Discounting In Excel

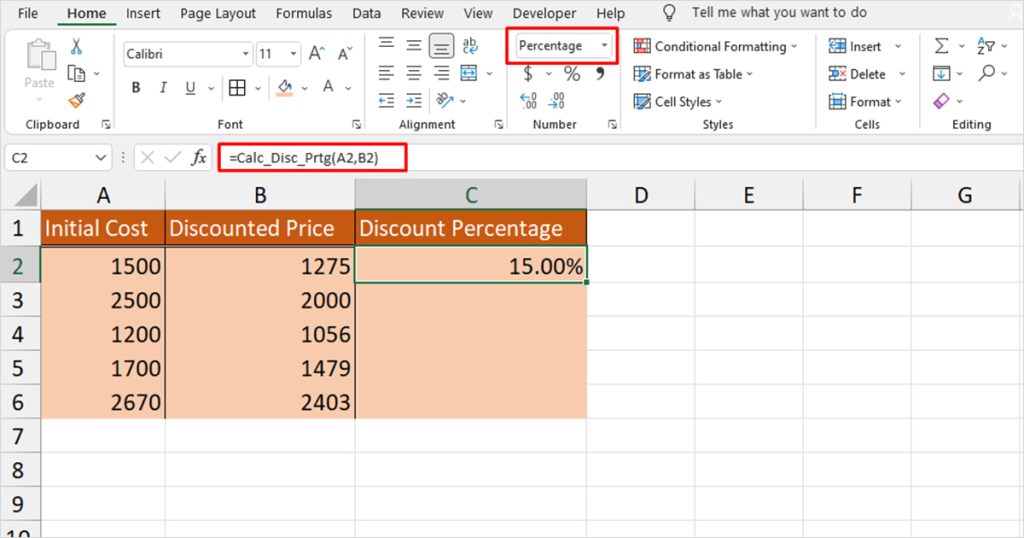

Discounting In Excel - The discounting formula is a financial calculation used to determine the present value of future cash flows. The future cash flow and the. Learn how discounting helps determine present value in finance, factoring in time value, formulas, and key influences on discount rates. Wharton’s john zhang says companies can correct negative perceptions of dynamic pricing by clearly communicating the value. Discounting is an economic concept that refers to the process of determining the present value of a payment or a stream of payments that will be received in the future. In finance, discounting is a mechanism in which a debtor obtains the right to delay payments to a creditor, for a defined period of time, in exchange for a charge or fee. It refers to the process of determining the present value of. Discounting is a critical concept in finance that helps determine the present value of future payments, reflecting the time value of money. In practice, it is accomplished by multiplying changes in future. This process reveals the current worth. Discounting refers to the act of estimating the present value of a future payment or a series of cash flows that are to be received in the future. Discounting allows for economically consistent comparisons of benefits and costs that occur in different time periods. It refers to the process of determining the present value of. This process reveals the current. It refers to the process of determining the present value of. Wharton’s john zhang says companies can correct negative perceptions of dynamic pricing by clearly communicating the value. Discounting principle, also known as present value analysis, is a key concept in managerial economics and finance. The future cash flow and the. In practice, it is accomplished by multiplying changes in. Discounting allows for economically consistent comparisons of benefits and costs that occur in different time periods. The discounting formula considers two main factors: In practice, it is accomplished by multiplying changes in future. Discounting principle, also known as present value analysis, is a key concept in managerial economics and finance. This process reveals the current worth. The discounting formula considers two main factors: Wharton’s john zhang says companies can correct negative perceptions of dynamic pricing by clearly communicating the value. Discounting allows for economically consistent comparisons of benefits and costs that occur in different time periods. A discount rate (also referred to as the. In finance, discounting is a mechanism in which a debtor obtains the. Discounting is a critical concept in finance that helps determine the present value of future payments, reflecting the time value of money. Wharton’s john zhang says companies can correct negative perceptions of dynamic pricing by clearly communicating the value. Discounting refers to the act of estimating the present value of a future payment or a series of cash flows that. Discounting is a critical concept in finance that helps determine the present value of future payments, reflecting the time value of money. Discounting principle, also known as present value analysis, is a key concept in managerial economics and finance. The discounting formula is a financial calculation used to determine the present value of future cash flows. Discounting is the financial. It refers to the process of determining the present value of. Discounting is a critical concept in finance that helps determine the present value of future payments, reflecting the time value of money. Discounting refers to the act of estimating the present value of a future payment or a series of cash flows that are to be received in the. In finance, discounting is a mechanism in which a debtor obtains the right to delay payments to a creditor, for a defined period of time, in exchange for a charge or fee. The discounting formula considers two main factors: It refers to the process of determining the present value of. Discounting is the financial process of determining the present value. The discounting formula is a financial calculation used to determine the present value of future cash flows. Discounting is an economic concept that refers to the process of determining the present value of a payment or a stream of payments that will be received in the future. Discounting allows for economically consistent comparisons of benefits and costs that occur in. Discounting refers to the act of estimating the present value of a future payment or a series of cash flows that are to be received in the future. Discounting allows for economically consistent comparisons of benefits and costs that occur in different time periods. The discounting formula considers two main factors: In practice, it is accomplished by multiplying changes in.How to Calculate Discount Percentage in Excel

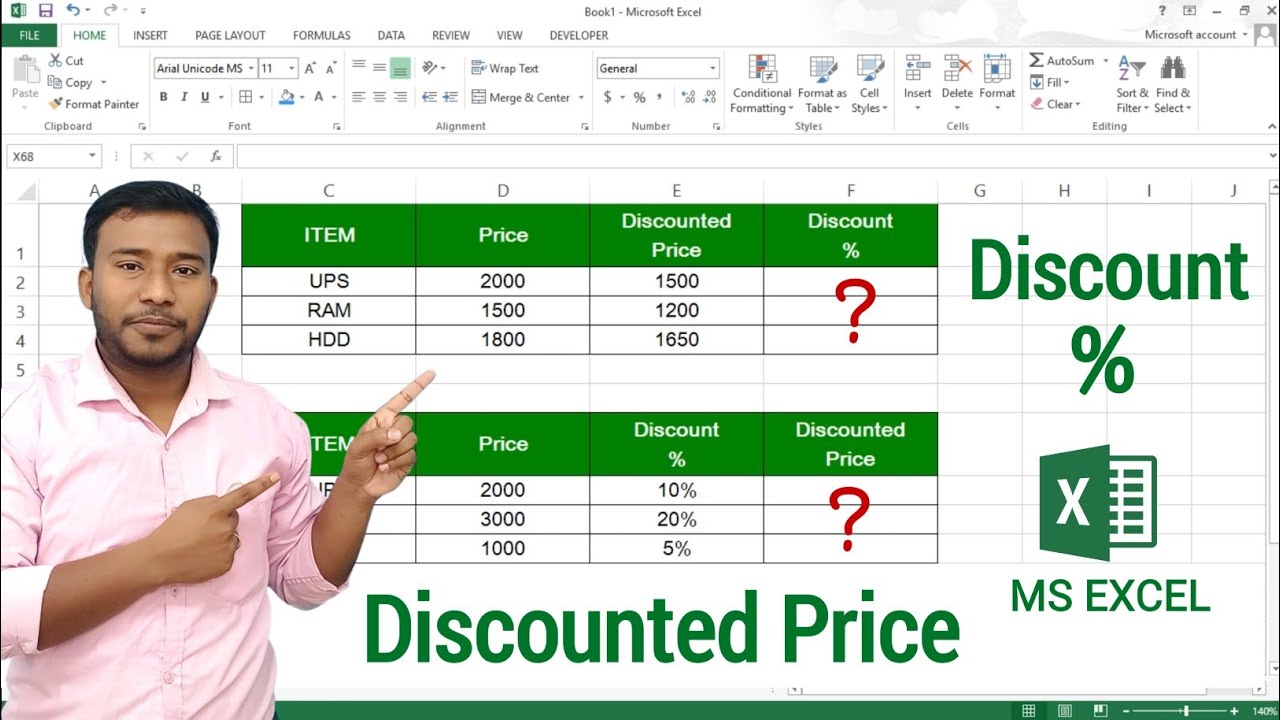

How to Calculate Discount Price in Excel (4 Quick Methods) ExcelDemy

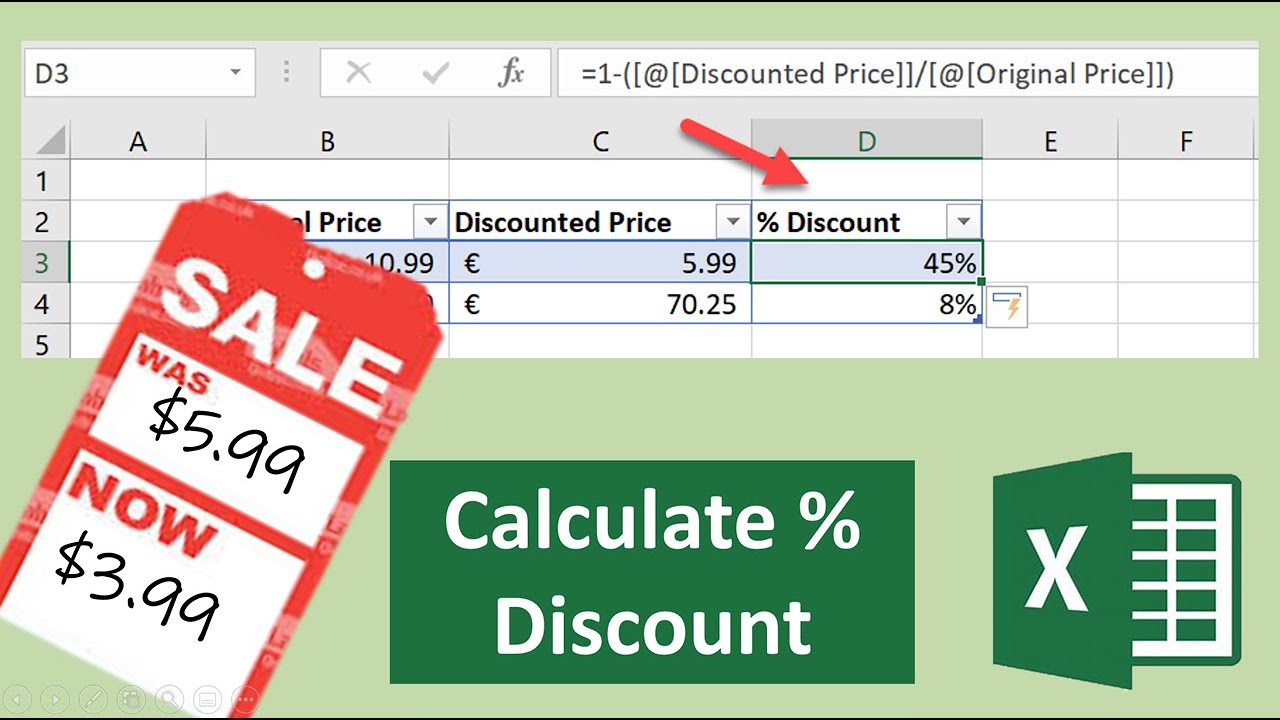

How to Calculate a Percentage Discount in Excel (Sale Price) YouTube

Discount Formula For Excel at Mitchell Cushing blog

How To Apply Discount to Price List for Different Customers in Excel

Discount in ms excel how to find discount in ms excel how to find

How to Calculate 10 Percent Discount in Excel (With Easy Steps)

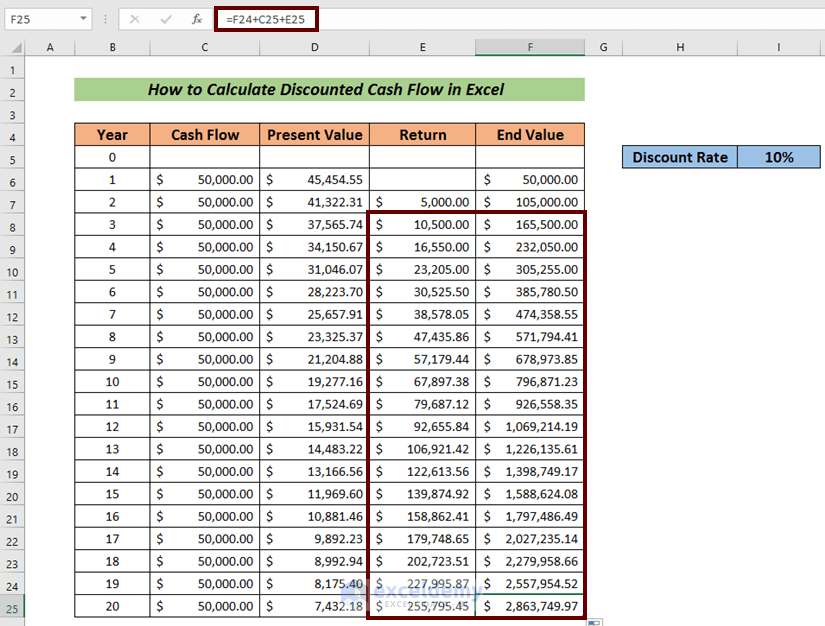

How to Calculate the Discounted Cash Flow in Excel 3 Easy Steps

Discount Formula For Excel at Mitchell Cushing blog

What Is A 50 10 Discount at Teresa Burks blog

Related Post: