Depreciation Calculator Excel

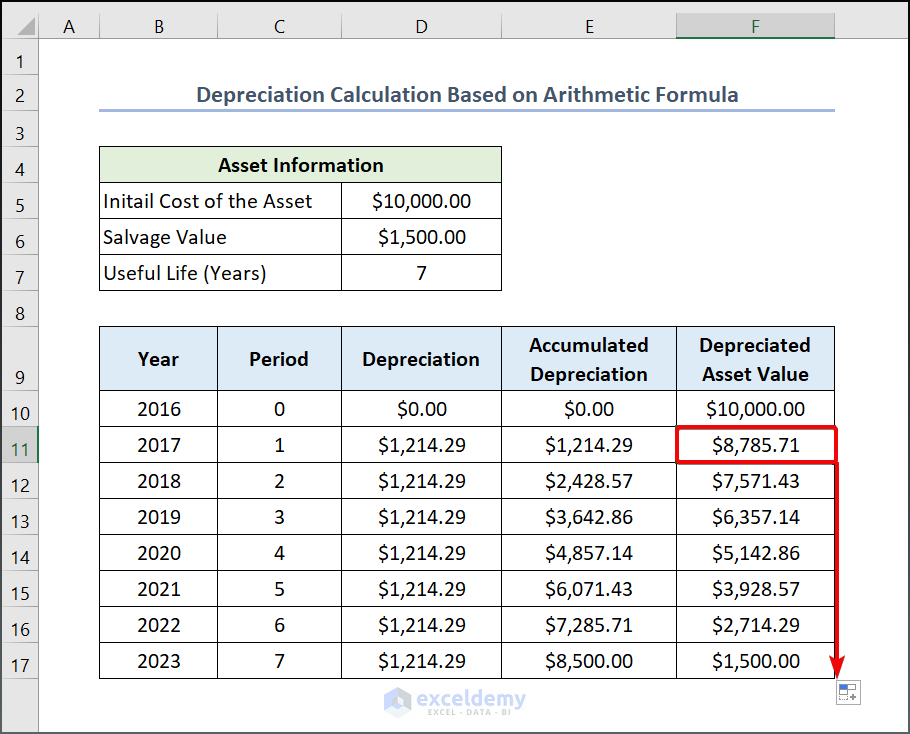

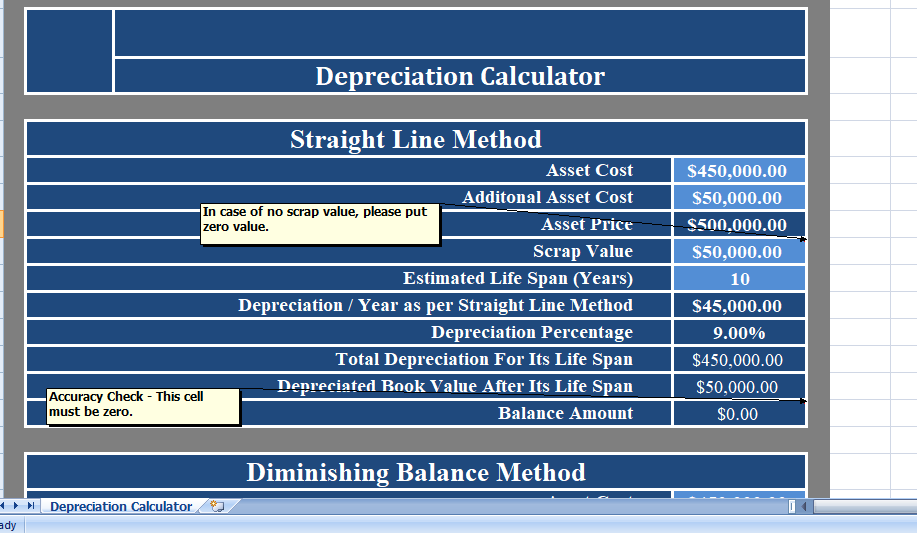

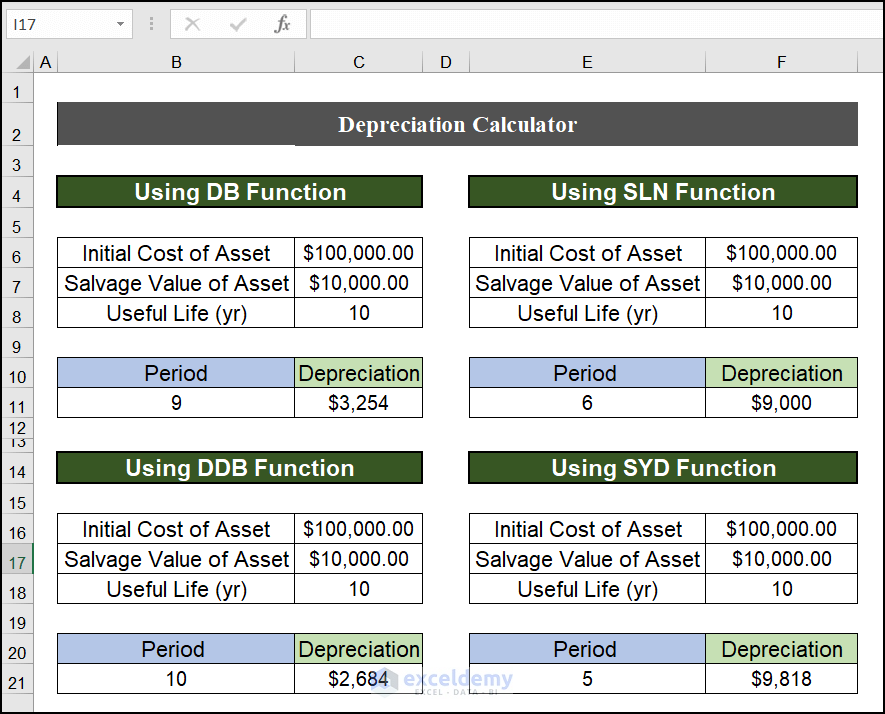

Depreciation Calculator Excel - Depreciation is thus the decrease in the value of assets and the method used to reallocate, or write down the cost of a tangible asset (such as equipment) over its useful life span. What is depreciation and how is it calculated? Depreciation is a planned, gradual reduction in the recorded value of an asset over its useful life by charging it to expense, usually over multiple years. Depreciation is necessary for measuring. The cost of the asset should be deducted over. Depreciation is an accounting method that spreads the cost of an asset over its expected useful life to give you a more accurate view of its value and your business’s profitability. Below is the summary of all four depreciation methods from the examples above. This tutorial explains what depreciation is and provides many examples Learn how depreciation impacts financial reporting and taxes, and discover strategies to maximize tax savings for your business by optimizing asset depreciation methods. Here is a graph showing the book value of an asset over time with each different method. Depreciation is an accounting method that spreads the cost of an asset over its expected useful life to give you a more accurate view of its value and your business’s profitability. The cost of the asset should be deducted over. Here is a graph showing the book value of an asset over time with each different method. This tutorial explains. Depreciation is necessary for measuring. Depreciation is a planned, gradual reduction in the recorded value of an asset over its useful life by charging it to expense, usually over multiple years. Here is a graph showing the book value of an asset over time with each different method. This tutorial explains what depreciation is and provides many examples The cost. The cost of the asset should be deducted over. Depreciation in accounting and bookkeeping is the process of allocating the cost of a fixed asset over the useful life of the asset. This tutorial explains what depreciation is and provides many examples Depreciation is a planned, gradual reduction in the recorded value of an asset over its useful life by. The cost of the asset should be deducted over. Depreciation is necessary for measuring. Depreciation is an accounting method that allocates the cost of a tangible asset over its useful life to reflect its decreasing value through use and obsolescence. What is depreciation and how is it calculated? Depreciation is thus the decrease in the value of assets and the. Depreciation is associated with buildings, equipment, vehicles, and other physical assets which will last for more than a year but will not last forever. Here is a graph showing the book value of an asset over time with each different method. This tutorial explains what depreciation is and provides many examples Depreciation in accounting and bookkeeping is the process of. Learn how depreciation impacts financial reporting and taxes, and discover strategies to maximize tax savings for your business by optimizing asset depreciation methods. This tutorial explains what depreciation is and provides many examples Depreciation in accounting and bookkeeping is the process of allocating the cost of a fixed asset over the useful life of the asset. Depreciation is thus the. Below is the summary of all four depreciation methods from the examples above. Depreciation is necessary for measuring. Here is a graph showing the book value of an asset over time with each different method. Depreciation in accounting and bookkeeping is the process of allocating the cost of a fixed asset over the useful life of the asset. Depreciation is. The cost of the asset should be deducted over. What is depreciation and how is it calculated? Depreciation in accounting and bookkeeping is the process of allocating the cost of a fixed asset over the useful life of the asset. Depreciation is associated with buildings, equipment, vehicles, and other physical assets which will last for more than a year but. Depreciation is necessary for measuring. Depreciation is an accounting method that allocates the cost of a tangible asset over its useful life to reflect its decreasing value through use and obsolescence. This tutorial explains what depreciation is and provides many examples Depreciation is an accounting method that spreads the cost of an asset over its expected useful life to give. What is depreciation and how is it calculated? The cost of the asset should be deducted over. Depreciation is associated with buildings, equipment, vehicles, and other physical assets which will last for more than a year but will not last forever. Depreciation is an accounting method that allocates the cost of a tangible asset over its useful life to reflect.Calculate Depreciation in Excel with SLN Straight line Method by

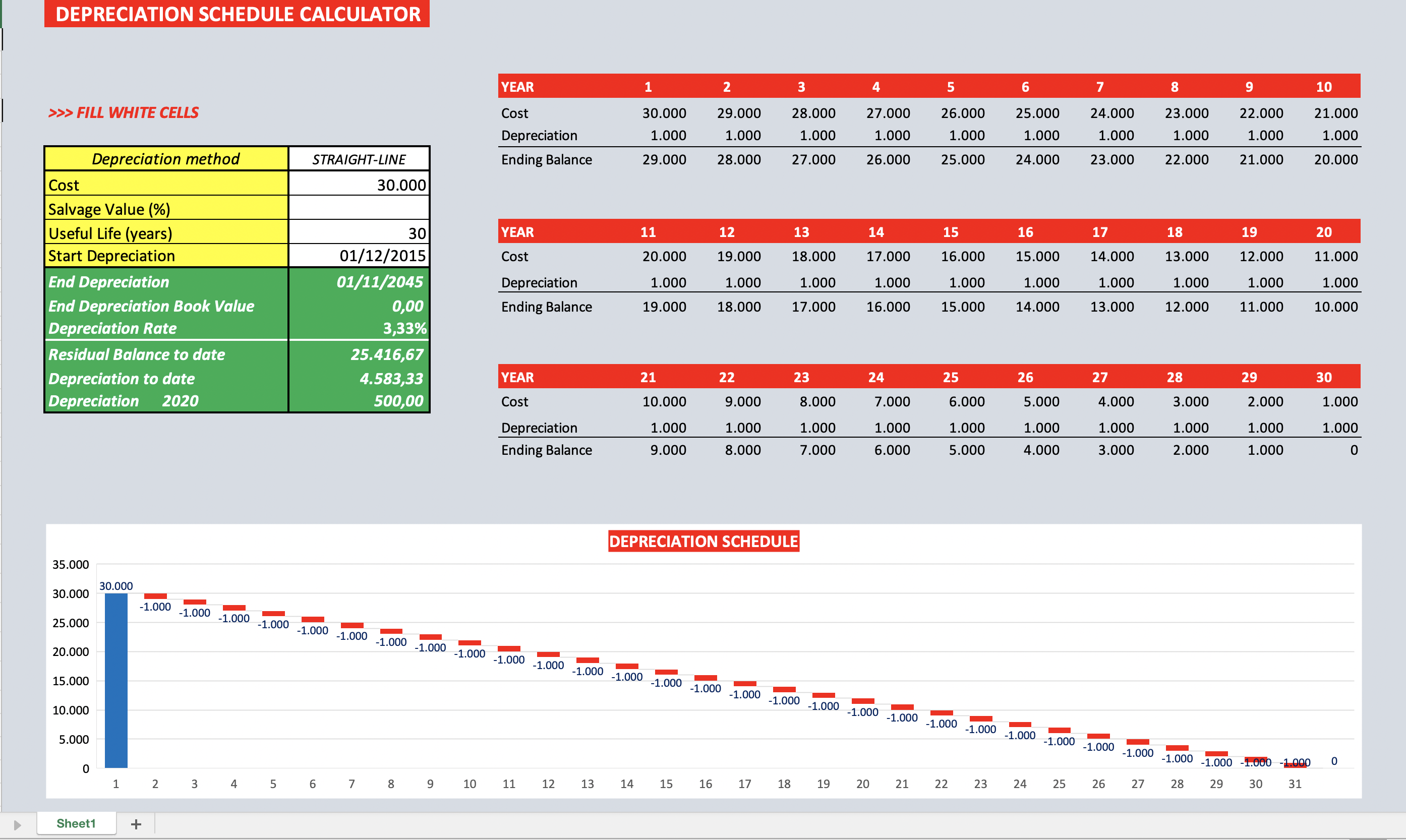

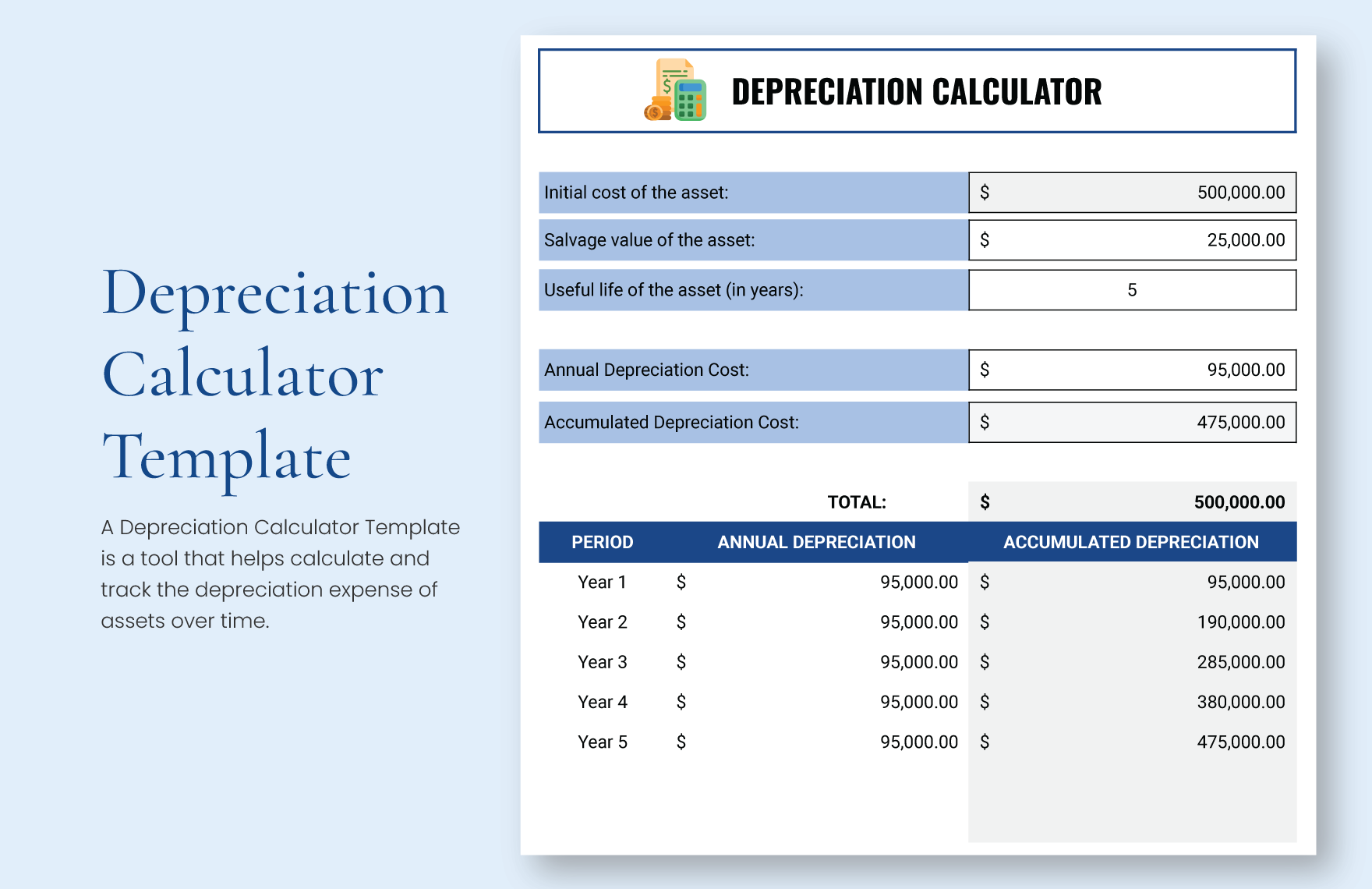

Excel Depreciation Template Accounting Depreciation Calculation Model

Excel Depreciation Template Accounting Depreciation Calculation Model

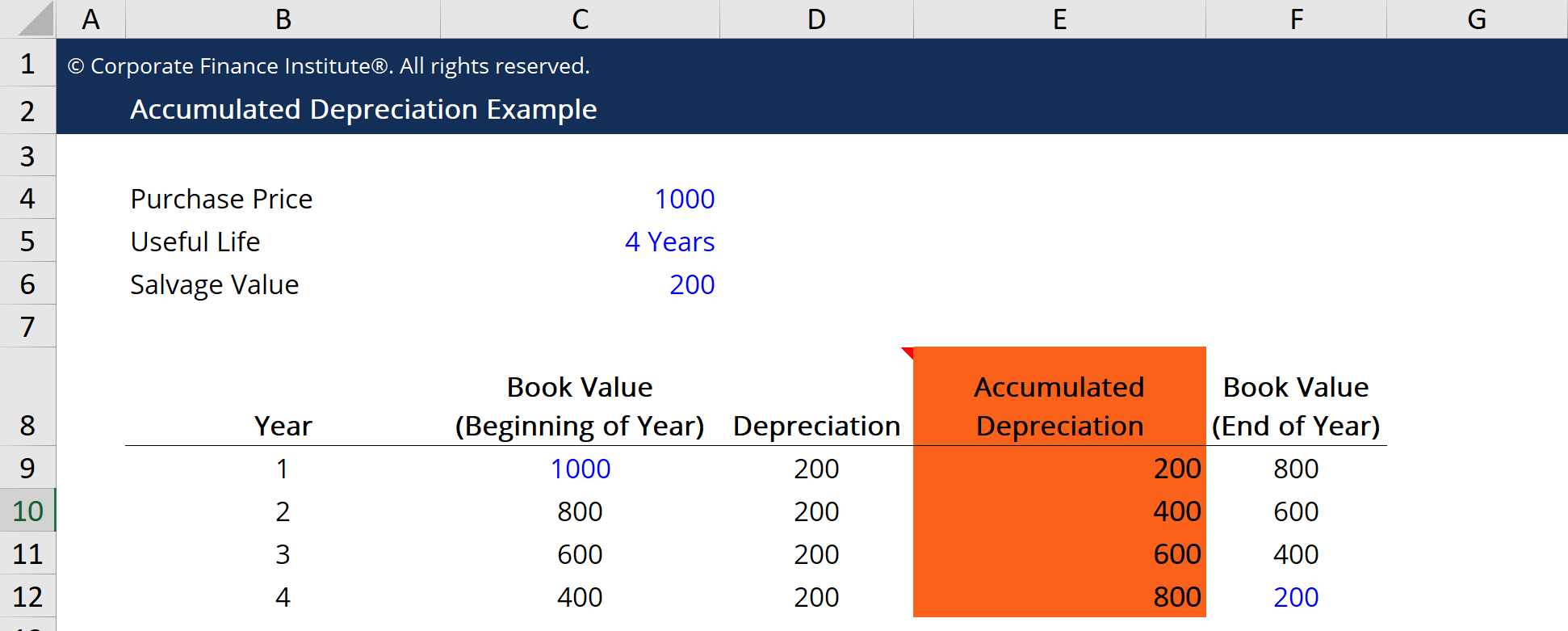

How to Calculate Accumulated Depreciation in Excel 9 Easy Ways

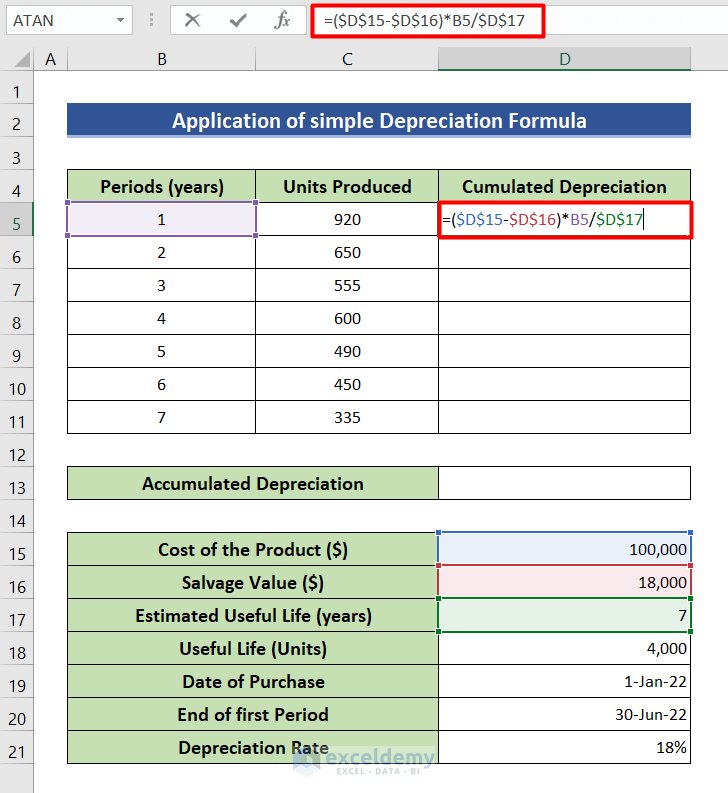

How to Calculate the Straight Line Depreciation Using a Formula in

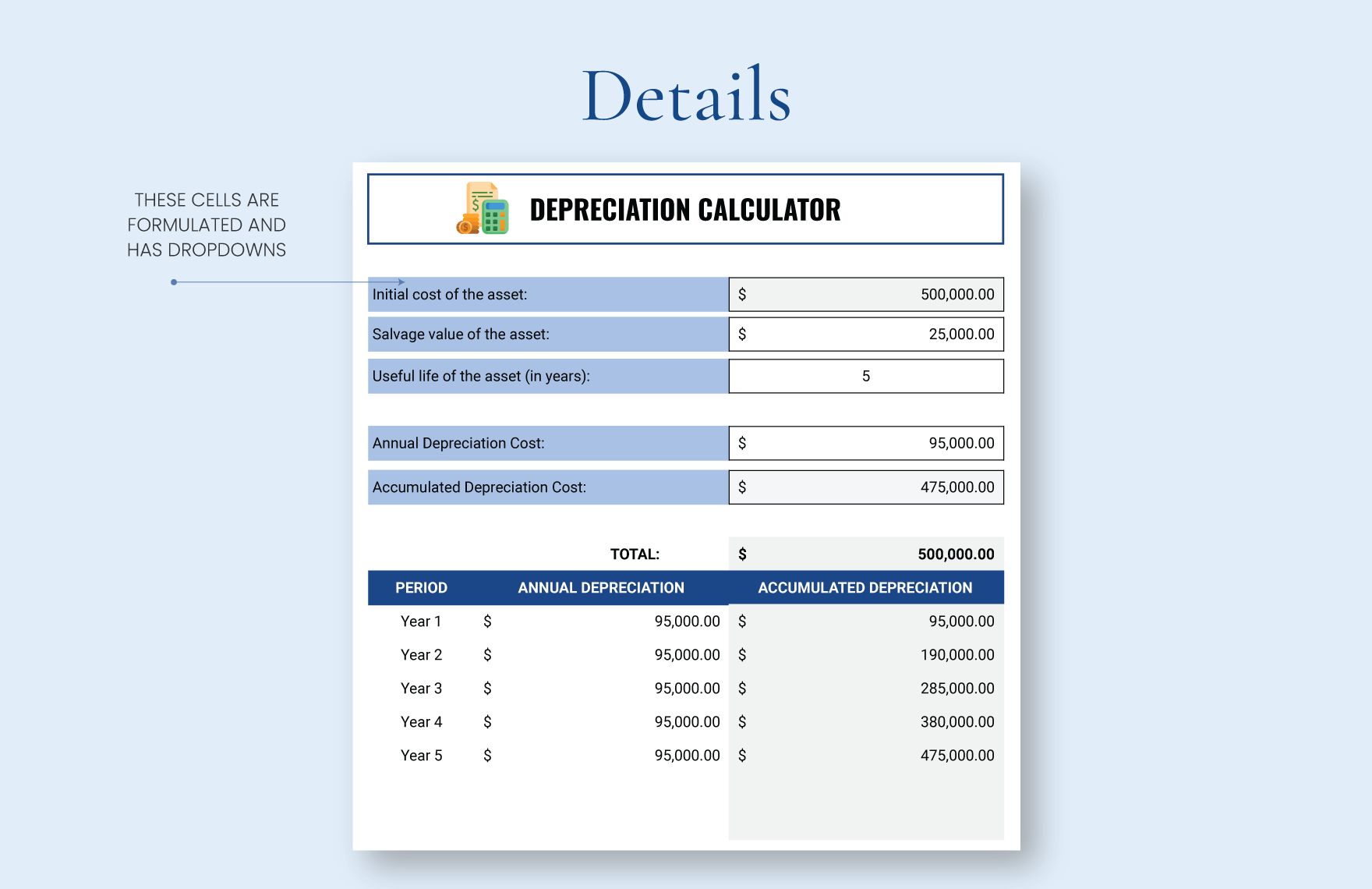

Simple Depreciation Calculator Template in Excel, Google Sheets

Depreciation Calculator template excel for free

How to Apply Declining Balance Depreciation Formula in Excel 6 Examples

Free Depreciation Calculator in Excel Zervant

Depreciation Calculator Excel Template at Gilbert Strothers blog

Related Post: