Discounted Cash Flow Calculator Excel

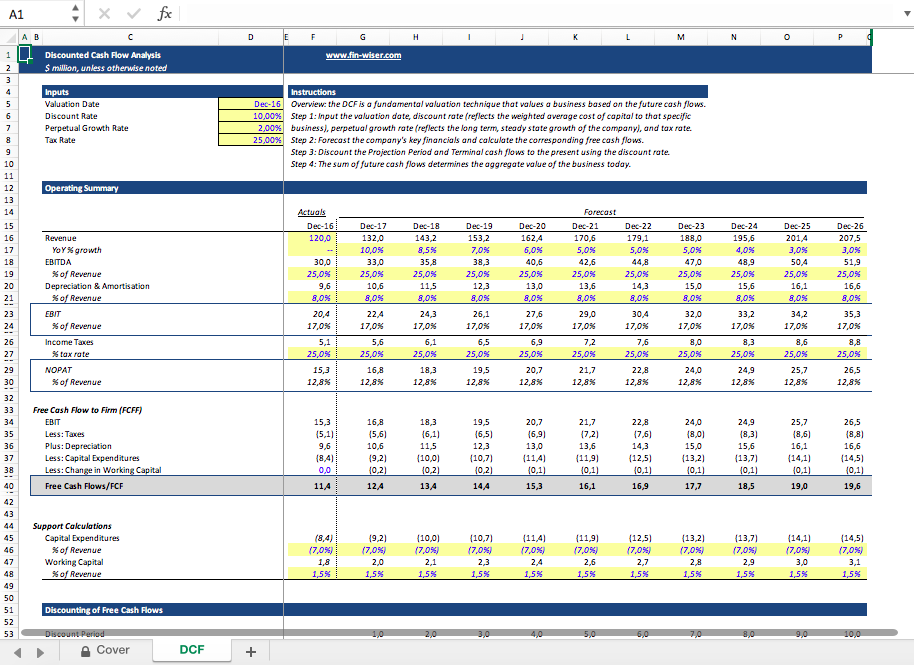

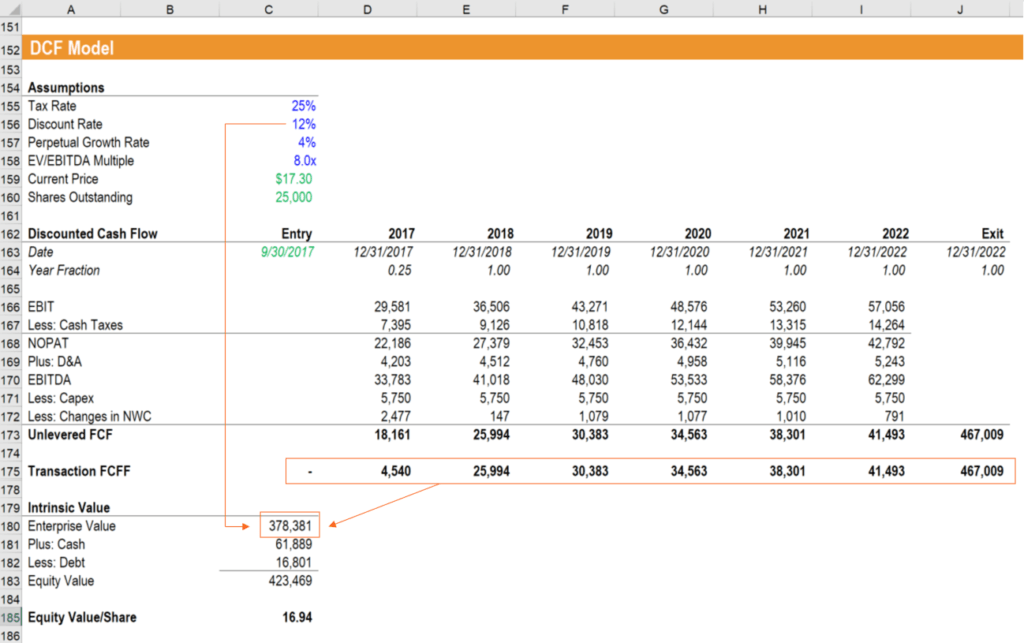

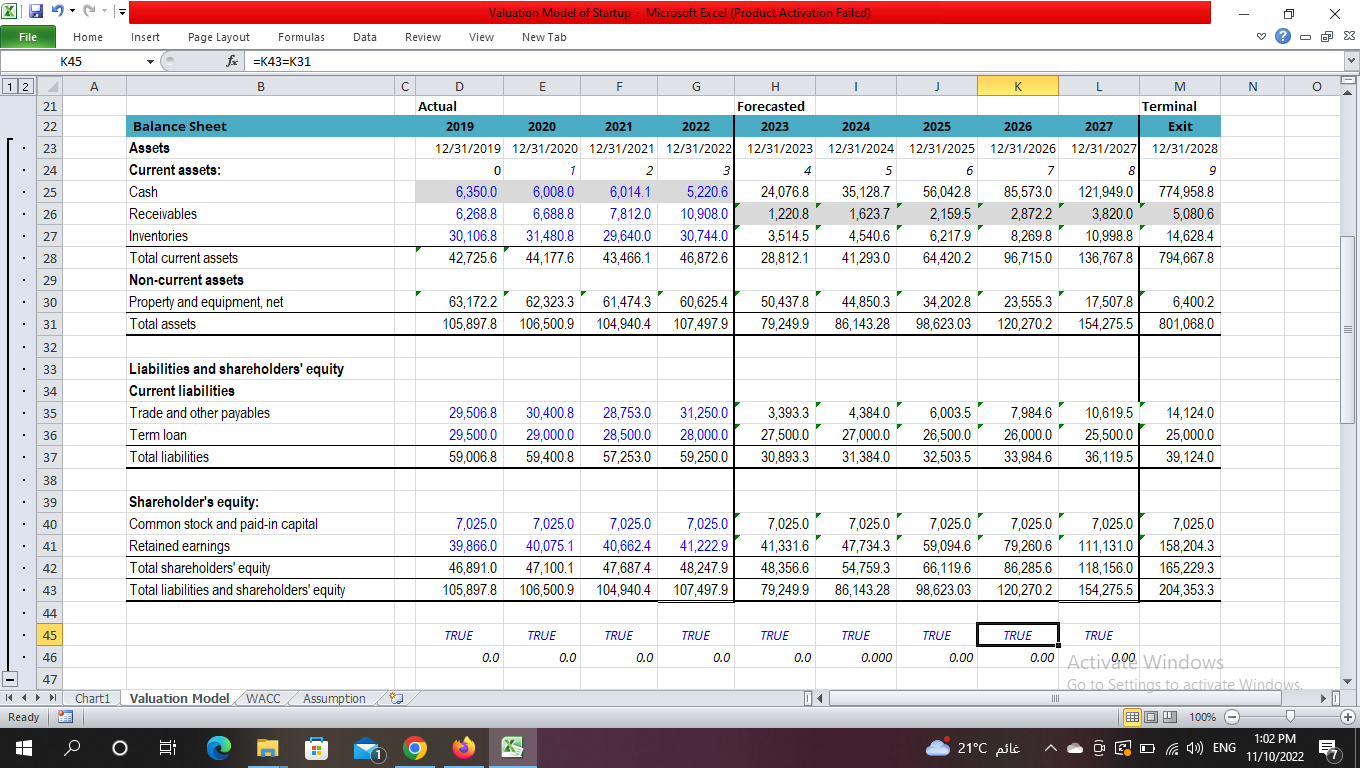

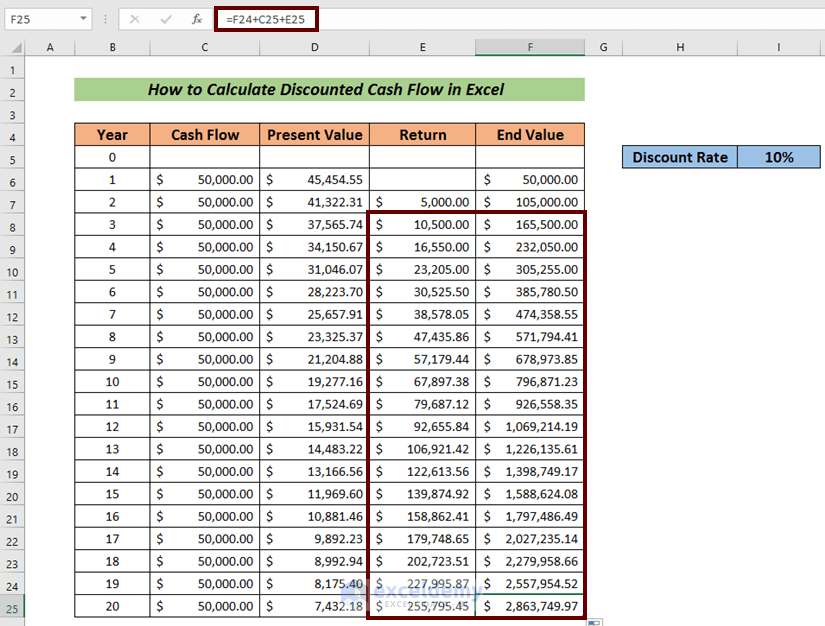

Discounted Cash Flow Calculator Excel - Master dcf valuation in excel. Excel’s a great place to do that and below i’ll show you how you can easily set up a template to calculate discounted cash flow that you can adjust for changes in the discount. Here is where you select the company you are looking to do the discount cash flow and enter your assumptions that will dictate the intrinsic value of the stock. As someone who regularly works with financial modeling, i find that the. There are two common approaches to calculating the cash flows that a business generates. Learn how to calculate discounted cash flow in excel using npv, yearly cash flows, and variable discount rates with simple, clear formulas. In a discounted cash flow model, the future cash flows are first estimated based on a cash flow growth rate and a discount rate and then, discounted to its current value at the discount rate. What is it and how to calculate it? Forecast and discount the operating cash flows. With expert tips and examples. Learn how to calculate discounted cash flow in excel using npv, yearly cash flows, and variable discount rates with simple, clear formulas. Learn the most important formulas, functions, and shortcuts to become confident in your financial analysis. In a discounted cash flow model, the future cash flows are first estimated based on a cash flow growth rate and a discount. Forecast and discount the operating cash flows. Learn how to calculate discounted cash flow in excel using npv, yearly cash flows, and variable discount rates with simple, clear formulas. Get insights into the discounted cash flow (dcf) model excel technique. Excel’s a great place to do that and below i’ll show you how you can easily set up a template. In a discounted cash flow model, the future cash flows are first estimated based on a cash flow growth rate and a discount rate and then, discounted to its current value at the discount rate. Learn the most important formulas, functions, and shortcuts to become confident in your financial analysis. Excel’s a great place to do that and below i’ll. Learn how to calculate discounted cash flow in excel using npv, yearly cash flows, and variable discount rates with simple, clear formulas. Here is where you select the company you are looking to do the discount cash flow and enter your assumptions that will dictate the intrinsic value of the stock. Learn the most important formulas, functions, and shortcuts to. Then, when you have a present. As someone who regularly works with financial modeling, i find that the. Forecast and discount the operating cash flows. Excel’s a great place to do that and below i’ll show you how you can easily set up a template to calculate discounted cash flow that you can adjust for changes in the discount. There. Forecast and discount the operating cash flows. Excel’s a great place to do that and below i’ll show you how you can easily set up a template to calculate discounted cash flow that you can adjust for changes in the discount. In a discounted cash flow model, the future cash flows are first estimated based on a cash flow growth. As someone who regularly works with financial modeling, i find that the. In a discounted cash flow model, the future cash flows are first estimated based on a cash flow growth rate and a discount rate and then, discounted to its current value at the discount rate. Master dcf valuation in excel. There are two common approaches to calculating the. Master dcf valuation in excel. Learn how to calculate discounted cash flow in excel using npv, yearly cash flows, and variable discount rates with simple, clear formulas. Learn the most important formulas, functions, and shortcuts to become confident in your financial analysis. Launch cfi’s excel crash course now to take your career to the next level and. Here is where. In a discounted cash flow model, the future cash flows are first estimated based on a cash flow growth rate and a discount rate and then, discounted to its current value at the discount rate. Then, when you have a present. Learn how to calculate discounted cash flow in excel using npv, yearly cash flows, and variable discount rates with. Launch cfi’s excel crash course now to take your career to the next level and. There are two common approaches to calculating the cash flows that a business generates. With expert tips and examples. Then, when you have a present. Forecast and discount the operating cash flows.How to do DCF Valuation SIMPLIFIED in 4 Steps DOWNLOAD Discounted

Discounted Cash Flow Excel Template Free, The purpose of the discounted

Discounted Cash Flow Template Free Excel Download

Discounted Cash Flow Excel Template Free DCF Valuation Model in Excel

Discounted Cash Flow (DCF) Model Free Excel Template, 51 OFF

Discounted Cash Flow DCF Formula Calculate NPV CFI

Discounted Cash Flow (DCF) Valuation Model by Excel for a Small

Navigate Your Success How to Calculate a DCF in Excel

Discounted Cash Flow Model in Excel Solving Finance

How to Calculate the Discounted Cash Flow in Excel 3 Easy Steps

Related Post: