Accrual To Cash Conversion Excel Worksheet

Accrual To Cash Conversion Excel Worksheet - In financial accounting, accruals refer to the recording of revenues a company has earned but has yet to receive payment for, and expenses that have been incurred but the company has yet to. The meaning of accrual is the action or process of accruing something. An accrual represents revenues earned or expenses incurred that are recorded in the financial statements before cash is received or paid. Accruals involve the following types of business. How to use accrual in a sentence. Accrual accounting is preferred by ifrs and gaap. Accruals are transactions incurred that impact a company's net income even though cash hasn't yet changed hands. It ensures transactions are recognized in the. In accounting and finance, an accrual is an asset or liability that represents revenue or expenses that are receivable or payable but which have not yet been paid. Accrual accounting tracks money when you earn or owe it, not when it actually moves. The accounting and bookkeeping term accruals refers to adjustments that must be made before a company’s financial statements are issued. Accruals involve the following types of business. It ensures transactions are recognized in the. Accruals are transactions incurred that impact a company's net income even though cash hasn't yet changed hands. Accrual accounting is a method of accounting where revenues. Accruals in accounting refer to revenues a company has earned or expenses it has incurred within a specific accounting period, even if no cash has been received or paid yet. The meaning of accrual is the action or process of accruing something. Accruals are transactions incurred that impact a company's net income even though cash hasn't yet changed hands. Accruals. Accrual accounting is a method of accounting where revenues and expenses are recorded when they are earned or incurred, not necessarily when cash is received or paid. Accrual accounting is preferred by ifrs and gaap. Accruals involve the following types of business. In financial accounting, accruals refer to the recording of revenues a company has earned but has yet to. How to use accrual in a sentence. Accrual accounting is a method of accounting where revenues and expenses are recorded when they are earned or incurred, not necessarily when cash is received or paid. In accounting and finance, an accrual is an asset or liability that represents revenue or expenses that are receivable or payable but which have not yet. Accrual accounting is preferred by ifrs and gaap. An accrual allows a business to record expenses and revenues for which it expects to expend cash or receive cash, respectively, in a future period. Accrual accounting tracks money when you earn or owe it, not when it actually moves. It ensures transactions are recognized in the. An accrual represents revenues earned. Accrual accounting tracks money when you earn or owe it, not when it actually moves. Accrual accounting is a method of accounting where revenues and expenses are recorded when they are earned or incurred, not necessarily when cash is received or paid. The meaning of accrual is the action or process of accruing something. In financial accounting, accruals refer to. Accrual accounting is a method of accounting where revenues and expenses are recorded when they are earned or incurred, not necessarily when cash is received or paid. Accruals are transactions incurred that impact a company's net income even though cash hasn't yet changed hands. The accounting and bookkeeping term accruals refers to adjustments that must be made before a company’s. An accrual represents revenues earned or expenses incurred that are recorded in the financial statements before cash is received or paid. In financial accounting, accruals refer to the recording of revenues a company has earned but has yet to receive payment for, and expenses that have been incurred but the company has yet to. The accounting and bookkeeping term accruals. The accounting and bookkeeping term accruals refers to adjustments that must be made before a company’s financial statements are issued. Accruals involve the following types of business. In financial accounting, accruals refer to the recording of revenues a company has earned but has yet to receive payment for, and expenses that have been incurred but the company has yet to.. An accrual allows a business to record expenses and revenues for which it expects to expend cash or receive cash, respectively, in a future period. Accruals involve the following types of business. In financial accounting, accruals refer to the recording of revenues a company has earned but has yet to receive payment for, and expenses that have been incurred but.Accrual To Cash Conversion Excel Worksheet Kindergarten Printable Sheet

Accrual To Cash Conversion Excel Worksheet Kindergarten Printable Sheet

Accrual To Cash Conversion Excel Worksheet Kindergarten Printable Sheet

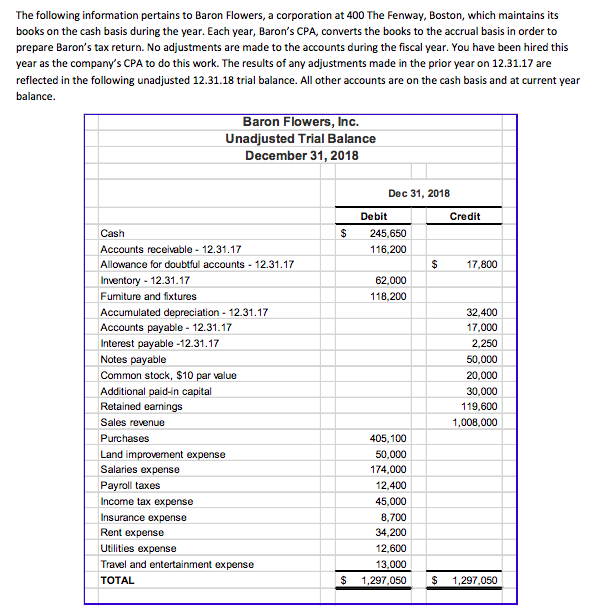

Accrual Accounting Excel Template

Accrual To Cash Conversion Excel Worksheet Kindergarten Printable Sheet

Accrual To Cash Conversion Excel Worksheet Kindergarten Printable Sheet

Accrual To Cash Conversion Excel Worksheet Kindergarten Printable Sheet

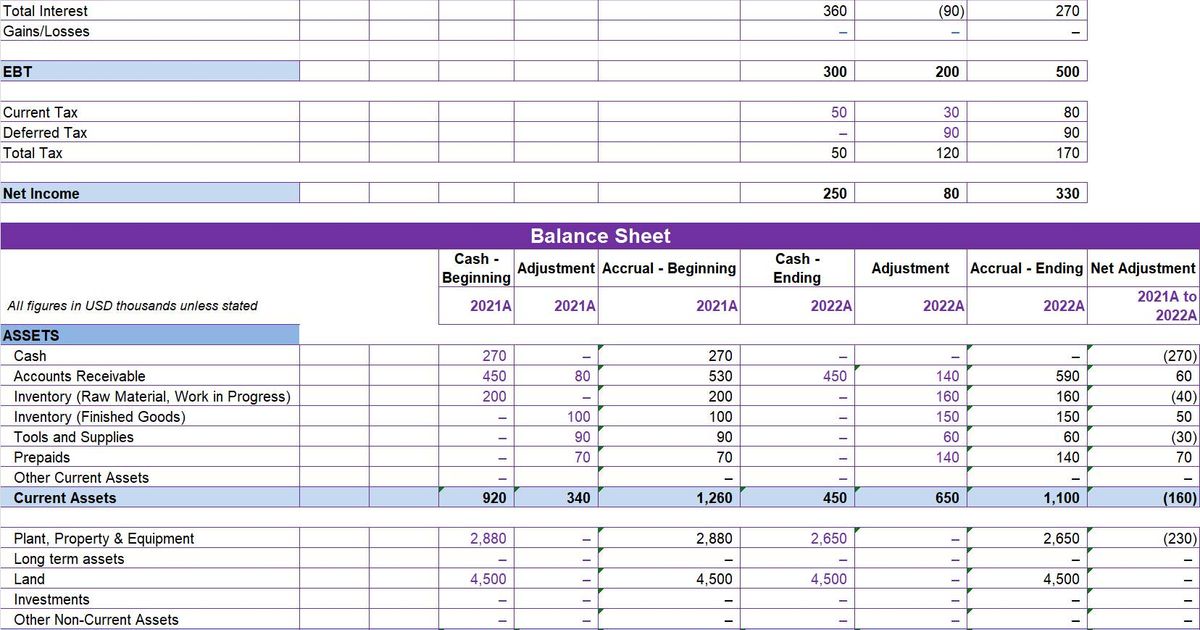

Cash to Accrual Accounting Excel Template for Easy Conversion

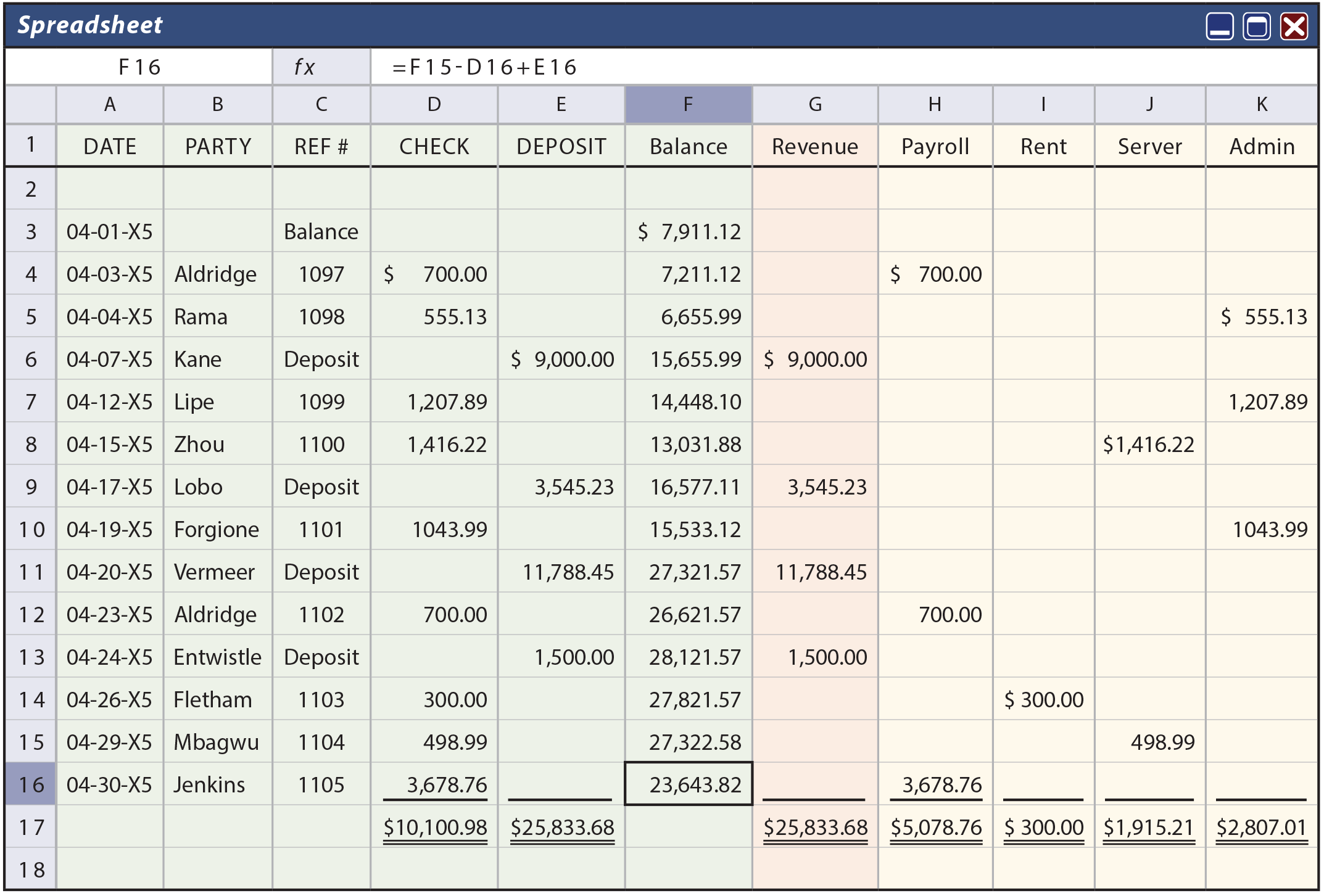

Accrual to Cash Conversion Excel Worksheet Double Entry Bookkeeping

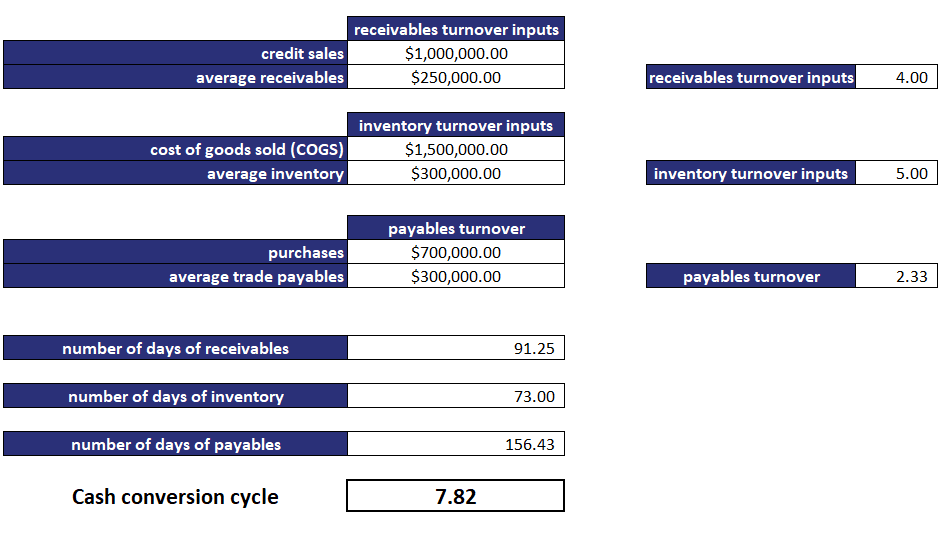

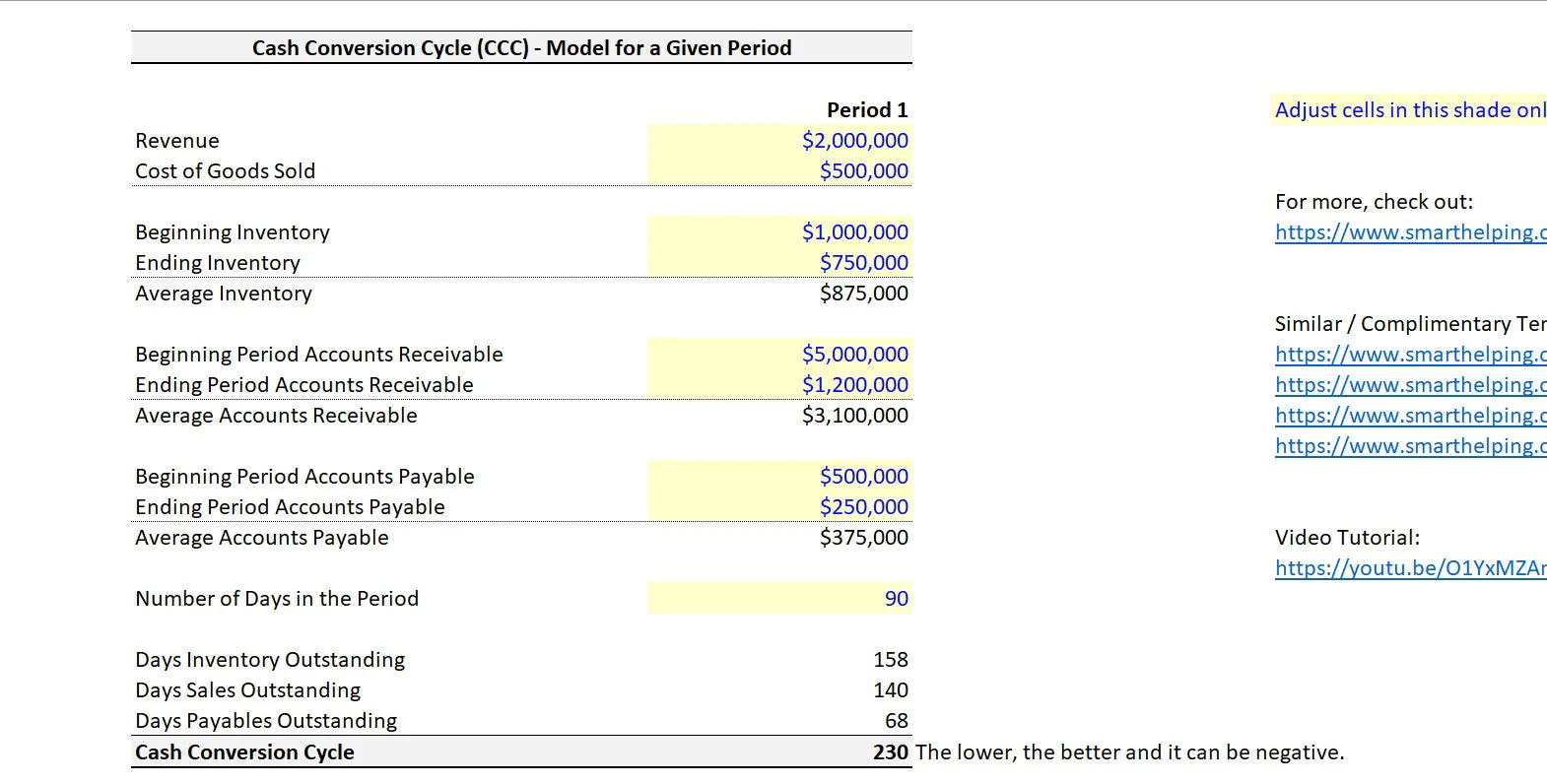

Cash Conversion Cycle (CCC) Model and Tracking Template Excel XLS

Related Post: