Bond Pricing In Excel

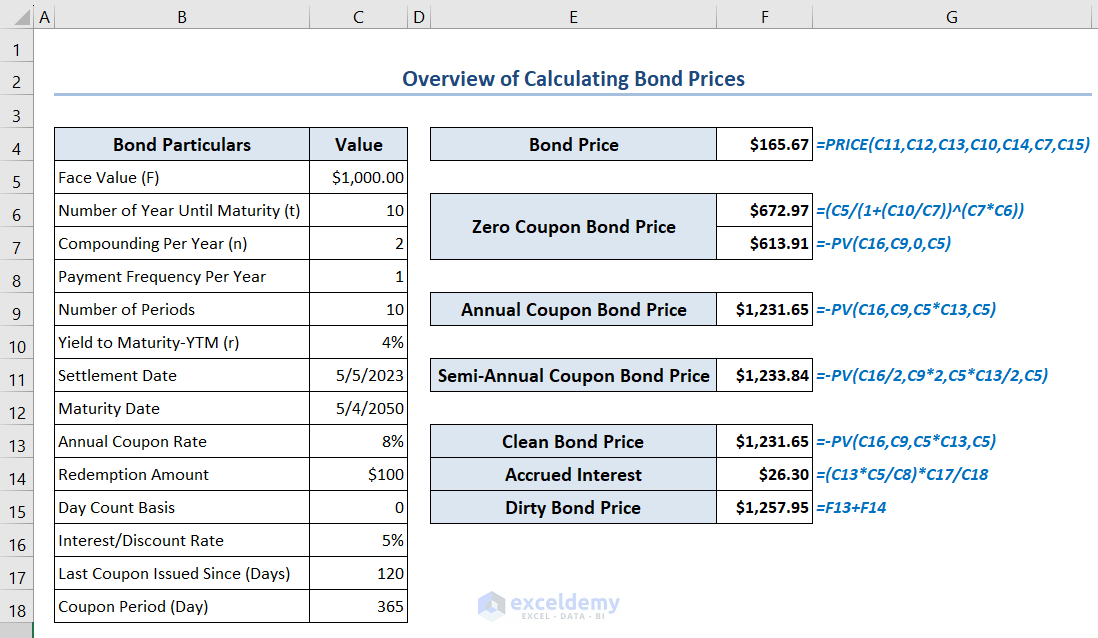

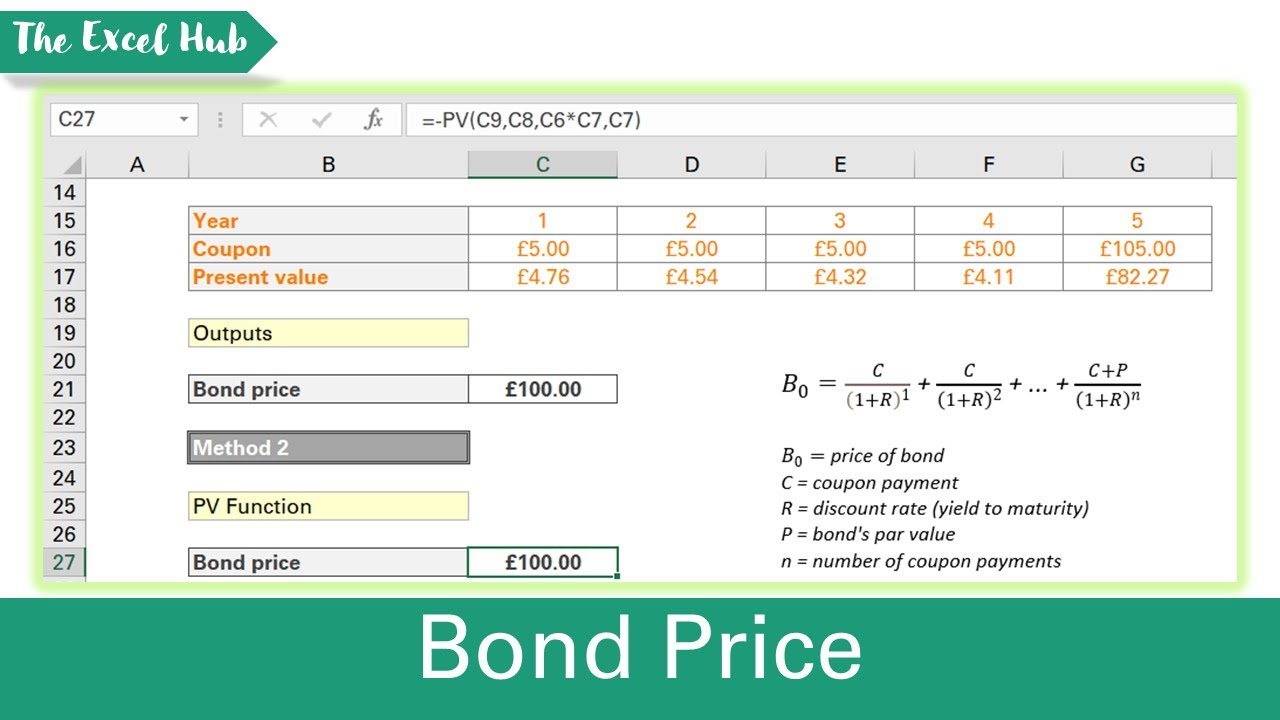

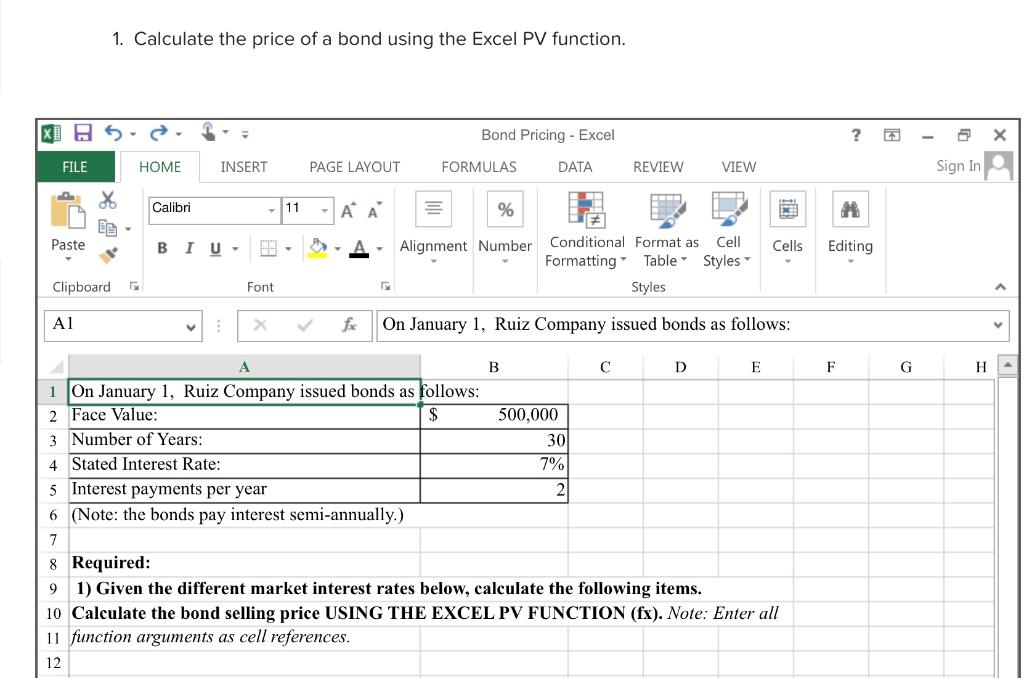

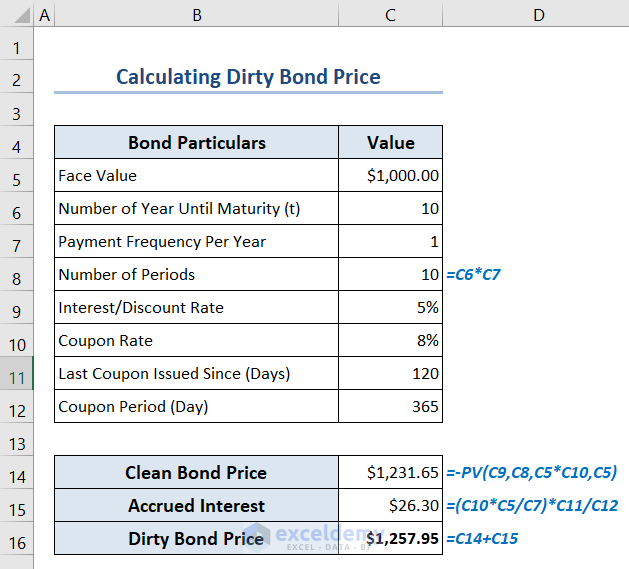

Bond Pricing In Excel - We discuss different bonds and ways to calculate the bond price in excel using fv and price function along with conventional bond formulas. This practice allows a bond price to be quoted without also having to state its face value, and it makes price quotes comparable across different bonds regardless of their face value. Type the column heading and data labels. It will calculate the price of a bond per $100 face value that pays a periodic interest rate. The price function is categorized under excel financial functions. To determine the value of a bond today—for a fixed principal (par value) to be repaid in the future—we can use an excel spreadsheet. Grasping these fundamentals provides a solid base for understanding how to calculate the price of a bond in excel and utilizing excel functions to determine bond values. Use the price function to calculate the price of a bond or similar security. This guide will cover the theoretical aspects of bond valuation, explain the key inputs required, and provide examples of how you can implement bond valuation in excel. Master advanced bond pricing and analysis techniques using excel, including yield calculations, duration, convexity, and scenario analysis. Master advanced bond pricing and analysis techniques using excel, including yield calculations, duration, convexity, and scenario analysis. Type the column heading and data labels. The price function is categorized under excel financial functions. This article introduces multiple practical solutions for. This practice allows a bond price to be quoted without also having to state its face value, and it makes. This guide will cover the theoretical aspects of bond valuation, explain the key inputs required, and provide examples of how you can implement bond valuation in excel. Grasping these fundamentals provides a solid base for understanding how to calculate the price of a bond in excel and utilizing excel functions to determine bond values. It will calculate the price of. We discuss different bonds and ways to calculate the bond price in excel using fv and price function along with conventional bond formulas. This article introduces multiple practical solutions for. Use the price function to calculate the price of a bond or similar security. The price function is categorized under excel financial functions. Type the column heading and data labels. To determine the value of a bond today—for a fixed principal (par value) to be repaid in the future—we can use an excel spreadsheet. This guide will cover the theoretical aspects of bond valuation, explain the key inputs required, and provide examples of how you can implement bond valuation in excel. Master advanced bond pricing and analysis techniques using excel,. The price function is categorized under excel financial functions. Grasping these fundamentals provides a solid base for understanding how to calculate the price of a bond in excel and utilizing excel functions to determine bond values. This article introduces multiple practical solutions for. To determine the value of a bond today—for a fixed principal (par value) to be repaid in. This article introduces multiple practical solutions for. Grasping these fundamentals provides a solid base for understanding how to calculate the price of a bond in excel and utilizing excel functions to determine bond values. We discuss different bonds and ways to calculate the bond price in excel using fv and price function along with conventional bond formulas. To determine the. The price function is categorized under excel financial functions. It will calculate the price of a bond per $100 face value that pays a periodic interest rate. We discuss different bonds and ways to calculate the bond price in excel using fv and price function along with conventional bond formulas. This article introduces multiple practical solutions for. Grasping these fundamentals. Type the column heading and data labels. This practice allows a bond price to be quoted without also having to state its face value, and it makes price quotes comparable across different bonds regardless of their face value. We discuss different bonds and ways to calculate the bond price in excel using fv and price function along with conventional bond. Type the column heading and data labels. Master advanced bond pricing and analysis techniques using excel, including yield calculations, duration, convexity, and scenario analysis. We discuss different bonds and ways to calculate the bond price in excel using fv and price function along with conventional bond formulas. This practice allows a bond price to be quoted without also having to. This guide will cover the theoretical aspects of bond valuation, explain the key inputs required, and provide examples of how you can implement bond valuation in excel. We discuss different bonds and ways to calculate the bond price in excel using fv and price function along with conventional bond formulas. Master advanced bond pricing and analysis techniques using excel, including.How to Use Bond Price Calculator in Excel? (A Complete Guide) ExcelDemy

How To Calculate The Price Of A Bond In Excel YouTube

Solved 1. Calculate the price of a bond using the Excel PV

How to Use Bond Price Calculator in Excel? (A Complete Guide) ExcelDemy

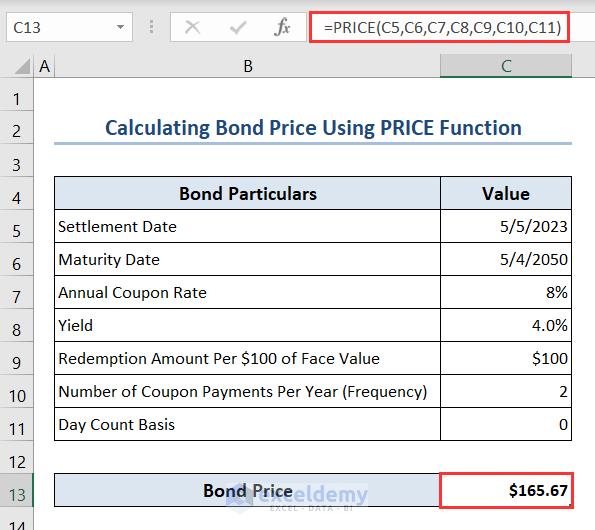

How to Calculate Bond Price in Excel (4 Simple Ways) ExcelDemy

PRICE Function In Excel Formula, Examples, How to Use?

Bond Price Using Excel 11110

How to Calculate Bond Price in Excel (4 Simple Ways) ExcelDemy

How to Use Bond Price Calculator in Excel? (A Complete Guide) ExcelDemy

Bonds, Bond Valuation, and Interest Rates ppt download

Related Post: