Macrs Depreciation Calculator Excel

Macrs Depreciation Calculator Excel - Under this system, the capitalized cost (basis) of tangible property is. It allows for a higher depreciation deduction in the. This comprehensive guide explores the macrs. Macrs allows for greater accelerated depreciation over. This means that the business can take larger tax deductions in the initial years and. Macrs consists of two depreciation systems, the general depreciation system (gds) and the alternative depreciation system (ads). The modified accelerated cost recovery system (macrs) is the current tax depreciation system in the united states. Macrs (the full form is modified accelerated cost recovery system) is a depreciation method used in the united states for tax purposes. It allows businesses to deduct the. Understanding the modified accelerated cost recovery system (macrs) is crucial for businesses managing asset depreciation. This comprehensive guide explores the macrs. Macrs allows for greater accelerated depreciation over. Under this system, the capitalized cost (basis) of tangible property is. It allows businesses to deduct the. The modified accelerated cost recovery system (macrs) is the proper depreciation method for most assets. The modified accelerated cost recovery system (macrs) is the current tax depreciation system in the united states. It allows businesses to deduct the. The macrs depreciation method allows greater accelerated depreciation over the life of the asset. Macrs consists of two depreciation systems, the general depreciation system (gds) and the alternative depreciation system (ads). Understanding the modified accelerated cost recovery. The modified accelerated cost recovery system (macrs) is the primary depreciation system for tax purposes in the united states. Macrs consists of two depreciation systems, the general depreciation system (gds) and the alternative depreciation system (ads). The modified accelerated cost recovery system (macrs) is the proper depreciation method for most assets. Switching to the straight line method for the 1st. This comprehensive guide explores the macrs. The modified accelerated cost recovery system (macrs) is the primary depreciation system for tax purposes in the united states. The macrs depreciation method allows greater accelerated depreciation over the life of the asset. Macrs consists of two depreciation systems, the general depreciation system (gds) and the alternative depreciation system (ads). Generally, these systems provide. Switching to the straight line method for the 1st taxable year for which using the straight line method with respect to the adjusted basis as of the beginning of such year will. The macrs depreciation method allows greater accelerated depreciation over the life of the asset. It allows businesses to deduct the. Generally, these systems provide different methods. The modified. Macrs consists of two depreciation systems, the general depreciation system (gds) and the alternative depreciation system (ads). Under this system, the capitalized cost (basis) of tangible property is. The macrs depreciation method allows greater accelerated depreciation over the life of the asset. This comprehensive guide explores the macrs. Generally, these systems provide different methods. The modified accelerated cost recovery system (macrs) is the primary depreciation system for tax purposes in the united states. Under this system, the capitalized cost (basis) of tangible property is. It allows businesses to deduct the. It allows for a higher depreciation deduction in the. The macrs depreciation method allows greater accelerated depreciation over the life of the asset. This means that the business can take larger tax deductions in the initial years and. This comprehensive guide explores the macrs. Macrs allows for greater accelerated depreciation over. It allows for a higher depreciation deduction in the. The modified accelerated cost recovery system (macrs) is the current tax depreciation system in the united states. The modified accelerated cost recovery system (macrs) is the current tax depreciation system in the united states. This comprehensive guide explores the macrs. It allows businesses to deduct the. Switching to the straight line method for the 1st taxable year for which using the straight line method with respect to the adjusted basis as of the beginning of such year. This means that the business can take larger tax deductions in the initial years and. The modified accelerated cost recovery system (macrs) is the primary depreciation system for tax purposes in the united states. Macrs consists of two depreciation systems, the general depreciation system (gds) and the alternative depreciation system (ads). The modified accelerated cost recovery system (macrs) is the.How To Use Macrs Depreciation Calculator at Jared Harper blog

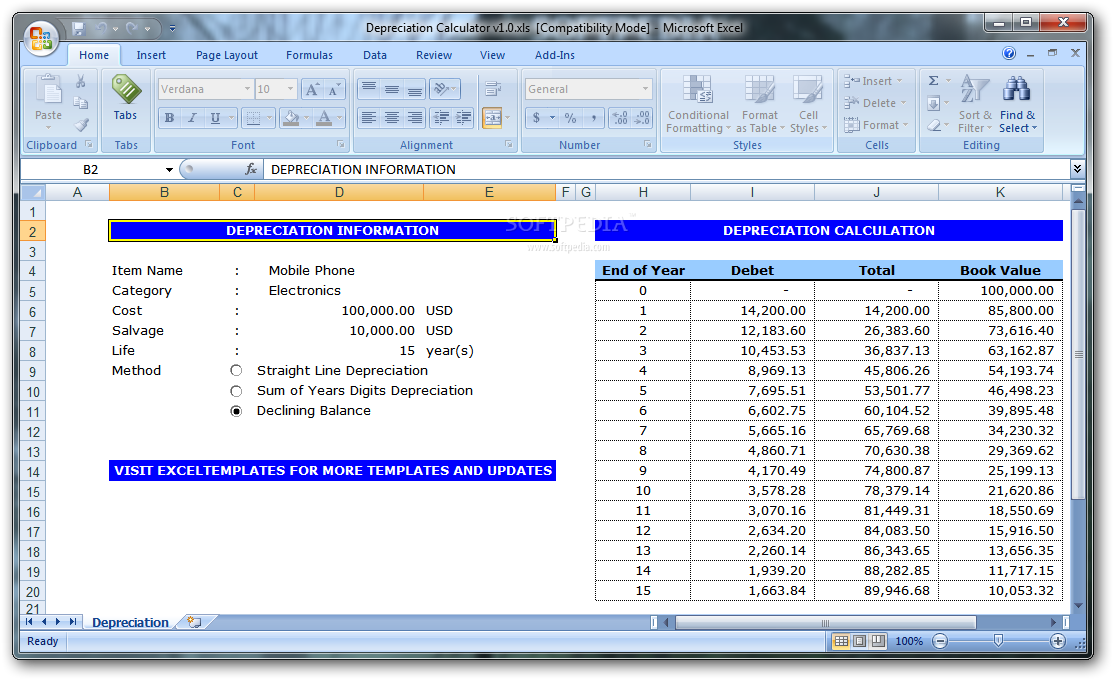

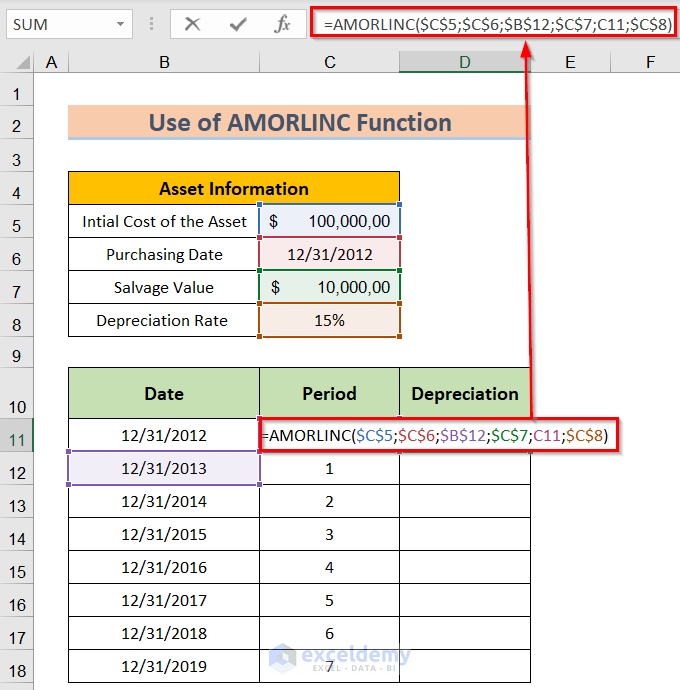

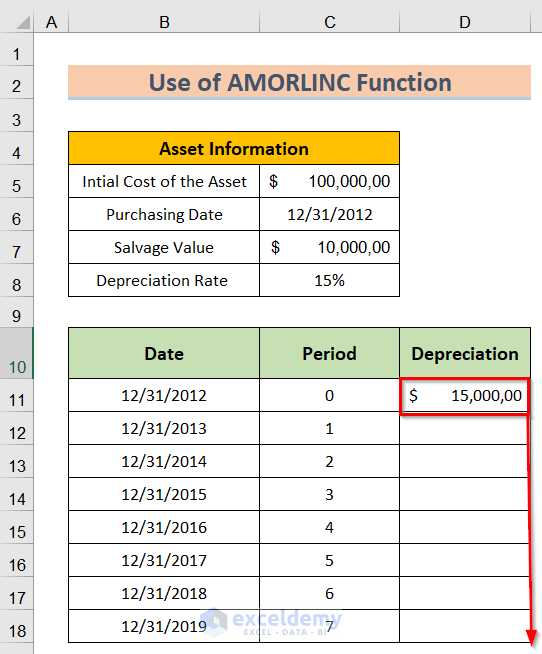

How to Use MACRS Depreciation Formula in Excel (8 Methods)

How to Calculate MACRS Depreciation in Excel Earn and Excel

The Easy Guide To Calculating MACRS Depreciation In Excel

How to Use MACRS Depreciation Formula in Excel (8 Methods)

How to Implement MACRS Depreciation Method + Example YouTube

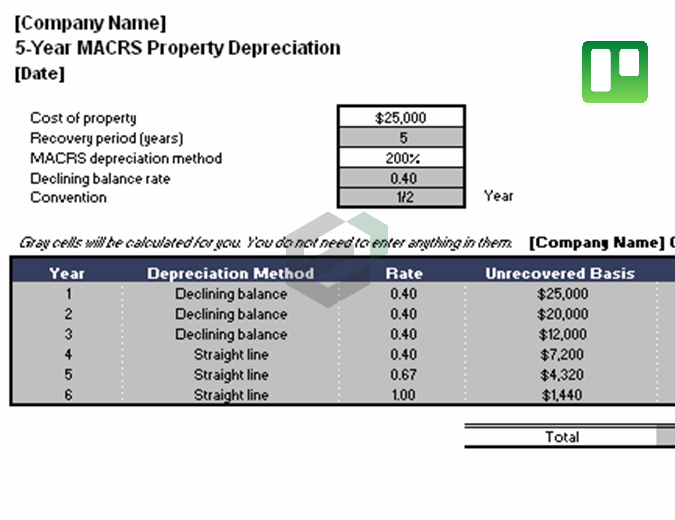

Download Free Excel Template for MACRS Property Depreciation

Implementing MACRS Depreciation in Excel YouTube

Irs macrs depreciation calculator LeeannLogan

MACRS Depreciation Schedule How to CALCULATE it in Excel! YouTube

Related Post: