Annuity In Excel

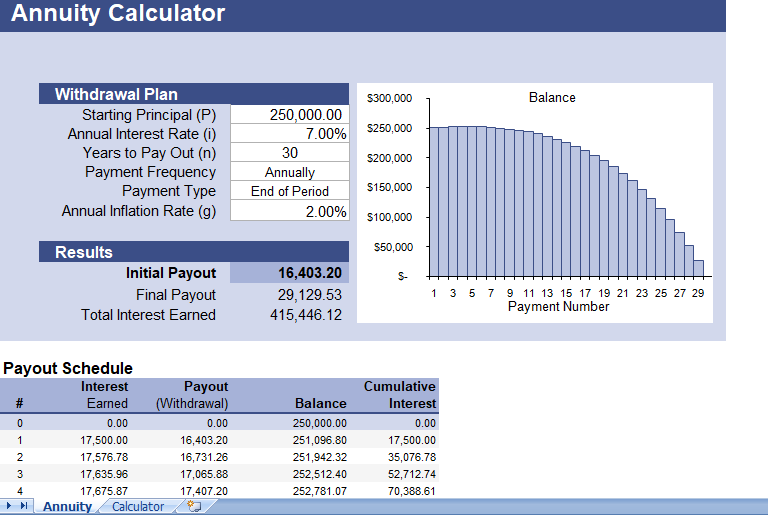

Annuity In Excel - An annuity is a contract between you and an insurance company to cover specific goals, such as principal protection, lifetime income, legacy planning. Many also have investment components that can potentially increase. The ultimate goal of an annuity is to give you a steady stream of income throughout your retirement, which sounds great at first. An annuity is a contract with an insurance company that converts your savings into steady, predictable income. Sold by financial services companies, annuities can help reinforce your. If you’re asking, “what is an annuity?” you are looking for a way to add security and predictability to your financial future. An annuity is a contract purchased from an insurance company with a large lump sum in return for regular payments, commonly used as an income source in retirement. An annuity is an insurance contract that exchanges present contributions for future income payments. Many retirees turn to annuities to protect their lifestyle in. An annuity is a contract with an insurance company. The ultimate goal of an annuity is to give you a steady stream of income throughout your retirement, which sounds great at first. An annuity is a contract purchased from an insurance company with a large lump sum in return for regular payments, commonly used as an income source in retirement. Annuities are simple — and complicated. Here are five. But are annuities really the best way to secure a. At its most basic level, an annuity is a contract between you and an insurance company that shifts a portion of risk away from you and onto the company. Many also have investment components that can potentially increase. The ultimate goal of an annuity is to give you a steady. Many also have investment components that can potentially increase. The ultimate goal of an annuity is to give you a steady stream of income throughout your retirement, which sounds great at first. Annuities are simple — and complicated. Annuities are insurance products designed to provide you with regular income—often for life. Here are five things you need to know if. Many also have investment components that can potentially increase. But are annuities really the best way to secure a. Here are five things you need to know if you’re considering an annuity. At its most basic level, an annuity is a contract between you and an insurance company that shifts a portion of risk away from you and onto the. An annuity is a contract with an insurance company. An annuity is a contract with an insurance company that converts your savings into steady, predictable income. Annuities are insurance products designed to provide you with regular income—often for life. If you’re asking, “what is an annuity?” you are looking for a way to add security and predictability to your financial. In the most basic annuity type, income annuities, you give the insurance company a pool of your money, and they send. An annuity is a contract between you and an insurance company to cover specific goals, such as principal protection, lifetime income, legacy planning. If you’re asking, “what is an annuity?” you are looking for a way to add security. An annuity is a contract with an insurance company. An annuity is a contract purchased from an insurance company with a large lump sum in return for regular payments, commonly used as an income source in retirement. If you’re asking, “what is an annuity?” you are looking for a way to add security and predictability to your financial future. An. This powerful insurance contract is designed to do exactly that: Sold by financial services companies, annuities can help reinforce your. The ultimate goal of an annuity is to give you a steady stream of income throughout your retirement, which sounds great at first. An annuity is a contract with an insurance company. An annuity is a contract between you and. If you’re asking, “what is an annuity?” you are looking for a way to add security and predictability to your financial future. Annuities are insurance products designed to provide you with regular income—often for life. An annuity is an insurance contract that exchanges present contributions for future income payments. Annuities are simple — and complicated. But are annuities really the. An annuity is a contract with an insurance company that converts your savings into steady, predictable income. At its most basic level, an annuity is a contract between you and an insurance company that shifts a portion of risk away from you and onto the company. An annuity is a contract with an insurance company. An annuity is a contract.Annuity Calculator Tool in excel template with data analysis for free

Future value of annuity Excel formula Exceljet

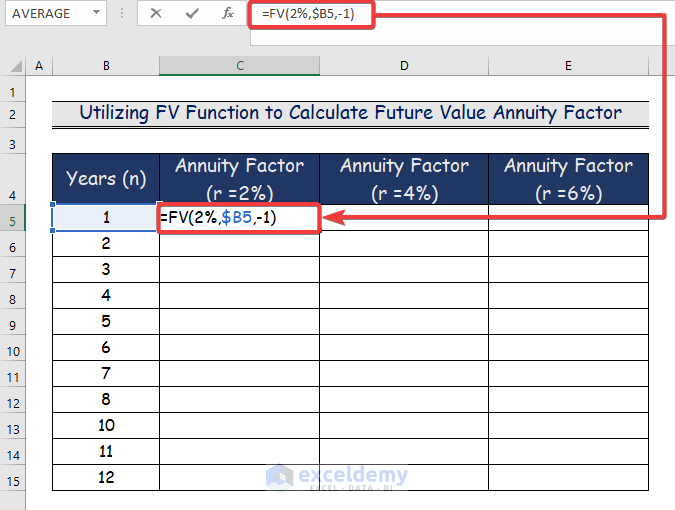

How to Calculate Annuity Factor in Excel (2 Ways) ExcelDemy

How to Calculate Annuity Factor in Excel (2 Ways) ExcelDemy

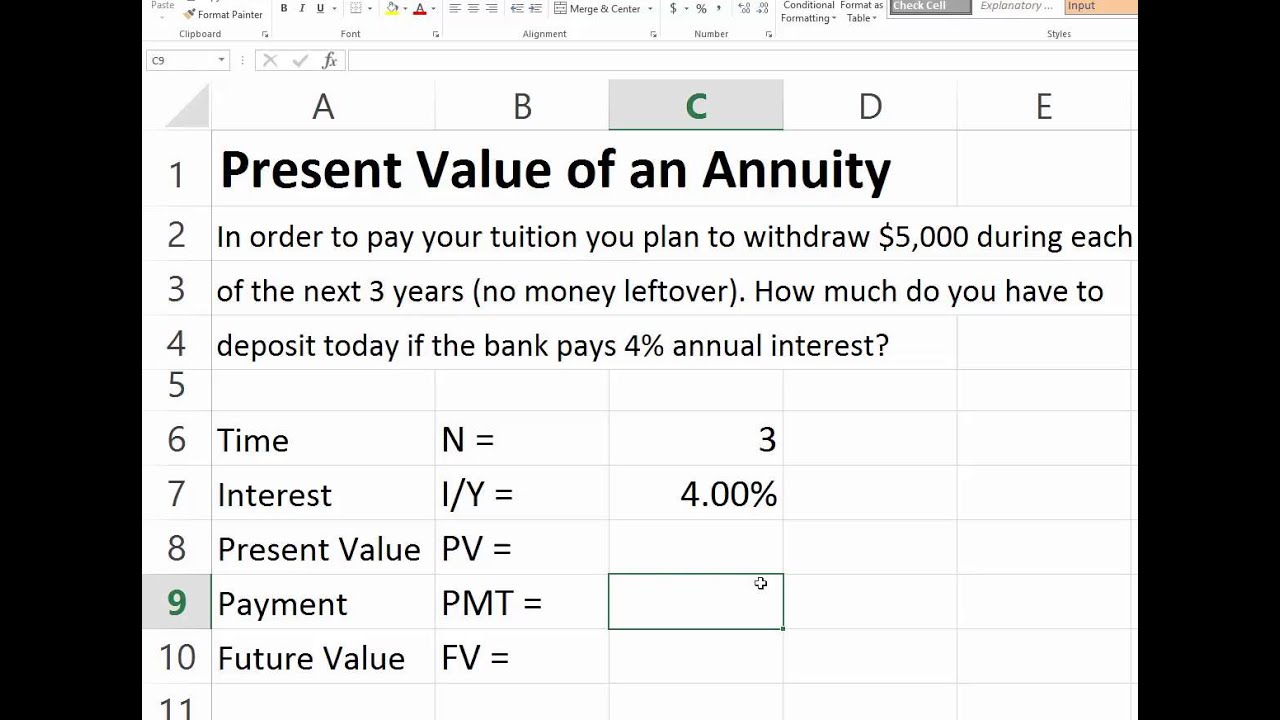

Present Value of Ordinary Annuity in Excel YouTube

Calculate periods for annuity Excel formula Exceljet

How to Calculate Growing Annuity in Excel (2 Easy Ways)

How to Calculate Annuity Factor in Excel (2 Ways) ExcelDemy

How to Calculate Growing Annuity in Excel (2 Easy Ways)

How to Calculate Growing Annuity in Excel (2 Easy Ways)

Related Post: