Irs Penalty And Interest Calculator Excel

Irs Penalty And Interest Calculator Excel - Your refund was used to pay your irs tax balance or certain state or federal debts. Get free tax help from the irs. Or speak with a representative by phone or in person. We help you understand and meet your federal tax responsibilities. We would like to show you a description here but the site won’t allow us. Get or renew an individual taxpayer identification number (itin) for federal tax purposes if you are not eligible. The internal revenue service (irs) administers and enforces u.s. How to track your refund or relief payment appeared. Find irs forms and answers to tax questions. When the statutory period expires, we. Your refund was used to pay your irs tax balance or certain state or federal debts. Get or renew an individual taxpayer identification number (itin) for federal tax purposes if you are not eligible. Create a payment plan for the amount you expect to owe in the current tax year view your balance view balances owed to the irs by. The post irs sending stimulus checks in october 2025? Create a payment plan for the amount you expect to owe in the current tax year view your balance view balances owed to the irs by tax year manage profile go paperless for. Or speak with a representative by phone or in person. Get free tax help from the irs. We. Your refund from a joint return was applied to your spouse's debts. When the statutory period expires, we. The post irs sending stimulus checks in october 2025? The internal revenue service (irs) administers and enforces u.s. Find irs forms and answers to tax questions. How to track your refund or relief payment appeared. Your refund from a joint return was applied to your spouse's debts. Your refund was used to pay your irs tax balance or certain state or federal debts. The post irs sending stimulus checks in october 2025? Create a payment plan for the amount you expect to owe in the current. Your refund was used to pay your irs tax balance or certain state or federal debts. Your refund from a joint return was applied to your spouse's debts. When the statutory period expires, we. How to track your refund or relief payment appeared. Create a payment plan for the amount you expect to owe in the current tax year view. Get free tax help from the irs. We would like to show you a description here but the site won’t allow us. We help you understand and meet your federal tax responsibilities. The post irs sending stimulus checks in october 2025? The internal revenue service (irs) administers and enforces u.s. Find irs forms and answers to tax questions. Your refund from a joint return was applied to your spouse's debts. Your refund was used to pay your irs tax balance or certain state or federal debts. We would like to show you a description here but the site won’t allow us. Get or renew an individual taxpayer identification number (itin). The post irs sending stimulus checks in october 2025? Create a payment plan for the amount you expect to owe in the current tax year view your balance view balances owed to the irs by tax year manage profile go paperless for. Get or renew an individual taxpayer identification number (itin) for federal tax purposes if you are not eligible.. We help you understand and meet your federal tax responsibilities. Or speak with a representative by phone or in person. When the statutory period expires, we. How to track your refund or relief payment appeared. We would like to show you a description here but the site won’t allow us. Get free tax help from the irs. We would like to show you a description here but the site won’t allow us. Your refund from a joint return was applied to your spouse's debts. When the statutory period expires, we. Your refund was used to pay your irs tax balance or certain state or federal debts.Overdraft Interest Calculator in Excel (with Example) ExcelDemy

Calculator For IRS Penalty And Interest

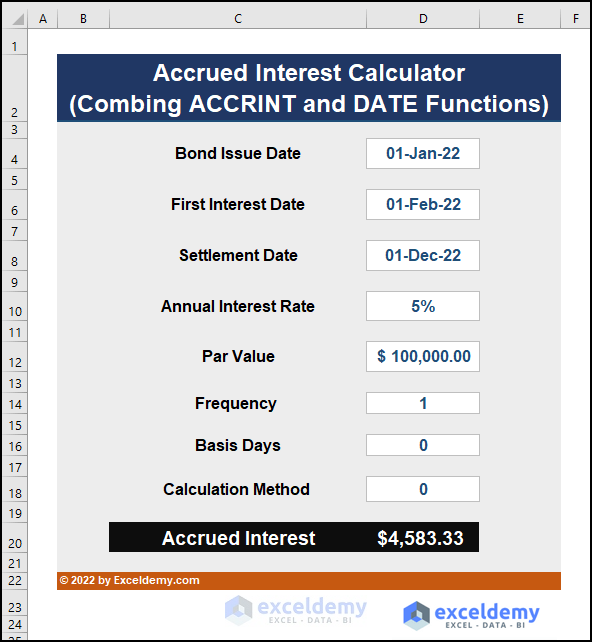

How to Create an Accrued Interest Calculator in Excel 5 Methods

IRS Penalty Calculator [INFOGRAPHIC] Tax Relief Center

IRS Penalty Calculator [INFOGRAPHIC] Tax Relief Center

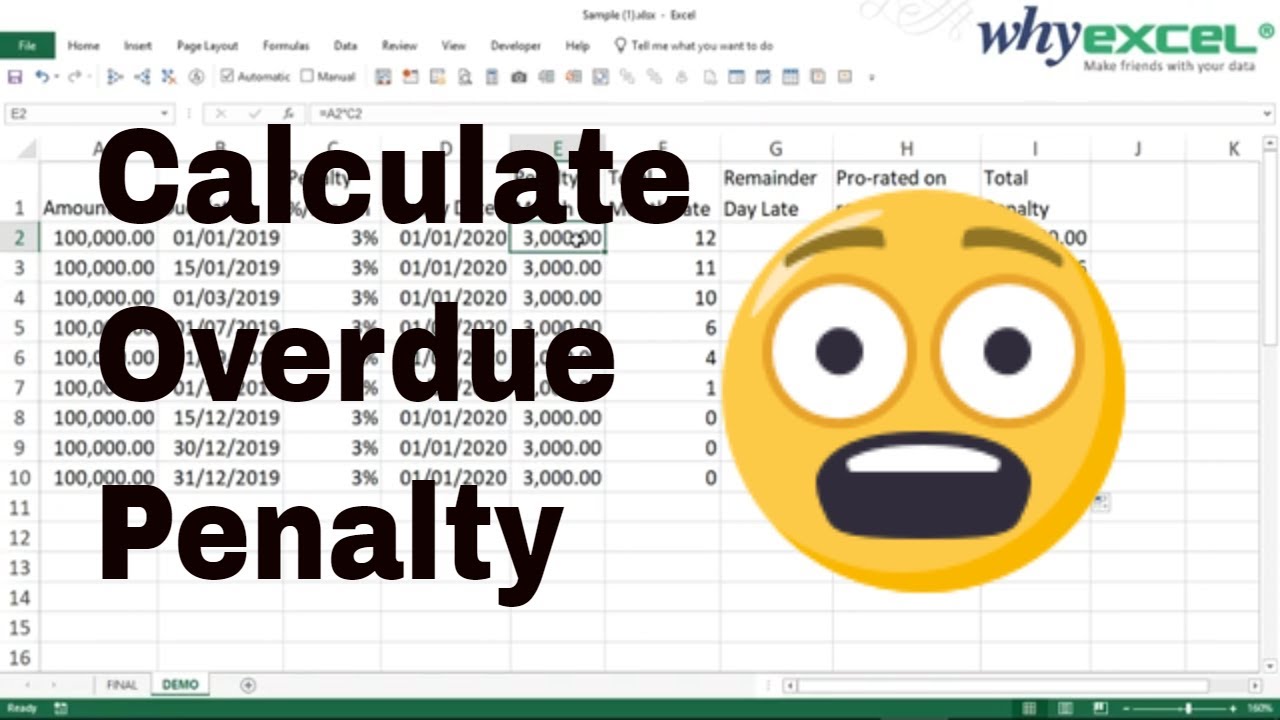

Calculate Penalty Amount by Overdue Months and Days in Excel YouTube

Excel Tutorial How To Calculate Penalty Interest On Loan In Excel

How does the IRS Calculate Interest and Penalties on Your Taxable

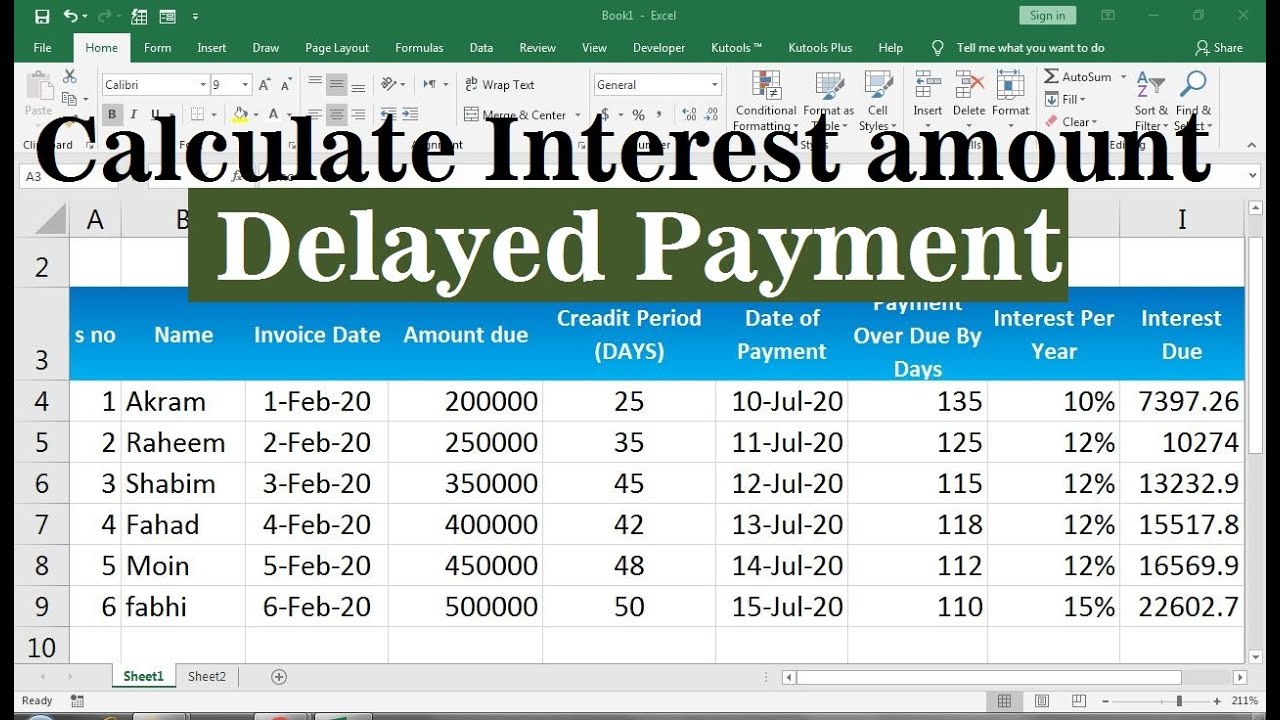

late payment interest calculator excel YouTube

Calculations In Excel

Related Post:

![IRS Penalty Calculator [INFOGRAPHIC] Tax Relief Center](https://eqp5jgfqqvh.exactdn.com/wp-content/uploads/2019/06/20190610-Tax-Relief-Center-IRS-Penalty-Calculator.jpg?strip=all&lossy=1&ssl=1)

![IRS Penalty Calculator [INFOGRAPHIC] Tax Relief Center](https://eqp5jgfqqvh.exactdn.com/wp-content/uploads/2019/06/TRC-PIN-IRS-Penalty-Calculator_-Breaking-Down-Your-IRS-Late-Fees.png?strip=all&lossy=1&resize=735%2C1102&ssl=1)