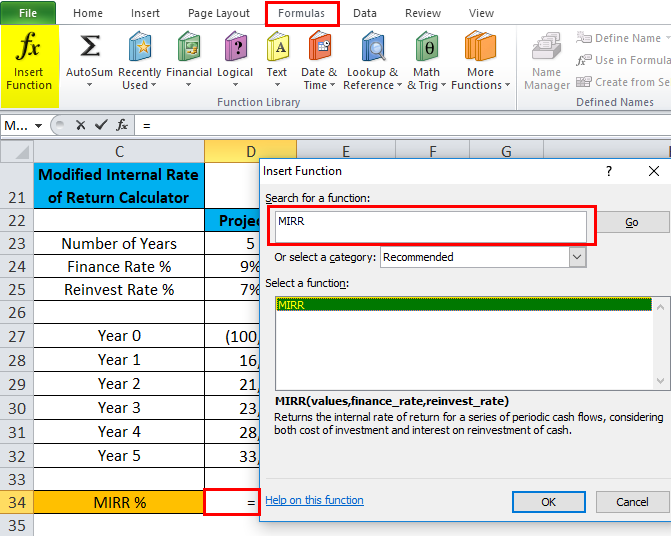

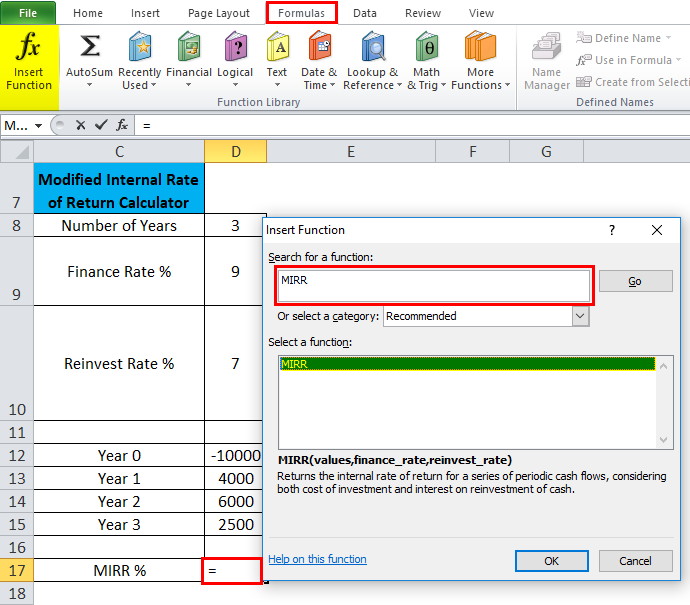

MIRR in Excel (Formula,Examples) How to Use MIRR Function?

Excel IRR Function Complete Guide to Internal Rate of Return Analysis

MIRR in Excel (Formula,Examples) How to Use MIRR Function?

How to Use MIRR Function in Excel (3 Quick Examples)

Related Post: