Calculate Npv In Excel

Calculate Npv In Excel - The discount rate and the series of cash flows. In this tutorial, i will show you different examples of calculating npv in excel. In the tutorial below, i am going to explain to you the concept of npv, multiple ways to calculate npv in excel, and the different functions that excel offers for npv calculation. Net present value (npv) is used to estimate the profitability of projects or investments. Learn how to calculate the net present value (npv) of your investments using microsoft excel. We’ll use a dataset containing period, monthly cash flow, and discount rate to demonstrate how to calculate npv using two different methods in excel. Learn how to calculate npv (net present value) in excel using npv and xnpv functions. Understand the difference between the two and how to compare multiple projects for profitability. The correct npv formula in excel uses the npv function to calculate the present value of a series of future cash flows and subtracts the initial investment. You can calculate npv in two ways using microsoft excel. The correct npv formula in excel uses the npv function to calculate the present value of a series of future cash flows and subtracts the initial investment. Calculates the net present value of an investment by using a discount rate and a series of future payments (negative values) and income (positive values). In this tutorial, i will show you different. Calculates the net present value of an investment by using a discount rate and a series of future payments (negative values) and income (positive values). In this tutorial, i will show you different examples of calculating npv in excel. We’ll use a dataset containing period, monthly cash flow, and discount rate to demonstrate how to calculate npv using two different. The correct npv formula in excel uses the npv function to calculate the present value of a series of future cash flows and subtracts the initial investment. Net present value (npv) is used to estimate the profitability of projects or investments. Learn how to calculate the net present value (npv) of your investments using microsoft excel. You can calculate npv. We’ll use a dataset containing period, monthly cash flow, and discount rate to demonstrate how to calculate npv using two different methods in excel. In this tutorial, i will show you different examples of calculating npv in excel. Calculates the net present value of an investment by using a discount rate and a series of future payments (negative values) and. Learn how to calculate the net present value (npv) of your investments using microsoft excel. The discount rate and the series of cash flows. The correct npv formula in excel uses the npv function to calculate the present value of a series of future cash flows and subtracts the initial investment. Learn how to calculate npv (net present value) in. In the tutorial below, i am going to explain to you the concept of npv, multiple ways to calculate npv in excel, and the different functions that excel offers for npv calculation. Learn how to calculate npv (net present value) in excel using npv and xnpv functions. Net present value (npv) is used to estimate the profitability of projects or. Learn how to calculate the net present value (npv) of your investments using microsoft excel. Net present value (npv) is used to estimate the profitability of projects or investments. This function requires two main inputs: In this tutorial, i will show you different examples of calculating npv in excel. Understand the difference between the two and how to compare multiple. Net present value (npv) is used to estimate the profitability of projects or investments. The discount rate and the series of cash flows. Calculates the net present value of an investment by using a discount rate and a series of future payments (negative values) and income (positive values). Learn how to calculate npv (net present value) in excel using npv. Calculates the net present value of an investment by using a discount rate and a series of future payments (negative values) and income (positive values). The correct npv formula in excel uses the npv function to calculate the present value of a series of future cash flows and subtracts the initial investment. You can calculate npv in two ways using. In this tutorial, i will show you different examples of calculating npv in excel. This function requires two main inputs: The discount rate and the series of cash flows. You can calculate npv in two ways using microsoft excel. We’ll use a dataset containing period, monthly cash flow, and discount rate to demonstrate how to calculate npv using two different.Calculate Net Present Value To Decide Between Two Projects In Excel

How to Calculate NPV Present Value) in Excel YouTube

How to Calculate NPV in Excel 9 Steps (with Pictures) wikiHow

How to Calculate NPV in Excel Present Value)

Net Present Value Excel Template

Excel NPV function Exceljet

How to Calculate Net Present Value In Excel Earn and Excel

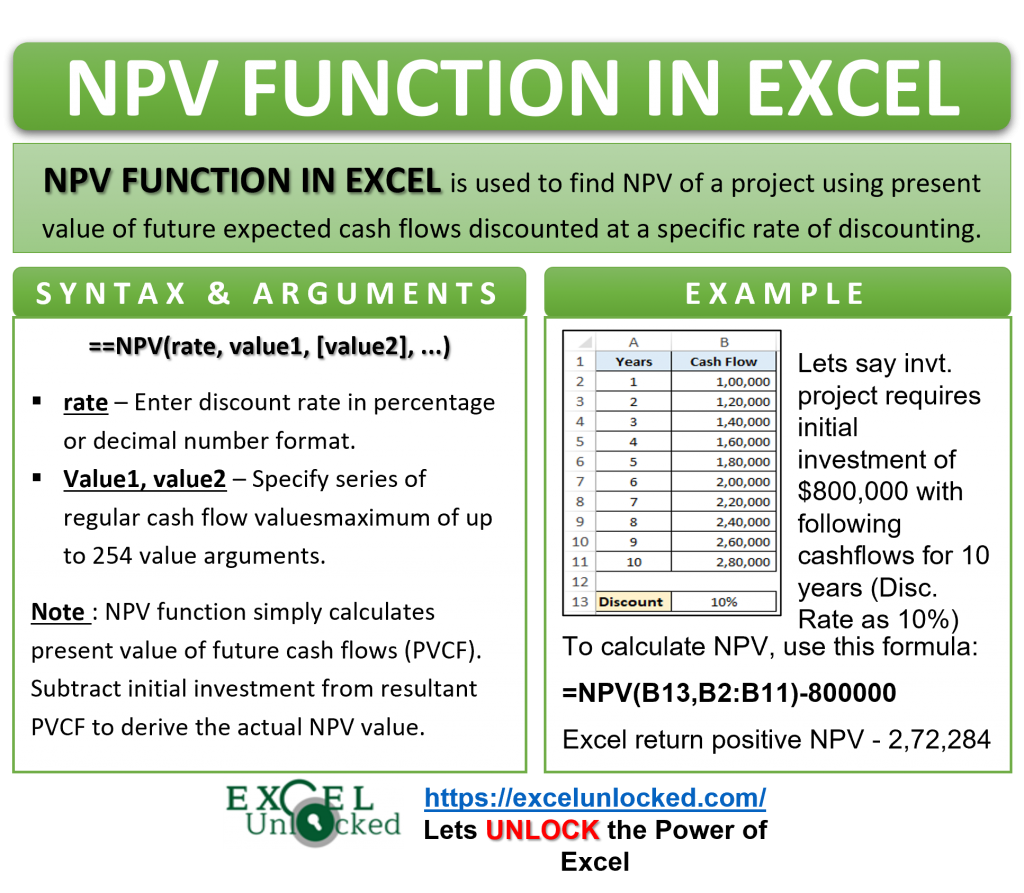

NPV Function How to Calculate NPV in Excel Excel Unlocked

How to Use NPV Function in Excel (3 Easy Examples) ExcelDemy

How to Calculate NPV in Excel 9 Steps (with Pictures) wikiHow

Related Post: