Amortization In Excel Formula

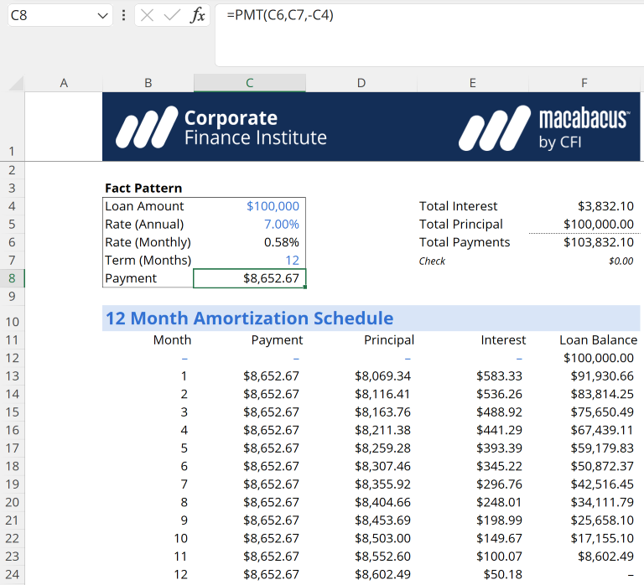

Amortization In Excel Formula - Amortization is the process of incrementally charging the cost of an asset to expense over its expected period of use. Use this amortization schedule calculator to estimate your monthly loan or mortgage repayments, and check a free amortization chart. Amortization is paying off a debt over time in equal installments. The loan is paid off at the end of the term. What is amortization in accounting? Amortization is the practice of spreading an intangible asset's cost over that asset's useful life. Part of each payment goes toward the loan principal, and part goes toward interest. Depreciation involves expensing a fixed asset as it's used to reflect its anticipated. Mortgage amortization is the process by which your equal monthly payments gradually pay off the principal and interest. It aims to allocate costs fairly, accurately, and systematically. Part of each payment goes toward the loan principal, and part goes toward interest. This amortization calculator returns monthly payment amounts as well as displays a schedule, graph, and pie chart breakdown of an amortized loan. Amortization is the practice of spreading an intangible asset's cost over that asset's useful life. A portion of each installment covers interest and the. This amortization calculator returns monthly payment amounts as well as displays a schedule, graph, and pie chart breakdown of an amortized loan. Mortgage amortization is the process by which your equal monthly payments gradually pay off the principal and interest. What is amortization in accounting? Learn more about how it works. Amortization involves paying down a loan with a series. Part of each payment goes toward the loan principal, and part goes toward interest. Mortgage amortization is the process by which your equal monthly payments gradually pay off the principal and interest. Depreciation involves expensing a fixed asset as it's used to reflect its anticipated. This method allows for the gradual reduction. What is amortization in accounting? Amortization is paying off a debt over time in equal installments. The loan is paid off at the end of the term. Use this amortization schedule calculator to estimate your monthly loan or mortgage repayments, and check a free amortization chart. Learn more about how it works. Mortgage amortization is the process by which your equal monthly payments gradually pay. The loan is paid off at the end of the term. This amortization calculator returns monthly payment amounts as well as displays a schedule, graph, and pie chart breakdown of an amortized loan. A portion of each installment covers interest and the remaining portion goes toward. Part of each payment goes toward the loan principal, and part goes toward interest.. Amortization is paying off a debt over time in equal installments. Depreciation involves expensing a fixed asset as it's used to reflect its anticipated. Amortization involves paying down a loan with a series of fixed payments. Amortization is the process of incrementally charging the cost of an asset to expense over its expected period of use. This method allows for. Mortgage amortization is the process by which your equal monthly payments gradually pay off the principal and interest. Amortization is paying off a debt over time in equal installments. The loan is paid off at the end of the term. It aims to allocate costs fairly, accurately, and systematically. Amortization is a fundamental financial and accounting process that systematically spreads. Learn more about how it works. This method allows for the gradual reduction. Amortization is the practice of spreading an intangible asset's cost over that asset's useful life. A portion of each installment covers interest and the remaining portion goes toward. The loan is paid off at the end of the term. This amortization calculator returns monthly payment amounts as well as displays a schedule, graph, and pie chart breakdown of an amortized loan. Amortization involves paying down a loan with a series of fixed payments. Learn more about how it works. Part of each payment goes toward the loan principal, and part goes toward interest. Mortgage amortization is the process by. Learn more about how it works. Mortgage amortization is the process by which your equal monthly payments gradually pay off the principal and interest. Part of each payment goes toward the loan principal, and part goes toward interest. This method allows for the gradual reduction. Use this amortization schedule calculator to estimate your monthly loan or mortgage repayments, and check.Amortization Formula Calculator (With Excel template)

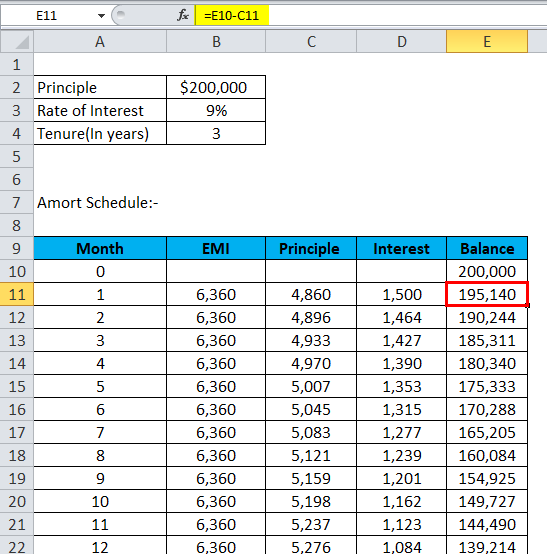

Amortization Table Excel Matttroy

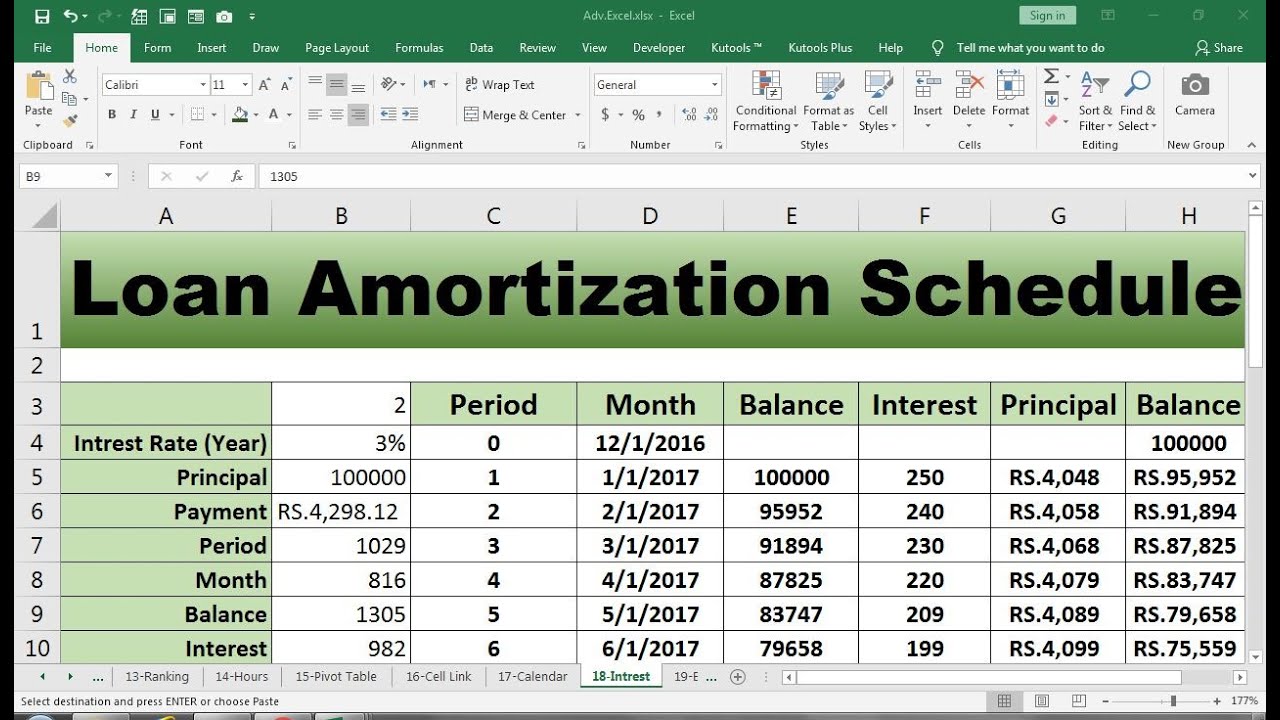

loan amortization schedule excel YouTube

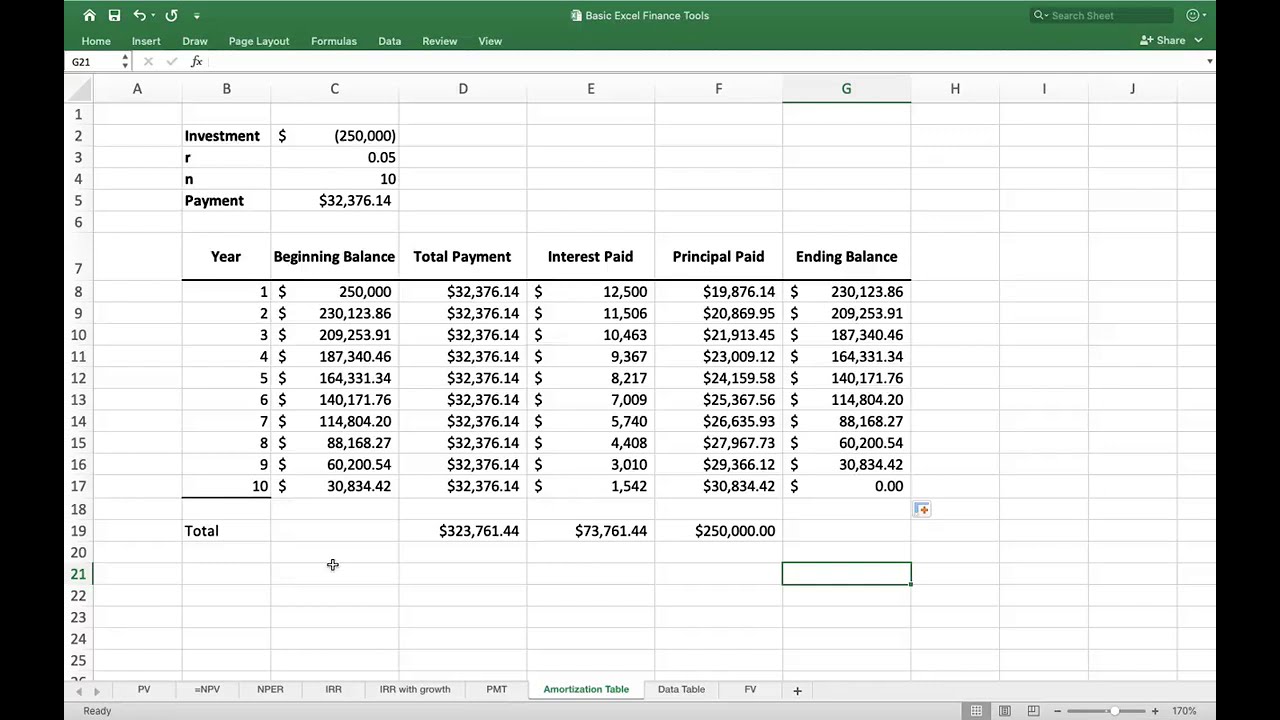

How to Use Excel to Calculate Amortization

How to Prepare Amortization Schedule in Excel 10 Steps

Loan Amortization Schedule Excel at Natalie Hawes blog

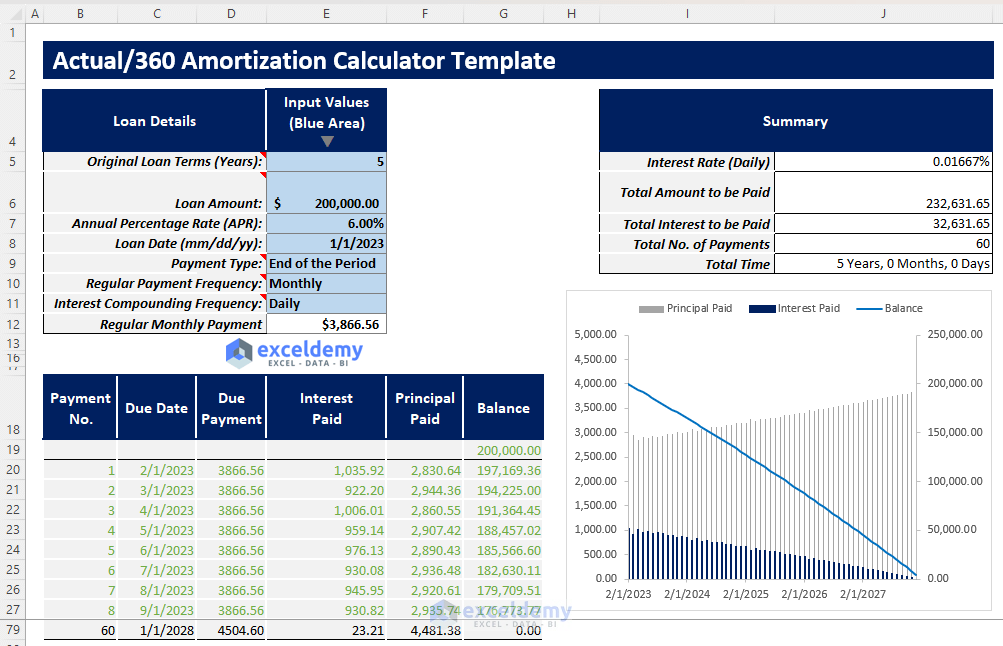

Excel Actual/360 Amortization Calculator Template [Free Download

Create a loan amortization schedule in Excel (with extra payments if

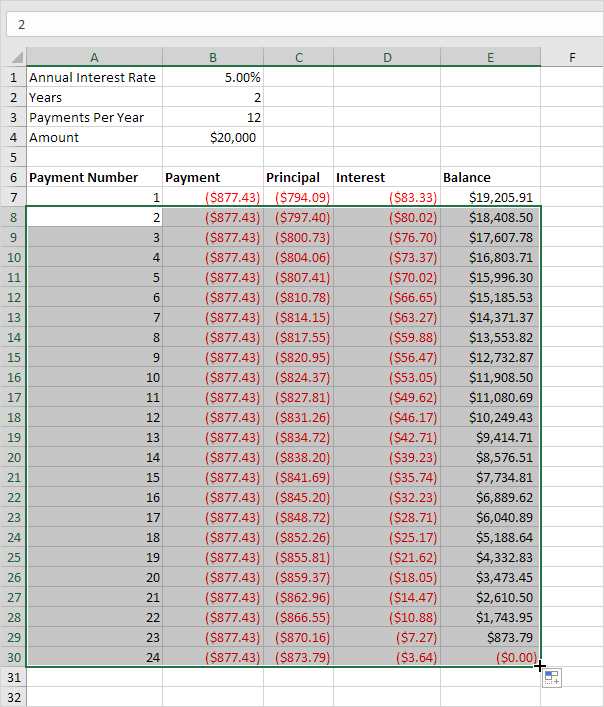

Loan Amortization Schedule in Excel Step by Step Tutorial

Loan Amortization Table With Extra Payments Excel Matttroy

Related Post: