Dscr Calculator Excel

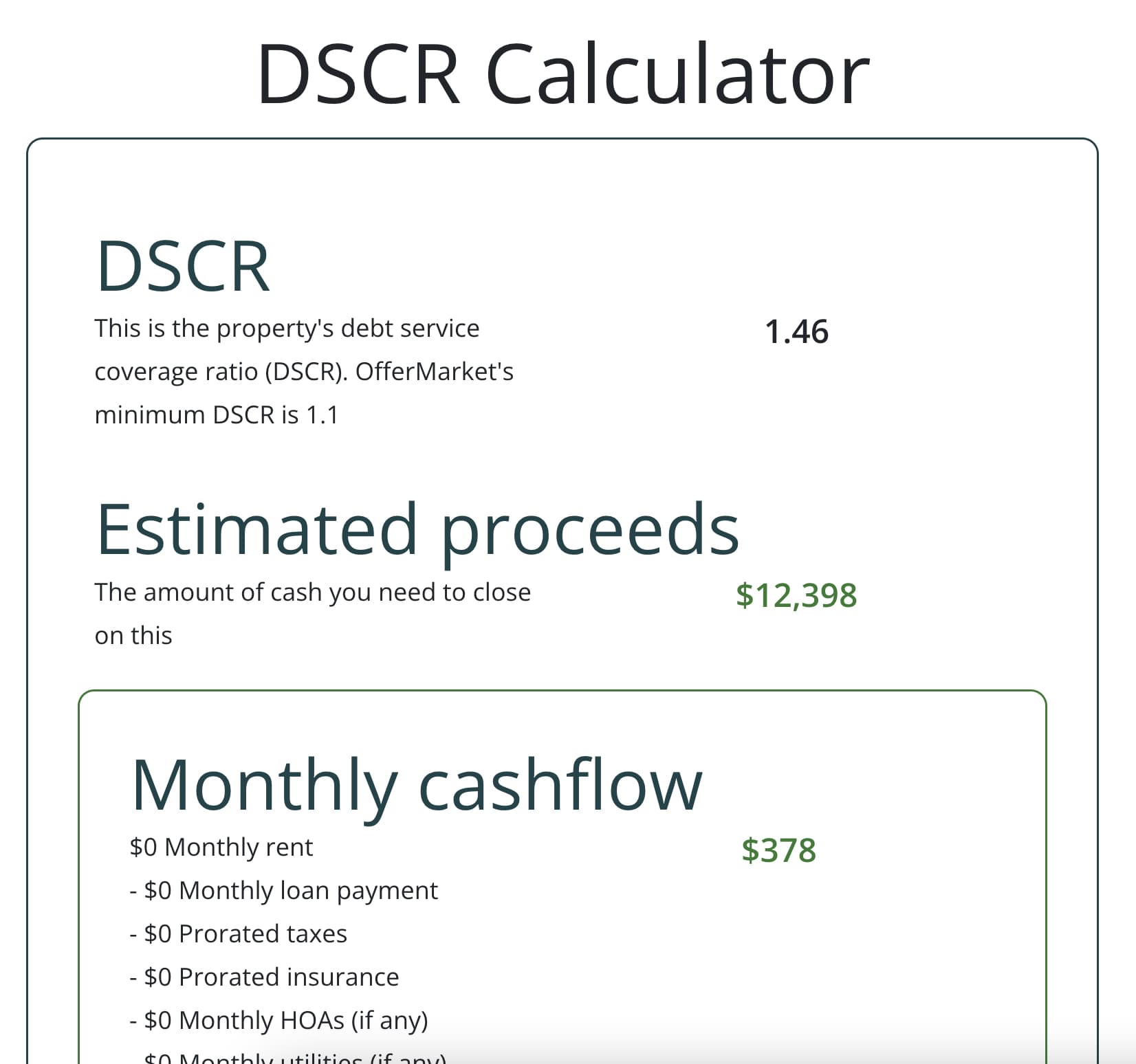

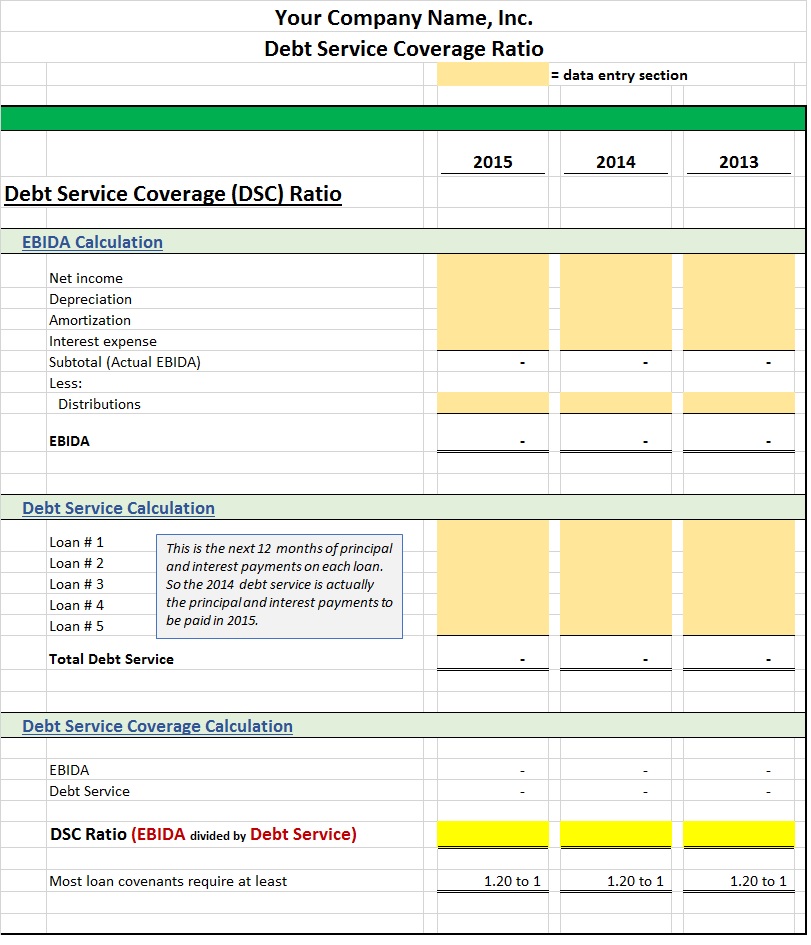

Dscr Calculator Excel - It is calculated as the ratio of net operating income to. In its simplest form, the ratio gauges the ability of a business to repay its. Understanding the debt service coverage ratio. The dscr (debt service coverage ratio) formula provides an intuitive understanding of the debt repayment capacity of the company. Keeping track of your dscr can. The debt service coverage ratio (dscr) is an important metric for small business owners that measures the company's ability to pay its debts. The debt service coverage ratio (dscr) is calculated by dividing the net operating income (noi) of an property by its annual debt service, which includes interest payments and. The dscr is widely used in commercial loan underwriting and is a key formula. It divides your net operating income (revenue minus operating expenses) by your total debt. Learn how to calculate and interpret dscr to assess financial health and make informed lending and investment decisions. The debt service coverage ratio (dscr) is calculated by dividing the net operating income (noi) of an property by its annual debt service, which includes interest payments and. The dscr (debt service coverage ratio) formula provides an intuitive understanding of the debt repayment capacity of the company. The dscr is widely used in commercial loan underwriting and is a key. Understanding the debt service coverage ratio. It divides your net operating income (revenue minus operating expenses) by your total debt. The dscr is widely used in commercial loan underwriting and is a key formula. It is calculated as the ratio of net operating income to. The debt service coverage ratio (dscr) is calculated by dividing the net operating income (noi). The dscr is widely used in commercial loan underwriting and is a key formula. The debt service coverage ratio (dscr) is calculated by dividing the net operating income (noi) of an property by its annual debt service, which includes interest payments and. Keeping track of your dscr can. The debt service coverage ratio (dscr) measures the ability of a borrower. The debt service coverage ratio (dscr) is an important metric for small business owners that measures the company's ability to pay its debts. It is calculated as the ratio of net operating income to. Learn how to calculate and interpret dscr to assess financial health and make informed lending and investment decisions. The dscr is widely used in commercial loan. The dscr (debt service coverage ratio) formula provides an intuitive understanding of the debt repayment capacity of the company. It divides your net operating income (revenue minus operating expenses) by your total debt. It is calculated as the ratio of net operating income to. The debt service coverage ratio (sometimes called dsc or dscr) is a credit metric used to. It is calculated as the ratio of net operating income to. The debt service coverage ratio (dscr) is an important metric for small business owners that measures the company's ability to pay its debts. Learn how to calculate and interpret dscr to assess financial health and make informed lending and investment decisions. The dscr (debt service coverage ratio) formula provides. The dscr (debt service coverage ratio) formula provides an intuitive understanding of the debt repayment capacity of the company. The debt service coverage ratio (dscr) is calculated by dividing the net operating income (noi) of an property by its annual debt service, which includes interest payments and. The dscr is widely used in commercial loan underwriting and is a key. In its simplest form, the ratio gauges the ability of a business to repay its. The debt service coverage ratio (dscr) is an important metric for small business owners that measures the company's ability to pay its debts. Understanding the debt service coverage ratio. The dscr is widely used in commercial loan underwriting and is a key formula. Learn how. The debt service coverage ratio (dscr) is an important metric for small business owners that measures the company's ability to pay its debts. The dscr is widely used in commercial loan underwriting and is a key formula. It divides your net operating income (revenue minus operating expenses) by your total debt. The debt service coverage ratio (dscr) is calculated by. The debt service coverage ratio (sometimes called dsc or dscr) is a credit metric used to understand how easily a company’s operating cash flow can cover its annual interest and. Learn how to calculate and interpret dscr to assess financial health and make informed lending and investment decisions. It is calculated as the ratio of net operating income to. The.Debt Service Coverage Ratio Calculator Free Template

Dscr Excel Template

Dscr Calculation In Excel Sheet Download Design Talk

Debt Service Coverage Ratio Formula in Excel ExcelDemy

Erik Frandsen on LinkedIn Excel DSCR Calculator.xlsx Excel 27

How to Calculate Debt Service Coverage Ratio (DSCR) in Excel

How to Calculate Debt Service Coverage Ratio (DSCR) in Excel

Dscr Calculation In Excel Sheet Download Design Talk

Debt Service Coverage Ratio Calculator Excel Template Free Download

Dscr Excel Template

Related Post:

:max_bytes(150000):strip_icc()/DSCR1-218052e5bc4240449f1479019381b358.jpg)

:max_bytes(150000):strip_icc()/DSCR-b224f0db64184eae800e27598a8bc2d7.png)