Compounding Interest Formula Excel

Compounding Interest Formula Excel - Compound interest allows your savings to grow faster over time. Guide to what is compounding & its meaning. Compounding lets your interest and returns earn interest and returns of their own. It’s a great first step. Increasing compounding frequency (e.g., monthly) can significantly accelerate investment. Compounding means getting returns on your previous returns as well as your initial investment. Compounding is the process where an asset’s earnings, from either capital gains or interest, are reinvested to generate additional earnings over time. You can also include regular deposits or withdrawals to see how they impact the. Contrary to a common assumption, you don't need a lot of money. You need a lot of time, and you need to use it as wisely as possible. We discuss compounding power, interest calculation, formula, investment, effect, and examples. You can also include regular deposits or withdrawals to see how they impact the. Compound interest allows your savings to grow faster over time. Compound interest grows by reinvesting earnings, creating larger interest over time. Compounding means getting returns on your previous returns as well as your initial investment. Compound interest allows your savings to grow faster over time. You need a lot of time, and you need to use it as wisely as possible. Simply enter your principal amount, interest rate, compounding frequency and the time period. Increasing compounding frequency (e.g., monthly) can significantly accelerate investment. It’s a great first step. Increasing compounding frequency (e.g., monthly) can significantly accelerate investment. You can also include regular deposits or withdrawals to see how they impact the. Compounding means getting returns on your previous returns as well as your initial investment. Compounding lets your interest and returns earn interest and returns of their own. Guide to what is compounding & its meaning. It’s a great first step. Simply enter your principal amount, interest rate, compounding frequency and the time period. Contrary to a common assumption, you don't need a lot of money. Guide to what is compounding & its meaning. We discuss compounding power, interest calculation, formula, investment, effect, and examples. Compound interest is the interest you earn on your original money and on the interest that keeps accumulating. Test your knowledge of compound interest, the rule of 72, and related investing concepts in our most popular investing quiz! Simply enter your principal amount, interest rate, compounding frequency and the time period. Compounding means getting returns on your previous returns as. Contrary to a common assumption, you don't need a lot of money. Simply enter your principal amount, interest rate, compounding frequency and the time period. Compounded interest can power your returns over time, especially if you have patience. You can also include regular deposits or withdrawals to see how they impact the. You need a lot of time, and you. Compounded interest can power your returns over time, especially if you have patience. Contrary to a common assumption, you don't need a lot of money. Compound interest grows by reinvesting earnings, creating larger interest over time. Compounding lets your interest and returns earn interest and returns of their own. Compound interest is the interest you earn on your original money. You can also include regular deposits or withdrawals to see how they impact the. Simply enter your principal amount, interest rate, compounding frequency and the time period. Compounded interest can power your returns over time, especially if you have patience. Compound interest grows by reinvesting earnings, creating larger interest over time. Compounding means getting returns on your previous returns as. Test your knowledge of compound interest, the rule of 72, and related investing concepts in our most popular investing quiz! We discuss compounding power, interest calculation, formula, investment, effect, and examples. Compound interest grows by reinvesting earnings, creating larger interest over time. You need a lot of time, and you need to use it as wisely as possible. Simply enter. It’s a great first step. Simply enter your principal amount, interest rate, compounding frequency and the time period. Compound interest grows by reinvesting earnings, creating larger interest over time. Compound interest and compound returns (also known as compounding) help your money work harder. You can also include regular deposits or withdrawals to see how they impact the.Compound Interest Formula In Excel Step by Step Calculation

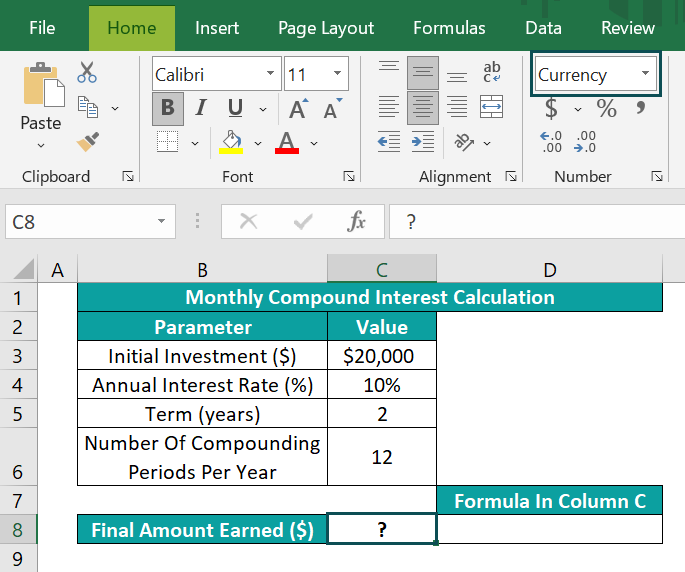

How to Calculate Monthly Compound Interest in Excel

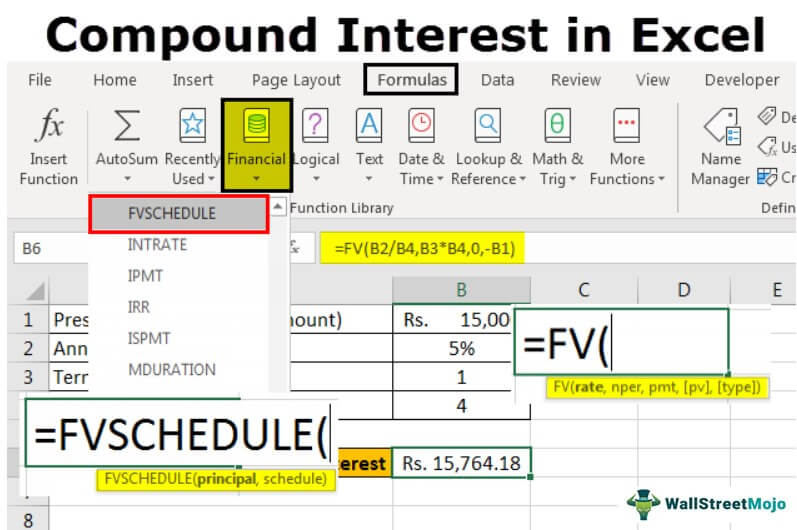

How to Calculate Compound Interest in Excel

How to Use Compound Interest Formula in Excel Sheetaki

How to Use Compound Interest Formula in Excel Sheetaki

Compound Interest Formula in Excel Calculation, Examples

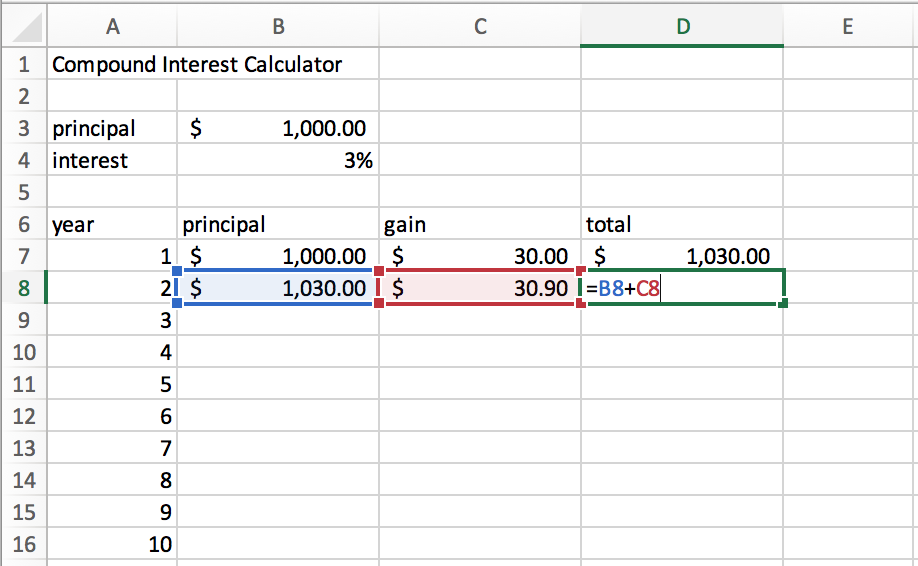

How to Make a Compound Interest Calculator in Microsoft Excel by

Calculate compound interest Excel formula Exceljet

Compound Interest Formula in Excel Calculator with All Criteria

Compound Interest Formula In Excel Step by Step Calculation

Related Post: