Capm In Excel

Capm In Excel - Icapm, like capm, makes several assumptions, including that global markets are integrated and efficient. If this assumption fails, then stock selection is critical; Capm得到的expected return of equity,我们可以用dividend discount model 和 这里得到的expected return of equity去给股票估值。 dividend discount model 强调的是未来现金流是预期. The capital asset pricing model (capm) is used to calculate the required rate of return for any risky asset. Capm如果适用,每个证券不存在 \alpha_i,都应该为0。 sim (或atp)内部分证券 \alpha_i 可以不为0,只需要保证. If this assumption fails, then stock selection is critical; Capm得到的expected return of equity,我们可以用dividend discount model 和 这里得到的expected return of equity去给股票估值。 dividend discount model 强调的是未来现金流是预期. Icapm, like capm, makes several assumptions, including that global markets are integrated and efficient. The capital asset pricing model (capm) is used to calculate the required rate of return for any risky asset. Capm如果适用,每个证券不存在 \alpha_i,都应该为0。 sim. Capm如果适用,每个证券不存在 \alpha_i,都应该为0。 sim (或atp)内部分证券 \alpha_i 可以不为0,只需要保证. Icapm, like capm, makes several assumptions, including that global markets are integrated and efficient. If this assumption fails, then stock selection is critical; Capm得到的expected return of equity,我们可以用dividend discount model 和 这里得到的expected return of equity去给股票估值。 dividend discount model 强调的是未来现金流是预期. The capital asset pricing model (capm) is used to calculate the required rate of return for. Capm得到的expected return of equity,我们可以用dividend discount model 和 这里得到的expected return of equity去给股票估值。 dividend discount model 强调的是未来现金流是预期. Icapm, like capm, makes several assumptions, including that global markets are integrated and efficient. The capital asset pricing model (capm) is used to calculate the required rate of return for any risky asset. If this assumption fails, then stock selection is critical; Capm如果适用,每个证券不存在 \alpha_i,都应该为0。 sim. Capm如果适用,每个证券不存在 \alpha_i,都应该为0。 sim (或atp)内部分证券 \alpha_i 可以不为0,只需要保证. If this assumption fails, then stock selection is critical; Capm得到的expected return of equity,我们可以用dividend discount model 和 这里得到的expected return of equity去给股票估值。 dividend discount model 强调的是未来现金流是预期. The capital asset pricing model (capm) is used to calculate the required rate of return for any risky asset. Icapm, like capm, makes several assumptions, including that global markets are. Capm得到的expected return of equity,我们可以用dividend discount model 和 这里得到的expected return of equity去给股票估值。 dividend discount model 强调的是未来现金流是预期. Icapm, like capm, makes several assumptions, including that global markets are integrated and efficient. If this assumption fails, then stock selection is critical; Capm如果适用,每个证券不存在 \alpha_i,都应该为0。 sim (或atp)内部分证券 \alpha_i 可以不为0,只需要保证. The capital asset pricing model (capm) is used to calculate the required rate of return for. The capital asset pricing model (capm) is used to calculate the required rate of return for any risky asset. If this assumption fails, then stock selection is critical; Icapm, like capm, makes several assumptions, including that global markets are integrated and efficient. Capm如果适用,每个证券不存在 \alpha_i,都应该为0。 sim (或atp)内部分证券 \alpha_i 可以不为0,只需要保证. Capm得到的expected return of equity,我们可以用dividend discount model 和 这里得到的expected return of equity去给股票估值。 dividend. Icapm, like capm, makes several assumptions, including that global markets are integrated and efficient. If this assumption fails, then stock selection is critical; The capital asset pricing model (capm) is used to calculate the required rate of return for any risky asset. Capm如果适用,每个证券不存在 \alpha_i,都应该为0。 sim (或atp)内部分证券 \alpha_i 可以不为0,只需要保证. Capm得到的expected return of equity,我们可以用dividend discount model 和 这里得到的expected return of equity去给股票估值。 dividend. Capm得到的expected return of equity,我们可以用dividend discount model 和 这里得到的expected return of equity去给股票估值。 dividend discount model 强调的是未来现金流是预期. Icapm, like capm, makes several assumptions, including that global markets are integrated and efficient. Capm如果适用,每个证券不存在 \alpha_i,都应该为0。 sim (或atp)内部分证券 \alpha_i 可以不为0,只需要保证. The capital asset pricing model (capm) is used to calculate the required rate of return for any risky asset. If this assumption fails, then stock. Capm如果适用,每个证券不存在 \alpha_i,都应该为0。 sim (或atp)内部分证券 \alpha_i 可以不为0,只需要保证. Icapm, like capm, makes several assumptions, including that global markets are integrated and efficient. Capm得到的expected return of equity,我们可以用dividend discount model 和 这里得到的expected return of equity去给股票估值。 dividend discount model 强调的是未来现金流是预期. The capital asset pricing model (capm) is used to calculate the required rate of return for any risky asset. If this assumption fails, then stock. Capm得到的expected return of equity,我们可以用dividend discount model 和 这里得到的expected return of equity去给股票估值。 dividend discount model 强调的是未来现金流是预期. Capm如果适用,每个证券不存在 \alpha_i,都应该为0。 sim (或atp)内部分证券 \alpha_i 可以不为0,只需要保证. The capital asset pricing model (capm) is used to calculate the required rate of return for any risky asset. If this assumption fails, then stock selection is critical; Icapm, like capm, makes several assumptions, including that global markets are.Microsoft Excel Capital Asset Pricing Model (CAPM) Tutorial

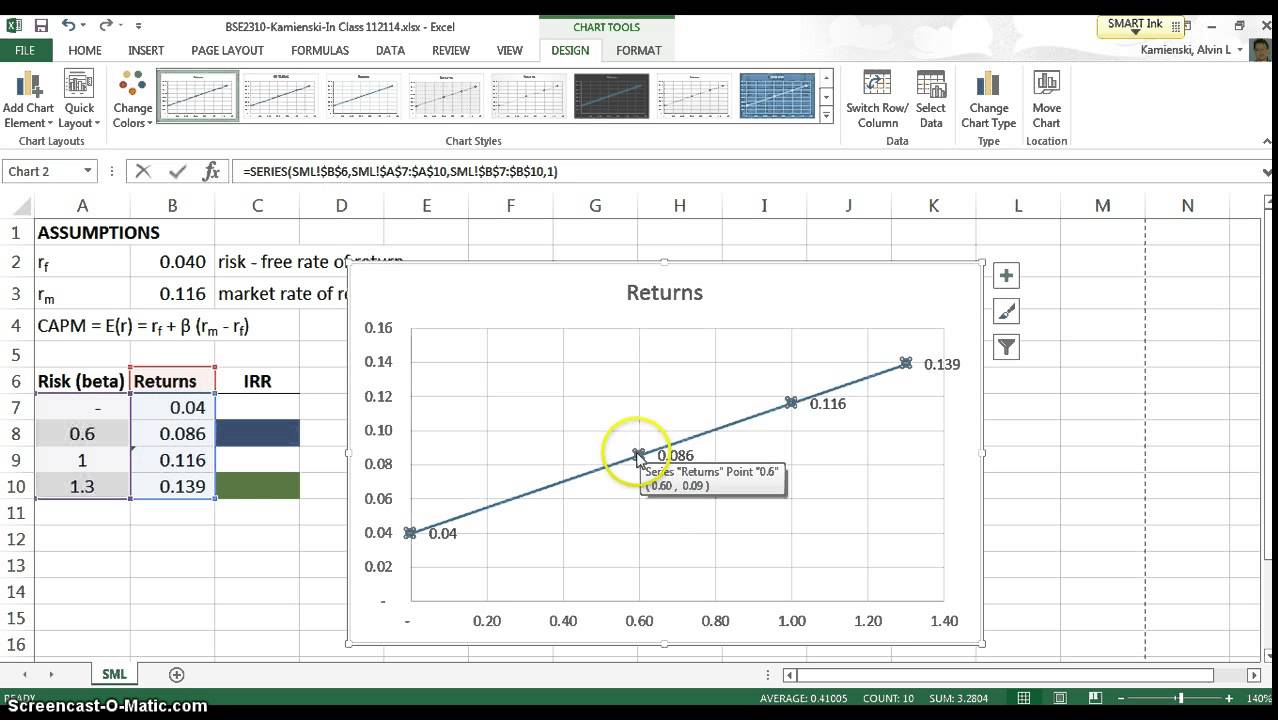

How to plot sml workbewer

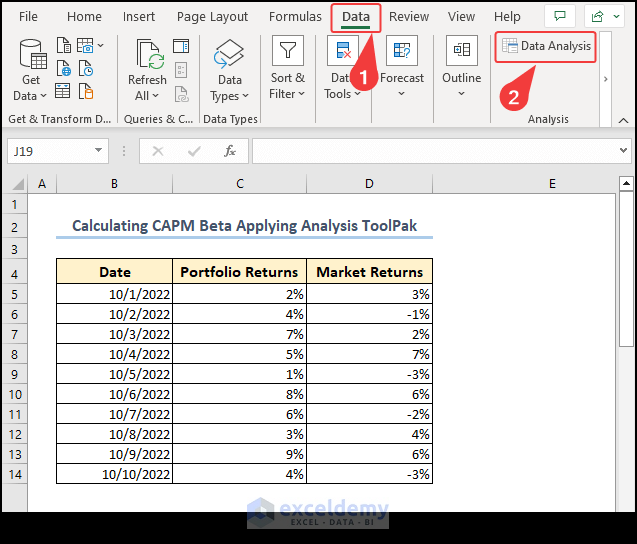

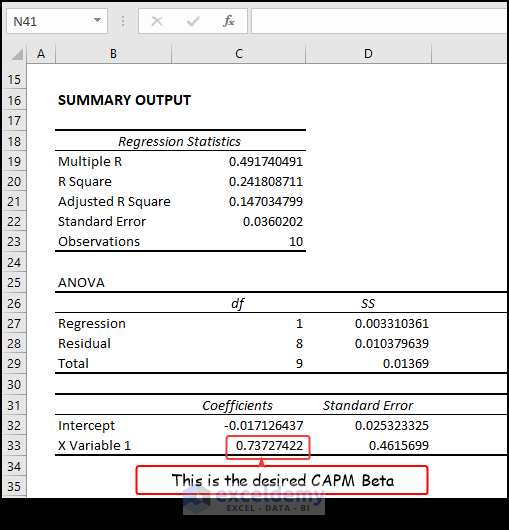

How to Calculate CAPM Beta in Excel 3 Quick Methods

How to Calculate CAPM Beta in Excel 3 Quick Methods

Capital Asset Pricing Model Capm Calculator Seputar Model

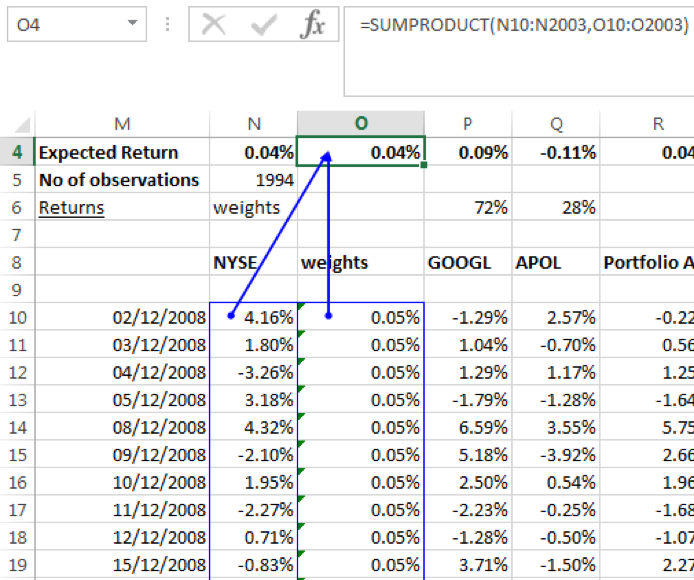

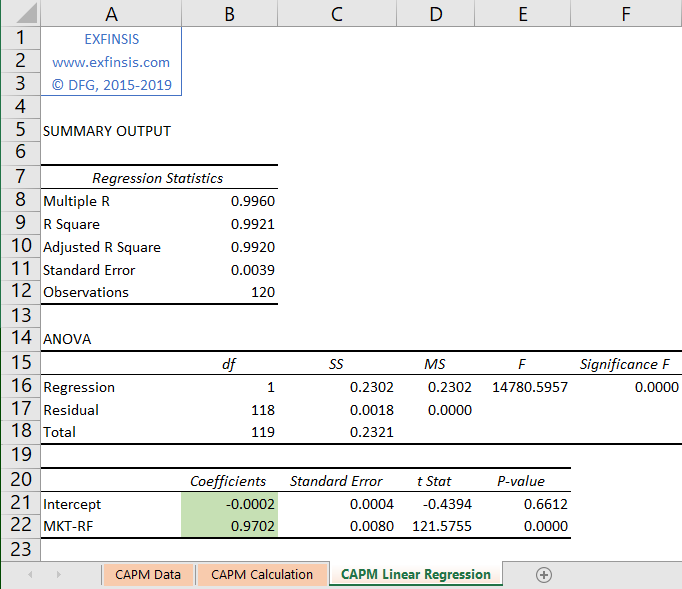

CAPM Single Factor Model with Excel EXFINSIS

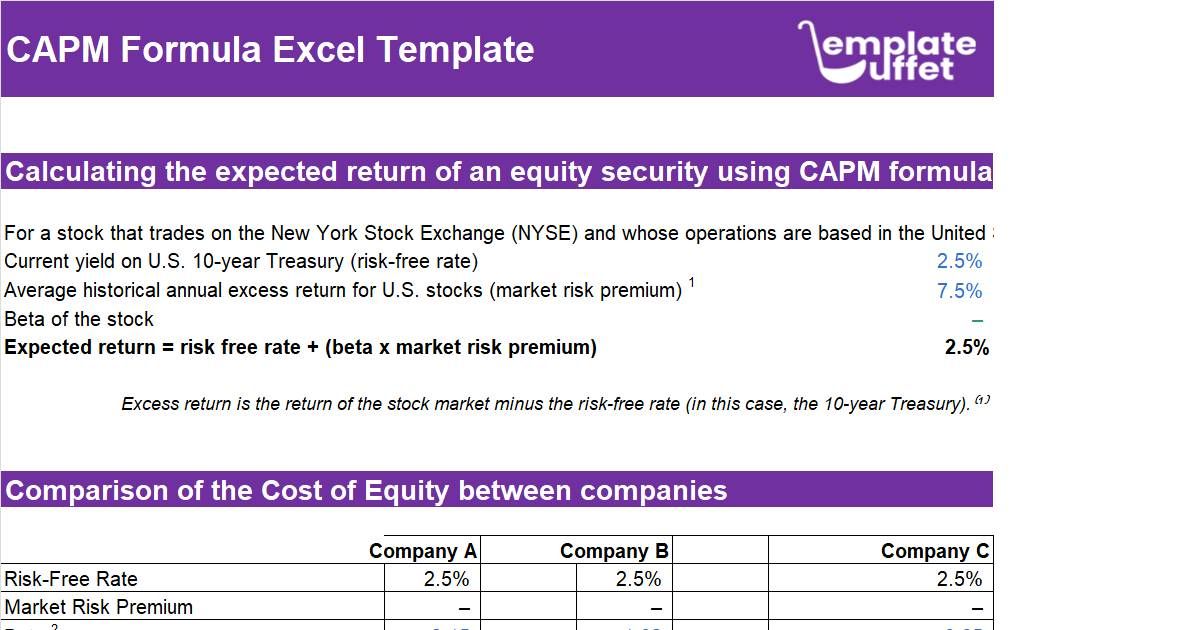

CAPM Excel Template Calculate Expected Returns with the Capital Asset

Capm in Excel PDF Beta (Finance) P Value

How to Calculate CAPM Alpha In Excel Earn and Excel

GitHub johntwk/CapitalAssetPricingModelCAPM An excel VBA

Related Post: