Fers Retirement Calculator Excel

Fers Retirement Calculator Excel - When you apply for a refund, opm will refund all retirement deductions to your credit under both fers and csrs. Welcome to opm.govopm is here to help you transition from serving the american people to enjoying your retirement. These links are useful to new and existing retirees throughout their. Opm retirement services processes benefits for federal retirees, manages accounts for retirees, survivors, and qualified former spouses, and sends. Unlike your fers refund, you have always been able to pay back the. They are employees who are automatically covered by the federal employees retirement system (fers), civil service retirement system (csrs) offset, and those who elected to. Fers is a retirement plan that provides benefits from three different sources: You can make a deposit for creditable federal employees retirement system (fers) service you performed before 1989 during which retirement deductions were not withheld from your pay. You must have become disabled, while employed in a position subject to fers, because of a disease or injury, for useful and efficient service in your current position. You can make a deposit for creditable federal employees retirement system (fers) service you performed before 1989 during which retirement deductions were not withheld from your pay. They are employees who are automatically covered by the federal employees retirement system (fers), civil service retirement system (csrs) offset, and those who elected to. You can make a deposit for creditable federal employees retirement system (fers) service you performed before 1989 during which retirement deductions were not withheld from your pay. These links are useful to new and existing. A basic benefit plan, social security and the thrift savings plan (tsp). Two of the three parts of fers. Fers employees who retire after age 62 are generally eligible to receive not only their fers annuity retirement benefit after they retire, but also their thrift savings plan benefits and their. You can make a deposit for creditable federal employees retirement. Opm retirement services processes benefits for federal retirees, manages accounts for retirees, survivors, and qualified former spouses, and sends. You can make a deposit for creditable federal employees retirement system (fers) service you performed before 1989 during which retirement deductions were not withheld from your pay. These links are useful to new and existing retirees throughout their. Unlike your fers. These links are useful to new and existing retirees throughout their. Fers employees who retire after age 62 are generally eligible to receive not only their fers annuity retirement benefit after they retire, but also their thrift savings plan benefits and their. When you apply for a refund, opm will refund all retirement deductions to your credit under both fers. They are employees who are automatically covered by the federal employees retirement system (fers), civil service retirement system (csrs) offset, and those who elected to. Fers is a retirement plan that provides benefits from three different sources: In addition, fers disability retirement benefits are. You can make a deposit for creditable federal employees retirement system (fers) service you performed before. When you apply for a refund, opm will refund all retirement deductions to your credit under both fers and csrs. In addition, fers disability retirement benefits are. Fers employees who retire after age 62 are generally eligible to receive not only their fers annuity retirement benefit after they retire, but also their thrift savings plan benefits and their. Fers disability. When you apply for a refund, opm will refund all retirement deductions to your credit under both fers and csrs. You can make a deposit for creditable federal employees retirement system (fers) service you performed before 1989 during which retirement deductions were not withheld from your pay. You must have become disabled, while employed in a position subject to fers,. Welcome to opm.govopm is here to help you transition from serving the american people to enjoying your retirement. They are employees who are automatically covered by the federal employees retirement system (fers), civil service retirement system (csrs) offset, and those who elected to. When you apply for a refund, opm will refund all retirement deductions to your credit under both. They are employees who are automatically covered by the federal employees retirement system (fers), civil service retirement system (csrs) offset, and those who elected to. You can make a deposit for creditable federal employees retirement system (fers) service you performed before 1989 during which retirement deductions were not withheld from your pay. Welcome to opm.govopm is here to help you. A basic benefit plan, social security and the thrift savings plan (tsp). Fers disability benefits are computed in different ways depending on the annuitant’s age and amount of service at retirement. In addition, fers disability retirement benefits are. Opm retirement services processes benefits for federal retirees, manages accounts for retirees, survivors, and qualified former spouses, and sends. You must have.Retirement Calculator for Excel

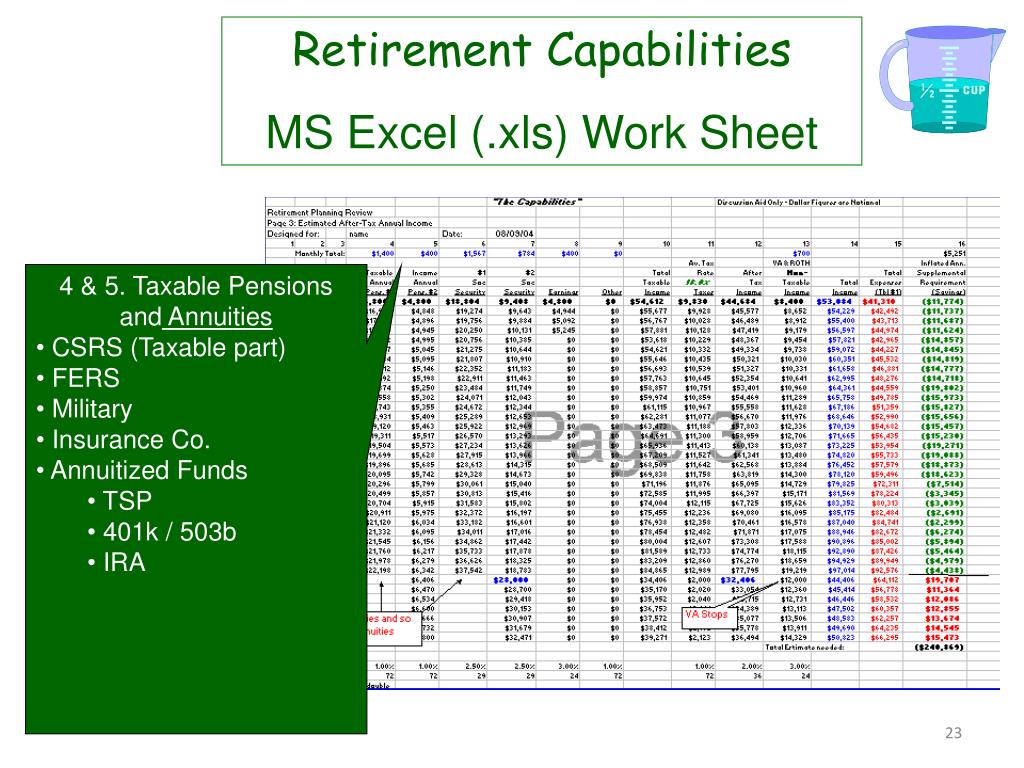

PPT What’s Your Retirement Number ? MS Excel Retirement Planning

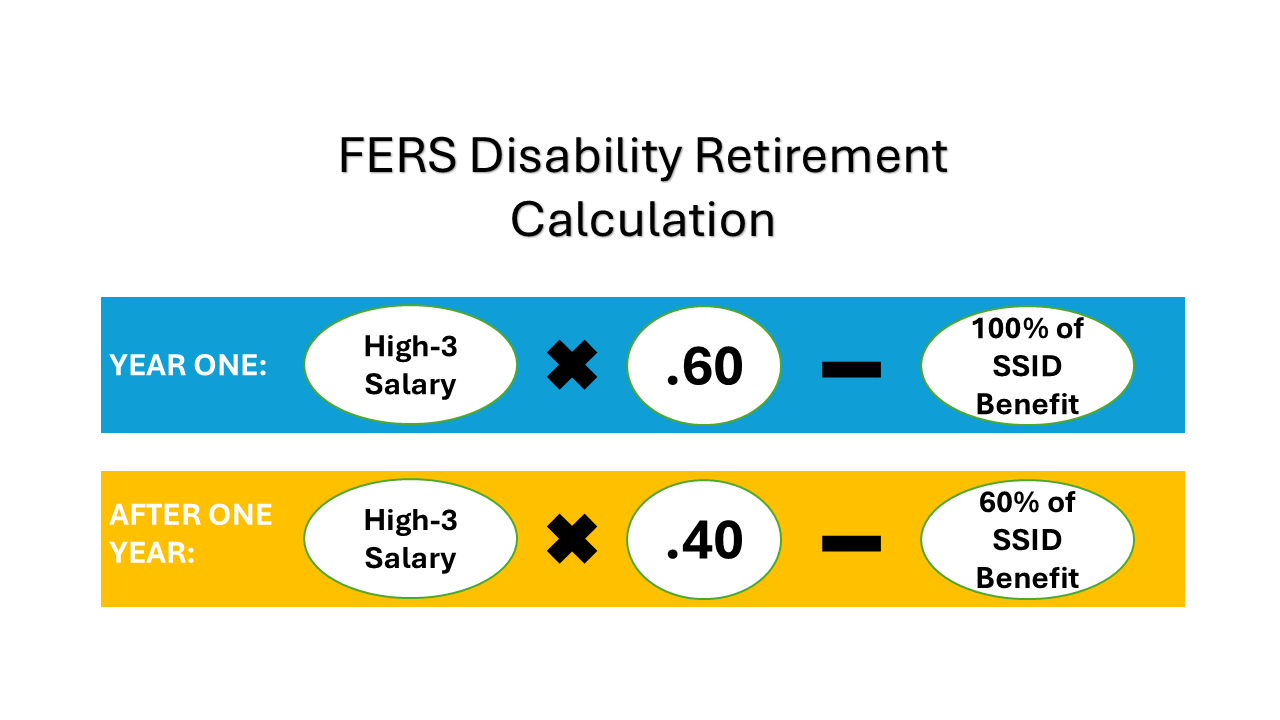

How to Calculate FERS Federal Disability Retirement Benefits

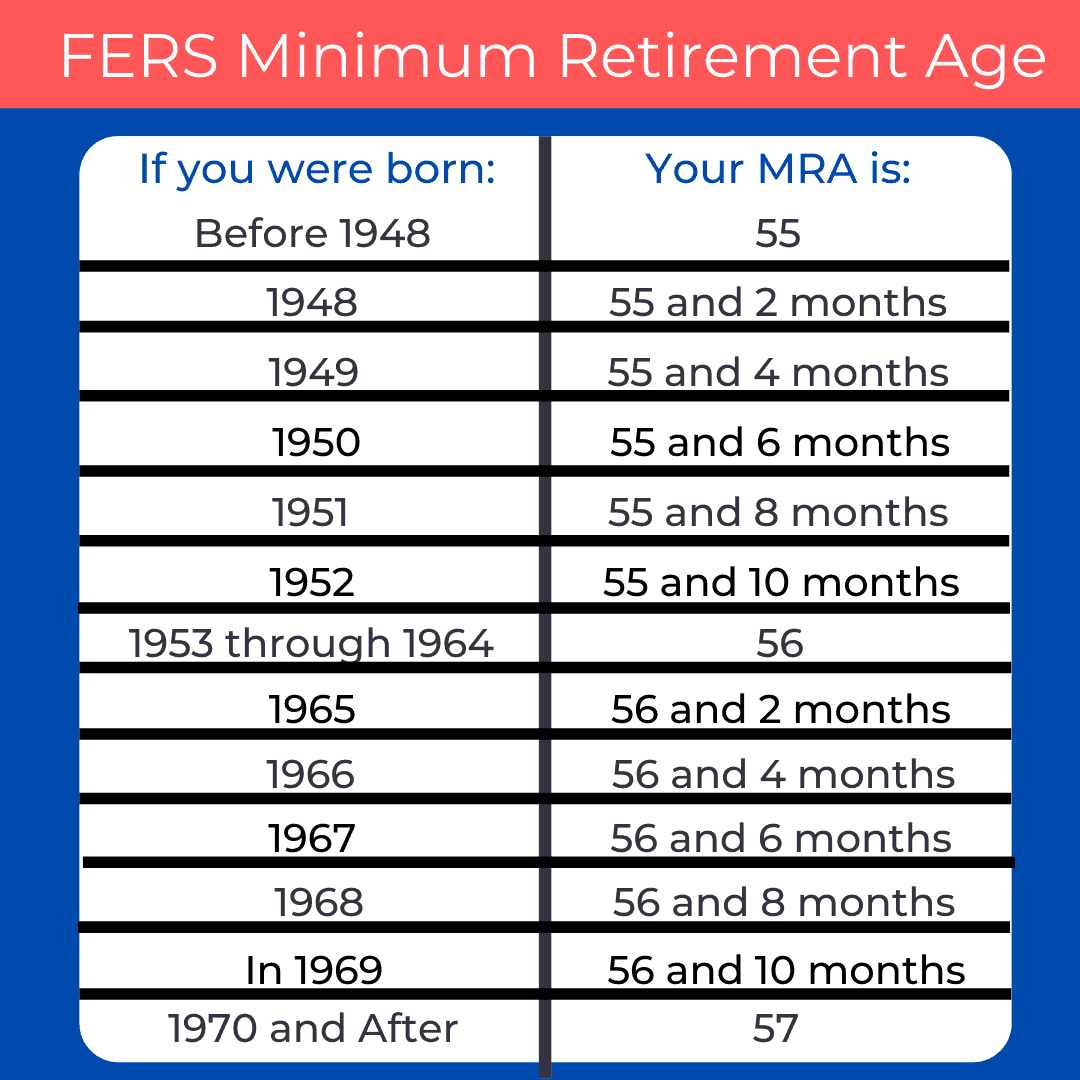

Fers retirement date calculator KaylieghAnwyn

How to Calculate FERS Federal Disability Retirement Benefits

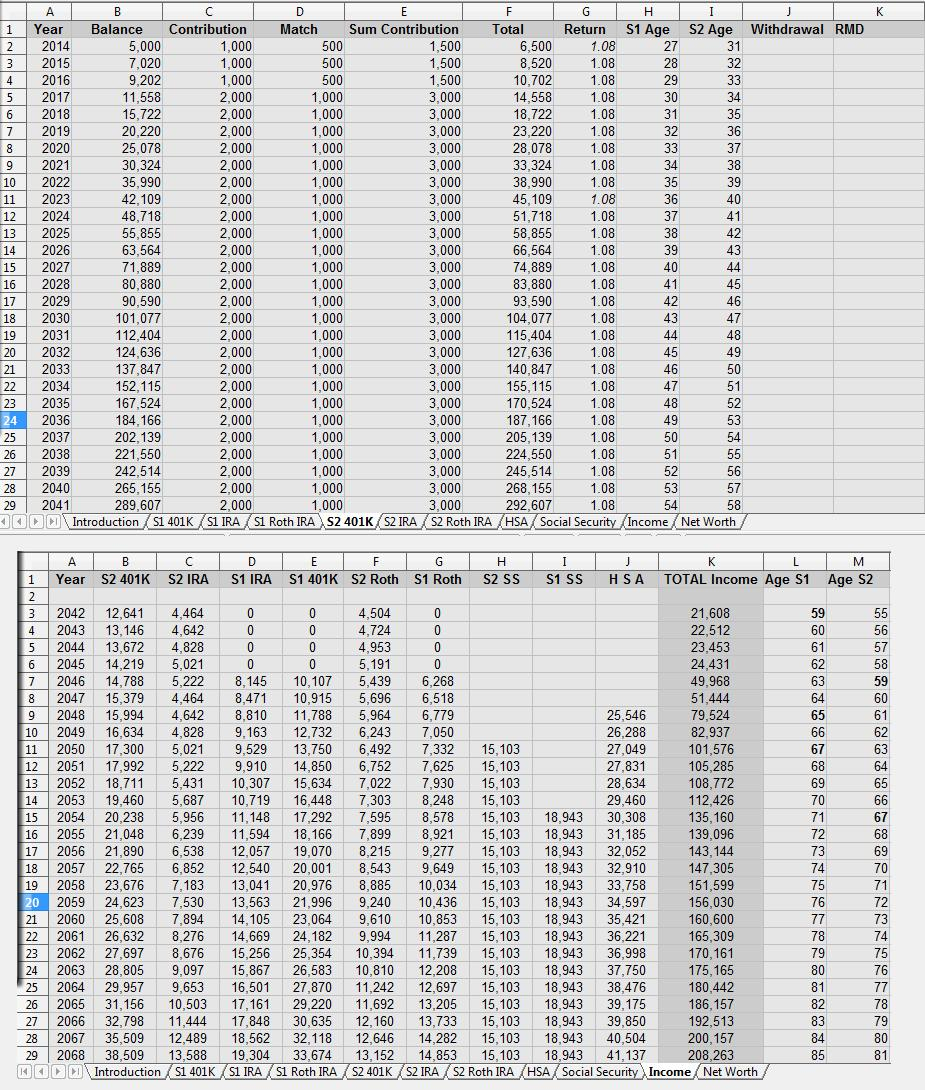

Fers Retirement Calculator Spreadsheet PapillonNorthwan inside

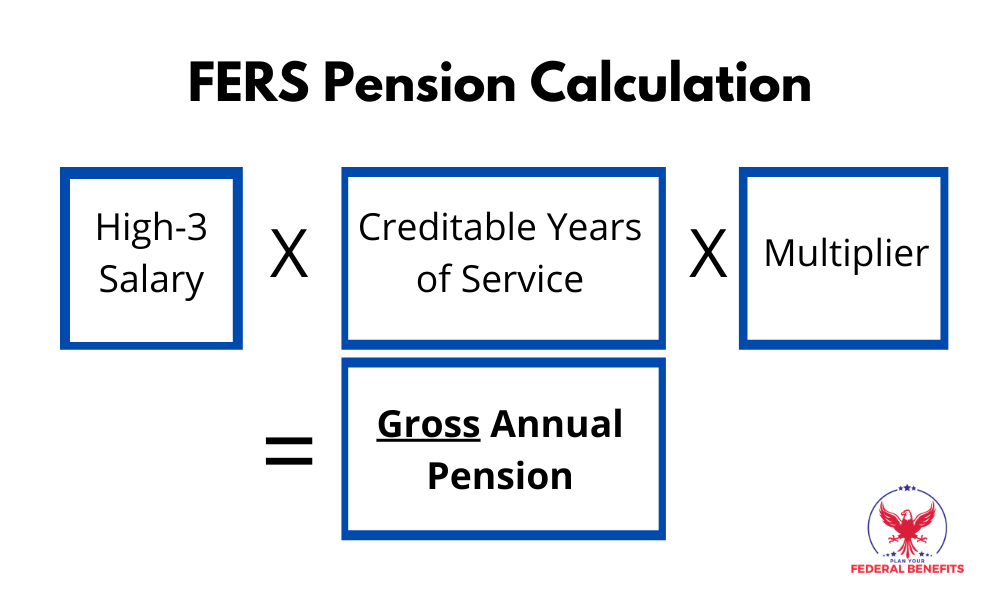

How to Calculate FERS Pension PlanWell Financial Planning

FERS Retirement/Pension Calculator

Ultimate Guide to Calculate FERS Retirement Benefits

FERS Pension Calculation Guide FERS Retirement Webinar

Related Post: