Lbo Model Excel

Lbo Model Excel - Here, you will also find detailed information about the various data categories within the database, including corporate tax rates, revenues, effective tax rates, and tax incentives for r&d and. European countries impose corporate income taxes on profits, with statutory rates varying significantly; The deloitte international tax source (dits) is an online database featuring tax rates information and country tax highlights for over 130 jurisdictions worldwide. There is not a global rule that controls the corporate tax rates from one country to the next; However, please confirm tax rates. This is below the worldwide average which, measured across 180 jurisdictions, was. Tax rates are checked regularly by kpmg member firms; The corporate tax rates vary from place to place around the world. Quick charts corporate income tax (cit) rates headline rates for wwts territories the headline cit rate is generally the highest statutory cit rate, inclusive of surtaxes but exclusive of local. The general corporate income tax rate will change from 21% to 20% in 2025. However, please confirm tax rates. Kpmg's online corporate tax table provides a view of corporate tax rates around the world. This is below the worldwide average which, measured across 180 jurisdictions, was. The general corporate income tax rate will change from 21% to 20% in 2025. See 2025 corporate tax rates across europe. The general corporate income tax rate will change from 21% to 20% in 2025. European countries impose corporate income taxes on profits, with statutory rates varying significantly; Rather, the tax rates are based on. Kpmg's online corporate tax table provides a view of corporate tax rates around the world. On average, european oecd countries currently levy a corporate income tax. Malta has the highest rate at 35%, while hungary has the lowest at 9%. The corporate tax rates vary from place to place around the world. This is below the worldwide average which, measured across 180 jurisdictions, was. Kpmg's online corporate tax table provides a view of corporate tax rates around the world. There is not a global rule that. Quick charts corporate income tax (cit) rates headline rates for wwts territories the headline cit rate is generally the highest statutory cit rate, inclusive of surtaxes but exclusive of local. However, please confirm tax rates. Malta has the highest rate at 35%, while hungary has the lowest at 9%. European countries impose corporate income taxes on profits, with statutory rates. European countries impose corporate income taxes on profits, with statutory rates varying significantly; However, please confirm tax rates. Quick charts corporate income tax (cit) rates headline rates for wwts territories the headline cit rate is generally the highest statutory cit rate, inclusive of surtaxes but exclusive of local. The deloitte international tax source (dits) is an online database featuring tax. Tax rates are checked regularly by kpmg member firms; European countries impose corporate income taxes on profits, with statutory rates varying significantly; Quick charts corporate income tax (cit) rates headline rates for wwts territories the headline cit rate is generally the highest statutory cit rate, inclusive of surtaxes but exclusive of local. The deloitte international tax source (dits) is an. See 2025 corporate tax rates across europe. Quick charts corporate income tax (cit) rates headline rates for wwts territories the headline cit rate is generally the highest statutory cit rate, inclusive of surtaxes but exclusive of local. There is not a global rule that controls the corporate tax rates from one country to the next; On average, european oecd countries. The corporate tax rates vary from place to place around the world. The general corporate income tax rate will change from 21% to 20% in 2025. Malta, portugal, germany, and italy have the highest 2025 corporate income tax rates in europe. There is not a global rule that controls the corporate tax rates from one country to the next; See. The deloitte international tax source (dits) is an online database featuring tax rates information and country tax highlights for over 130 jurisdictions worldwide. On average, european oecd countries currently levy a corporate income tax rate of 21.7 percent. This is below the worldwide average which, measured across 180 jurisdictions, was. However, please confirm tax rates. Quick charts corporate income tax. However, please confirm tax rates. Tax rates are checked regularly by kpmg member firms; Quick charts corporate income tax (cit) rates headline rates for wwts territories the headline cit rate is generally the highest statutory cit rate, inclusive of surtaxes but exclusive of local. The general corporate income tax rate will change from 21% to 20% in 2025. The corporate.Leveraged Buyout (LBO) Model Template Excel Eloquens

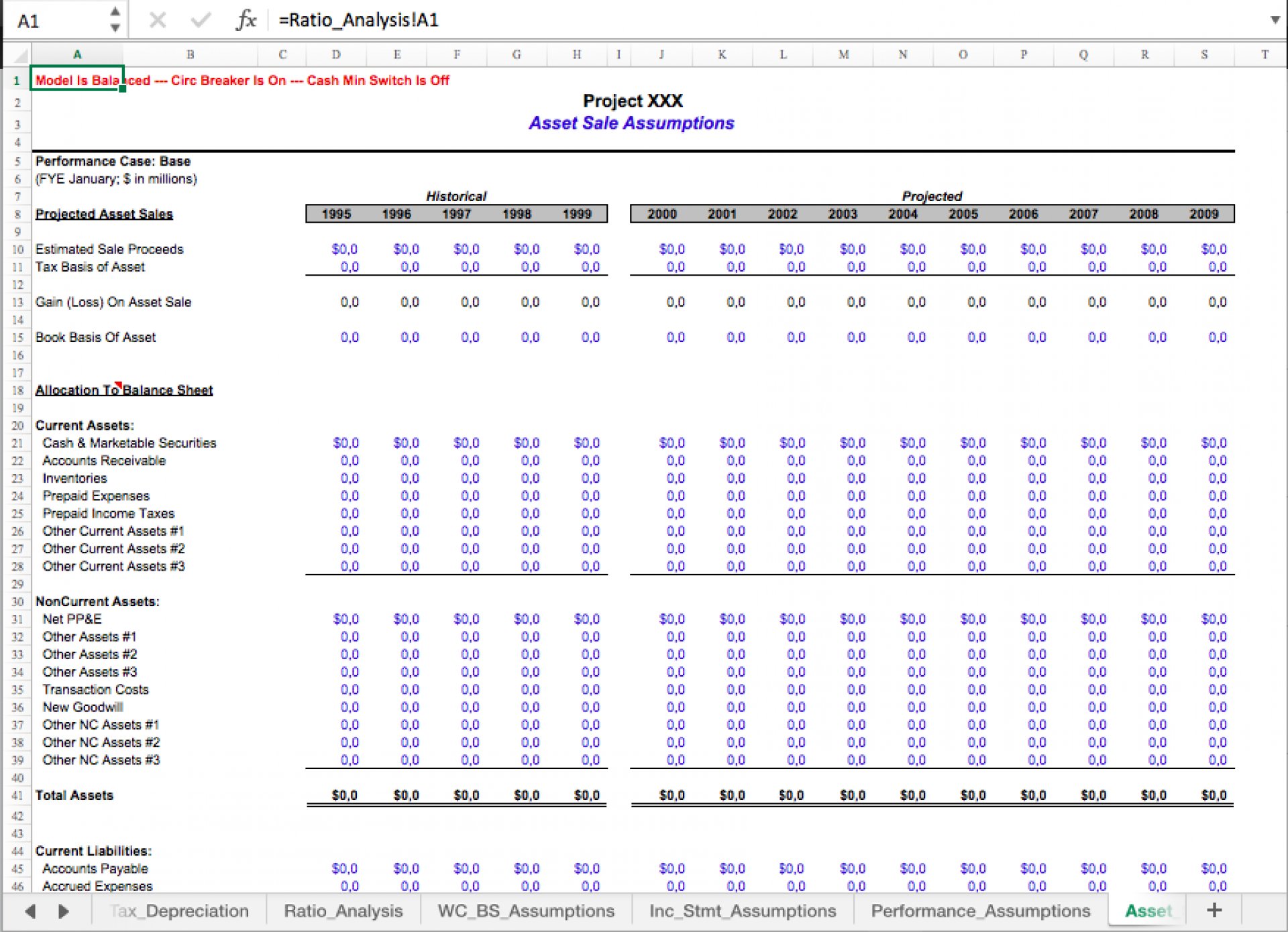

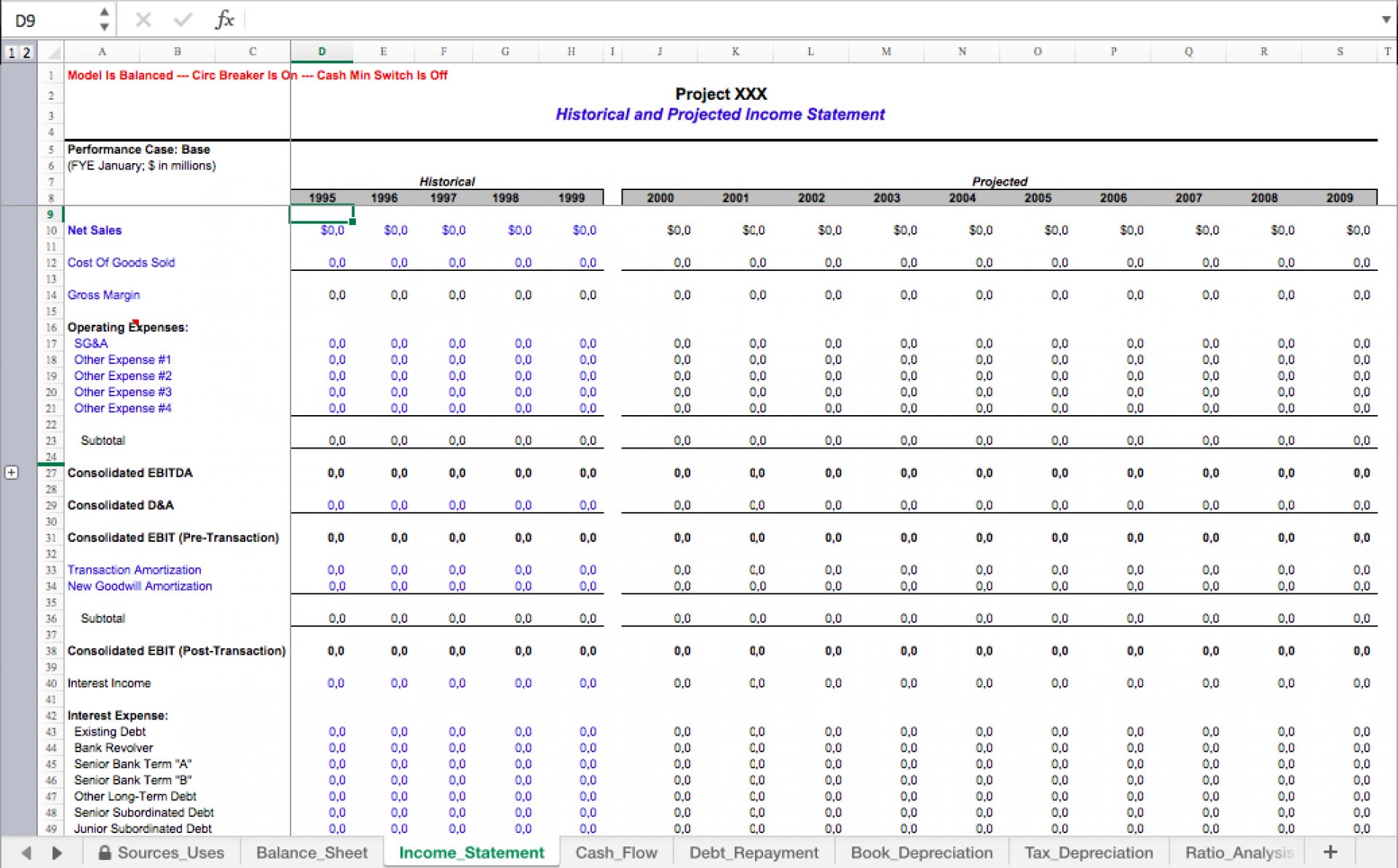

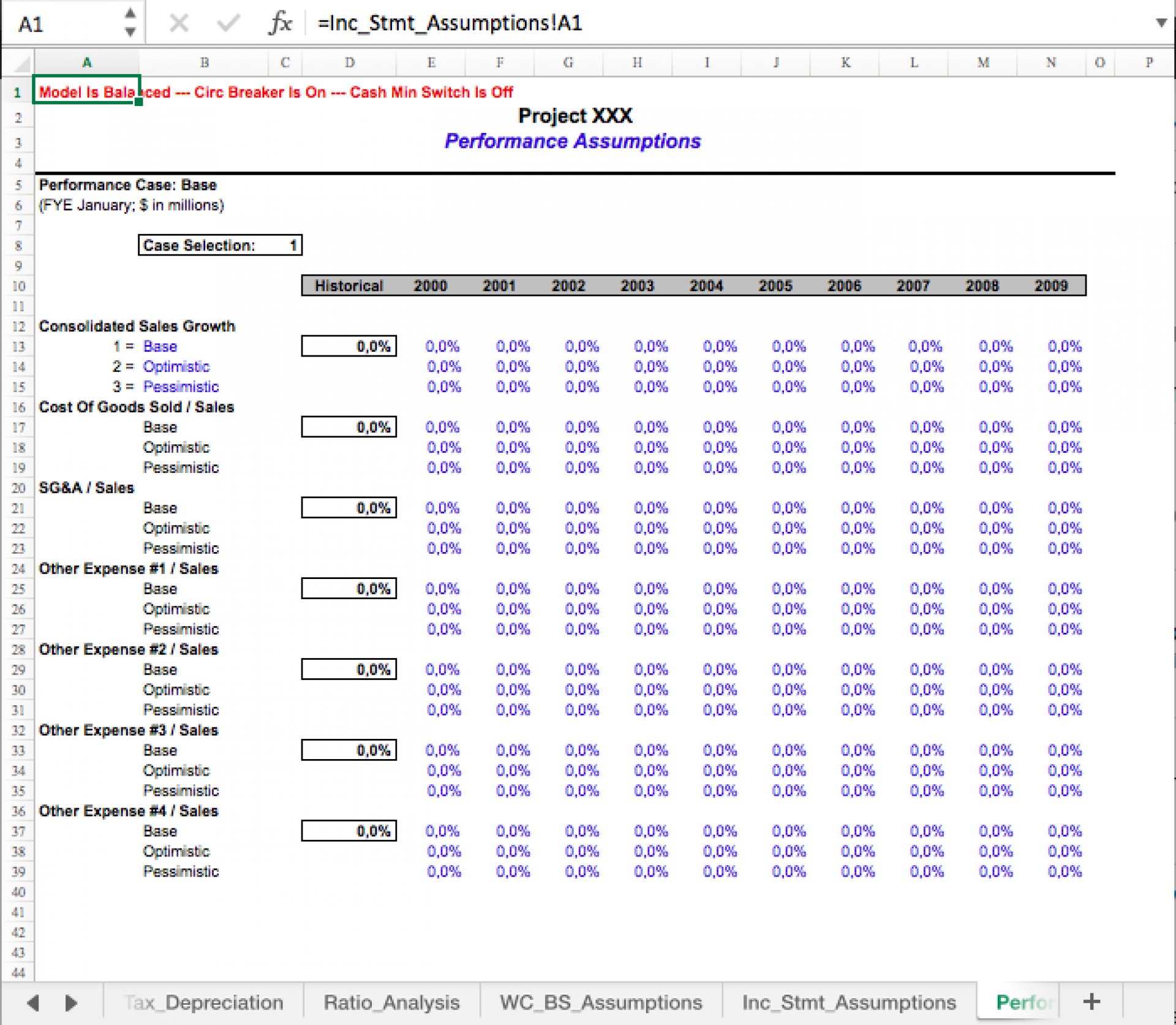

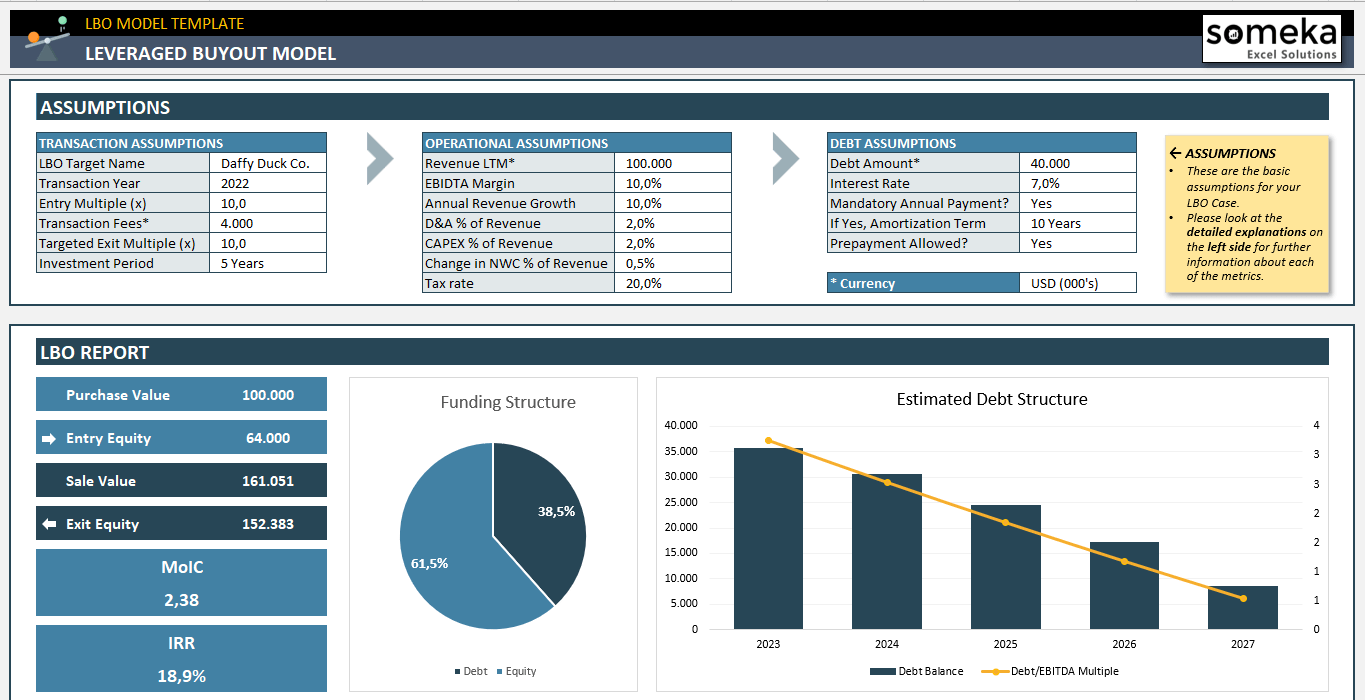

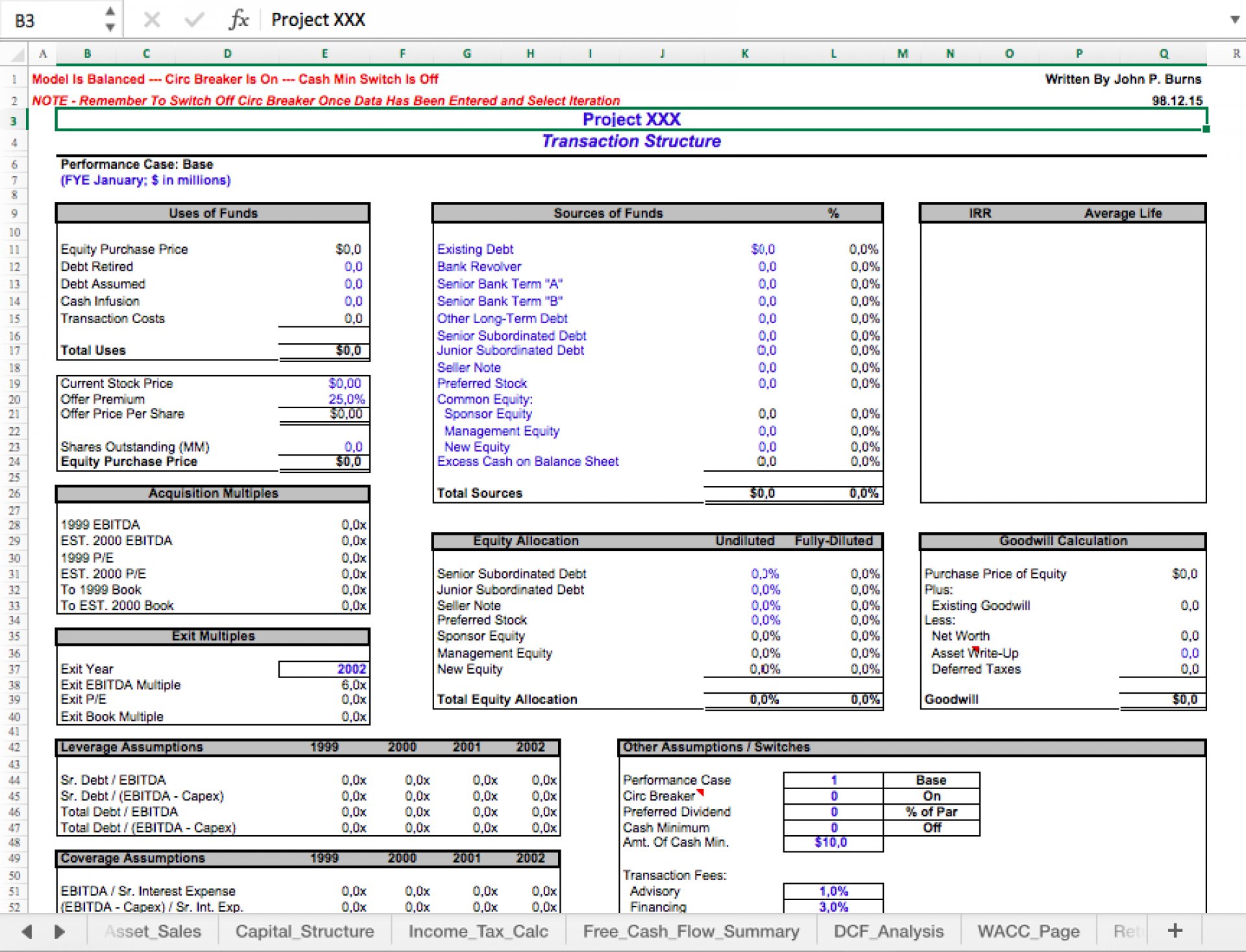

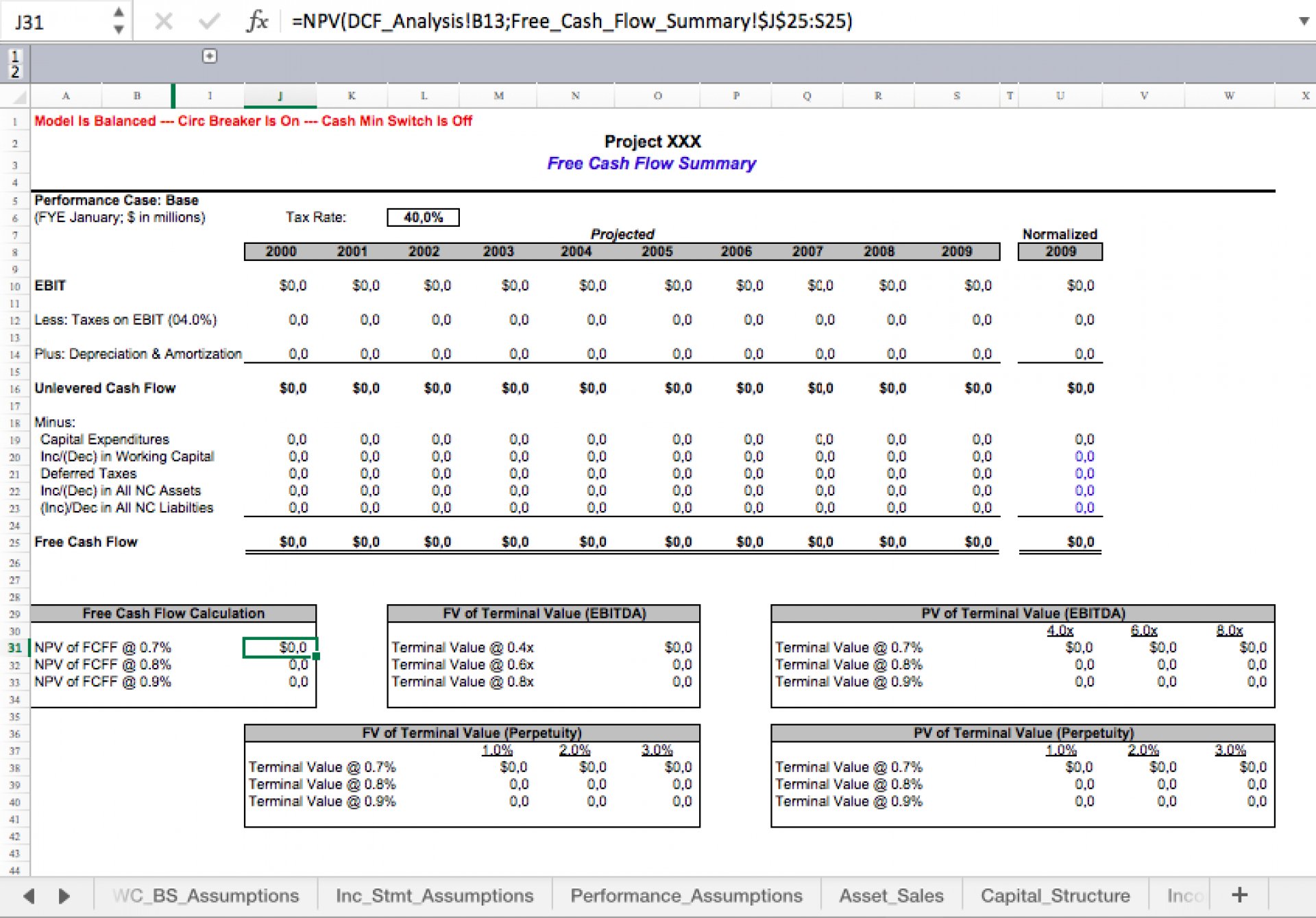

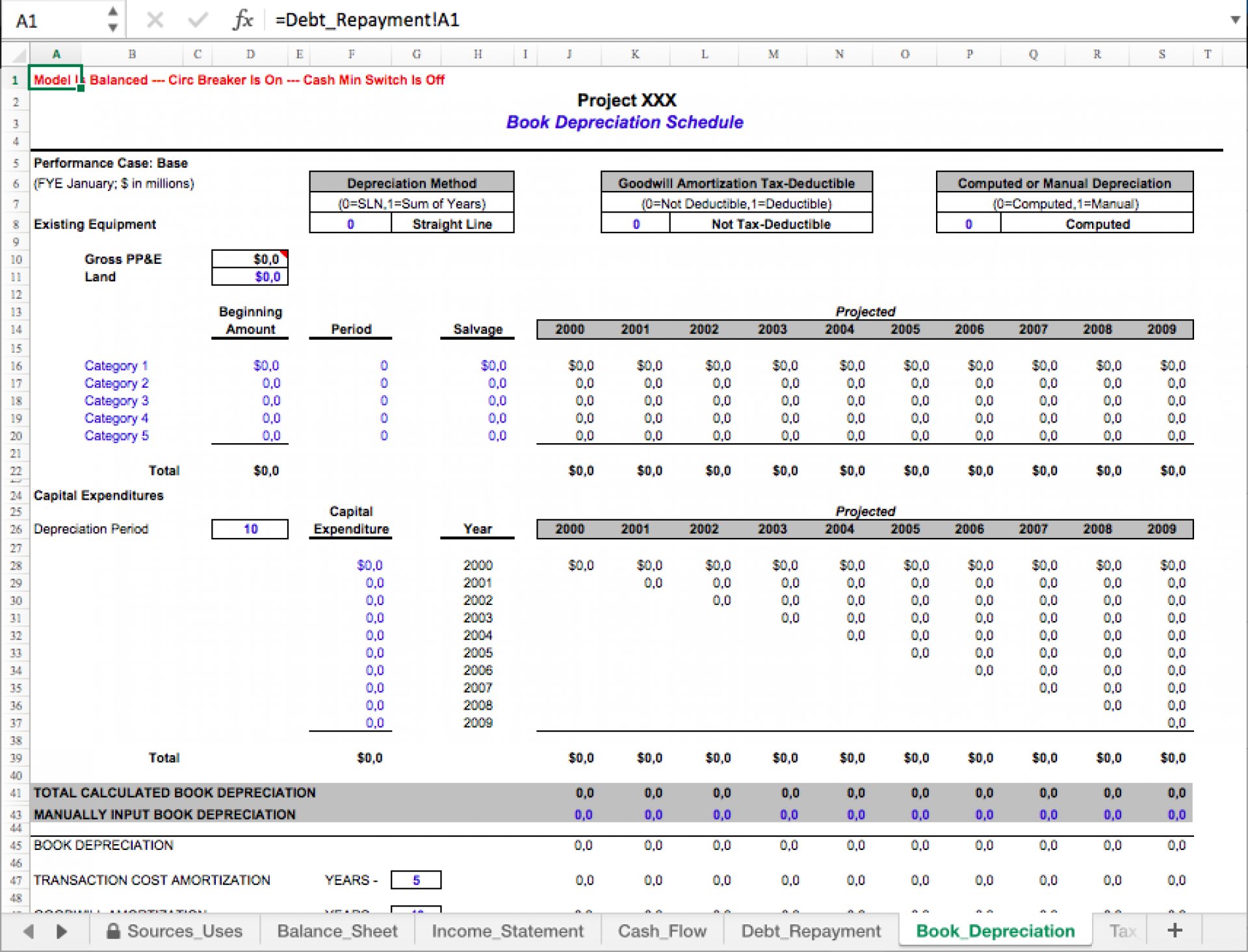

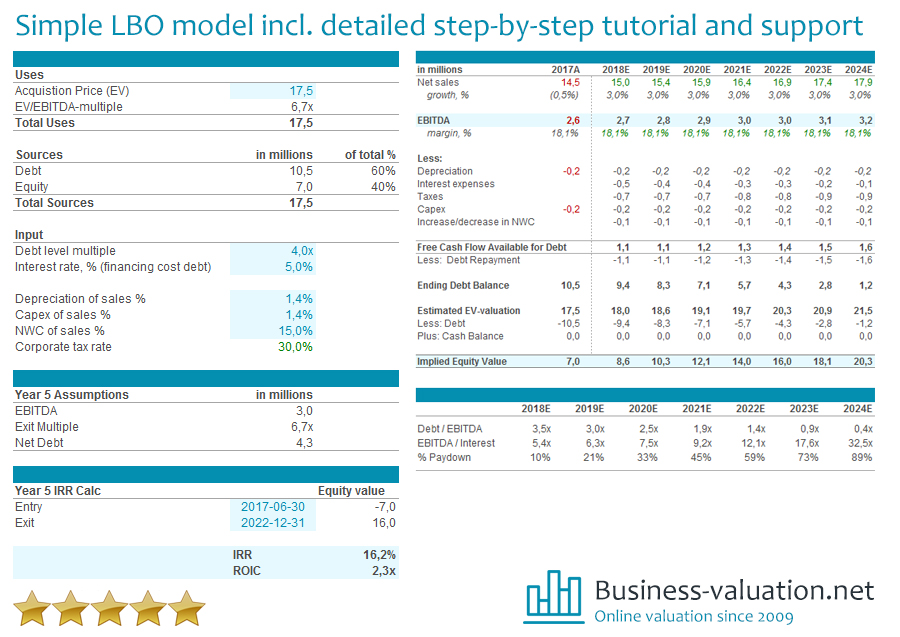

Leveraged Buyout (LBO) Model Template Excel XLS

Leveraged Buyout (LBO) Model Template Excel Eloquens

Leveraged Buyout (LBO) Model Template Excel Eloquens

LBO Model Excel Template Leveraged Buyout Model Valuation

Leveraged Buyout (LBO) Model Template Excel Eloquens

Leveraged Buyout (LBO) Model Template Excel Eloquens

Leveraged Buyout (LBO) Model Template Excel Eloquens

Leveraged Buyout Model (LBO) Excel Model for Private Equity Eloquens

Simple Leveraged Buyout (LBO) Model Excel Template Instructions

Related Post: