Credit Card Payment Excel Template

Credit Card Payment Excel Template - The debtor promises to repay the lender, often with interest, or risk financial or legal penalties. How to build, improve, and check your credit. Learn how to get your credit score, the number that creditors use to determine your credit behavior, including how likely you are to make payments on a loan. When you use a credit card, you’re borrowing money. Understand how credit reports and credit scores work, what your rights are, common issues with credit reports, and how to work with credit reporting companies. Start with your free experian credit report and fico® score. Credit is an agreement between a creditor (lender) and a borrower (debtor). How many credit cards do you have? You get a daily transunion credit report & score, monitoring and much more. Get the info you need to take control of your credit. Experian is committed to helping you protect, understand, and improve your credit. Explore types of credit, how credit scores work, and tips to build or improve your credit with confidence. When you use a credit card, you’re borrowing money. You get a daily transunion credit report & score, monitoring and much more. How to build, improve, and check your credit. How many credit cards do you have? Learn what credit is and why it matters. Learn how to get your credit score, the number that creditors use to determine your credit behavior, including how likely you are to make payments on a loan. When you use a credit card, you’re borrowing money. Your credit history describes how you use money. We also have identity protection tools with daily monitoring and alerts Free manage your credit with a free subscription. When people talk about your credit, they mean your credit history. Learn how to get your credit score, the number that creditors use to determine your credit behavior, including how likely you are to make payments on a loan. Intuit credit. The debtor promises to repay the lender, often with interest, or risk financial or legal penalties. Credit is an agreement between a creditor (lender) and a borrower (debtor). Intuit credit karma offers free credit scores, reports and insights. When people talk about your credit, they mean your credit history. We also have identity protection tools with daily monitoring and alerts We also have identity protection tools with daily monitoring and alerts Free manage your credit with a free subscription. The debtor promises to repay the lender, often with interest, or risk financial or legal penalties. Experian is committed to helping you protect, understand, and improve your credit. Explore types of credit, how credit scores work, and tips to build or. When people talk about your credit, they mean your credit history. When you use a credit card, you’re borrowing money. How many credit cards do you have? Learn what credit is and why it matters. Free manage your credit with a free subscription. The debtor promises to repay the lender, often with interest, or risk financial or legal penalties. Your credit history describes how you use money. Explore types of credit, how credit scores work, and tips to build or improve your credit with confidence. Free manage your credit with a free subscription. How to build, improve, and check your credit. Intuit credit karma offers free credit scores, reports and insights. Get credit reports and credit scores for businesses and consumers from equifax today! We also have identity protection tools with daily monitoring and alerts Explore types of credit, how credit scores work, and tips to build or improve your credit with confidence. How many credit cards do you have? Your credit history tells businesses how you handle money and pay your bills. You get a daily transunion credit report & score, monitoring and much more. We also have identity protection tools with daily monitoring and alerts Understand how credit reports and credit scores work, what your rights are, common issues with credit reports, and how to work with credit. Free manage your credit with a free subscription. Credit is an agreement between a creditor (lender) and a borrower (debtor). Learn how to get your credit score, the number that creditors use to determine your credit behavior, including how likely you are to make payments on a loan. How many credit cards do you have? Your credit history tells businesses.Free Credit Card Payment Calculator Template in Excel

Credit Card Tracker Excel Template

Excel Credit Card Payoff Calculator and Timeline Easy Financial

Credit Card Payment Excel Template Smart Template Maker

How to Create a Credit Card Payoff Spreadsheet in Excel (2 Ways)

Free Credit Card Payment Calculator Template in Excel

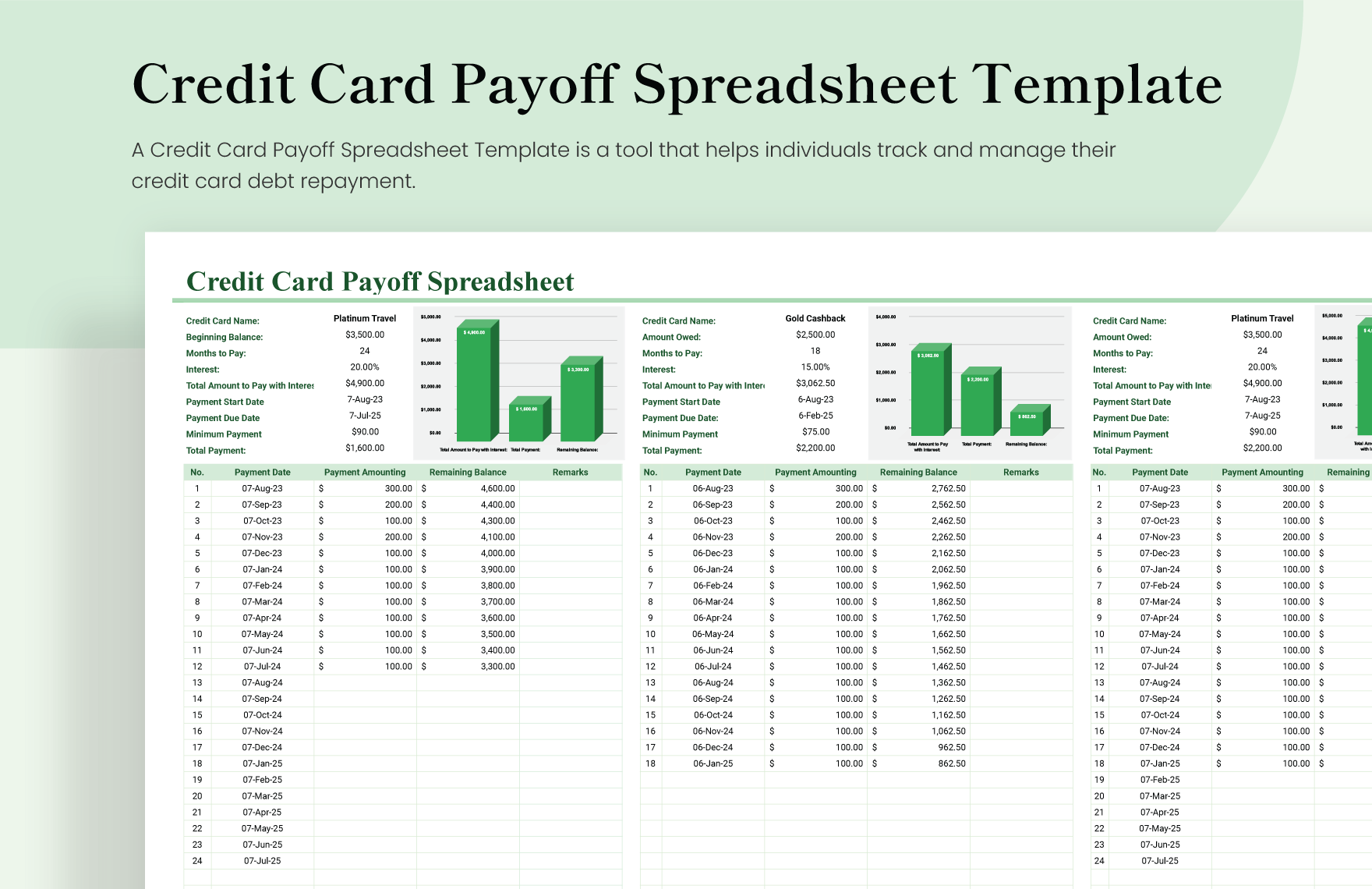

Credit Card Payoff Spreadsheet Template in Excel, Google Sheets

Credit Card Payment Excel Template

Credit Card Payment Spreadsheet Template

Monthly Credit Card Payment Spreadsheet with Credit Card Utilization

Related Post: