How To Amortize A Loan On Excel

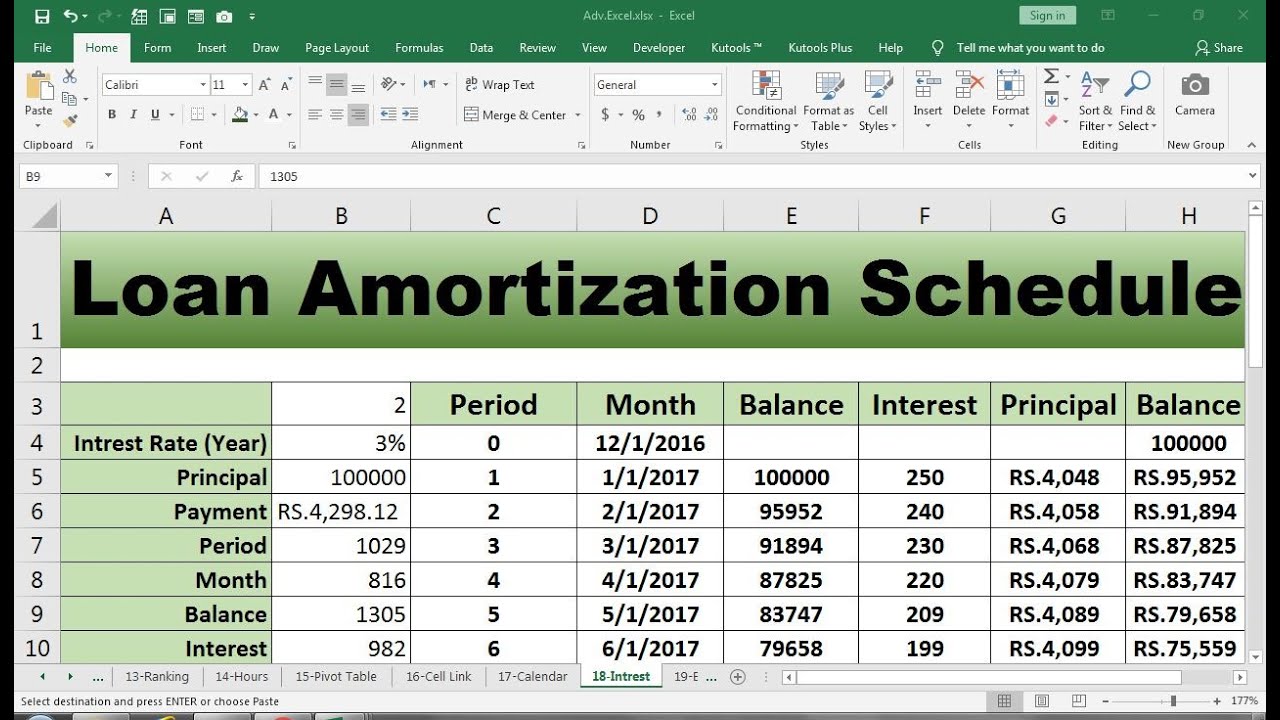

How To Amortize A Loan On Excel - See examples of amortize used in a. It aims to allocate costs fairly, accurately, and systematically. For help determining what interest rate you might pay, check out today’s mortgage rates. For loans, it details each payment’s breakdown between principal. To liquidate or extinguish (a mortgage, debt, or other obligation), especially by periodic payments to the creditor or to a sinking fund. An amortization schedule is a chart that tracks the falling book value of a loan or an intangible asset over time. Amortization is the process of paying off a debt or loan over time in predetermined installments. Amortize means to gradually write off a cost over a period. In accounting, amortization is conceptually similar to the depreciation of a plant asset or the depletion of a natural resource. The second is used in the context of business accounting and is the act of. It aims to allocate costs fairly, accurately, and systematically. For loans, it details each payment’s breakdown between principal. To reduce a debt or cost by paying small regular amounts: Amortization is the process of paying off a debt or loan over time in predetermined installments. For help determining what interest rate you might pay, check out today’s mortgage rates. It aims to allocate costs fairly, accurately, and systematically. There are two general definitions of amortization. Amortization is the process of paying off a debt or loan over time in predetermined installments. The meaning of amortize is to pay off (an obligation, such as a mortgage) gradually usually by periodic payments of principal and interest or by payments to a. Amortization is the process of paying off a debt or loan over time in predetermined installments. See examples of amortize used in a. The meaning of amortize is to pay off (an obligation, such as a mortgage) gradually usually by periodic payments of principal and interest or by payments to a sinking fund. An amortization schedule is a chart that. For loans, it details each payment’s breakdown between principal. The first is the systematic repayment of a loan over time. Amortize means to gradually write off a cost over a period. Amortization is a fundamental financial and accounting process that systematically spreads a cost or payment over a defined period. There are two general definitions of amortization. There are two general definitions of amortization. In accounting, amortization is conceptually similar to the depreciation of a plant asset or the depletion of a natural resource. The first is the systematic repayment of a loan over time. For help determining what interest rate you might pay, check out today’s mortgage rates. Amortization is a fundamental financial and accounting process. Amortization is a fundamental financial and accounting process that systematically spreads a cost or payment over a defined period. Amortize means to gradually write off a cost over a period. Depreciation is recorded to reflect that an asset is no longer worth the previous carrying cost reflected on the financial. The second is used in the context of business accounting. In accounting, amortization is conceptually similar to the depreciation of a plant asset or the depletion of a natural resource. To take a cost, for example the…. There are two general definitions of amortization. Amortize means to gradually write off a cost over a period. The second is used in the context of business accounting and is the act of. The second is used in the context of business accounting and is the act of. Perhaps the most common example of the term amortization is. The meaning of amortize is to pay off (an obligation, such as a mortgage) gradually usually by periodic payments of principal and interest or by payments to a sinking fund. Amortize means to gradually write. Depreciation is recorded to reflect that an asset is no longer worth the previous carrying cost reflected on the financial. To take a cost, for example the…. The first is the systematic repayment of a loan over time. An amortization schedule is a chart that tracks the falling book value of a loan or an intangible asset over time. The. An amortization schedule is a chart that tracks the falling book value of a loan or an intangible asset over time. In accounting, amortization is conceptually similar to the depreciation of a plant asset or the depletion of a natural resource. Amortize means to gradually write off a cost over a period. For help determining what interest rate you might.How to Calculate Loan Amortization in Excel YouTube

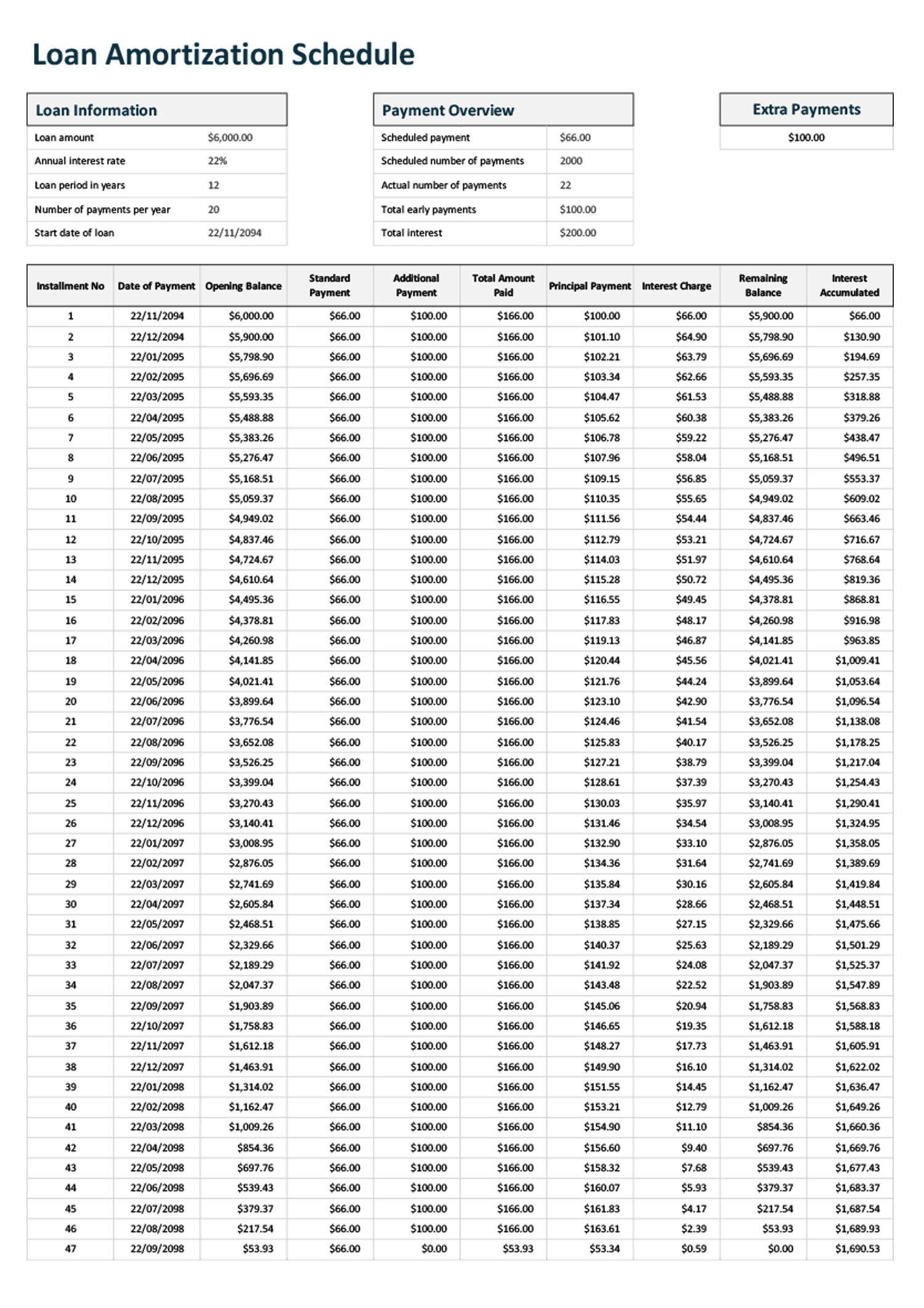

EXCEL of Loan Amortization Schedule.xlsx WPS Free Templates

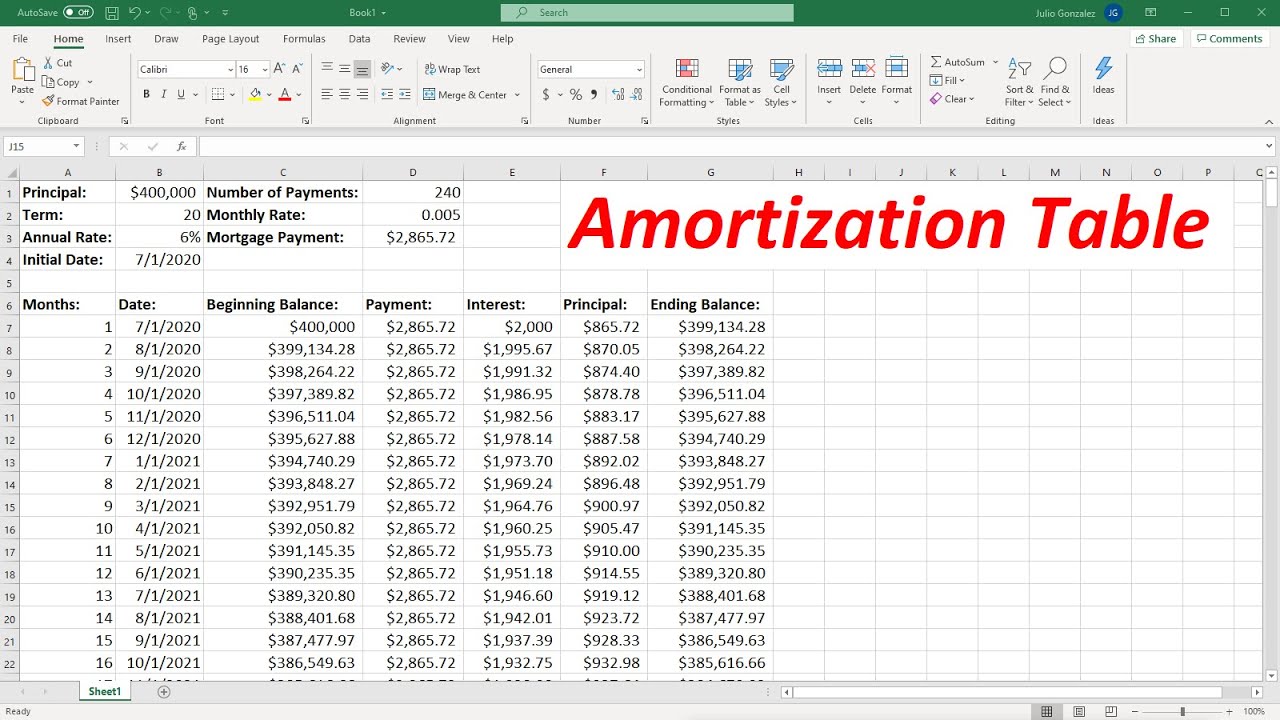

How to Make a Flexible Excel Loan Payment Calculator and Amortization

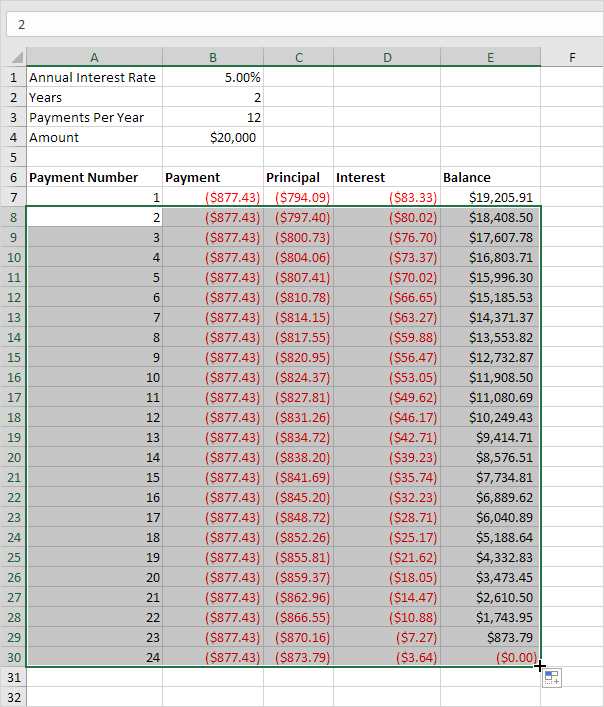

How to Create a Loan Amortization Schedule in Excel StepByStep

How to Make an Amortization Schedule in Excel 7 Steps (with Templates

loan amortization schedule excel YouTube

D Rudiant Build loan amortization table excel

Loan Amortization Schedule in Excel Step by Step Tutorial

How to Prepare Amortization Schedule in Excel 10 Steps

Loan Amortization Schedule Excel at Natalie Hawes blog

Related Post: