Insert Date On Excel

Insert Date On Excel - Operational risk in the banking sector has grown in the past years, and operational resilience has become of key relevance. However, while banks have developed. Explore the top five operational risks in banking and financial services institutions, emerging trends in orm and learn how to manage operational risks by adopting best practices. In the banking sector, operational risk refers to the risk of loss resulting from inadequate or failed internal processes, systems, human behavior, or external events (as defined by the basel. Operational risk is the risk of loss due to errors, interruptions, or damages caused by people, systems, or processes. Operational risk management in banking refers to identifying, assessing, and mitigating the risks arising from the bank’s. Discover crucial aspects of operational risk, from its causes and management strategies to examples and assessment techniques, for better business oversight. In the decade since the global financial crisis, banks—and their regulators—have become increasingly mindful of the need to manage risk. The evolving regulatory landscape, driven by factors such as changing geopolitical dynamics, technological advancements, and consumer protection, presents significant operational risks. Risks to operational resilience are increasingly systemic as the. Eu legislation requires that institutions adequately manage and mitigate operational risk, which is defined as the risk of losses stemming from inadequate or failed internal processes, people. The evolving regulatory landscape, driven by factors such as changing geopolitical dynamics, technological advancements, and consumer protection, presents significant operational risks. Although we do not possess a crystal ball that will tell us. In the decade since the global financial crisis, banks—and their regulators—have become increasingly mindful of the need to manage risk. Operational risk is the risk of loss due to errors, interruptions, or damages caused by people, systems, or processes. Operational risk management in banking refers to identifying, assessing, and mitigating the risks arising from the bank’s. Explore the top five. Although we do not possess a crystal ball that will tell us what banks’ risk functions will look like in 2025, or what financial crises or technological changes may disrupt risk management between. However, while banks have developed. The evolving regulatory landscape, driven by factors such as changing geopolitical dynamics, technological advancements, and consumer protection, presents significant operational risks. Operational. What is operational risk management in banking? In the decade since the global financial crisis, banks—and their regulators—have become increasingly mindful of the need to manage risk. The evolving regulatory landscape, driven by factors such as changing geopolitical dynamics, technological advancements, and consumer protection, presents significant operational risks. Risks to operational resilience are increasingly systemic as the. Operational risk in. Operational risk in the banking sector has grown in the past years, and operational resilience has become of key relevance. Explore the top five operational risks in banking and financial services institutions, emerging trends in orm and learn how to manage operational risks by adopting best practices. Risks to operational resilience are increasingly systemic as the. Operational risk management in. Operational risk in the banking sector has grown in the past years, and operational resilience has become of key relevance. However, while banks have developed. The evolving regulatory landscape, driven by factors such as changing geopolitical dynamics, technological advancements, and consumer protection, presents significant operational risks. In the decade since the global financial crisis, banks—and their regulators—have become increasingly mindful. Eu legislation requires that institutions adequately manage and mitigate operational risk, which is defined as the risk of losses stemming from inadequate or failed internal processes, people. Although we do not possess a crystal ball that will tell us what banks’ risk functions will look like in 2025, or what financial crises or technological changes may disrupt risk management between.. The operational type of risk is low for simple business operations such. In the banking sector, operational risk refers to the risk of loss resulting from inadequate or failed internal processes, systems, human behavior, or external events (as defined by the basel. The evolving regulatory landscape, driven by factors such as changing geopolitical dynamics, technological advancements, and consumer protection, presents. In the decade since the global financial crisis, banks—and their regulators—have become increasingly mindful of the need to manage risk. Operational risk in the banking sector has grown in the past years, and operational resilience has become of key relevance. Although we do not possess a crystal ball that will tell us what banks’ risk functions will look like in. The evolving regulatory landscape, driven by factors such as changing geopolitical dynamics, technological advancements, and consumer protection, presents significant operational risks. Eu legislation requires that institutions adequately manage and mitigate operational risk, which is defined as the risk of losses stemming from inadequate or failed internal processes, people. However, while banks have developed. Operational risk management in banking refers to.How to Insert Current Date and Time in Microsoft Excel

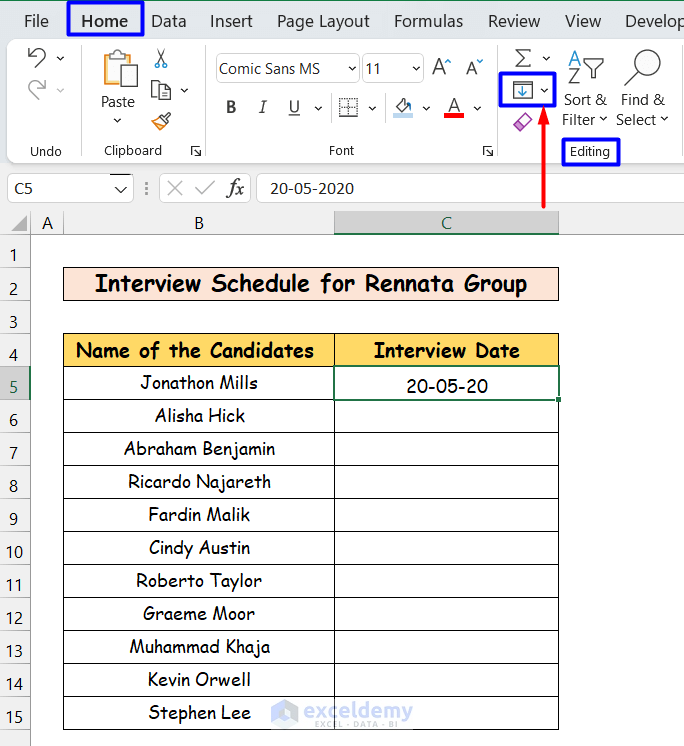

How to Insert Dates in Excel Automatically 4 Methods

How to Insert Date in Excel Formula (8 Ways) ExcelDemy

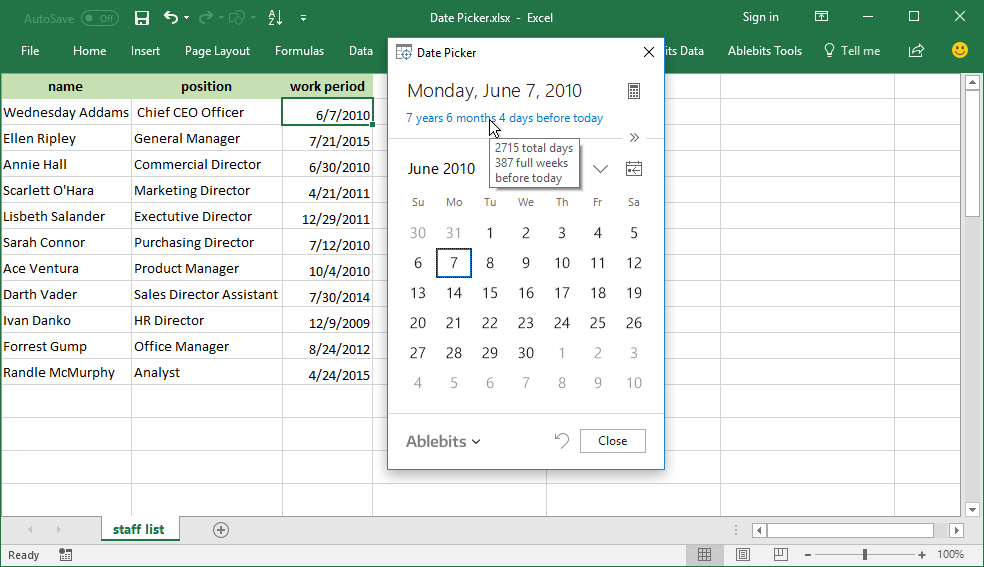

Quickly insert a date or a formatted date in Excel

How to Insert Date in Excel (7 Simple Methods) ExcelDemy

How to Insert Date in Excel (7 Simple Methods) ExcelDemy

How To Insert Auto Date And Time In Excel Printable Templates Free

How To Insert Date In Excel Using Formula Printable Online

How to Insert Day and Date in Excel (3 Ways) ExcelDemy

How to Insert Date in Excel Formula (8 Ways) ExcelDemy

Related Post: