Apr Calculator In Excel

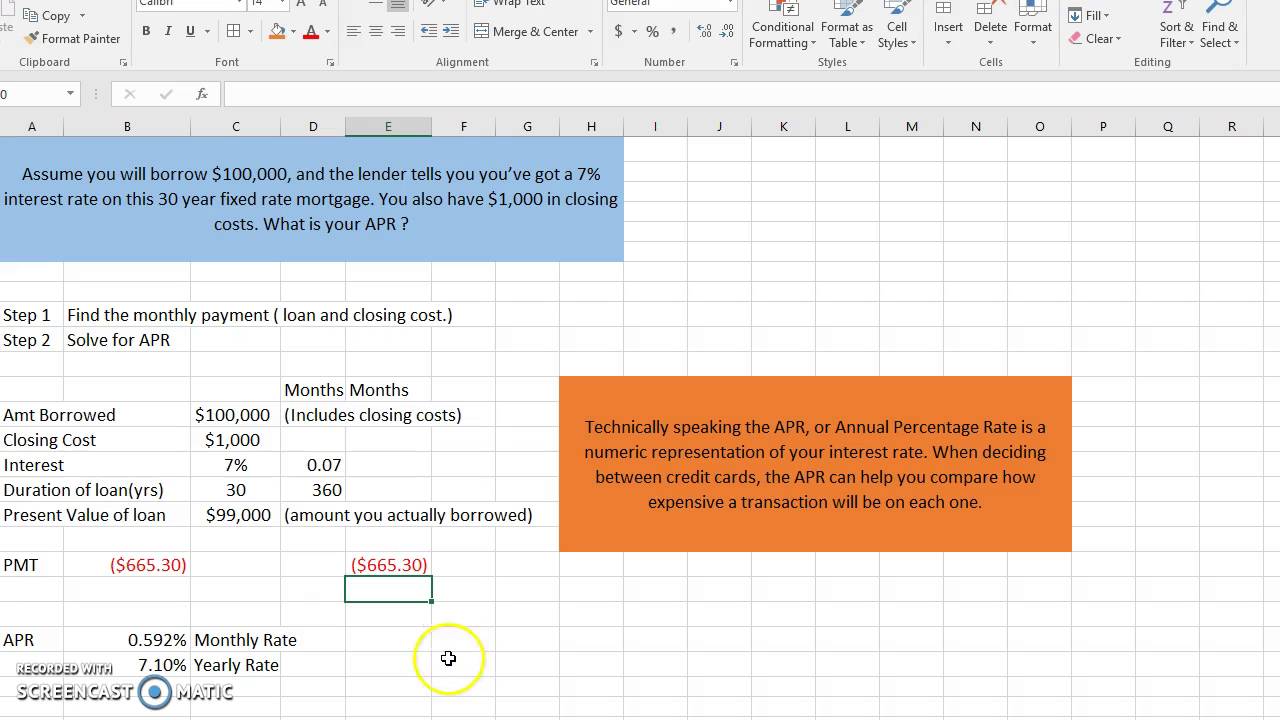

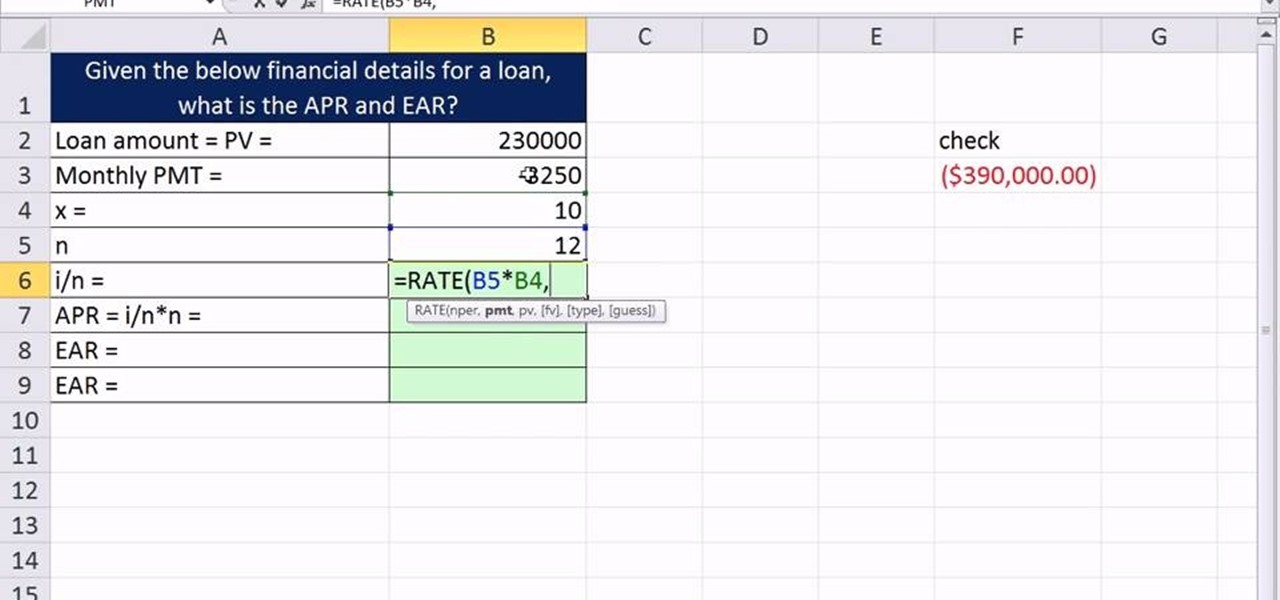

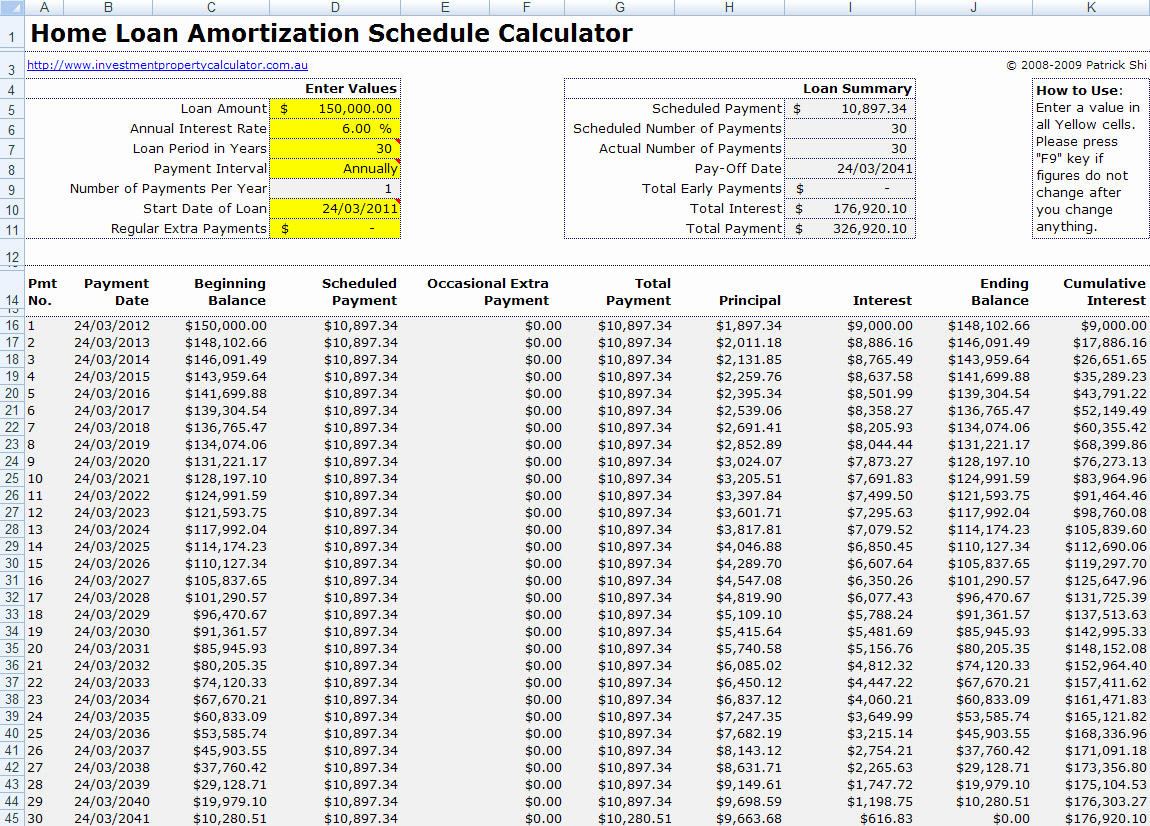

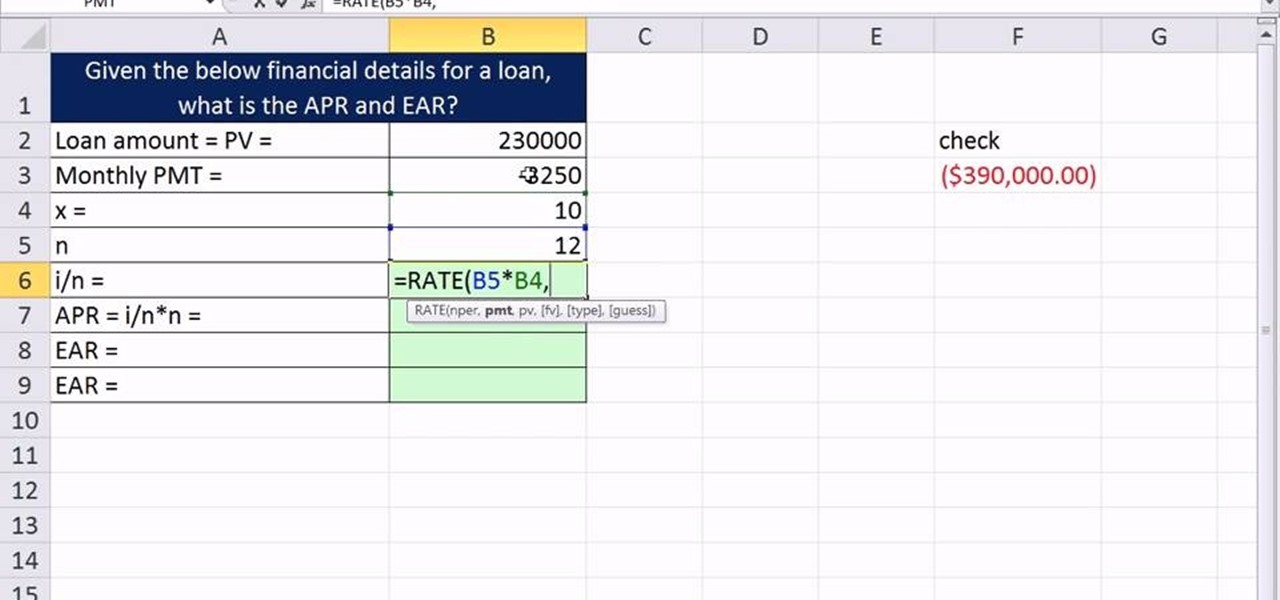

Apr Calculator In Excel - A loan’s interest rate is the cost you pay to the lender for borrowing money. Learn what apr (annual percentage rate) is, how it’s calculated, and how to compare rates across loans and lenders. Apr helps you compare mortgage offers. As you shop around for financing, it's important to understand. What is the difference between a loan interest rate and the apr? Aprs are everywhere, from car financing to credit card offers. Annual percentage rate (apr) is a number that represents the total cost of borrowing money from a lender. Annual percentage rate (apr) is the rate of interest charged on borrowing or earned through investing, expressed as a yearly rate. When you don't pay your credit card balance in full each month, your card issuer charges interest on your carried balance. [3] in some areas, the annual percentage rate (apr) is. Free calculator to find out the real apr of a loan, considering all the fees and extra charges. A loan’s interest rate is the cost you pay to the lender for borrowing money. Mortgage apr reflects the interest rate plus the fees charged by the lender. The effective apr is the fee+ compound interest rate (calculated across a year). [3]. Apr is an interest rate that represents your annual borrowing costs for a loan or line of credit. Mortgage apr reflects the interest rate plus the fees charged by the lender. When you don't pay your credit card balance in full each month, your card issuer charges interest on your carried balance. Founded in 1997, apr is the global leader. [3] in some areas, the annual percentage rate (apr) is. Free calculator to find out the real apr of a loan, considering all the fees and extra charges. Aprs are everywhere, from car financing to credit card offers. Apr helps you compare mortgage offers. There is also a version specially designed for mortgage loans. Annual percentage rate (apr) is the rate of interest charged on borrowing or earned through investing, expressed as a yearly rate. There is also a version specially designed for mortgage loans. A loan’s interest rate is the cost you pay to the lender for borrowing money. Mortgage apr reflects the interest rate plus the fees charged by the lender. Founded. There is also a version specially designed for mortgage loans. Founded in 1997, apr is the global leader in performance aftermarket products for volkswagen, audi, seat, skoda, porsche, and other vehicles. A loan’s interest rate is the cost you pay to the lender for borrowing money. As you shop around for financing, it's important to understand. What is the difference. It is typically used to compare different. The effective apr is the fee+ compound interest rate (calculated across a year). As you shop around for financing, it's important to understand. Aprs are everywhere, from car financing to credit card offers. Apr is an interest rate that represents your annual borrowing costs for a loan or line of credit. Annual percentage rate (apr) is the rate of interest charged on borrowing or earned through investing, expressed as a yearly rate. Apr is an interest rate that represents your annual borrowing costs for a loan or line of credit. It is typically used to compare different. Mortgage apr reflects the interest rate plus the fees charged by the lender. What. What is the difference between a loan interest rate and the apr? Apr helps you compare mortgage offers. Mortgage apr reflects the interest rate plus the fees charged by the lender. Apr is an interest rate that represents your annual borrowing costs for a loan or line of credit. Learn what apr (annual percentage rate) is, how it’s calculated, and. Learn what apr (annual percentage rate) is, how it’s calculated, and how to compare rates across loans and lenders. Founded in 1997, apr is the global leader in performance aftermarket products for volkswagen, audi, seat, skoda, porsche, and other vehicles. Annual percentage rate (apr) is the rate of interest charged on borrowing or earned through investing, expressed as a yearly. Aprs are everywhere, from car financing to credit card offers. Apr helps you compare mortgage offers. It is typically used to compare different. When you don't pay your credit card balance in full each month, your card issuer charges interest on your carried balance. Annual percentage rate (apr) is a number that represents the total cost of borrowing money from.Excel Mortgage Payment and APR Spreadsheet Etsy

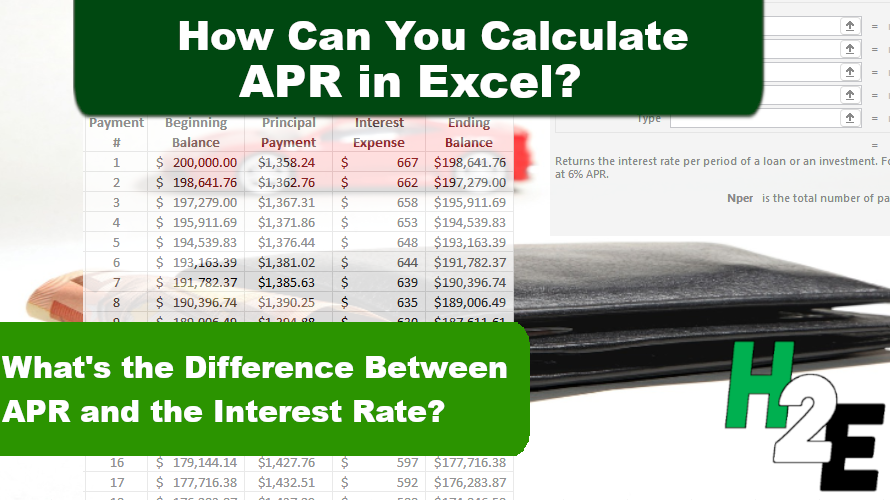

How to calculate APR using Excel YouTube

How to Calculate APR in Excel (3 Simple Methods) ExcelDemy

Free Apr Calculator Templates For Google Sheets And Microsoft Excel

How to Calculate APR in Excel (3 Simple Methods) ExcelDemy

How to Calculate APR and EAR given cash flows from annuity in Excel

How to Calculate APR in Excel Earn and Excel

Mortgage Excel Spreadsheet inside Mortgage Apr Calculator Excel

How to Calculate APR and EAR given cash flows from annuity in Excel

How to Calculate APR in Excel

Related Post: