Charitable Remainder Trust Calculator Excel

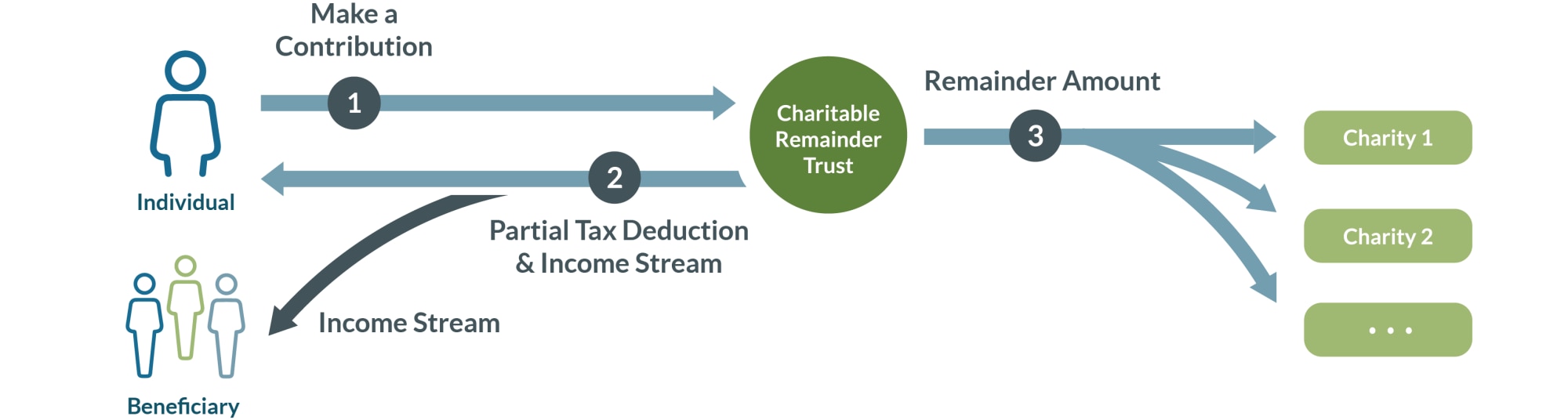

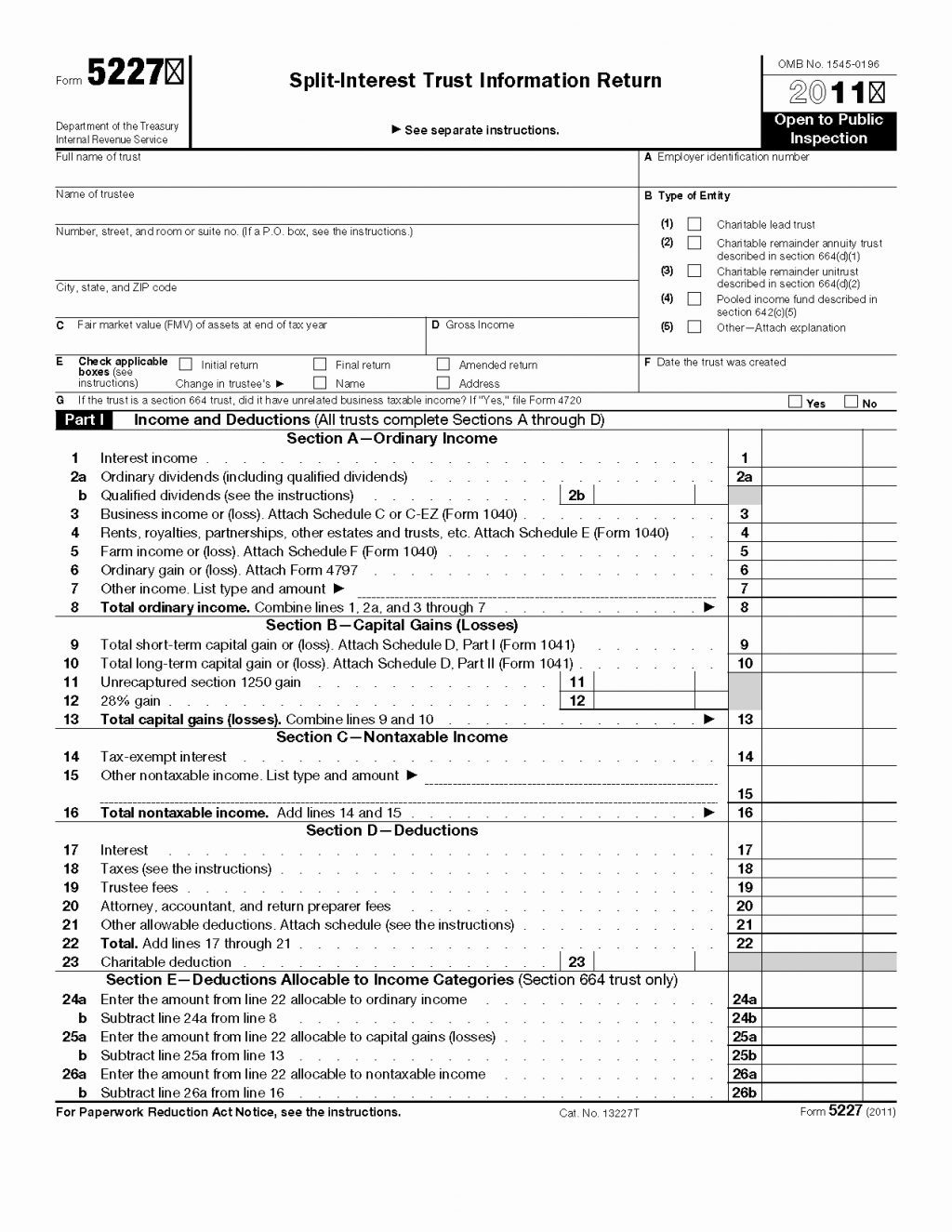

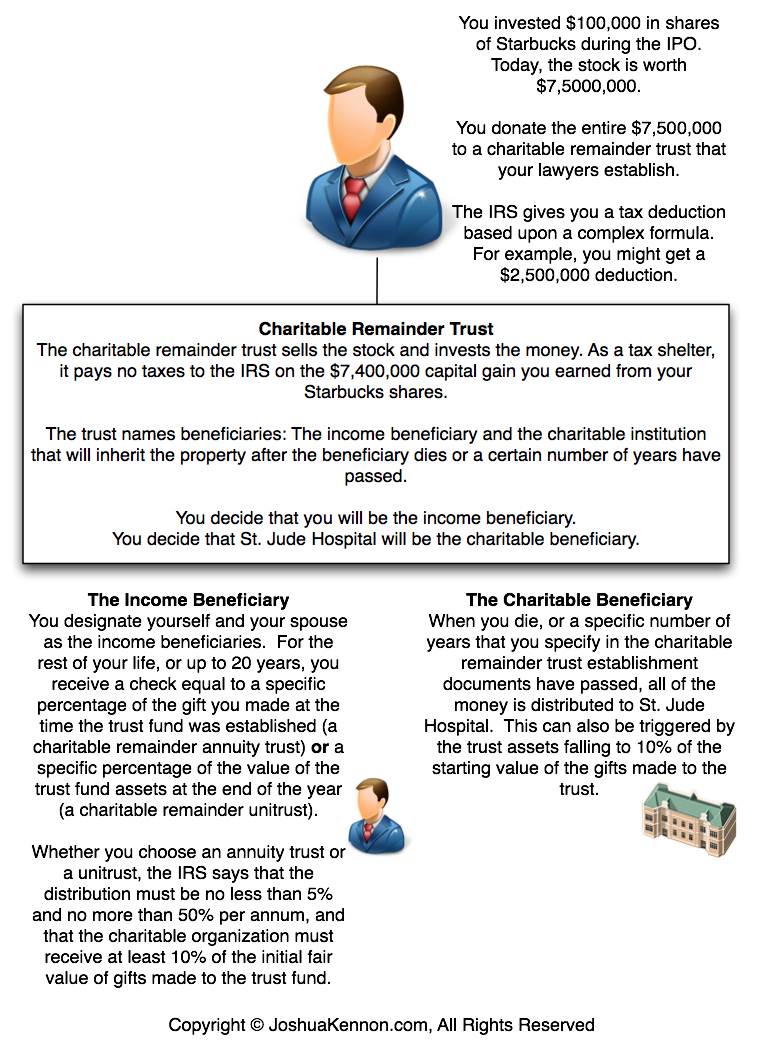

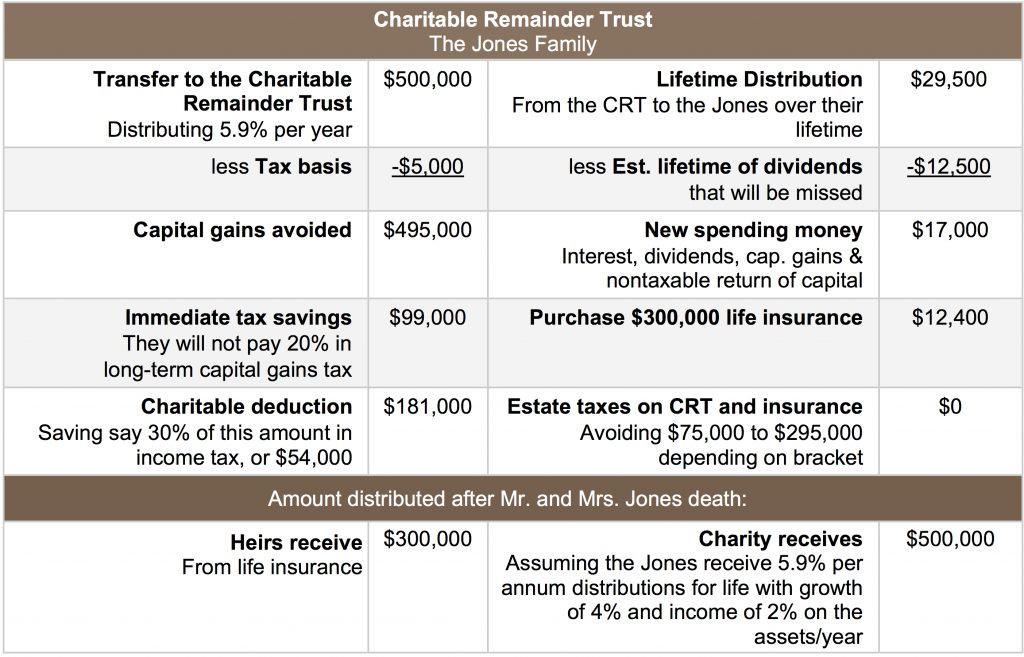

Charitable Remainder Trust Calculator Excel - If you are trying to figure out what a charitable remainder trust is, or if you already have one, then here is a good new idea for you. Please click the button below to open the calculator. Calculate crut vs crat benefits, tax deductions, income streams, and estate planning strategies. Instead of trying to figure out what that is, let. The trust sells immediately (no upfront cg tax), pays you a fixed % each year. A great way to make a gift to ij, receive fixed payments, and defer or eliminate capital gains tax. Estimate charitable remainder trust tax savings, lifetime income, and charitable impact with valur’s free calculator. Calculate the benefits and financial impact of a charitable remainder unitrust (crut) with our crut calculator. A charitable remainder trust calculator that helps charitable or philanthropic individuals as well as nonprofit organizations to measure potential tax benefits and growth projections of a charitable. Your calculation above is an estimate and is for illustrative purposes only. Estimate annuity payments, remainder value, and tax advantages to plan. Calculate the benefits and financial impact of a charitable remainder unitrust (crut) with our crut calculator. Plan your charitable giving effectively with wealthplannerpro.ai. Optimize taxes and giving today. We compare against selling personally today — counting. Free crt calculator for charitable remainder trusts. Estimate charitable remainder trust tax savings, lifetime income, and charitable impact with valur’s free calculator. Enter the capital gain amount you’ll place in the crut. Consider including us in your will, trust or estate plan. Your calculation above is an estimate and is for illustrative purposes only. It's a simple way to make an impact and leave a lasting legacy. Please click the button below to open the calculator. Estimate your income and tax benefits from a charitable remainder trust with our calculator. We compare against selling personally today — counting. Estimate charitable remainder trust tax savings, lifetime income, and charitable impact with valur’s free calculator. We compare against selling personally today — counting. Estimate annuity payments, remainder value, and tax advantages to plan. Free crt calculator for charitable remainder trusts. Plan your charitable giving effectively with wealthplannerpro.ai. Estimate charitable remainder trust tax savings, lifetime income, and charitable impact with valur’s free calculator. We compare against selling personally today — counting. Instead of trying to figure out what that is, let. Calculate the benefits and financial impact of a charitable remainder unitrust (crut) with our crut calculator. Estimate annuity payments, remainder value, and tax advantages to plan. Plan your charitable giving effectively with wealthplannerpro.ai. A charitable remainder trust calculator that helps charitable or philanthropic individuals as well as nonprofit organizations to measure potential tax benefits and growth projections of a charitable. Consider including us in your will, trust or estate plan. The trust sells immediately (no upfront cg tax), pays you a fixed % each year. Please click the button below to open the. The trust sells immediately (no upfront cg tax), pays you a fixed % each year. Estimate charitable remainder trust tax savings, lifetime income, and charitable impact with valur’s free calculator. Find out how a crut calculator can help you balance philanthropy with financial planning for a lasting impact. Calculate crut vs crat benefits, tax deductions, income streams, and estate planning. Your calculation above is an estimate and is for illustrative purposes only. Optimize taxes and giving today. We compare against selling personally today — counting. Estimate your income and tax benefits from a charitable remainder trust with our calculator. It's a simple way to make an impact and leave a lasting legacy. Calculate the benefits and financial impact of a charitable remainder unitrust (crut) with our crut calculator. Find out how a crut calculator can help you balance philanthropy with financial planning for a lasting impact. Consider including us in your will, trust or estate plan. A charitable remainder trust calculator that helps charitable or philanthropic individuals as well as nonprofit organizations. Your calculation above is an estimate and is for illustrative purposes only. Free crt calculator for charitable remainder trusts. Instead of trying to figure out what that is, let. Consider including us in your will, trust or estate plan. Please click the button below to open the calculator.The Power of Charitable Remainder Trusts (CRTs) in HighInterest Rate

How to Prepare Charitable Trust Balance Sheet Format in Excel

Charitable Remainder Trusts Fidelity Charitable

Charitable Remainder Trust Spreadsheet inside Goodwill Donation Excel

Charitable Remainder Trust Spreadsheet throughout Charitable Remainder

Charitable Trusts A WinWin for Everyone Borchers Trust Law

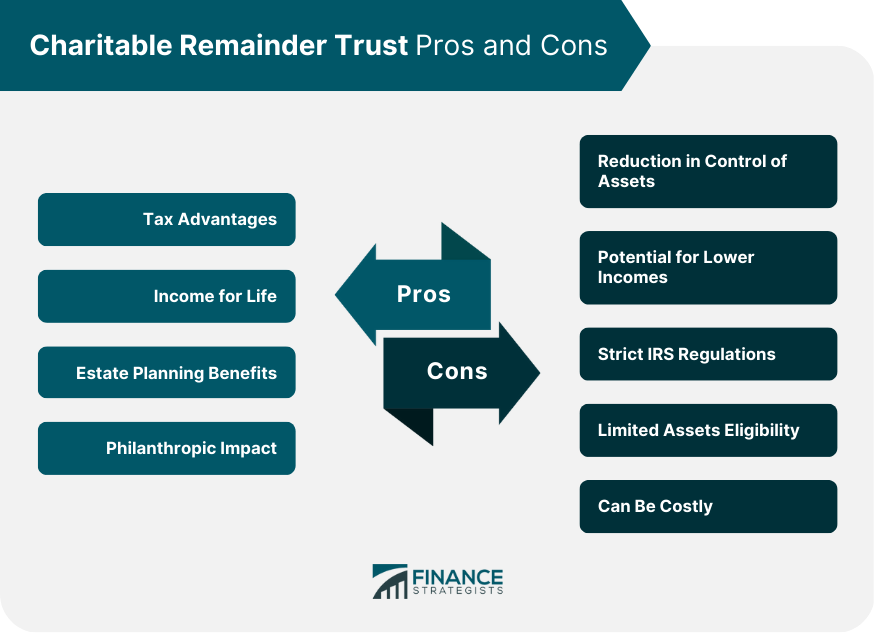

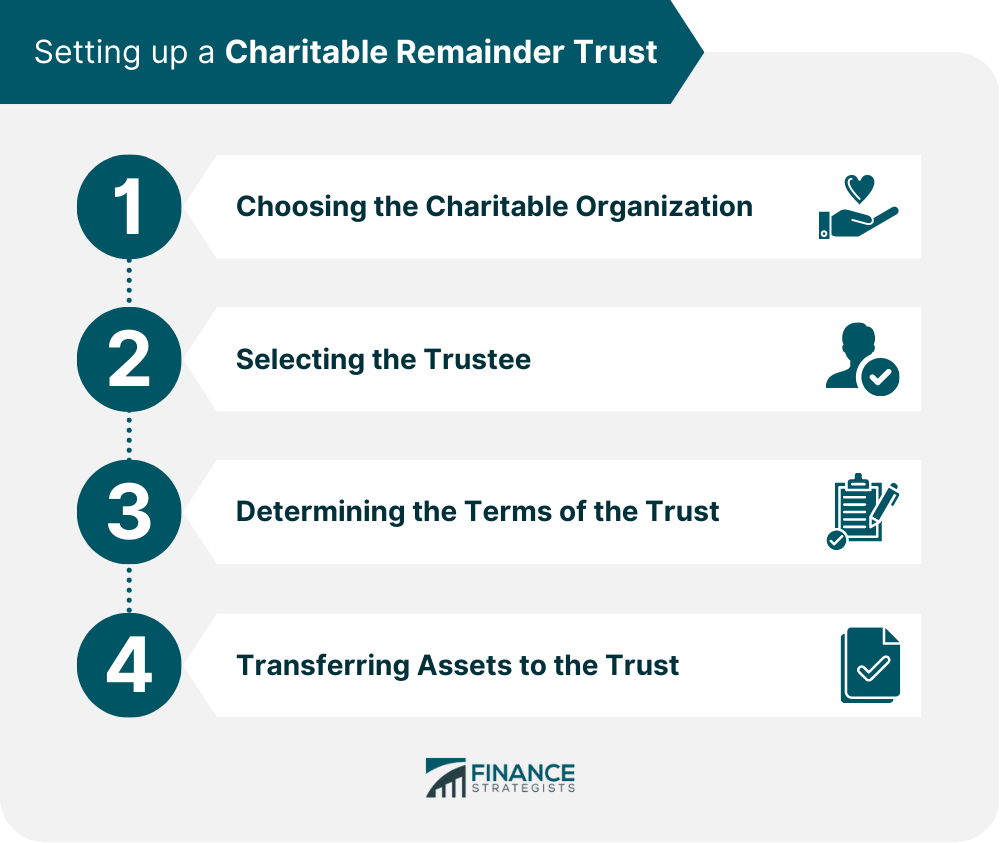

Charitable Remainder Trust (CRT) Definition, Pros and Cons

Trust Charitable Remainder Template

What Is a Charitable Remainder Trust? NC LongTerm Care Planning

Charitable Remainder Trust (CRT) Definition, Pros and Cons

Related Post: