Excel Depreciation Formula

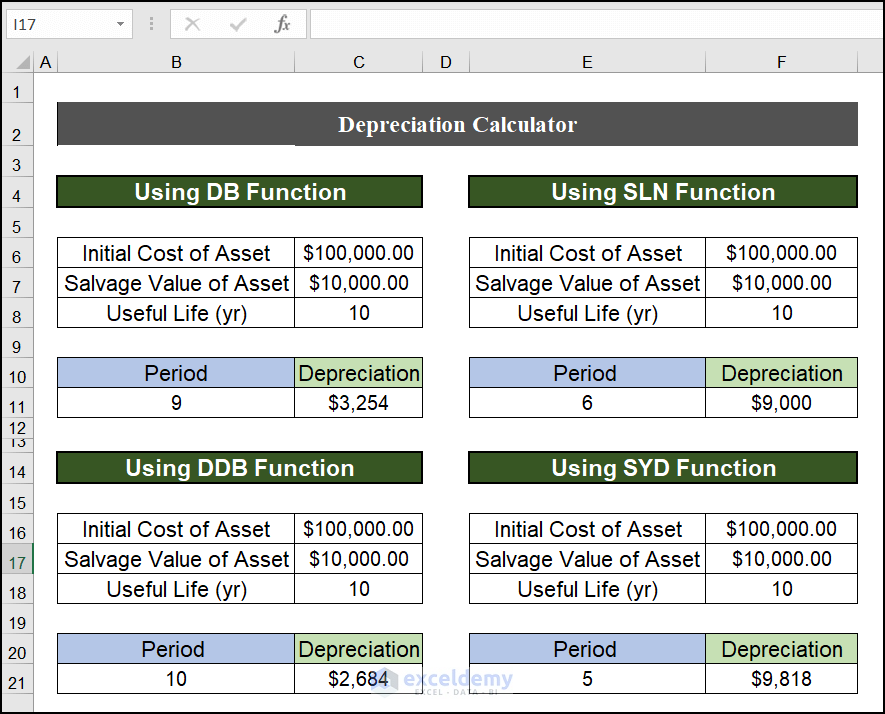

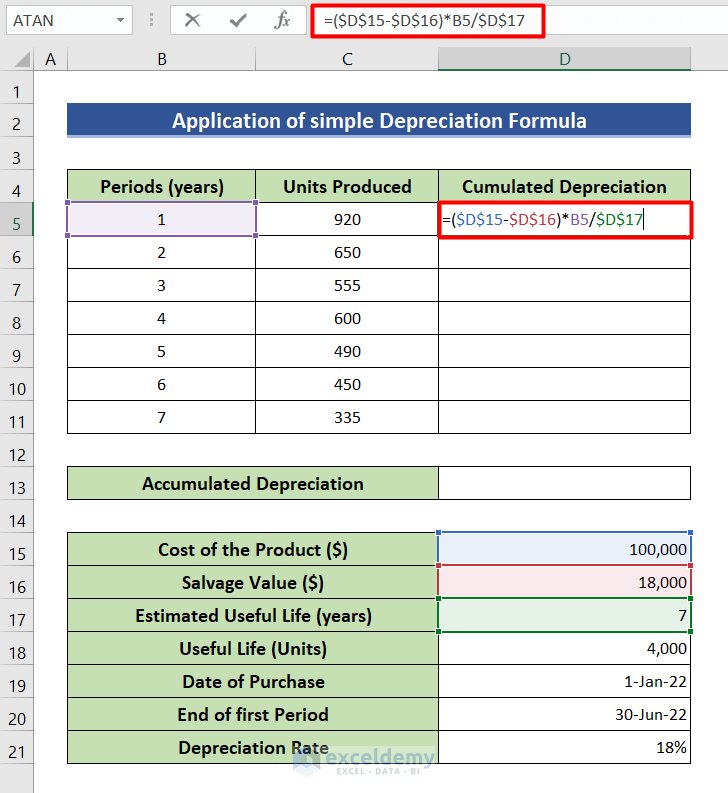

Excel Depreciation Formula - Master excel depreciation formulas with ease. In this article, you will find 5 easy methods on how to calculate depreciation in excel. The different depreciation methods, and the associated excel functions, are. We consider an asset with an initial cost of $10,000, a salvage value (residual value) of $1000 and a useful life of 10 periods (years). Ddb (cost, salvage, life, period, [factor]) the ddb. You can use any one of them. Learn sln, ddb, vdb methods, and avoid common mistakes in asset calculations for optimal results. It is easy to make a depreciation worksheet in excel without using complex and conditional formulas. Master depreciation calculations in excel with this comprehensive guide, covering various methods and efficient spreadsheet setup. You only need to familiarize yourself with the sln , ddb , and syd. Excel offers five different depreciation functions. The different depreciation methods, and the associated excel functions, are. You can use any one of them. Learn sln, ddb, vdb methods, and avoid common mistakes in asset calculations for optimal results. Ddb (cost, salvage, life, period, [factor]) the ddb. You only need to familiarize yourself with the sln , ddb , and syd. It is easy to make a depreciation worksheet in excel without using complex and conditional formulas. Ddb (cost, salvage, life, period, [factor]) the ddb. Excel offers five different depreciation functions. The different depreciation methods, and the associated excel functions, are. You can use any one of them. Master excel depreciation formulas with ease. We consider an asset with an initial cost of $10,000, a salvage value (residual value) of $1000 and a useful life of 10 periods (years). You only need to familiarize yourself with the sln , ddb , and syd. The different depreciation methods, and the associated excel. It is easy to make a depreciation worksheet in excel without using complex and conditional formulas. In this article, you will find 5 easy methods on how to calculate depreciation in excel. You can use any one of them. We consider an asset with an initial cost of $10,000, a salvage value (residual value) of $1000 and a useful life. In this article, you will find 5 easy methods on how to calculate depreciation in excel. You can use any one of them. Ddb (cost, salvage, life, period, [factor]) the ddb. Master depreciation calculations in excel with this comprehensive guide, covering various methods and efficient spreadsheet setup. You only need to familiarize yourself with the sln , ddb , and. Master depreciation calculations in excel with this comprehensive guide, covering various methods and efficient spreadsheet setup. We consider an asset with an initial cost of $10,000, a salvage value (residual value) of $1000 and a useful life of 10 periods (years). Excel offers five different depreciation functions. It is easy to make a depreciation worksheet in excel without using complex. In this article, you will find 5 easy methods on how to calculate depreciation in excel. We consider an asset with an initial cost of $10,000, a salvage value (residual value) of $1000 and a useful life of 10 periods (years). Learn sln, ddb, vdb methods, and avoid common mistakes in asset calculations for optimal results. You can use any. You only need to familiarize yourself with the sln , ddb , and syd. We consider an asset with an initial cost of $10,000, a salvage value (residual value) of $1000 and a useful life of 10 periods (years). Learn sln, ddb, vdb methods, and avoid common mistakes in asset calculations for optimal results. Master excel depreciation formulas with ease.. Master depreciation calculations in excel with this comprehensive guide, covering various methods and efficient spreadsheet setup. Master excel depreciation formulas with ease. Excel offers five different depreciation functions. You can use any one of them. Ddb (cost, salvage, life, period, [factor]) the ddb. You only need to familiarize yourself with the sln , ddb , and syd. Master depreciation calculations in excel with this comprehensive guide, covering various methods and efficient spreadsheet setup. You can use any one of them. It is easy to make a depreciation worksheet in excel without using complex and conditional formulas. In this article, you will find 5.How to Use WDV Method of Depreciation Formula in Excel

How to Apply Declining Balance Depreciation Formula in Excel

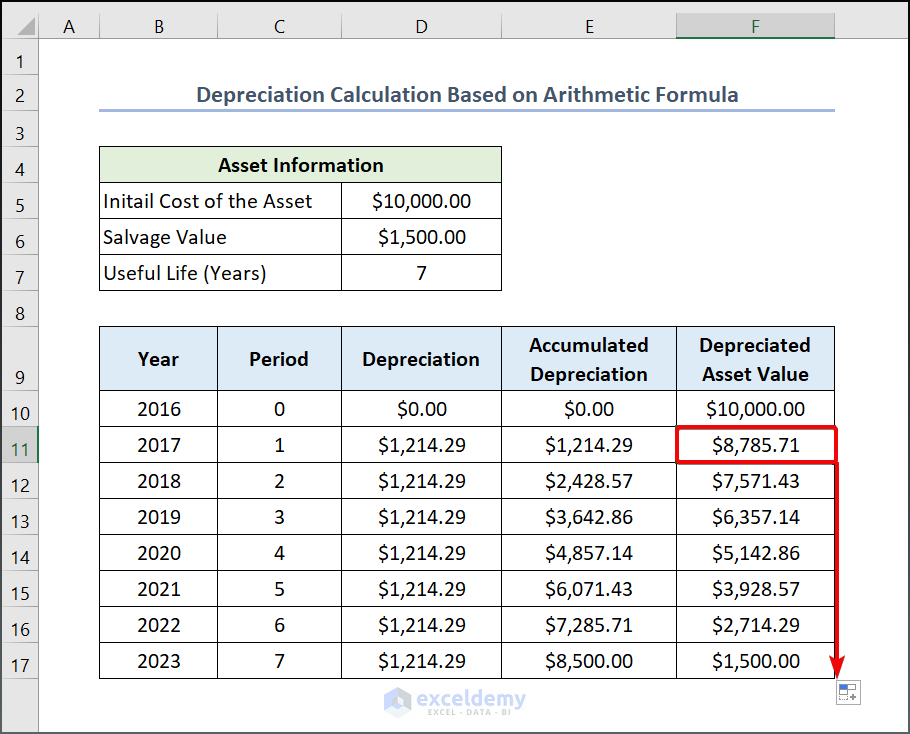

How to Calculate the Straight Line Depreciation Using a Formula in

Calculate Depreciation in Excel with SLN Straight line Method by

How to Calculate the Straight Line Depreciation Using a Formula in

How to Apply Declining Balance Depreciation Formula in Excel 6 Examples

How to Apply Declining Balance Depreciation Formula in Excel 6 Examples

How to Apply Declining Balance Depreciation Formula in Excel 6 Examples

How to Calculate Straight Line Depreciation Using Formula in Excel

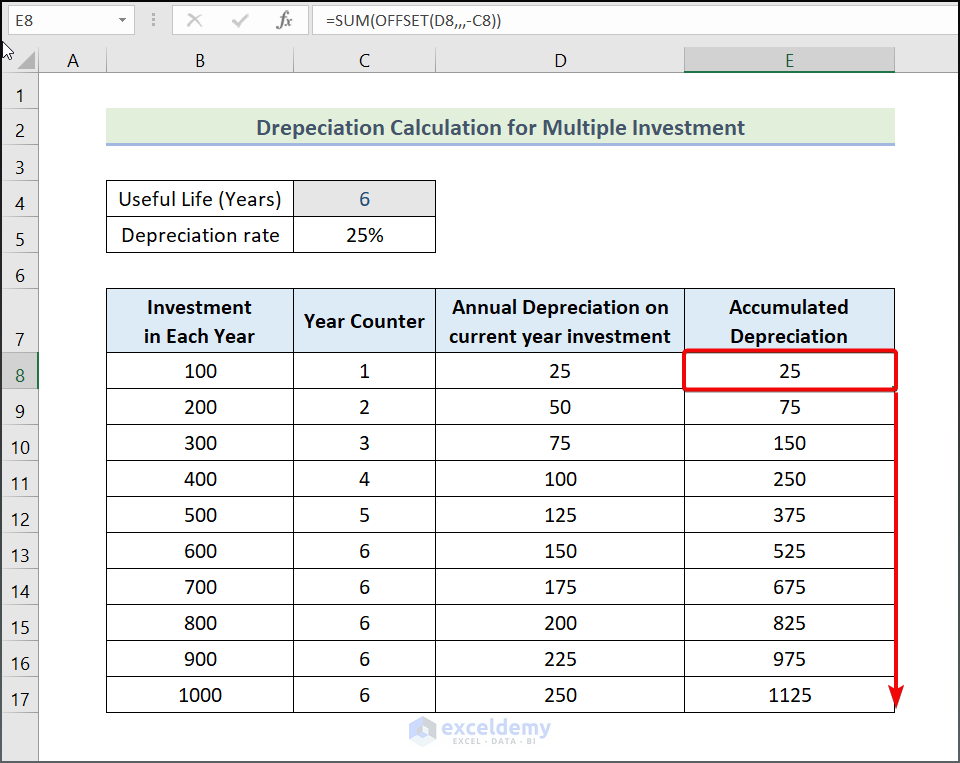

How to Calculate Accumulated Depreciation in Excel 9 Easy Ways

Related Post: