How To Unlock Protected Excel Workbook

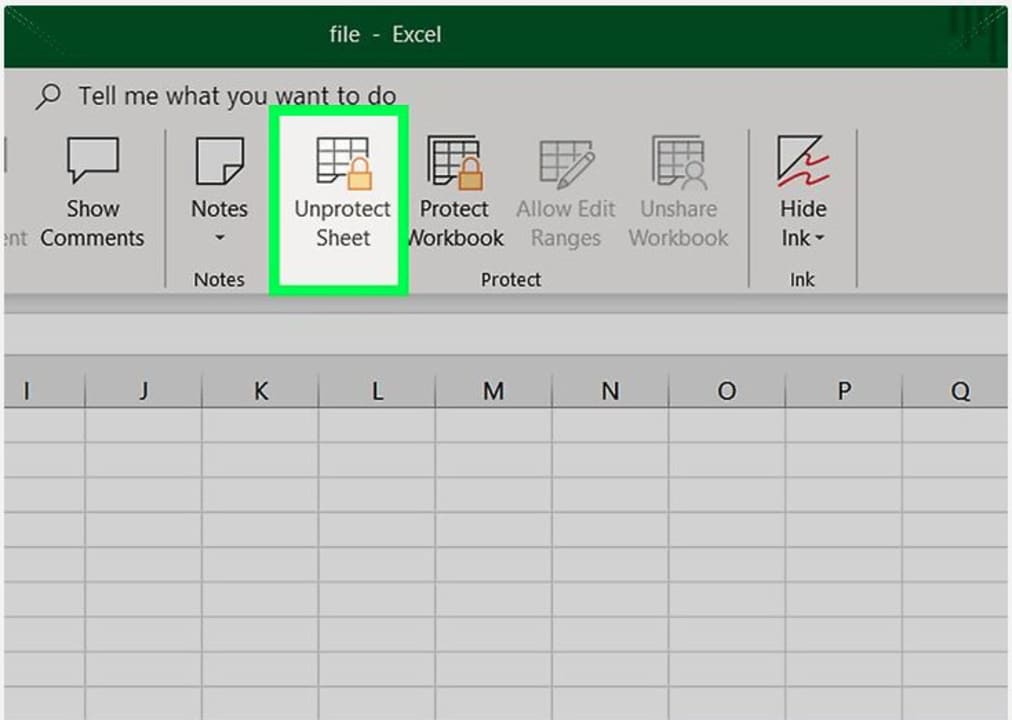

How To Unlock Protected Excel Workbook - With an unlock home equity agreement (hea), you receive a lump sum of cash today in exchange for a share of your home’s future value. An unlock agreement has no age requirements. In most cases, unlock must be in no greater than 2nd lien position and the property must be clear of any liens deemed unacceptable by unlock in its discretion. While there are many ways to tap home equity, a home equity agreement (hea) from unlock is unique because it was designed to help families solve their financial challenges, and in doing. A minimum hea amount of. Learn more about who we are and what we offer. There are no monthly payments and no interest charges. Unlock technologies offers home equity agreements that allow you to receive cash for a portion of the future value of your property. Discover how a home equity agreement lets you access cash from your equity—no monthly payments. A fintech company that helps you access funds without monthly payments or added debt. While there are many ways to tap home equity, a home equity agreement (hea) from unlock is unique because it was designed to help families solve their financial challenges, and in doing. There are no monthly payments and no interest charges. The cost of your hea is based on how. Through our hea, unlock provides a lump sum of cash. In most cases, unlock must be in no greater than 2nd lien position and the property must be clear of any liens deemed unacceptable by unlock in its discretion. Depending on your circumstances an unlock agreement can yield more or less cash to you up front versus a reverse mortgage. A fintech company that helps you access funds without monthly. Depending on your circumstances an unlock agreement can yield more or less cash to you up front versus a reverse mortgage. To secure the performance of your obligations under hea, unlock will place a lien on your property in the form of either a “performance deed of trust” or a “performance mortgage”. In most cases, unlock must be in no. While there are many ways to tap home equity, a home equity agreement (hea) from unlock is unique because it was designed to help families solve their financial challenges, and in doing. A fintech company that helps you access funds without monthly payments or added debt. Learn more about who we are and what we offer. In most cases, unlock. Depending on your circumstances an unlock agreement can yield more or less cash to you up front versus a reverse mortgage. A minimum hea amount of. To secure the performance of your obligations under hea, unlock will place a lien on your property in the form of either a “performance deed of trust” or a “performance mortgage”. The cost of. In most cases, unlock must be in no greater than 2nd lien position and the property must be clear of any liens deemed unacceptable by unlock in its discretion. An unlock agreement has no age requirements. With an unlock home equity agreement (hea), you receive a lump sum of cash today in exchange for a share of your home’s future. With an unlock home equity agreement (hea), you receive a lump sum of cash today in exchange for a share of your home’s future value. Through our hea, unlock provides a lump sum of cash (up to $500,000) in exchange for a portion of your home’s future value. The cost of your hea is based on how. Here’s a look. Discover how a home equity agreement lets you access cash from your equity—no monthly payments. A fintech company that helps you access funds without monthly payments or added debt. Through our hea, unlock provides a lump sum of cash (up to $500,000) in exchange for a portion of your home’s future value. A minimum hea amount of. With an unlock. Here’s a look at the conditions. Depending on your circumstances an unlock agreement can yield more or less cash to you up front versus a reverse mortgage. Unlock technologies offers home equity agreements that allow you to receive cash for a portion of the future value of your property. A fintech company that helps you access funds without monthly payments. The cost of your hea is based on how. With an unlock home equity agreement (hea), you receive a lump sum of cash today in exchange for a share of your home’s future value. To secure the performance of your obligations under hea, unlock will place a lien on your property in the form of either a “performance deed of.How to unprotect or unlock protected areas in a worksheet in Excel

How to Unlock Microsoft Excel in 3 Steps Softonic

Microsoft Excel How to lock or unlock a spreadsheet

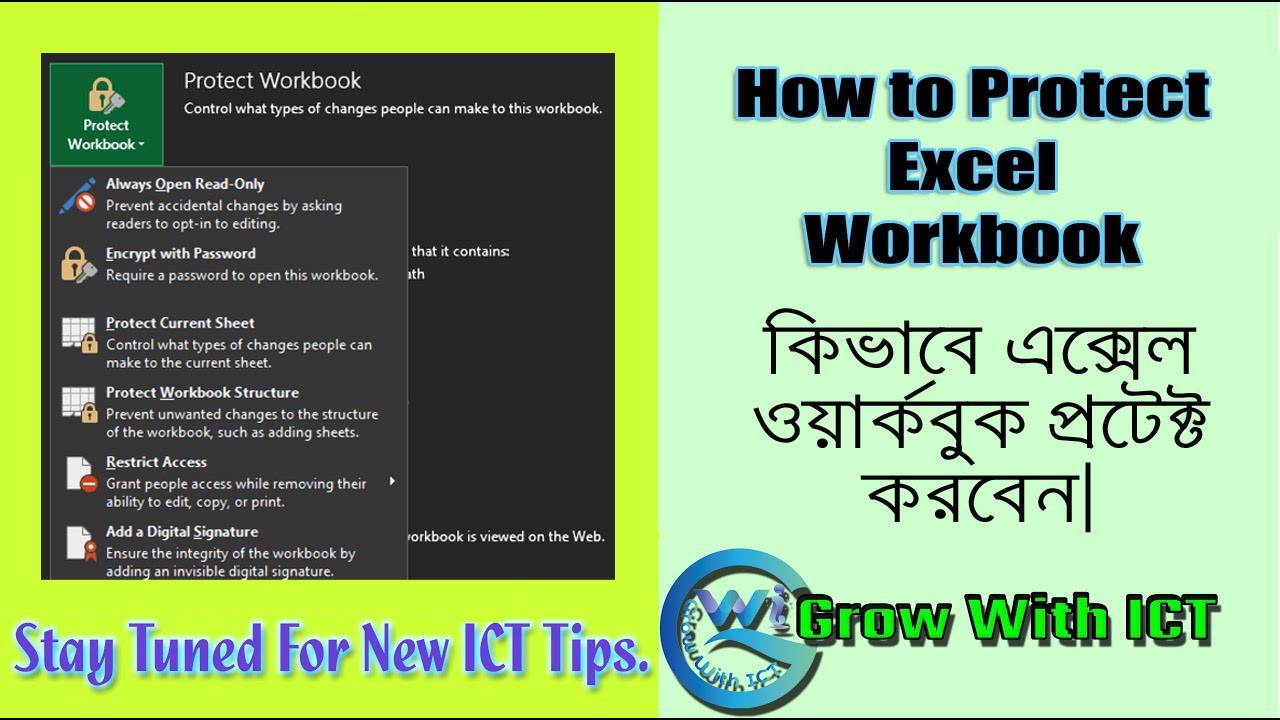

How To protect Excel Workbook. Lock/Unlock Excel File. YouTube

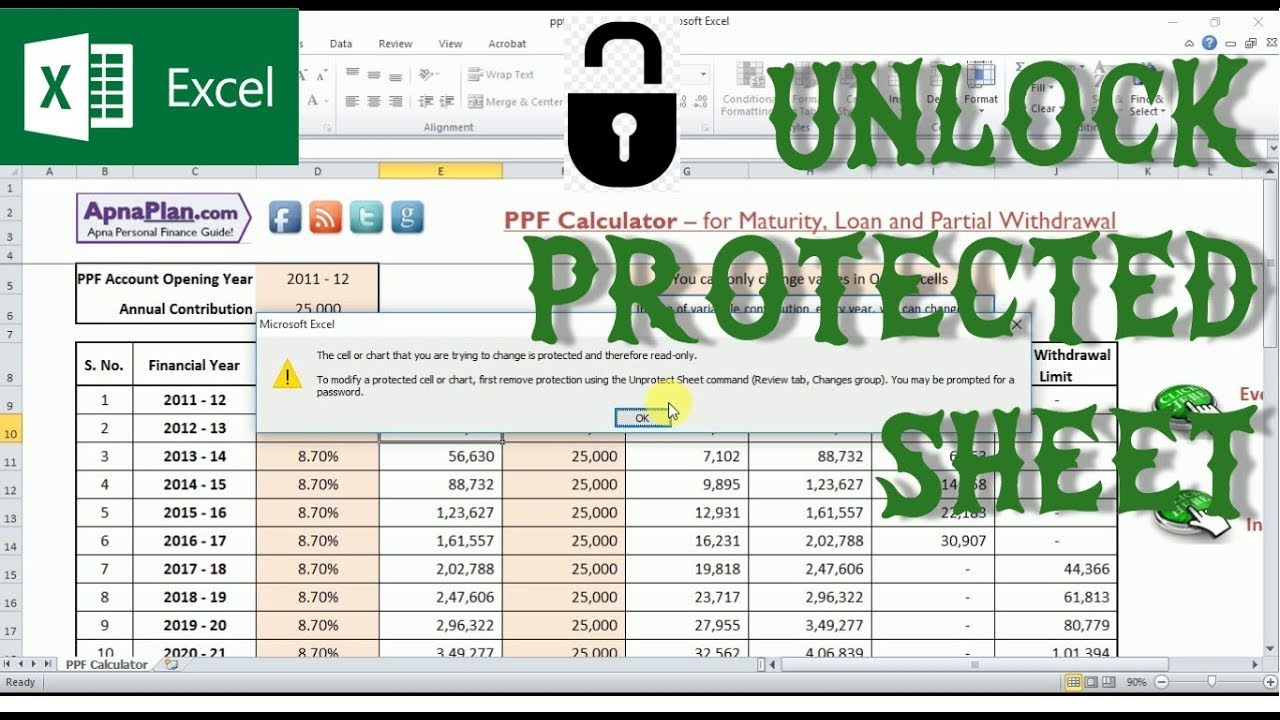

How To Unlock Worksheet In Excel Microsoft Excel Protected S

Protect Worksheet In Excel But Allow Input

Easily Unlock Any Protected Excel sheet without any password YouTube

How to Protect Excel Worksheet, Workbook with Password Locking

How To Unlock A Protected Excel Worksheet Excel Unlock Cells

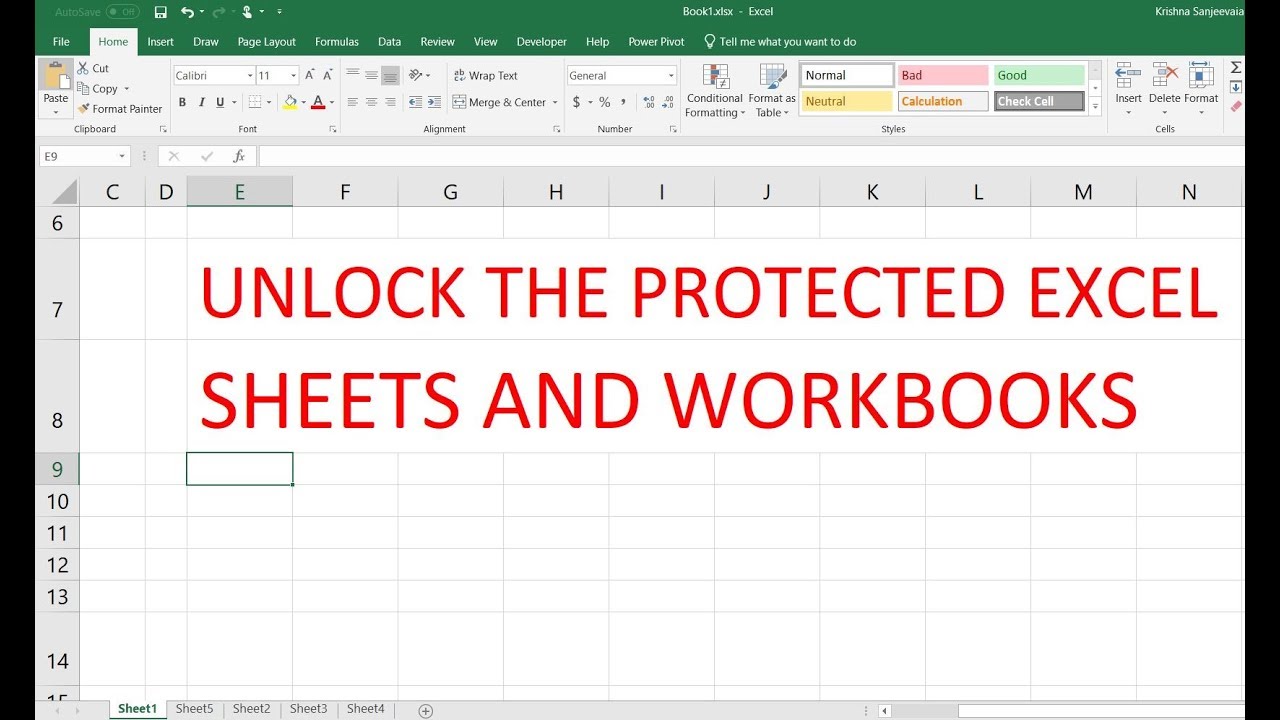

Unlocking password protected excel sheets and workbook YouTube

Related Post: