Excel Npv Formula

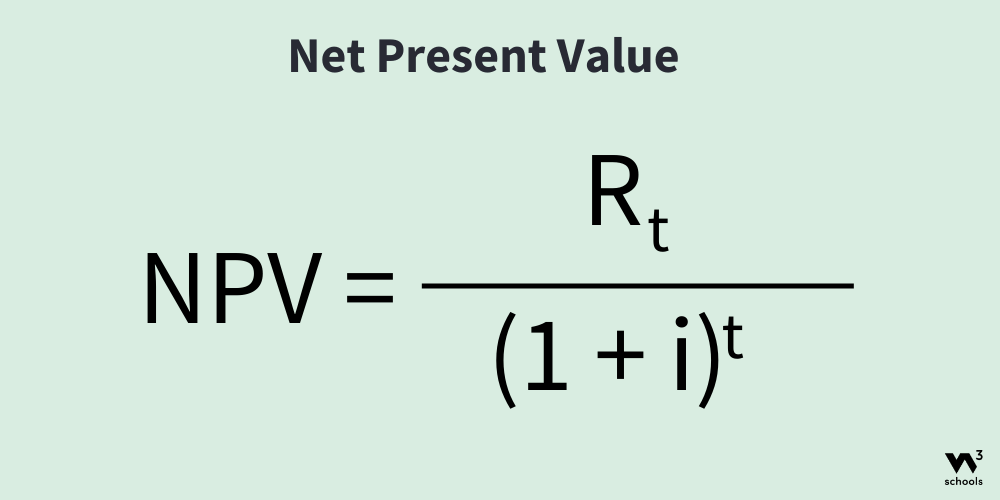

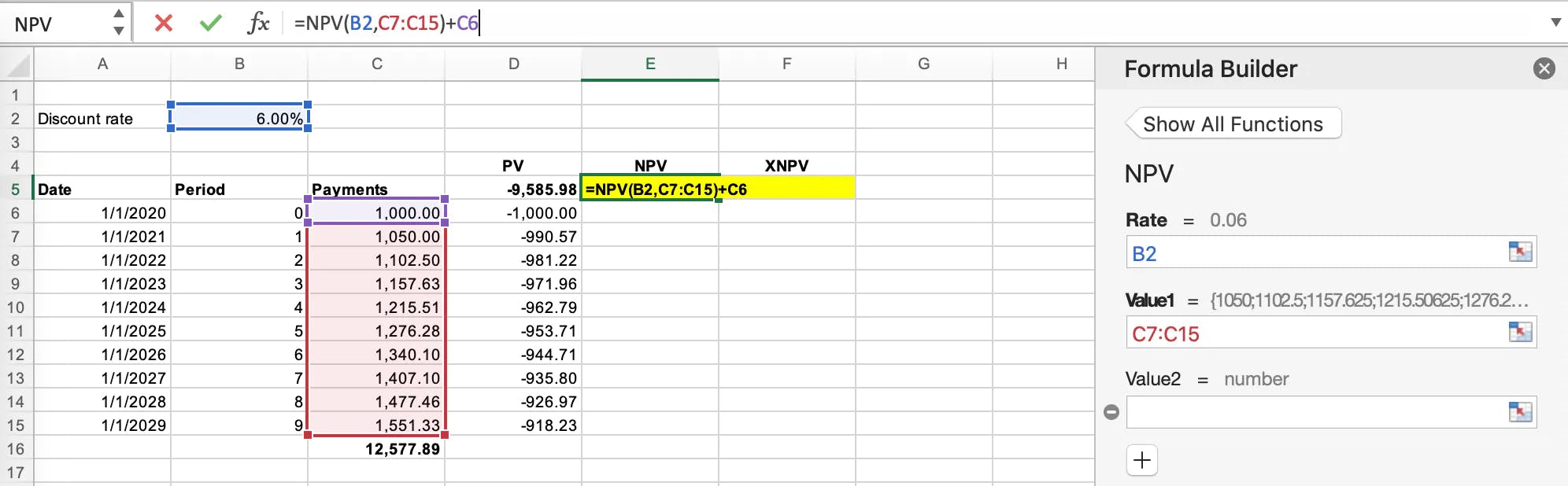

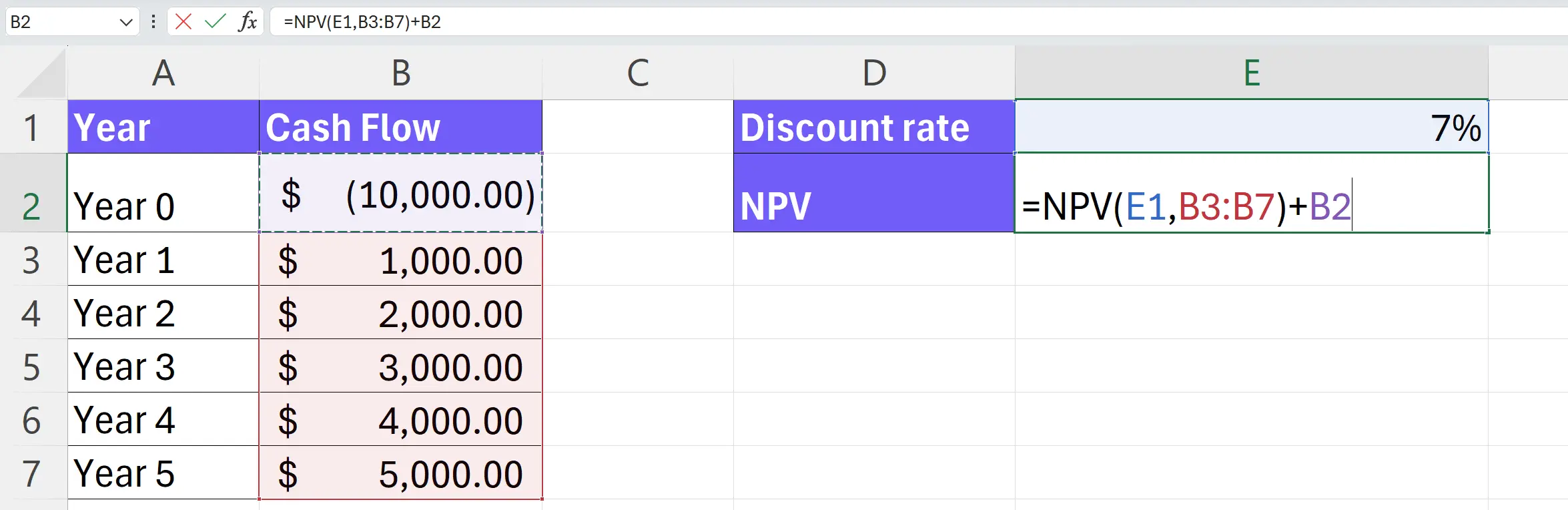

Excel Npv Formula - Calculates the net present value of an investment by using a discount rate and a series of future payments (negative values) and income (positive values). The correct npv formula in excel uses the npv function to calculate the present value of a series of future cash flows and subtracts the initial investment. We will demonstrate 3 different examples of using the npv function in different situations. You can use the basic formula, calculating the present value of each component for each year individually and then summing. We will use this function to write an npv formula for monthly cash flows in excel. The syntax of the npv function is. Learn how to use the npv formula in excel for financial analysis. In the tutorial below, i am going to explain to you the concept of npv, multiple ways to calculate npv in excel, and the different functions that excel offers for npv calculation. Npv stands for net present value which represents the difference between the values of the present cash inflows and outflows applying a discount rate. There are two methods to calculate npv in excel. The syntax of the npv function is. Npv stands for net present value which represents the difference between the values of the present cash inflows and outflows applying a discount rate. You can use the basic formula, calculating the present value of each component for each year individually and then summing. The correct npv formula in excel uses the npv. There are two methods to calculate npv in excel. We will demonstrate 3 different examples of using the npv function in different situations. You can use the basic formula, calculating the present value of each component for each year individually and then summing. Npv stands for net present value which represents the difference between the values of the present cash. We will use this function to write an npv formula for monthly cash flows in excel. The correct npv formula in excel uses the npv function to calculate the present value of a series of future cash flows and subtracts the initial investment. You can use the basic formula, calculating the present value of each component for each year individually. Npv stands for net present value which represents the difference between the values of the present cash inflows and outflows applying a discount rate. Calculates the net present value of an investment by using a discount rate and a series of future payments (negative values) and income (positive values). Master npv calculations, avoid common mistakes, and make better investment decisions.. Calculates the net present value of an investment by using a discount rate and a series of future payments (negative values) and income (positive values). There are two methods to calculate npv in excel. Master npv calculations, avoid common mistakes, and make better investment decisions. Learn how to use the npv formula in excel for financial analysis. Npv stands for. Master npv calculations, avoid common mistakes, and make better investment decisions. Npv stands for net present value which represents the difference between the values of the present cash inflows and outflows applying a discount rate. We will demonstrate 3 different examples of using the npv function in different situations. There are two methods to calculate npv in excel. Calculates the. In the tutorial below, i am going to explain to you the concept of npv, multiple ways to calculate npv in excel, and the different functions that excel offers for npv calculation. When working with financial data, calculating the. There are two methods to calculate npv in excel. We will use this function to write an npv formula for monthly. Calculates the net present value of an investment by using a discount rate and a series of future payments (negative values) and income (positive values). We will use this function to write an npv formula for monthly cash flows in excel. There are two methods to calculate npv in excel. When working with financial data, calculating the. Npv stands for. The syntax of the npv function is. In the tutorial below, i am going to explain to you the concept of npv, multiple ways to calculate npv in excel, and the different functions that excel offers for npv calculation. We will demonstrate 3 different examples of using the npv function in different situations. Npv stands for net present value which. The syntax of the npv function is. The correct npv formula in excel uses the npv function to calculate the present value of a series of future cash flows and subtracts the initial investment. In this tutorial, i will show you different examples of calculating npv in excel. We will demonstrate 3 different examples of using the npv function in.How to Calculate NPV Using Excel

Net Present Value Formula Examples With Excel Template

How to Calculate the Present Value of Future Lease Payments

Net Present Value (NPV) Calculator in Excel eFinancialModels

How to Use NPV in Excel to Calculate the Present Value of Future Cash

How to Use NPV Function in Excel (3 Easy Examples) ExcelDemy

NPV formula for net present value Excel formula Exceljet

Free NPV Calculator Online Calculate Net Present Value AI For Data

How to Calculate NPV in Excel Present Value)

NPV Formula Excel Step by Step Net Present Value Formula Guide

Related Post: