Debt Service Coverage Ratio Formula In Excel

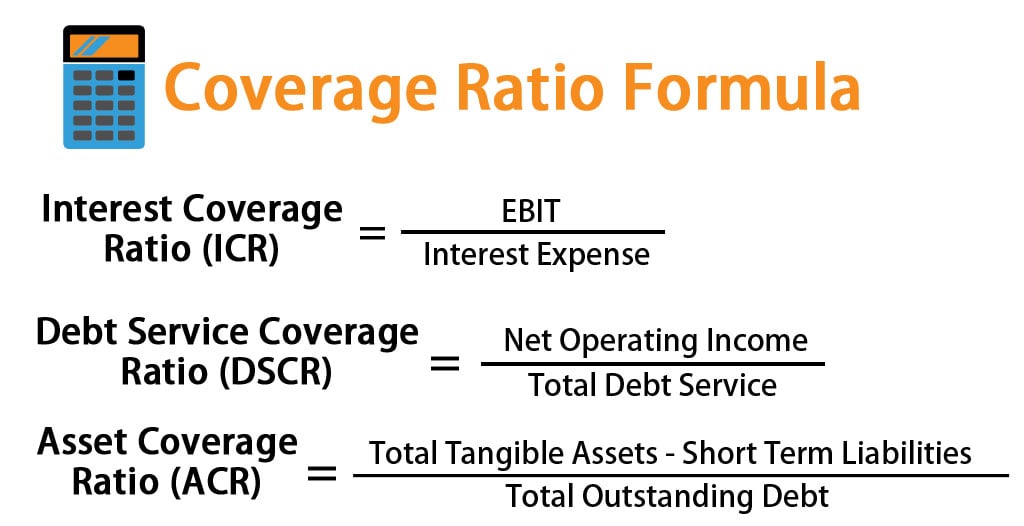

Debt Service Coverage Ratio Formula In Excel - Here’s what to know about debt basics, types of debt (from credit cards to mortgages) and. All debts are not created equal. Debt is a part of everyday life. Learn how to tell if you have too much debt and how to find relief. Here are a few considerations when figuring out which you should focus on first. Prioritizing saving money or paying debts depends on your unique situation. Good debt builds credit or equity. Debt is a financial obligation that must be repaid. A budget is a roadmap to plan your finances. Debt is an obligation that requires one party, the debtor, to pay money borrowed or otherwise withheld from another party, the creditor. What’s the difference between good and bad debt? In short, debt is the money you owe to someone or something. Debt is a financial obligation that must be repaid. In the modern world, a debt may be a large sum of money borrowed for a major purchase and repaid over. A budget is a roadmap to plan your finances. It's money that you borrowed and must pay back, according to the consumer financial protection bureau. Here’s what to know about debt basics, types of debt (from credit cards to mortgages) and. What’s the difference between good and bad debt? Debt is a financial obligation that must be repaid. Learn how to tell if you have too much debt and. All debts are not created equal. Understanding debt can help you better plan for it. Debt is an obligation that requires one party, the debtor, to pay money borrowed or otherwise withheld from another party, the creditor. In short, debt is the money you owe to someone or something. Here are a few considerations when figuring out which you should. Understanding debt can help you better plan for it. At debt.com, we know debt and the solutions you need to get out of it. In the modern world, a debt may be a large sum of money borrowed for a major purchase and repaid over. Debt is a part of everyday life. Good debt builds credit or equity. Debt is an obligation that requires one party, the debtor, to pay money borrowed or otherwise withheld from another party, the creditor. A budget is a roadmap to plan your finances. Here’s what to know about debt basics, types of debt (from credit cards to mortgages) and. What’s the difference between good and bad debt? In the modern world, a. Prioritizing saving money or paying debts depends on your unique situation. Debt is money you borrow and have to repay, but not all debt is created equal. Learn how to tell if you have too much debt and how to find relief. A budget is a roadmap to plan your finances. What’s the difference between good and bad debt? Learn how to tell if you have too much debt and how to find relief. Debt may be owed by a sovereign state or country,. In the modern world, a debt may be a large sum of money borrowed for a major purchase and repaid over. What’s the difference between good and bad debt? Here are the main types of. Debt is a financial obligation that must be repaid. Learn how to tell if you have too much debt and how to find relief. Debt may be owed by a sovereign state or country,. Debt is money you borrow and have to repay, but not all debt is created equal. Here are a few considerations when figuring out which you. In short, debt is the money you owe to someone or something. In the modern world, a debt may be a large sum of money borrowed for a major purchase and repaid over. It's money that you borrowed and must pay back, according to the consumer financial protection bureau. Understanding debt can help you better plan for it. Here’s what. And there are different types of debt and many ways people can use it to their advantage. Debt is an obligation that requires one party, the debtor, to pay money borrowed or otherwise withheld from another party, the creditor. Prioritizing saving money or paying debts depends on your unique situation. Here’s what to know about debt basics, types of debt.Coverage Ratio Formula How To Calculate Coverage Ratio?

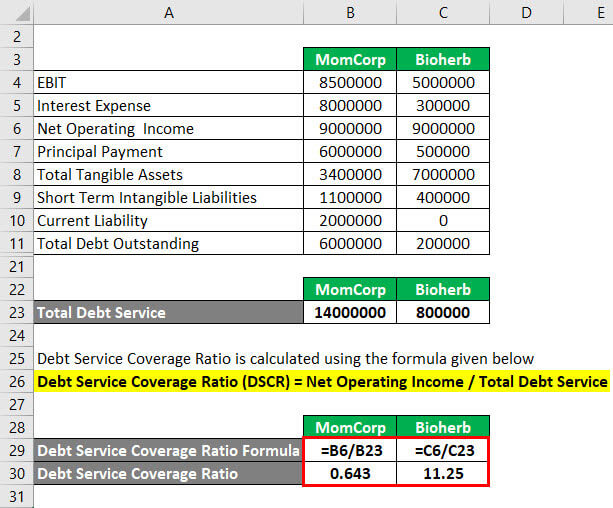

How to Calculate Debt Service Coverage Ratio (DSCR) in Excel Sheetaki

Debt Service Coverage Ratio (DSCR) berekenen in Excel

Debt Service Coverage Ratio Formula in Excel ExcelDemy

Coverage Ratio Formula How To Calculate Coverage Ratio?

Debt Service Coverage Ratio (DSCR) berekenen in Excel

How to Calculate Debt Service Coverage Ratio (DSCR) in Excel

Debt Service Coverage Ratio Formula Calculator (Excel Template)

How to Calculate Debt Service Coverage Ratio (DSCR) in Excel

Debt Service Coverage Ratio Formula in Excel ExcelDemy

Related Post:

:max_bytes(150000):strip_icc()/DSCR-b224f0db64184eae800e27598a8bc2d7.png)

:max_bytes(150000):strip_icc()/DSCR1-218052e5bc4240449f1479019381b358.jpg)