Depreciation Schedule Excel Format

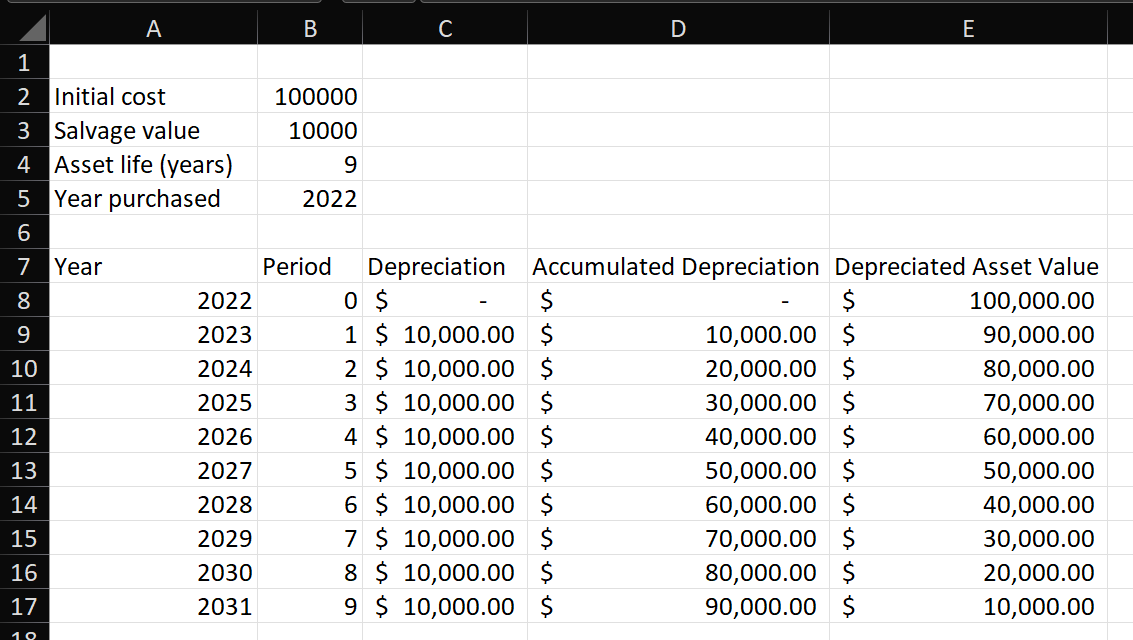

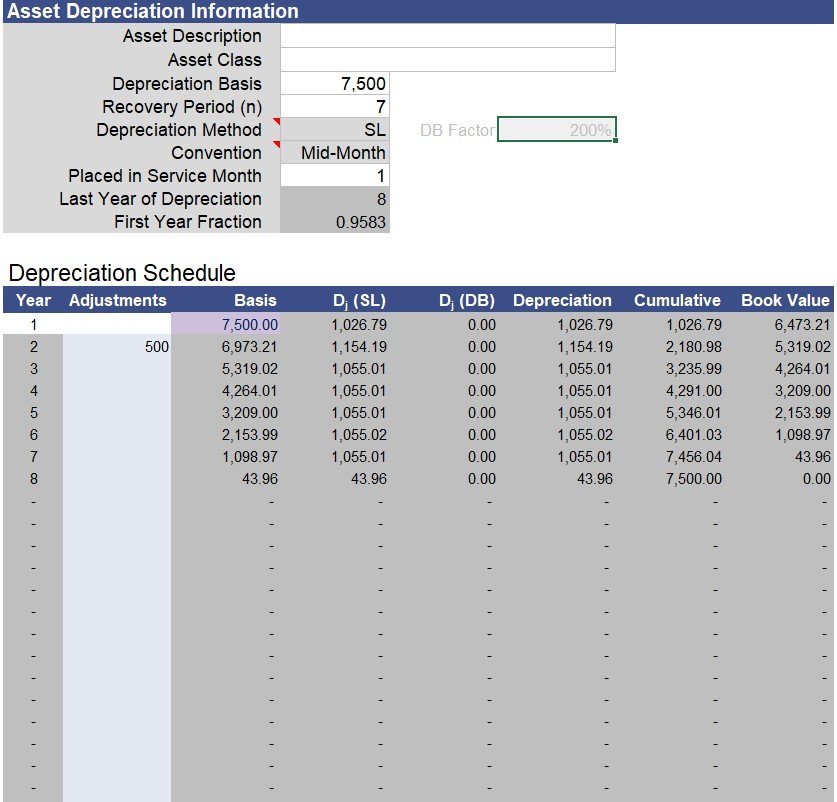

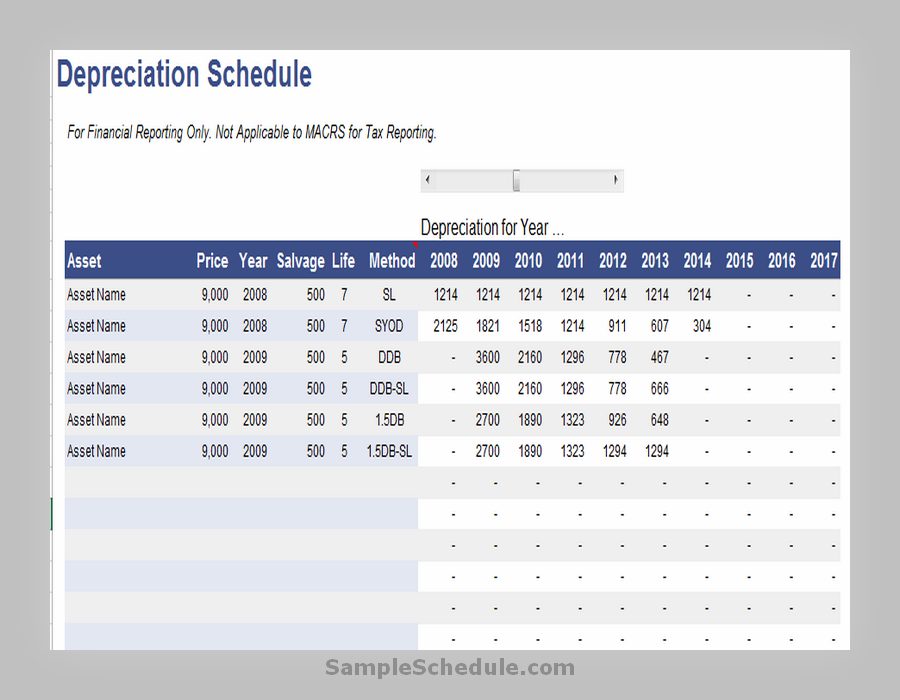

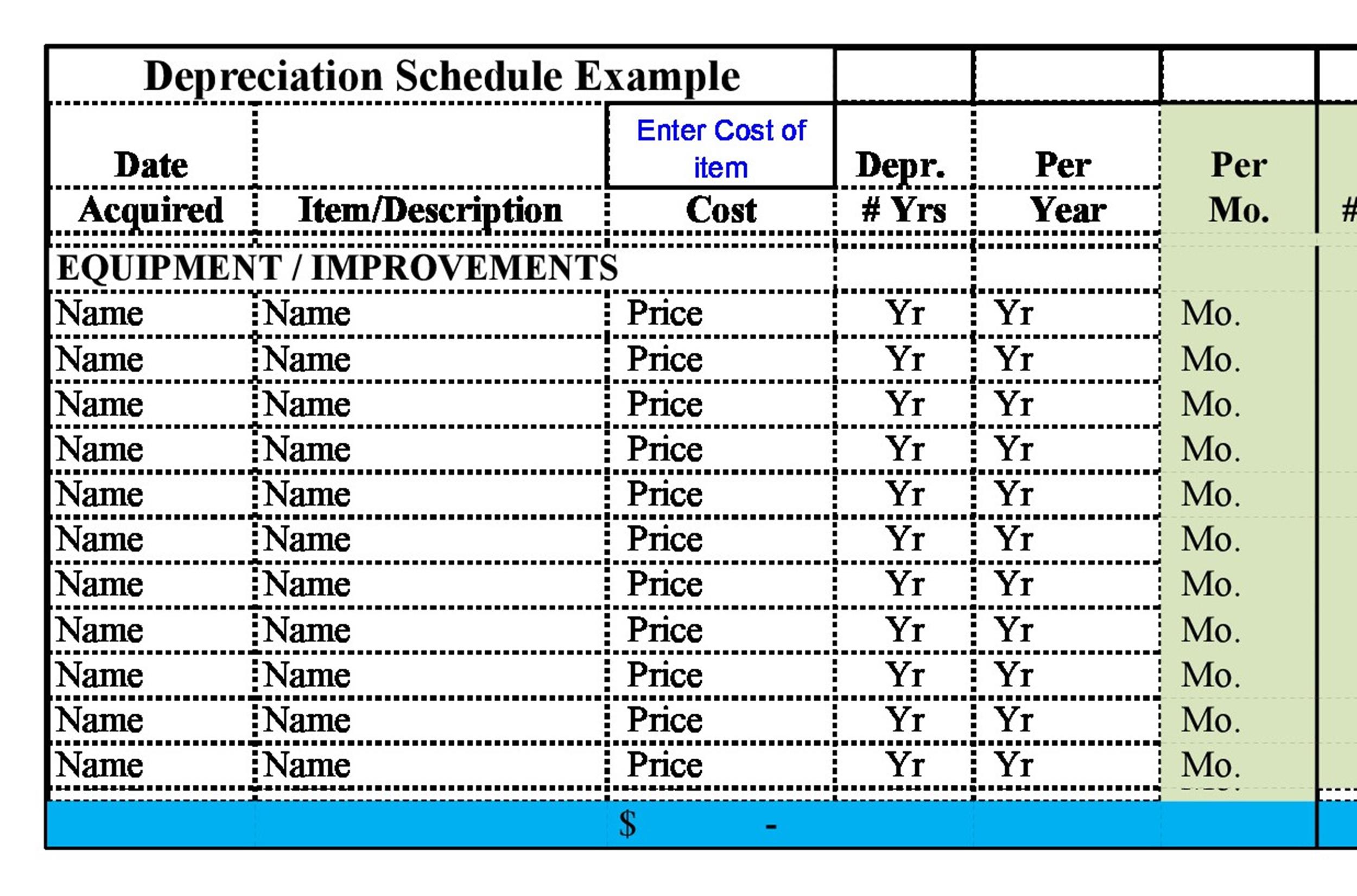

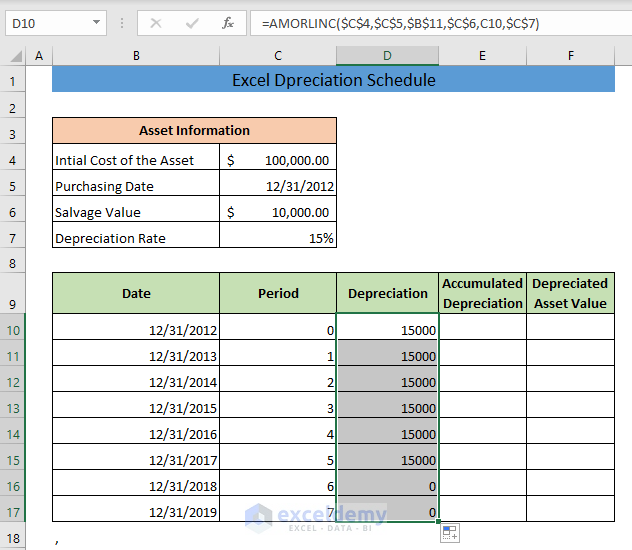

Depreciation Schedule Excel Format - Depreciation is associated with buildings, equipment, vehicles, and other physical assets which will last for more than a year but will not last forever. What is depreciation and how is it calculated? Below is the summary of all four depreciation methods from the examples above. Depreciation is necessary for measuring. This tutorial explains what depreciation is and provides many examples The cost of the asset should be deducted over. Depreciation is an accounting method that spreads the cost of an asset over its expected useful life to give you a more accurate view of its value and your business’s profitability. Depreciation in accounting and bookkeeping is the process of allocating the cost of a fixed asset over the useful life of the asset. Learn how depreciation impacts financial reporting and taxes, and discover strategies to maximize tax savings for your business by optimizing asset depreciation methods. Depreciation is a planned, gradual reduction in the recorded value of an asset over its useful life by charging it to expense, usually over multiple years. Depreciation is associated with buildings, equipment, vehicles, and other physical assets which will last for more than a year but will not last forever. Here is a graph showing the book value of an asset over time with each different method. What is depreciation and how is it calculated? Depreciation is an accounting method that spreads the cost of an. Depreciation is thus the decrease in the value of assets and the method used to reallocate, or write down the cost of a tangible asset (such as equipment) over its useful life span. This tutorial explains what depreciation is and provides many examples What is depreciation and how is it calculated? Depreciation in accounting and bookkeeping is the process of. Depreciation is associated with buildings, equipment, vehicles, and other physical assets which will last for more than a year but will not last forever. Depreciation is an accounting method that spreads the cost of an asset over its expected useful life to give you a more accurate view of its value and your business’s profitability. Depreciation in accounting and bookkeeping. Depreciation is necessary for measuring. This tutorial explains what depreciation is and provides many examples Depreciation is thus the decrease in the value of assets and the method used to reallocate, or write down the cost of a tangible asset (such as equipment) over its useful life span. The cost of the asset should be deducted over. Learn how depreciation. Depreciation is necessary for measuring. This tutorial explains what depreciation is and provides many examples Depreciation is a planned, gradual reduction in the recorded value of an asset over its useful life by charging it to expense, usually over multiple years. Here is a graph showing the book value of an asset over time with each different method. Learn how. The cost of the asset should be deducted over. Below is the summary of all four depreciation methods from the examples above. Depreciation is an accounting method that spreads the cost of an asset over its expected useful life to give you a more accurate view of its value and your business’s profitability. Depreciation is necessary for measuring. Depreciation is. What is depreciation and how is it calculated? Depreciation in accounting and bookkeeping is the process of allocating the cost of a fixed asset over the useful life of the asset. Depreciation is necessary for measuring. Here is a graph showing the book value of an asset over time with each different method. Below is the summary of all four. Depreciation is necessary for measuring. Depreciation is associated with buildings, equipment, vehicles, and other physical assets which will last for more than a year but will not last forever. Learn how depreciation impacts financial reporting and taxes, and discover strategies to maximize tax savings for your business by optimizing asset depreciation methods. Depreciation is thus the decrease in the value. This tutorial explains what depreciation is and provides many examples Depreciation is an accounting method that allocates the cost of a tangible asset over its useful life to reflect its decreasing value through use and obsolescence. Below is the summary of all four depreciation methods from the examples above. Learn how depreciation impacts financial reporting and taxes, and discover strategies. The cost of the asset should be deducted over. Depreciation is associated with buildings, equipment, vehicles, and other physical assets which will last for more than a year but will not last forever. Depreciation is thus the decrease in the value of assets and the method used to reallocate, or write down the cost of a tangible asset (such as.Depreciation Schedule Excel Template

Depreciation Schedule Excel Format Printable Art and Words

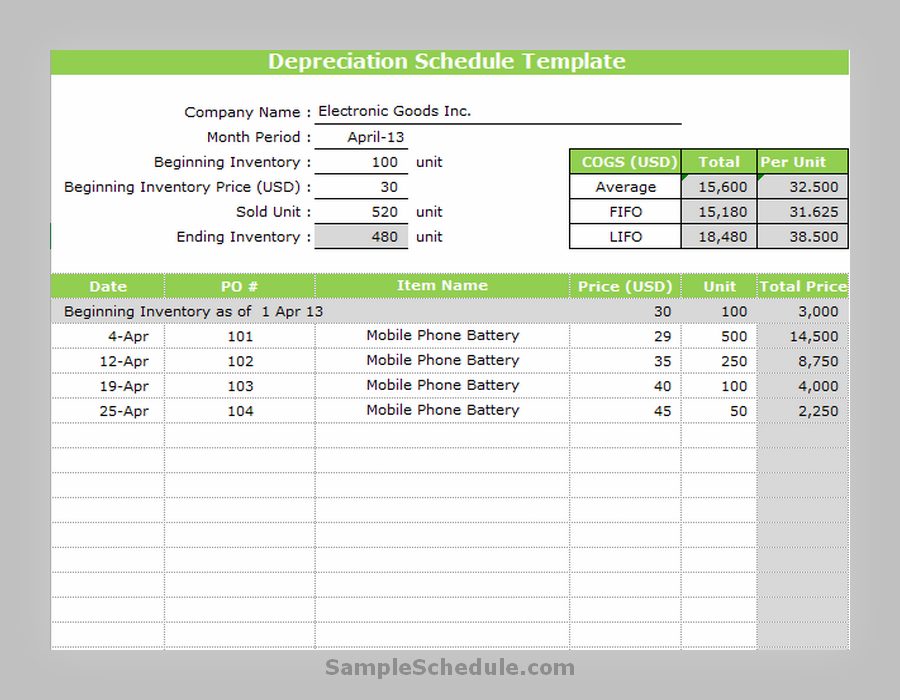

25+ Depreciation Schedule Template Excel Free to Use sample schedule

Free Printable Depreciation Schedule Templates (Excel / PDF) Excel TMP

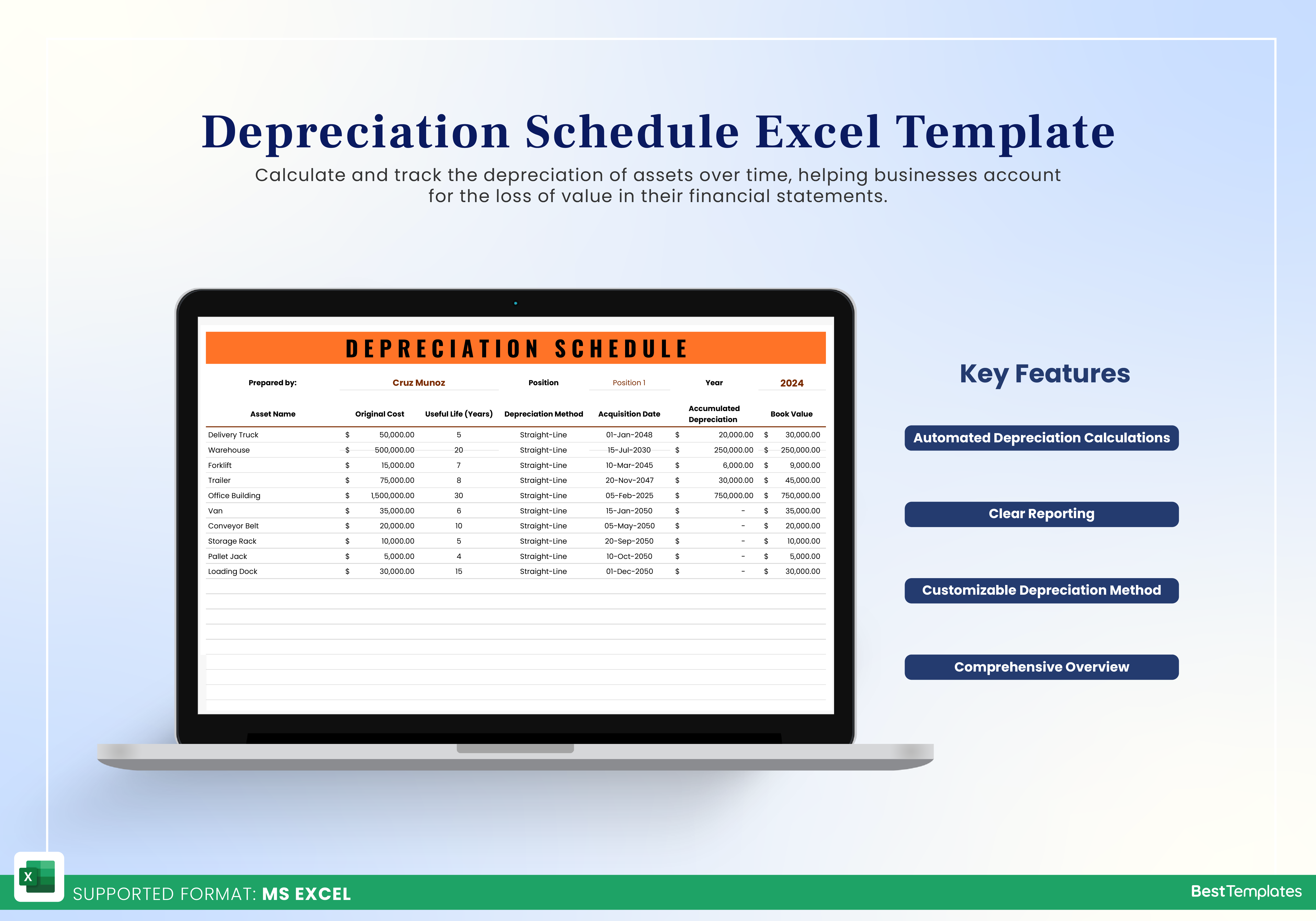

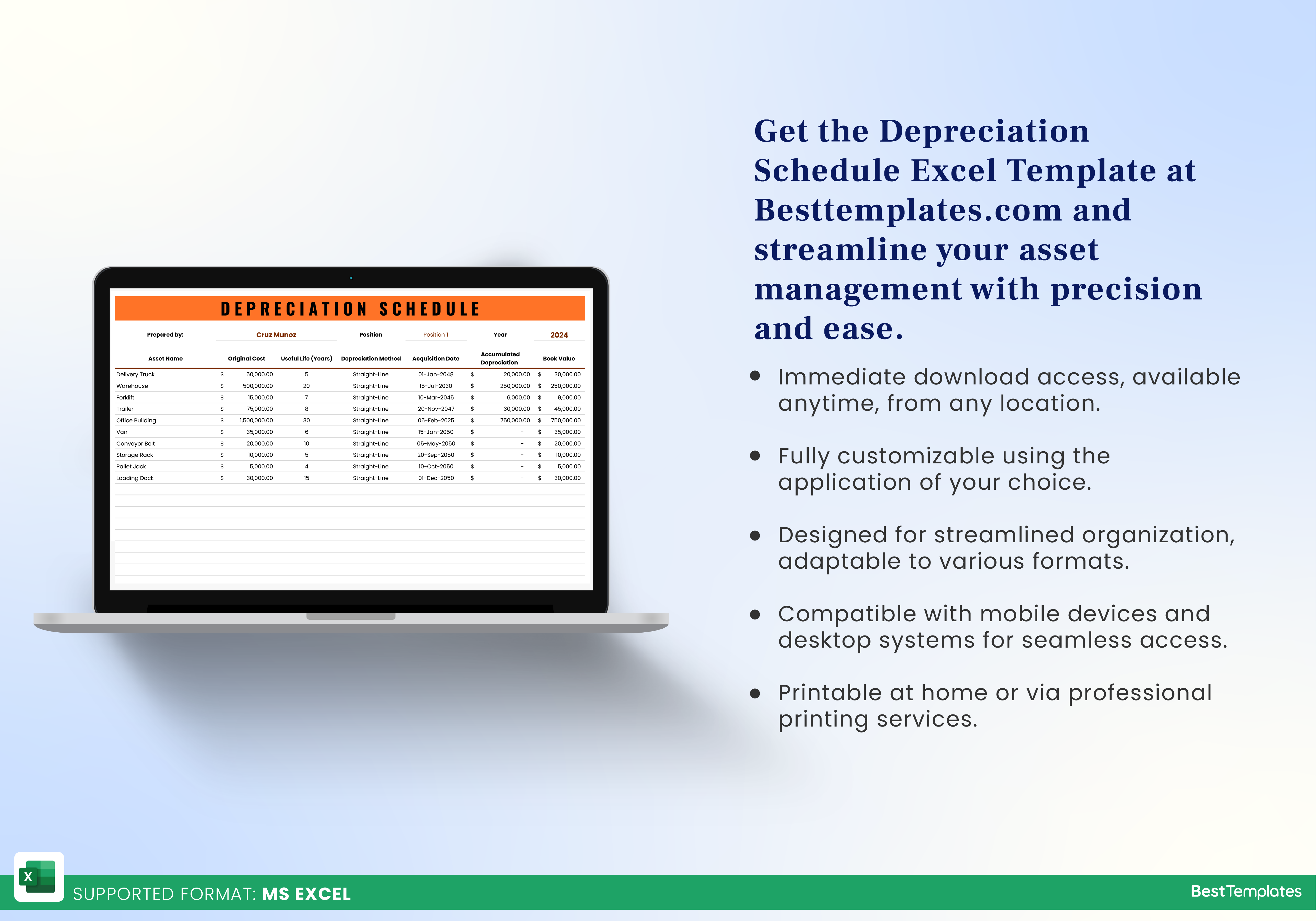

Depreciation Schedule Excel Template Best Templates

25+ Depreciation Schedule Template Excel Free to Use sample schedule

Depreciation Schedule Excel Template

Depreciation Schedule Excel Template Best Templates

Depreciation Schedule Excel Format Printable Art and Words

Depreciation Schedule Excel Template

Related Post: