Calculate Beta In Excel

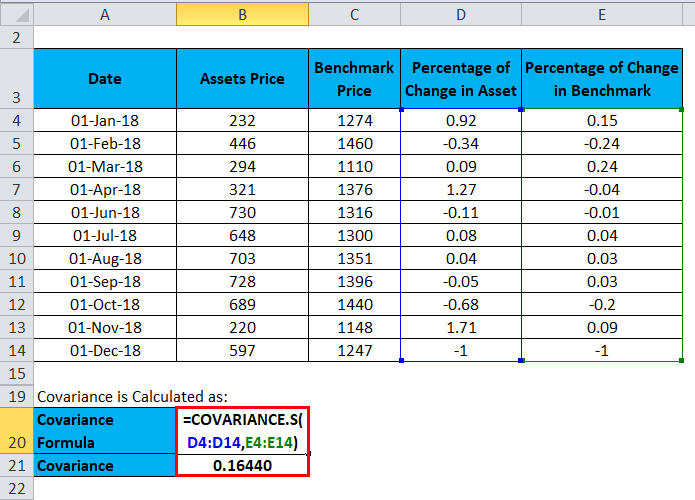

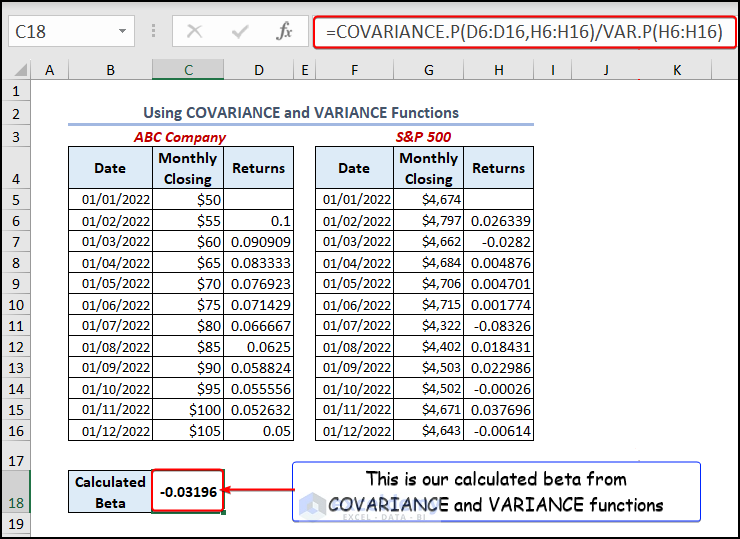

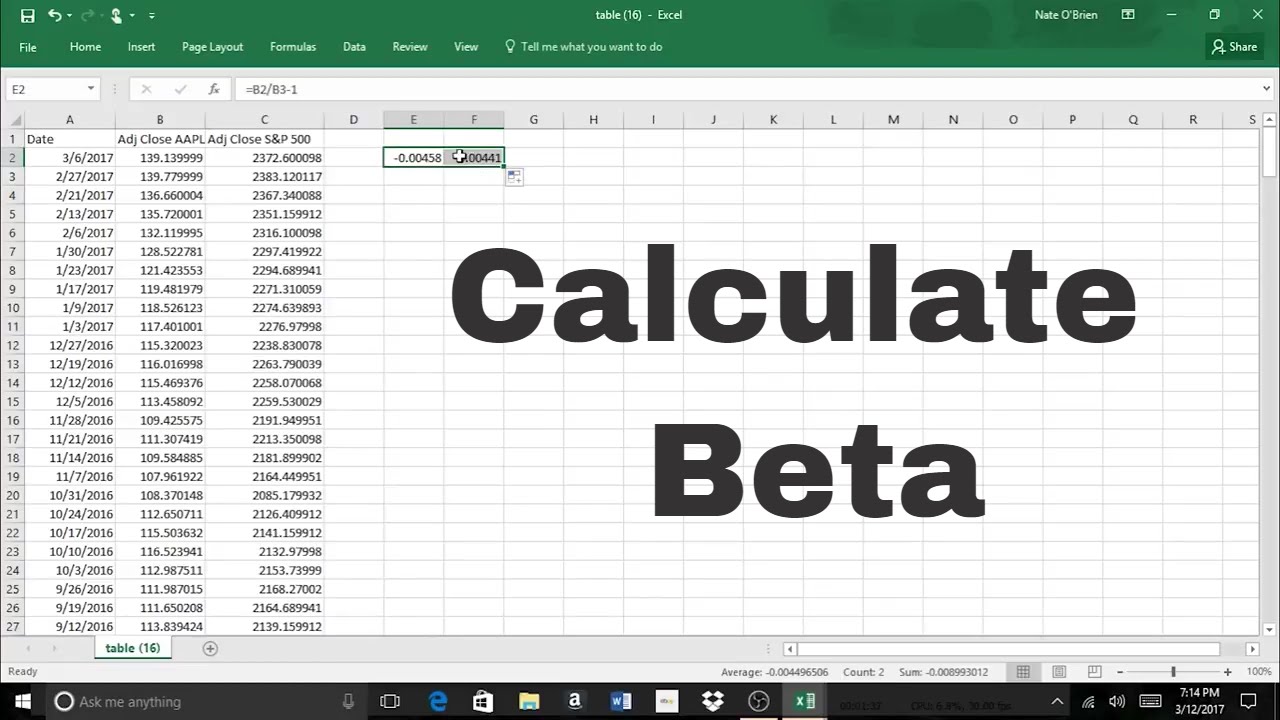

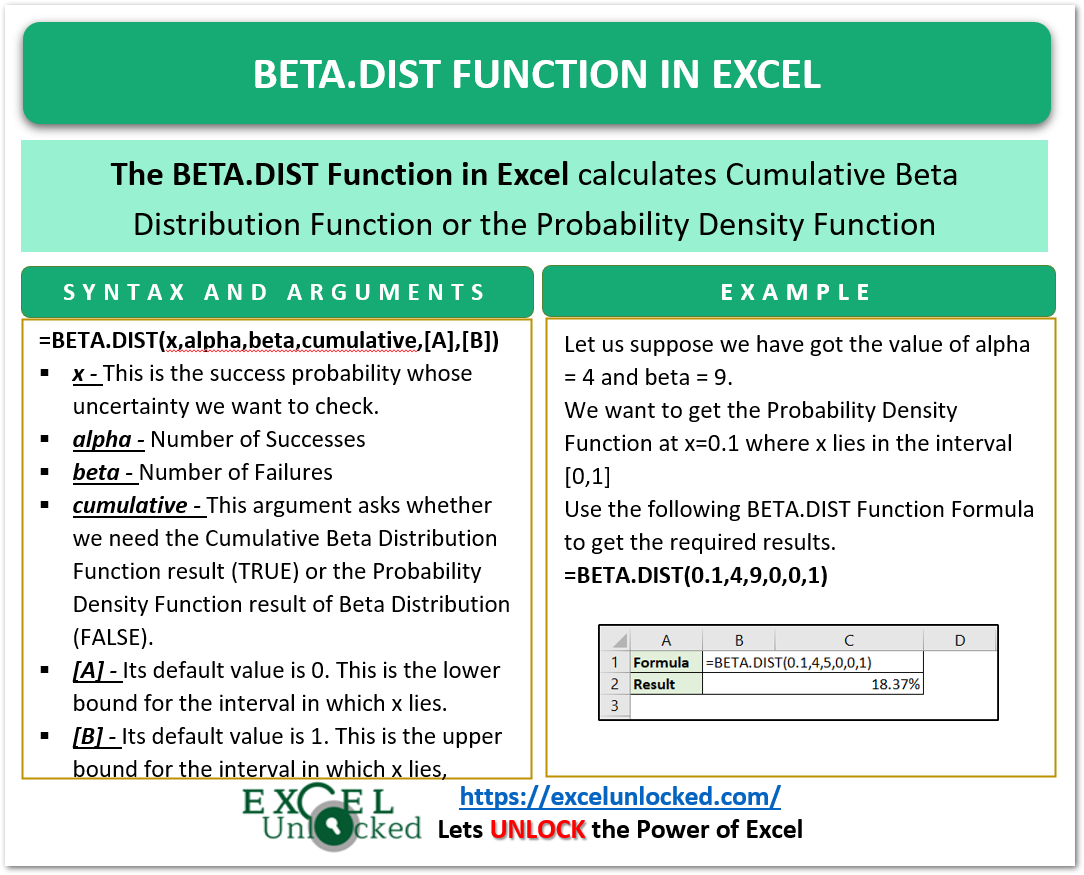

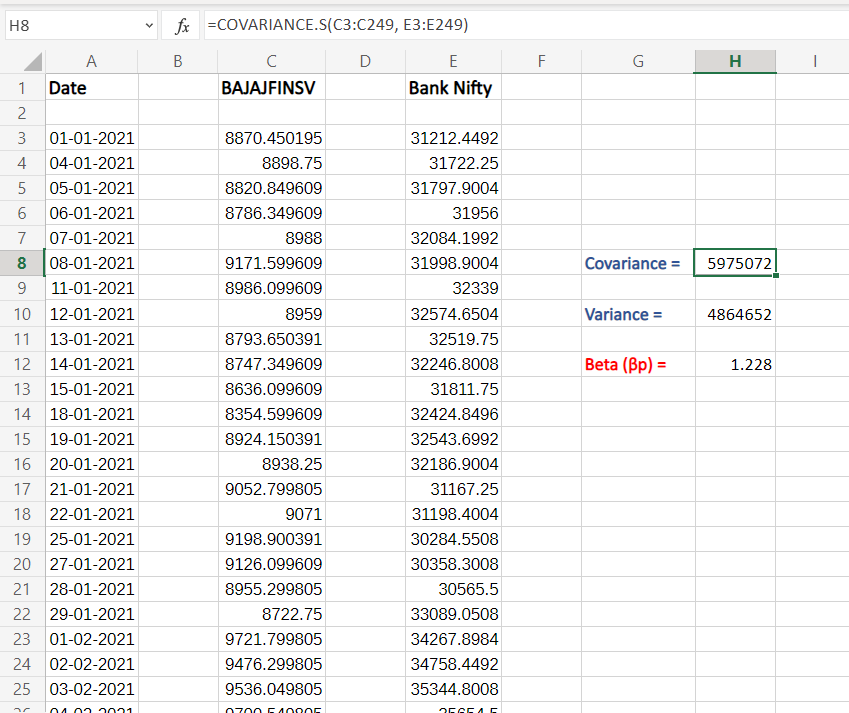

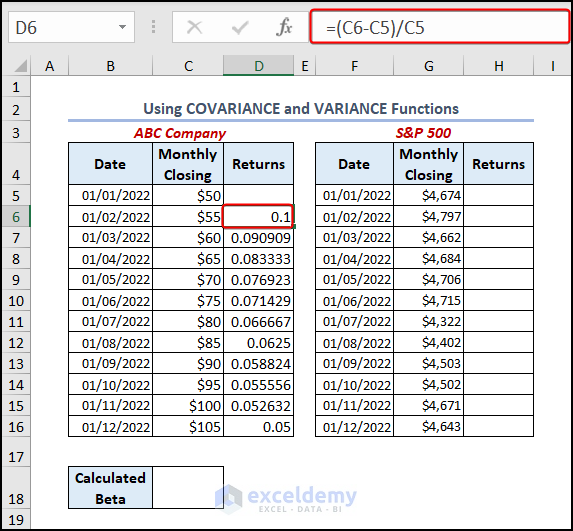

Calculate Beta In Excel - To calculate beta in excel, first retrieve the historical prices for a stock and its benchmark index. Compute the periodic returns, then calculate the covariance between the stock and market. In other words, it quantifies how much a stock’s price tends to. Compare the beta values obtained from financial sources and compute beta using microsoft excel. Here we learn how to calculate beta using top 3 methods along with practical examples and downloadable excel template. (1) obtain historical stock price data for a company (2) obtain historical data for the s&p 500 (3). Unlock the secrets of financial analysis with a comprehensive guide on how to calculate the beta of a stock in excel. Then, we offer four different ways of computing betas in excel (the first. In this tutorial, we’ll show you how to calculate beta in excel. We use the regression, covariance, variance, and slope functions, and vba. (1) obtain historical stock price data for a company (2) obtain historical data for the s&p 500 (3). We use the regression, covariance, variance, and slope functions, and vba. First, we explain the data you need before getting started. Compare the beta values obtained from financial sources and compute beta using microsoft excel. We've discussed 4 different methods to calculate. First, we explain the data you need before getting started. To calculate beta in excel, first retrieve the historical prices for a stock and its benchmark index. Compare the beta values obtained from financial sources and compute beta using microsoft excel. (1) obtain historical stock price data for a company (2) obtain historical data for the s&p 500 (3). In. Learn how to calculate beta using microsoft excel. We use the regression, covariance, variance, and slope functions, and vba. Then, we offer four different ways of computing betas in excel (the first. Here we learn how to calculate beta using top 3 methods along with practical examples and downloadable excel template. Unlock the secrets of financial analysis with a comprehensive. You can calculate the beta of a stock in microsoft excel by following these steps: First, we explain the data you need before getting started. Compare the beta values obtained from financial sources and compute beta using microsoft excel. Then, we offer four different ways of computing betas in excel (the first. In this tutorial, we’ll show you how to. In other words, it quantifies how much a stock’s price tends to. In this tutorial, we’ll show you how to calculate beta in excel. Beta (β) is a metric that measures the volatility, or systematic risk, of a stock’s returns compared to the market’s overall returns. Then, we offer four different ways of computing betas in excel (the first. We've. We use the regression, covariance, variance, and slope functions, and vba. (1) obtain historical stock price data for a company (2) obtain historical data for the s&p 500 (3). In other words, it quantifies how much a stock’s price tends to. Compare the beta values obtained from financial sources and compute beta using microsoft excel. To calculate beta in excel,. Beta (β) is a metric that measures the volatility, or systematic risk, of a stock’s returns compared to the market’s overall returns. (1) obtain historical stock price data for a company (2) obtain historical data for the s&p 500 (3). First, we explain the data you need before getting started. You can calculate the beta of a stock in microsoft. Compare the beta values obtained from financial sources and compute beta using microsoft excel. To calculate beta in excel, first retrieve the historical prices for a stock and its benchmark index. You can calculate the beta of a stock in microsoft excel by following these steps: Learn how to calculate beta using microsoft excel. Unlock the secrets of financial analysis. Beta (β) is a metric that measures the volatility, or systematic risk, of a stock’s returns compared to the market’s overall returns. To calculate beta in excel, first retrieve the historical prices for a stock and its benchmark index. We've discussed 4 different methods to calculate beta in excel. Unlock the secrets of financial analysis with a comprehensive guide on. We've discussed 4 different methods to calculate beta in excel. Learn how to calculate beta using microsoft excel. (1) obtain historical stock price data for a company (2) obtain historical data for the s&p 500 (3). Unlock the secrets of financial analysis with a comprehensive guide on how to calculate the beta of a stock in excel. You can calculate.Beta Formula Calculator for Beta Formula (With Excel template)

How to Calculate Beta in Excel 4 Easy Methods ExcelDemy

How to Calculate Beta in Excel for Investment Analysis

Unlevered Beta Formula Calculator Examples With Excel

Calculate The Beta Of A Portfolio In Excel The Excel Hub YouTube

Calculate Beta of a Portfolio in Excel by Paul Borosky, MBA. YouTube

How to Calculate Beta in Excel A Comprehensive Guide Earn and Excel

How to Calculate Beta Value for a Stock in Excel QuickExcel

How to Calculate Beta in Excel 4 Easy Methods ExcelDemy

How To Calculate Beta on Excel Using Linear Regression Analysis Tool

Related Post: